Germany Electric Truck Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Light-duty Truck, Medium-duty Truck, and Heavy-duty Truck), By Propulsion (Battery Electric Truck, Hybrid Electric Truck, Plug-in Hybrid Electric Truck, and Fuel Cell Electric Truck), and Germany Electric Truck Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationGermany Electric Truck Market Insights Forecasts to 2035

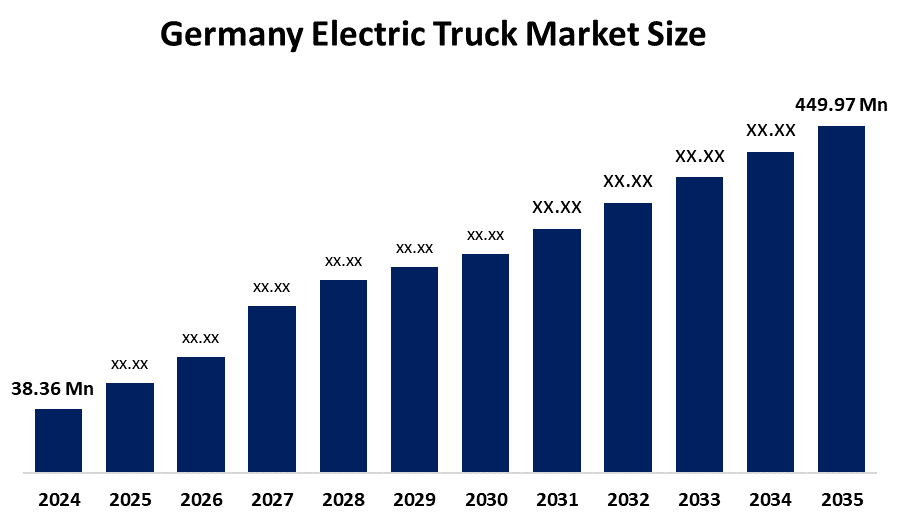

- The Germany Electric Truck Market Size was estimated at USD 38.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 25.09% from 2025 to 2035

- The Germany Electric Truck Market Size is Expected to Reach USD 449.97 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Electric Truck Market is anticipated to reach USD 449.97 million by 2035, growing at a CAGR of 25.09% from 2025 to 2035. Market is primarily driven by the nation's transition belief in sustainable mobility, increasing restrictions on the emission of gases, and improvements in electric vehicle technology.

Market Overview

The industry engaged in the manufacture, distribution, and uptake of battery-electric trucks intended for freight and commercial transportation within Germany is referred to as the Germany electric truck market. Additionally, well-known truck manufacturers in Germany, including Daimler Truck, MAN, and Volkswagen's Traton Group, are using their own engineering capabilities to mass-produce hydrogen fuel-cell and battery-electric trucks. For example, Mercedes-Benz Trucks declared in May 2025 that it would add new eActros 600 models to its lineup, each of which would be customized for a variety of transport uses in Germany and abroad. Building on the eActros 600's 500 km range and award-winning LFP battery technology, the updated portfolio will include semitrailer tractors, platform chassis with additional wheelbases, flexible battery configurations, and longer cab options. All of these will be available for order starting in the fall of 2025.

Report Coverage

This research report categorizes the market for the Germany electric truck market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany electric truck market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany electric truck market.

Germany Electric Truck Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 38.36 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 25.09% |

| 2035 Value Projection: | USD 449.97 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Vehicle Type, By Propulsion |

| Companies covered:: | Market Players, Investors, End-users, Government Authorities, Consulting and Research Firm, Venture capitalists, Value-Added Resellers (VARs), and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Germany’s electric truck market is supported by strong government incentives, including procurement subsidies and electrification work along autobahn projects that comprise zero-emission freight corridors. Domestic OEMs and battery gigafactories are improving production efficiency and lowering costs, while EU climate mandates and urban low-emission zones are driving fleet operators to electrification.

Restraining Factors

The high initial costs of electric trucks in comparison to diesel alternatives, the scarcity of public charging stations for heavy-duty vehicles, and worries about battery range and payload capacity for long-distance driving are the main obstacles facing the German electric truck market.

Market Segmentation

The Germany electric truck market share is classified into vehicle type and propulsion.

- The light-duty truck segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany electric truck market is segmented by vehicle type into light-duty truck, medium-duty truck, and heavy-duty truck. Among these, the light-duty truck segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased demand for last-mile delivery in cities due to tighter emission regulations in urban areas and the growth of e-commerce. Along with easier charging compatibility and reduced operating costs, these trucks also take advantage of fleet electrification initiatives and specific government incentives. While OEMs continue to innovate with lightweight designs and modular platforms to meet a variety of commercial needs, their small size and enhanced battery range make them perfect for short-haul logistics.

- The battery electric truck segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany electric truck market is segmented by propulsion into battery electric truck, hybrid electric truck, plug-in hybrid electric truck, and fuel cell electric truck. Among these, the battery electric truck segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to advantageous government policies that lower operating costs for fleet operators, such as purchase incentives and CO2-based toll exemptions, Germany is seeing strong growth. These trucks are now practical for both urban and regional logistics thanks to improvements in payload capacity and range brought about by advancements in lithium-ion battery technology. Adoption is further supported by OEM investments in scalable electric platforms and the growth of fast-charging infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany electric truck market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daimler Truck AG

- MAN Truck & Bus SE

- Volkswagen Group

- Quantron AG

- Volta Trucks

- Others

Recent Developments:

- In June 2025, MAN began mass production of its eTruck models (eTGX, eTGS, eTGL) at its Munich plant, marking a turning point for the company after investing nearly €400 million in R&D. The facility produced both diesel and electric trucks on the same line, with plans to deliver the first 1,000 eTrucks by year-end. Each truck offered up to 740 km range with expanded battery options and was optimized for flexible logistics in Germany and across Europe

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Electric Truck Market based on the below-mentioned segments:

Germany Electric Truck Market, By Vehicle Type

- Light-duty Truck

- Medium-duty Truck

- Heavy-duty Truc

Germany Electric Truck Market, By Propulsion

- Battery Electric Truck

- Hybrid Electric Truck

- Plug-in Hybrid Electric Truck

- Fuel Cell Electric Truck

Frequently Asked Questions (FAQ)

-

What is the Germany electric truck market size?The Germany Electric Truck Market is expected to grow from USD 38.36 million in 2024 to USD 449.97 million by 2035, growing at a CAGR of 25.09% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?The main drivers of growth include stricter EU emissions regulations, government incentives, greater accessibility of charging stations, increased fuel prices, and the growing interest in sustainable logistics alternatives in urban and regional freight transport.

-

What factors restrain the Germany electric truck market?The fundamental constraints involve substantial upfront expenses, minimal charging infrastructure, range limitations for long-distance travel, battery supply limitations, and uncertainty regarding resale value and overall total cost of ownership for fleets.

-

Who are the key players in the Germany electric truck market?Daimler Truck AG, MAN Truck & Bus SE, Volkswagen sGroup, Quantron AG, Volta Trucks, Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?