Germany Electric Vehicle Charging Station Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), and Hybrid Electric Vehicle (HEV)), By Application (Residential and Commercial), and Germany Electric Vehicle Charging Station Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationGermany Electric Vehicle Charging Station Market Insights Forecasts to 2035

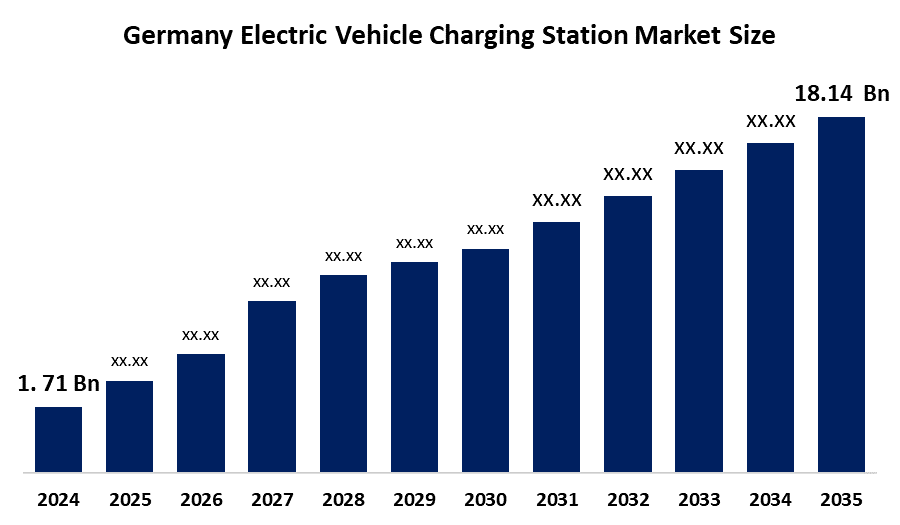

- The Germany Electric Vehicle Charging Station Market Size Market was estimated at USD 1.71 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.95% from 2025 to 2035

- The Germany Electric Vehicle Charging Station Market Size is Expected to Reach USD 18.14 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Electric Vehicle Charging Station Market Size is anticipated to reach USD 18.14 Billion by 2035, growing at a CAGR of 23.95% from 2025 to 2035. The market is expanding significantly due to increased EV adoption, government incentives, and technology breakthroughs.

Market Overview

The Market Size for Electric Vehicle Charging Stations in Germany encompasses a vast ecosystem that supports the rollout, operation and integration of electric vehicle charging solutions across the country. It includes public, private and commercial charging networks driven by national sustainability objectives, regulatory requirements and increasing adoption of electric vehicles. Additionally, the German government is playing a key role in sustaining the growth of the electric vehicle (EV) charging station market through aggressive regulations. As a part of the climate action plan to lower carbon emissions, the government is offering financial incentives for EV infrastructure development. Along with this, the provision of grants and subsidies for public and private charging stations, especially for ultra-fast and renewable-powered stations, is critical. Also, the strict limits on CO2 emissions imposed on carmakers is driving the automotive industry to act faster on developing electric vehicles, leading to more demand for a common charging network. Programs such as the National Charging Infrastructure Master Plan will provide both urban and rural areas with access to charging points, resulting in further increases in electric vehicle uptake at a national level. As an instance, in July 2024, the German government launched a national fast-charging network for heavy-duty electric trucks that is aimed at reducing transport emissions. The "Power to the Road" program plans to establish 350 fast-charging sites covering 95% of German highways. By 2030, Germany plans to have one-third of its heavy-road-haulage truck chassis electrified or running on fuels generated by electric power. The plan aligns with the EU's regulation which requires a majority of new heavy-duty trucks to be emission-free by 2040.

Report Coverage

This research report categorizes the market for the Germany electric vehicle charging station market size based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany electric vehicle charging station market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany electric vehicle charging station market.

