Germany Livestock Insurance Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Bovine, Swine, Sheep & Goats, Poultry, and Others), By Coverage (Mortality, Revenue, Disability, Disease, and Others), and Germany Livestock Insurance Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialGermany Livestock Insurance Market Insights Forecasts to 2035

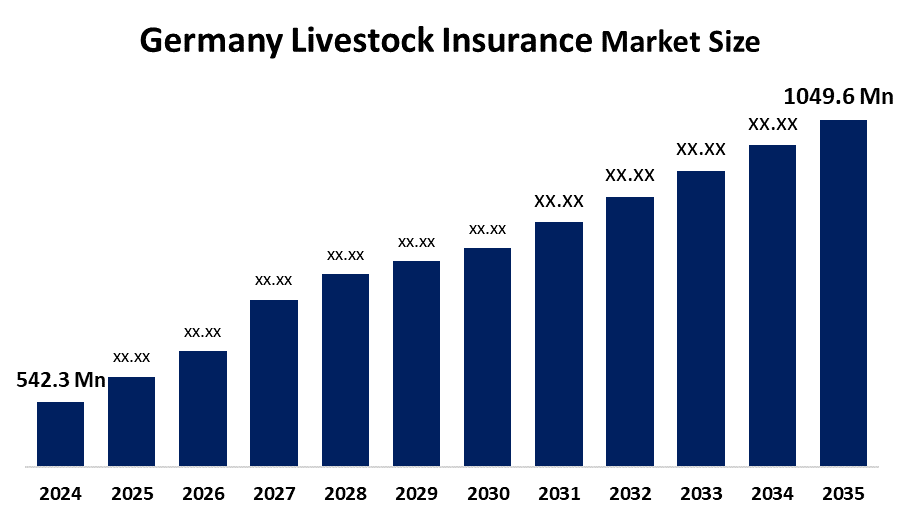

- The Germany Livestock Insurance Market Size was estimated at USD 542.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.19% from 2025 to 2035

- The Germany Livestock Insurance Market Size is Expected to Reach USD 1049.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Livestock Insurance Market is anticipated to reach USD 1049.6 million by 2035, growing at a CAGR of 6.19% from 2025 to 2035. The forthcoming prospects in the German livestock insurance sector are the adoption of risk-protection by livestock farmers at a larger scale, digital insurance platforms, parametric and tailored products, climate-risk reduction solutions, support incentives from the public and private sectors, and an increase in demand for disease outbreak coverage.

Market Overview

The term Germany livestock insurance market signifies the insurance coverage that helps farmers to cope with financial losses due to death of livestock, diseases in cattle, accidents, and natural disasters. The market is a contributing factor to the stability of the agricultural economy since it lowers the risk for cattle, poultry, pigs, and other livestock owners. The market's advance is driven by the top-notch agricultural practices in Germany, the increasing awareness of risk management benefits, and the growing uncertainties associated with climate changes. Public-private partnerships and government support programs are also working to increase the uptake of insurance. Moreover, through technology, such as digital policy management and data-driven risk assessment, service efficiency is being enhanced. Besides that, the rising concerns regarding animal health, biosecurity, and income protection are pushing the demand for not only comprehensive but also customized livestock insurance products throughout Germany.

Report Coverage

This research report categorizes the market for the Germany livestock insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany livestock insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany livestock insurance market.

Germany Livestock Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 542.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.19% |

| 2035 Value Projection: | USD 1049.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Allianz SE Munich Re R+V Versicherung Gothaer Versicherung HDI Versicherung and other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Main contributors to the Germany livestock insurance industry encompass on the one hand, the elevating climate perils, the upsurge of animal diseases, the increasing consciousness of farmers regarding financial risk management, government support programs, and public–private cooperation, and on the other hand, the creation of digital insurance platforms and the consumers’ demand for income stability and sustainable agricultural practices.

Restraining Factors

The German livestock insurance market is restrained by several factors such as the expensive premiums, the lack of awareness of the insurance among the small farmers, the complicated policy terms, the inadequate historical loss data, the hesitancy to use insurance as a solution, and the reliance on government subsidies for the broad penetration of the market.

Market Segmentation

The Germany livestock insurance market share is classified into animal type and coverage.

- The bovine segment dominated the market in 2024, approximately 39.1% and is projected to grow at a substantial CAGR during the forecast period.

The Germany livestock insurance market is segmented by animal type into bovine, swine, sheep & goats, poultry, and others. Among these, the bovine segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The expansion of the segment is mainly attributed to the high economic value of cattle, the increased demand for milk and meat products, the growing occurrence of diseases in cattle, and better risk management practices among farmers as well as the government's support through schemes to promote livestock insurance in Germany.

- The mortality segment dominated the market in 2024, approximately 40%% and is projected to grow at a substantial CAGR during the forecast period.

The Germany livestock insurance market is segmented by coverage into mortality, revenue, disability, disease, and others. Among these, the mortality segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment is expanding as a result of considerable financial losses owing to livestock deaths, higher incidence of diseases and accidents, farmers’ growing consciousness regarding risk coverage, samt the need to secure income and ensure sustainability in Germany’s livestock sector, government aid programs, and so forth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany livestock insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz SE

- Munich Re

- R+V Versicherung

- Gothaer Versicherung

- HDI Versicherung

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Livestock Insurance Market based on the below-mentioned segments:

Germany Livestock Insurance Market, By Animal Type

- Bovine

- Swine

- Sheep & Goats

- Poultry

- Others

Germany Livestock Insurance Market, By

Frequently Asked Questions (FAQ)

-

What is the Germany livestock insurance market size?Germany Livestock Insurance Market is expected to grow from USD 542.3 million in 2024 to USD 1049.6 million by 2035, growing at a CAGR of 6.19% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The main factors that will drive the growth of the Germany livestock insurance market are the increase in climate-related risks, the number of animal diseases getting higher, the farmers getting more and more aware of the financial risk, government backing, cooperation between the public and private sectors, use of technology in insurance, and the requirement for income reliability.

-

What factors restrain the Germany livestock insurance market?The market for livestock insurance in Germany is restricted by the high costs of premiums, poor knowledge of insurance among small farmers, complicated policies, lack of historical loss data, farmers' unwillingness to accept insurance, reliance on government support, and the unavailability of digital insurance platforms

-

Who are the key players in the Germany livestock insurance market?Allianz SE, Munich Re, R+V Versicherung, Gothaer Versicherung, HDI Versicherung, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?