Germany Helium Market Size, Share, By Purity Level (Industrial Grade, Electronic Grade, And Ultra-High Purity), By End Use (Healthcare, Electronics, Aerospace, Automotive, And Nuclear), By Application (Cryogenics, Balloons, Welding, Leak Detection, And Semiconductors), And Germany Helium Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsGermany Helium Market Size Insights Forecasts to 2035

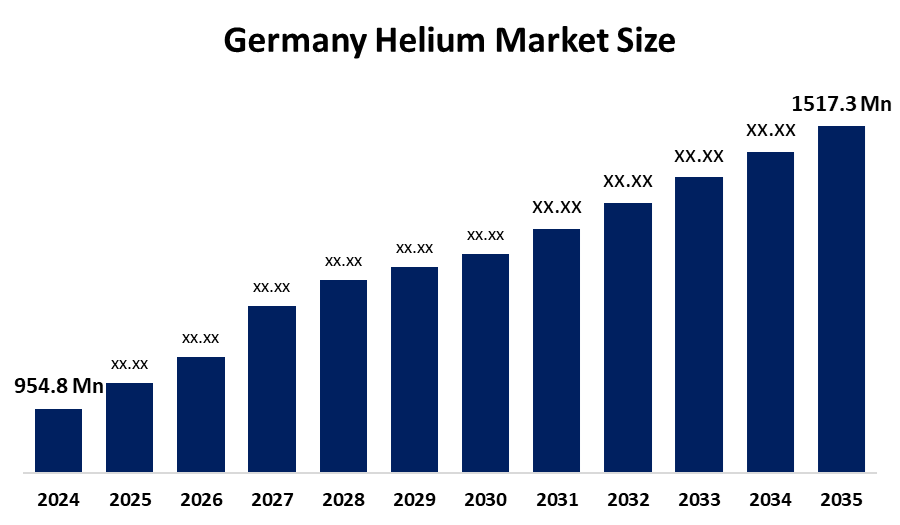

- Germany Helium Market Size 2024: USD 954.8 Mn

- Germany Helium Market Size 2035: USD 1517.3 Mn

- Germany Helium Market Size CAGR 2024: 4.3%

- Germany Helium Market Size Segments: Purity Level, End Use, and Application

Get more details on this report -

The Germany Helium Market Size focuses primarily on providing helium, a gas that is light and non-reactive, which is used in many critical areas such as medical imaging mainly MRI machines, semi-conductors, cryogenic applications, aerospace, leak detection, and laboratories due to its excellent cooling and inert properties. In terms of consumption volumes, Germany is Europe's largest user of helium, primarily due to its highly developed industrial, medical and high technologies sector, and it is forecasted that due to the continuing dependence on imports and ever-expanding end-use applications, the German helium market experienced continued growth.

The Helium in Germany are backed by government support, including the Germany's Federal Ministry for Economic Affairs and Climate Action investing €50 million in 2024 for projects related to the recovery and reuse of critical materials such as helium, thus creating a circular economy around these materials. Helium Recovery will create a secure supply of helium for future use as well promoting sustainable ways to utilize this finite resource. With more than 3,500 operating MRI machines, providers in Germany have been adopting helium recovery systems, bringing down their operational costs by an estimated 45%, thereby enabling the continued use of helium as an essential diagnostic tool within healthcare.

As technology advances, Germany helium providers are now using advanced systems to recycle and recover helium, using more efficient methods to purify and store helium, and conducting research on domestic extraction projects such as exploration licences for potential helium reserves, companies are trying to limit their reliance on unstable global supply chains for helium.

Germany Helium Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 954.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.3% |

| 2035 Value Projection: | 1517.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Purity Level, By End Use |

| Companies covered:: | Linde plc., Air Liquide, Air Products & Chemicals, Messae SE & Co. KGaA, Iwatani Corporation, ExxonMobil, Matheson Tri-Gas, Nippon Sanso Holdings Corp, PGNiG SA, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Germany Helium Market Size:

The Germany Helium Market Size is driven by the high level of demand for MRI systems and other medical equipment produced by the healthcare industry, the increased need for semiconductor production and other types of electronic engineering services, Germany's strong research base in the areas of physics, cryogenics and advanced manufacturing are, along with increased focus on high technology sectors and government backing to support growth.

