Germany E-bike Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Pedal Assisted, Speed Pedelec, and Throttle Assisted), By Application (Cargo/Utility, City/Urban, and Trekking), and Germany E-bike Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationGermany E-bike Market Insights Forecasts to 2035

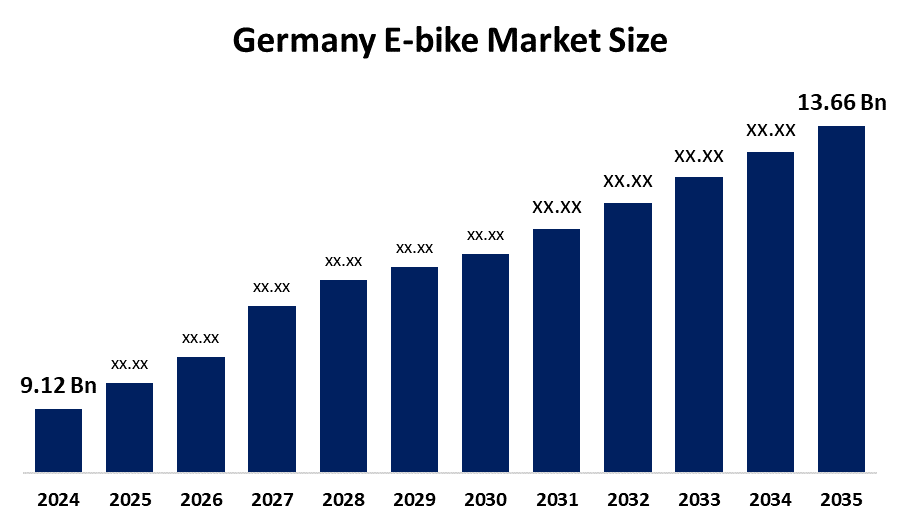

- The Germany E-bike Market Size was estimated at USD 9.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.74% from 2025 to 2035

- The Germany E-bike Market Size is Expected to Reach USD 13.66 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany E-bike Market Size is anticipated to reach USD 13.66 Billion by 2035, growing at a CAGR of 3.74% from 2025 to 2035. Key factors driving the market growth include rising environmental consciousness, urban congestion, battery technology advancements, health benefits, advantageous government incentives, and the need for affordable, environmentally friendly transportation options that appeal to both commuters and leisure users.

Market Overview

The Germany E-bike Market Size represents the ecosystem of e-bikes, which are defined as bicycles with at least one electric assist option that combines human and electric propulsion to assist cycling across the country. The market is powered by technology, environmental regulations, and changing consumer behavior to identify sustainable and efficient transportation options. The market includes many propulsion types, applications, and business models, all of which are correlated to government incentives, broad infrastructure improvement, and increased health and climate awareness. Additionally, prototype solid-state batteries created by QuantumScape and PowerCo are achieving 844 WhorL energy density, and can be charged to 80% in 12 minutes. Commercial mid-drive motors produce 85 Nm, weigh 2.8 kg, and will improve climbing performance without exceeding Germany’s 250 W nominal limit. The new DJI Avinox unit produces 105 Nm, weighs 2.5 kg, has 12 A fast-charge inlets, and reflects the trend of consumer-electronics engineering entering the drivetrain.

Report Coverage

This research report categorizes the market for the Germany e-bike market size based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany e-bike market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany e-bike market.

Germany E-bike Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.74% |

| 2035 Value Projection: | USD 13.66 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Propulsion Type, By Application |

| Companies covered:: | Riese & Müller Cube Focus Kalkhoff Haibike Winora Rotwild and Other, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Fiscal policy is a major factor in Germany's corporate bike-leasing boom. A 2019 amendment to the Income Tax Act permits employees to treat only a small percentage of the manufacturer's list price as a monthly taxable benefit when they lease bicycles or e-bikes through salary sacrifice. Leasing company bikes is one of the key actions highlighted in the National Cycling Plan 3.0 to replace driving for work-related travel. If a sizable percentage of short commutes switch to bicycles or e-bikes, they predict a sizable annual CO2 savings. Employees receive substantial discounts on bike models through gross-salary leasing. While suppliers value the stability of bulk contracts, which are less susceptible to retail fluctuations, employers value the predictability of monthly deductions.

Restraining Factors

The Market Size for E-Bikes Market Size in Germany is constrained by a number of factors, such as high upfront costs that put off budget-conscious buyers, short battery life and replacement costs, and worries about safety and theft in cities. Broader adoption is also hampered by the regulatory complexity surrounding throttle-assisted models and speed pedelecs.

Market Segmentation

The Germany e-bike market share is classified into propulsion type and application.

- The pedal assisted segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany E-Bike Market Size is segmented by propulsion type into pedal assisted, speed pedelec, and throttle assisted. Among these, the pedal assisted segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to supportive regulatory environments, growing demand for urban mobility, and growing consumer inclination toward environmentally friendly and health-conscious modes of transportation. EU laws make pedal-assisted e-bikes affordable and accessible by permitting them to travel under 25 km/h without a license or insurance. Although government incentives and infrastructure expansion continue to support widespread adoption across commuting, leisure, and cargo applications, technological advancements in battery efficiency and lightweight design have further improved usability.

- The city/urban segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany E-Bike Market Size is segmented by application into cargo or utility, city or urban, and trekking. Among these, the city or urban segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to a growing desire for sustainable mobility solutions, worries about traffic congestion, and urbanization. Accessibility and safety for city riders have improved thanks to government initiatives supporting cycling infrastructure, such as bike-sharing programs and designated bike lanes. The convenience of e-bikes for short-distance commuting, growing fuel prices, and environmental consciousness have also made them a popular option among city people.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany e-bike market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Riese & Müller

- Cube

- Focus

- Kalkhoff

- Haibike

- Winora

- Rotwild

- Others

Recent Developments:

- In May 2025, Fafrees had unveiled its first EU-type-approved high-speed e-bikes during Eurobike 2025 at Messe Frankfurt.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany E-bike Market based on the below-mentioned segments:

Germany E-bike Market, By Propulsion Type

- Pedal Assisted

- Speed Pedelec

- Throttle Assisted

Germany E-bike Market, By Application

- Cargo or Utility

- City or Urban

- Trekking

Frequently Asked Questions (FAQ)

-

What is the Germany e-bike market size?Germany E-bike Market is expected to grow from USD 9.12 billion in 2024 to USD 13.66 billion by 2035, growing at a CAGR of 3.74% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Rising demand for sustainable mobility, reducing urban congestion, government incentives, advancements in battery technology, and greater consumer preference for environmentally friendly and health-conscious modes of transportation are some of the major factors propelling the German e-bike market.

-

What factors restrain the Germany e-bike market?High initial costs, battery replacement worries, a lack of charging infrastructure, unclear regulations, and safety concerns about speed, theft, and road-sharing dynamics are some of the main factors holding back the German e-bike market.

Need help to buy this report?