Germany Electric Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars and Trucks), By Propulsion Type (Battery Electric Vehicle (BEV) and Fuel Cell Electric Vehicles (FCEVs)), By Drive Type (Front-Wheel Drive (FWD) and All-Wheel Drive (AWD)), and Germany Electric Vehicle Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationGermany Electric Vehicle Market Size Insights Forecasts to 2035

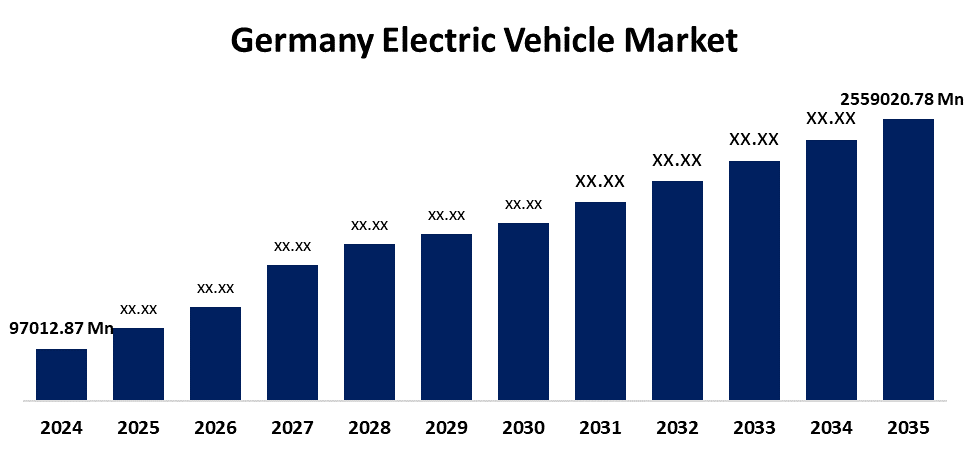

- The Germany Electric Vehicle Market Size Was Estimated at USD 94012.87 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 35.03% from 2025 to 2035

- The Germany Electric Vehicle Market Size is Expected to Reach USD 2559020.78 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Electric Vehicle Market Size is anticipated to Reach USD 2559020.78 Million by 2035, Growing at a CAGR of 35.03% from 2025 to 2035. Government incentives and legislation are speeding up the use of electric vehicles, or EVs.

Market Overview

The electric vehicle (EV) industry covers the production, sale, and use of vehicles that run on electricity (e.g., plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs)). Growth in the EV sector is being driven by several elements, such as government incentives, environmental considerations, and advancements in technology. EVs tend to consume less energy, therefore reducing fuel expense, and electricity is often a less expensive fuel source than gasoline or diesel. EVs have fewer parts and components than internal combustion engine (ICE) vehicles, assisting in keeping maintenance and repair costs lower throughout the lifecycle. Additionally, the emergence of EV leasing and financing options for consumers and fleets has opened up access to EVs as an option for their vehicles. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) program provides facilities for EV charging, as well as monetized incentives for EV purchases. The Production-Linked Incentive (PLI) program encourages investment and technological development to increase domestic production of EVs and EV support components.

Report Coverage

This research report categorizes the market for Germany electric vehicle market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany electric vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany electric vehicle market.

Germany Electric Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 94012.87 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 35.03% |

| 2035 Value Projection: | USD 2559020.78 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 174 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Propulsion Type and COVID-19 Impact Analysis |

| Companies covered:: | BMW Group, Volkswagen AG, Daimler AG (Mercedes-Benz), Audi (being part of VW group), Smart (brand), StreetScooter, E GO Mobile (Next.e.GO Mobile), Sono Motors, Elaris, PULSETRAIN, Electric Brands (maker of microcars like |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing environmental issues and tightening emission restrictions around the world. Growing government incentives and subsidies stimulate EV adoption, while battery technology improves both costs and driving range. Growing consumer awareness of sustainability and the total cost of ownership is expanding consumer demand. The growth of charging infrastructure and urbanization also supports market growth.

Restraining Factors

The increasing awareness of environmental issues and stricter emissions regulations are calling for cleaner transportation. EVs are becoming more affordable due to government incentives and tax breaks, making the shift to electric vehicles easier. We continue to see improvements in battery technology, which enhances driving range and lowers costs. We have also seen significant growth in supportive charging infrastructure, improving convenience.

Market Segmentation

The Germany electric vehicle market share is classified into vehicle type, propulsion type, and drive type.

- The passenger cars segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany electric vehicle market is segmented by vehicle type into passenger cars and trucks. Among these, the passenger cars segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. A sharp increase in their uptake in key regions, the trajectory of electric passenger cars is set for tremendous expansion. Electric cars are still predicted to account for around one-fourth of all automobile sales, despite passenger car sales and the progressive elimination of subsidies in several nations. This data highlights a notable trend toward electric mobility, which is being driven by both consumer demand and legislative efforts to reduce transportation's carbon footprint.

- The battery electric vehicle (BEV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany electric vehicle market is segmented by propulsion type into battery electric vehicle (BEV) and fuel cell electric vehicles (FCEVs). Among these, the battery electric vehicle (BEV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rise in the use of BEVs can be linked to customers' increased awareness of environmental issues, which has stoked demand for greener modes of transportation. BEVs are a more environmentally friendly option than conventional cars with internal combustion engines. Additionally, the usage of electric buses in metropolitan public transportation fleets is expanding quickly on a scale.

- The front-wheel drive (FWD) segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany electric vehicle market is segmented by drive type into front-wheel drive (FWD) and all-wheel drive (AWD)). Among these, the front-wheel drive (FWD) segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. FWD's cost-effectiveness in manufacturing is driving its growing adoption. Compared to rear-wheel drive systems, FWD vehicles require fewer components, which lowers production costs. Cost advantage, automakers are able to provide consumers with vehicles at more competitive prices. Furthermore, FWD electric vehicles are usually lighter, which improves fuel economy and reduces drivers' overall operating expenses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany electric vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BMW Group

- Volkswagen AG

- Daimler AG (Mercedes-Benz)

- Audi (being part of VW group)

- Smart (brand)

- StreetScooter

- E. GO Mobile (Next.e.GO Mobile)

- Sono Motors

- Elaris

- PULSETRAIN

- Electric Brands (maker of microcars like "Evetta")

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany electric vehicle market based on the below-mentioned segments:

Germany Electric Vehicle Market, By Vehicle Type

- Passenger Cars

- Trucks

Germany Electric Vehicle Market, By Propulsion Type

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicles (FCEVs))

Germany Electric Vehicle Market, By Drive Type

- Front-Wheel Drive (FWD)

- All-Wheel Drive (AWD)

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Electric Vehicle Market in 2024?A: The Germany Electric Vehicle Market size was estimated USD 94012.87 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Electric Vehicle Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 35.03% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Electric Vehicle Market?A: Key players include BMW Group, Volkswagen AG, Daimler AG (Mercedes‑Benz), Audi (being part of VW group), Smart (brand), StreetScooter, E. GO Mobile (Next.e.GO Mobile), Sono Motors, Elaris, PULSETRAIN, Electric Brands (maker of microcars like “Evetta”)

-

Q.4: What are the main drivers of growth in the Germany Electric Vehicle Market?A: The increasing environmental issues and tightening emission restrictions around the world. Growing government incentives and subsidies stimulate EV adoption, while battery technology improves both costs and driving range.

-

Q.5: What is the main restraining of growth in the Germany Electric Vehicle Market?A: The increasing awareness of environmental issues and stricter emissions regulations are calling for cleaner transportation.

Need help to buy this report?