The Germany Helium Market Size is restrained by the relies on imports of helium due to its limited availability throughout the world, cause supply chain disruptions and expose the country to geopolitical risks associated with international trade, price fluctuations and regulatory and environmental issues impacting exploration and extraction projects.

The future of Germany helium market is bright and promising, with versatile opportunities emerging from the advancements in helium recycling technologies, as well as circular supply chains for helium. New methods of extracting helium have also been developed in addition to new methods of storing it. Because of these technological advancements, there will be significant demand for helium to support the growth of these industries and increased opportunities for helium market in Germany.

Market Segmentation

The Germany Helium Market Size share is classified into purity level, end use, and application.

By Purity Level:

The Germany Helium Market Size is divided by purity level into industrial grade, electronic grade, and ultra-high purity. Among these, the industrial grade segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High volume use across manufacturing, semiconductors, automotive, welding, and leak detection, strong industrial base, and cost effective in large quantities all contribute to the industrial grade segment's largest share and higher spending on helium when compared to other purity level.

By End Use:

The Germany Helium Market Size is divided by end use into healthcare, electronics, aerospace, automotive, and nuclear. Among these, the healthcare segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The healthcare segment dominates because helium is essential for cooling semiconducting magnets in MRI machines, well- established healthcare infrastructure with widespread MRI adoption with continuous and high helium demand in healthcare sector.

By Application:

The Germany Helium Market Size is divided by application into cryogenics, balloons, welding, leak detection, and semiconductors. Among these, the cryogenics segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Extremely low boiling point, essential for cooling superconducting magnets, scientific research, and low temperature applications all contribute to the cryogenics segment's largest share and higher spending on helium when compared to other applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany helium market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Helium Market Size:

- Linde plc.

- Air Liquide

- Air Products & Chemicals

- Messae SE & Co. KGaA

- Iwatani Corporation

- ExxonMobil

- Matheson Tri-Gas

- Nippon Sanso Holdings Corp

- PGNiG SA

- Others

Recent Developments in Germany Helium Market Size:

In December 2025, Uniper signed a major long-term deal with QatarEnergy to receive 70 million cubic feet of helium from the Ras Laffan facility over 15 years. This agreement enhanced the reliability of the helium supply chain for German industries.

In September 2025, Messer SE & Co. KGaA, a major industrial gases company, signed its own direct long-term helium supply deal with QatarEnergy.Messer also operated the Messer Helium Cliffside facility, which was used for the shortage and reinjection of excess helium supply to balance the market.

In February 2024, Linde plc., a major gases company commissioned a large helium storage cavern in Texas and launched a new purification and liquefaction plant in Qatar, which supports the global market, including German demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany helium market based on the below-mentioned segments:

Germany Helium Market Size, By Purity Level

- Industrial Grade

- Electronic Grade

- Ultra-High Purity

Germany Helium Market Size, By End Use

- Healthcare

- Electronics

- Aerospace

- Automotive

- Nuclear

Germany Helium Market Size, By Application

- Cryogenics

- Balloons

- Welding

- Leak Detection

- Semiconductors

Frequently Asked Questions (FAQ)

-

What is the Germany Helium Market Size?Germany helium market is expected to grow from USD 954.8 million in 2024 to USD 1517.3 million by 2035, growing at a CAGR of 4.3% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the strong demand from the healthcare sector, especially for MRI systems, growth in semiconductor manufacturing, electronics, and precision engineering, Germany’s robust research ecosystem in physics, cryogenics, and advanced manufacturing supports steady demand, increasing focus on high-tech industries such as quantum computing and aerospace, and strong government support continues to strengthen market growth.

-

What factors restrain the Germany Helium Market Size?Constraints include the limited global availability of helium, heavy dependence on imports, making Germany vulnerable to supply disruptions and geopolitical risks, price volatility, and regulatory and environmental constraints affecting exploration and extraction initiatives.

-

How is the market segmented by purity level?The market is segmented into industrial grade, electronic grade, and ultra-high purity.

-

Who are the key players in the Germany Helium Market Size?Key companies include Linde plc., Air Liquide, Air Products & Chemicals, Messae SE & Co. KGaA, Iwatani Corporation, ExxonMobil, Matheson Tri-Gas, Nippon Sanso Holdings Corp, PGNiG SA, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?