Germany Dopamine Agonist Market Size, Share, and COVID-19 Impact Analysis, By Drug (Non-ergot Dopamine Agonists and Ergot Alkaloids), By Route of Administration (Oral and Injectable), By Application (Parkinson’s Disease and Restless Legs Syndrome (RLS)), and Germany Dopamine Agonist Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Dopamine Agonist Market Insights Forecasts to 2035

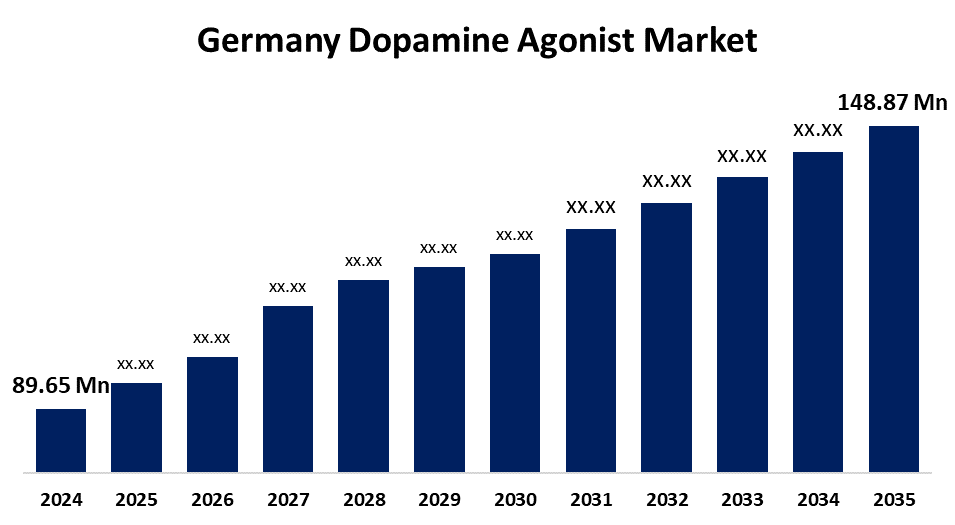

- The Germany Dopamine Agonist Market Size Was Estimated at USD 89.65 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.72% from 2025 to 2035

- The Germany Dopamine Agonist Market Size is Expected to Reach USD 148.87 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Dopamine Agonist Market Size is anticipated to reach USD 148.87 Million by 2035, Growing at a CAGR of 4.72% from 2025 to 2035. The growing incidence of Parkinson's disease, restless legs syndrome, and other neurological conditions that call for dopamine-modulating therapies is the main driver of the market. The occurrence of these disorders is predicted to rise as the world's population ages, which will increase demand even further.

Market Overview

The market defined by the use of drugs that stimulate dopamine receptors in the brain and mimic the actions of dopamine is called the dopamine agonist market. The principal indications for these agonists are hyperprolactinemia and movement disorders such as Parkinson's disease (PD). Both ergot-derived and non-ergot-derived dopamine agonists are available and differ in terms of distribution and administration routes. Dopamine agonists are used for movement disorders characteristic of PD, such as rigidity, tremors, and bradykinesia. They address non-motor PD symptoms such as mood and sleep disturbances that lead to emotional dysregulation. One major contributor remains the demographic shift, which increases the prevalence of both PD and restless legs syndrome, disorders that can be treated with dopamine agonists. Research and development are geared towards providing more potent agonists with fewer side effects. Neurological disorders, like PD that use dopamine agonists, have historically been funded through research grants provided by governments to investigate causes and potential prevention or treatment measures.

Report Coverage

This research report categorizes the market for Germany dopamine agonist market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany dopamine agonist market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany dopamine agonist market.

Germany Dopamine Agonist Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 89.65 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.72% |

| 2035 Value Projection: | USD 148.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Drug, By Route of Administration, By Application |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of Parkinson’s disease and restless legs syndrome, the expanding geriatric population, and the growing incidence of awareness of neurological disorders. Improvements in drug delivery systems and long-acting dosage forms are improving treatment outcomes and compliance. In addition, increased healthcare spending, favorable reimbursement models, and ongoing R&D spending by pharmaceutical companies will support market growth.

Restraining Factors

The high cost of treatment and limited access to advanced healthcare in low-income regions. Adverse effects such as impulse control disorders, hallucinations, and sleep disturbances reduce patient compliance and hinder adoption. The availability of alternative therapies and the complexity of accurate diagnosis also challenge market growth.

Market Segmentation

The Germany dopamine agonist market share is classified into drug, route of administration, and application.

- The non-ergot dopamine agonists segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany dopamine agonist market is segmented by drug into non-ergot dopamine agonists and ergot alkaloids. Among these, the non-ergot dopamine agonists segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The superior safety profile, less likelihood of fibrosis-related adverse effects, and high effectiveness in treating neurological conditions including Parkinson's disease and restless legs syndrome (RLS) are the reasons for their dominance. Because they are more tolerable and cause fewer cardiovascular side effects than their ergot-derived counterparts, non-ergot dopamine agonists, including pramipexole, ropinirole, rotigotine, and apomorphine have become widely used.

- The oral segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany dopamine agonist market is segmented by route of administration into oral and injectable. Among these, the oral segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The large market share is a result of oral formulations like as pramipexole, ropinirole, and bromocriptine being the first-line treatment for ailments like Parkinson's disease and restless legs syndrome (RLS).

- The parkinson's disease segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany dopamine agonist market is segmented by application into parkinson's disease and restless legs syndrome (RLS). Among these, the parkinson's disease segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. Broad availability, ease of use, and high rates of prescription refills for long-term illnesses, including RLS and Parkinson's disease. Retail pharmacies offer reasonable cost, insurance coverage, and easy access to oral dopamine agonists, patients choose them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany dopamine agonist market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany dopamine agonist market based on the below-mentioned segments:

Germany Dopamine Agonist Market, By Drug

- Non-ergot Dopamine Agonists

- Ergot Alkaloids

Germany Dopamine Agonist Market, By Route of Administration

- Oral

- Injectable

Germany Dopamine Agonist Market, Application

- Parkinson's Disease

- Restless Legs Syndrome (RLS)

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Dopamine Agonist Market in 2024?A: The Germany Dopamine Agonist Market size was estimated USD 89.65 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Dopamine Agonist Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 4.72% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Dopamine Agonist Market?A: Key players include Boehringer Ingelheim, Bayer HealthCare Pharmaceuticals, Stada Arzneimittel, Berlin‑Chemie / Menarini (Berlin‑Chemie), Teva Germany (through Teva Pharmaceutical Industries), UCB (operates in Germany / EU presence), Others

-

Q.4: What are the main drivers of growth in the Germany Dopamine Agonist Market?A: The increasing incidence of Parkinson’s disease and restless legs syndrome, the expanding geriatric population, and the growing incidence of awareness of neurological disorders.

-

Q.5: What is the main restraining of growth in the Germany Dopamine Agonist Market?A: Adverse effects such as impulse control disorders, hallucinations, and sleep disturbances reduce patient compliance and hinder adoption.

Need help to buy this report?