Germany Electric Vehicle Charging Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.71 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 23.95% |

| 2035 Value Projection: | USD 18.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Application |

| Companies covered:: | EnBW E.ON Drive GmbH Compleo Charging Solutions AG innogy eMobility Solutions GmbH Allego GmbH ubitricity and other, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Smart charging technologies are gaining more traction, which maximize energy usage by varying the speed of the charging with respect to demand on the grid or the availability of renewable energy. They increase user convenience and facilitate Germany’s transition to renewable energy. Furthermore, they reduce the total electrical power demand during peak periods. For instance, in March of 2024, Kempower, one of the pioneers of fast-charging technology for electric vehicles, announced the installation of its first public charging equipment at Kleve, Germany. The charging hub operated by Kuster Energy has a total power output of up to 400 kW and four Kempower Satellites that operate with one connection cable. Due to the Eichrecht certification, Kempower is now able to provide their charging technology for public use. The company aims to provide efficient and trustworthy solutions for electric vehicle drivers throughout Germany.

Restraining Factors

The Market Size for Electric Vehicle Charging Stations in Germany is constrained by a number of factors, such as the high cost of installation and upkeep, particularly for fast-charging infrastructure, which prevents widespread adoption. Expanding operations are made more difficult by grid integration issues like capacity limitations and the requirement for upgrades. In addition, slow permitting procedures, uneven charging standards, and restricted network interoperability impede seamless user experience and infrastructure scalability.

Market Segmentation

The Germany electric vehicle charging station market share is classified into vehicle type and application.

- The battery electric vehicle (BEV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany Electric Vehicle Charging Station Market Size is segmented by vehicle type into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV). Among these, the battery electric vehicle (BEV) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Germany is propelled by significant government incentives, an increase in the number of public and private charging infrastructure, and an uptick in consumer preference for zero-emission mobility. Technological improvements in battery efficiency, range, and fast charging capabilities have improved performance and convenience for users. Furthermore, major EU emission regulations and the electrification of corporate fleets have driven BEV uptake, proving to be the central focus of Germany’s sustainable mobility transition.

- The commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany eEectric Vehicle Charging Station Market Size is segmented by application into residential and commercial. Among these, the commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the growing need for public access infrastructure, workplace charging options, and fleet electrification. Fast-charging stations have been installed by logistics companies, retail chains, and business parks as a result of government incentives and sustainability regulations, which have improved operational efficiency and decreased emissions. This sector is essential to Germany's e-mobility transition because of the scalability of commercial installations and integration with smart energy systems, which facilitate wider adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations or companies involved within the Germany electric vehicle charging station market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EnBW

- E.ON Drive GmbH

- Compleo Charging Solutions AG

- innogy eMobility Solutions GmbH

- Allego GmbH

- ubitricity

- Others

Recent Developments:

- In May 2024, DHL Group and E.ON announced a partnership to expand electric charging infrastructure for heavy commercial vehicles in Germany. The agreement included the establishment of fast-charging stations at DHL Group locations, with E.ON responsible for planning, construction, and operation. DHL service partners were also granted access to the new charging infrastructure. This initiative aligned with DHL Group's sustainability strategy to reduce emissions and optimize supply chains.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Electric Vehicle Charging Station Market based on the below-mentioned segments:

Germany Electric Vehicle Charging Station Market, By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Germany Electric Vehicle Charging Station Market, By Application

- Residential

- Commercial

Frequently Asked Questions (FAQ)

-

What is the Germany electric vehicle charging station market size?Germany Electric Vehicle Charging Station Market is expected to grow from USD 1.71 billion in 2024 to USD 18.14 billion by 2035, growing at a CAGR of 23.95% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The market for EV charging stations in Germany is expected to grow due in large part to government incentives, rising EV adoption, infrastructure investments, integration of renewable energy sources, and technological developments in smart grid connectivity and fast charging.

-

What factors restrain the Germany electric vehicle charging station market?High installation costs, difficulties integrating into the grid, inconsistent regional coverage, protracted permitting procedures, and restricted compatibility between charging networks and car models are some of the main factors holding back the German market for EV charging stations.

-

Who are the key players in the Germany electric vehicle charging station market?EnBW, E.ON Drive GmbH, Compleo Charging Solutions AG, innogy eMobility Solutions GmbH, Allego GmbH, Ubitricity, Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?