Germany Continuous Bioprocessing Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments and Consumables & Reagents), By Application (Monoclonal Antibodies and Vaccines), By End Use (Pharmaceutical & Biotechnology Companies, CMOs & CROs, and Research & Academic Institutes), and Germany Continuous Bioprocessing Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsGermany Continuous Bioprocessing Market Insights Forecasts to 2035

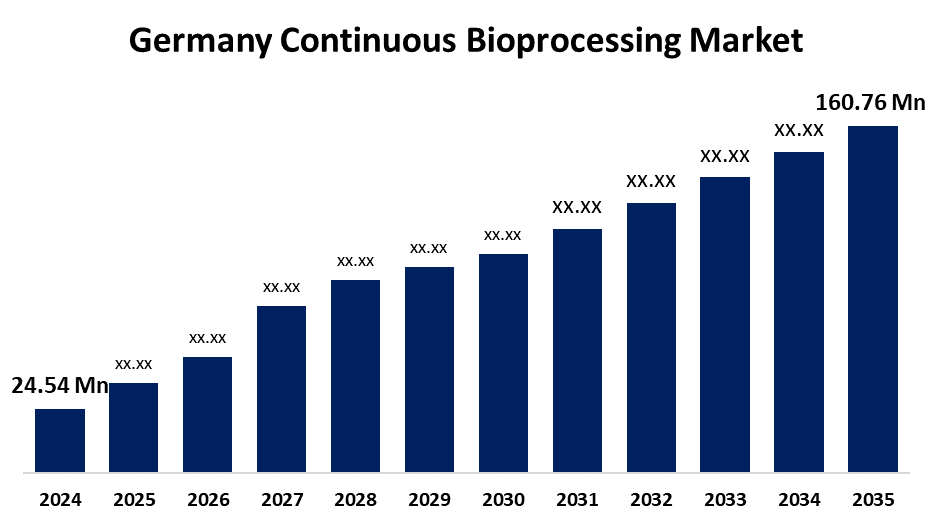

- The Germany Continuous Bioprocessing Market Size Was Estimated at USD 24.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.63% from 2025 to 2035

- The Germany Continuous Bioprocessing Market Size is Expected to Reach USD 160.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Continuous Bioprocessing Market Size is anticipated to reach USD 160.76 Million by 2035, Growing at a CAGR of 18.63% from 2025 to 2035. The increasing need for scalable and affordable biopharmaceutical manufacturing, especially for monoclonal antibodies, vaccines, and cell and gene therapies, is what propels the sector.

Market Overview

Continuous bioprocessing is a modern manufacturing methodology used in the biopharmaceutical realm that keeps biologics, like vaccines or monoclonal antibodies, flowing through integrated and automated systems in a continuous manner. It has significant benefits over traditional batch processing, including improved productivity, better product quality, shortened production time, and lower manufacturing costs. The German market is well-positioned with opportunities backed by increasing demand for biologics, increasing R&D investment, and the growth of biologics manufacturing for biosimilars. Additionally, government-sponsored initiatives that support the growth of biotechnology include grants and funding incentives for originality, innovation, or infrastructure. Such initiatives further support a greater adoption of advanced technologies and partnerships to facilitate innovation across industry and academia. The ultimate goal for these initiatives is to further position Germany as a global leader in biopharmaceutical manufacturing and innovation.

Report Coverage

This research report categorizes the market for Germany continuous bioprocessing market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany continuous bioprocessing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany continuous bioprocessing market.

Germany Continuous Bioprocessing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.54 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.63% |

| 2035 Value Projection: | USD 160.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Application, By End Use |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for biopharmaceuticals, such as monoclonal antibodies (mAbs) and vaccines, as well as cell and gene therapies, is driven by an aging population and chronic diseases. Companies are pursuing cost efficiency, in part from increased productivity and continuous systems, which have a smaller footprint. There are enabling technologies such as Artificial Intelligence (AI), Process Analytical Technology (PAT) sensors, single-use systems, and continuous chromatography, which facilitate improved process control and scalability of biopharmaceutical production in real-time.

Restraining Factors

The substantial initial investments required for specialized equipment, automation, and facility improvements may dissuade smaller firms from engaging. The technical complexity and need for specialized personnel make it difficult to develop potential processes, scale them up, and control them in real time. Regulatory ambiguities surrounding validation protocols and the lack of widely accepted guidelines (e.g., ICH Q13) hamper its adoption because of compliance concerns.

Market Segmentation

The Germany continuous bioprocessing market share is classified into product, application, end-use.

- The instruments segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany continuous bioprocessing market is segmented by product into instruments and consumables & reagents. Among these, the instruments segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The increased adoption of advanced bioreactors, sensors, and control systems for real-time monitoring and process optimization. Rising demand for efficient, scalable biomanufacturing in pharmaceuticals and biologics drives growth, supported by technological innovation and investment in bioprocessing infrastructure.

- The monoclonal antibodies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany continuous bioprocessing market is segmented by application into monoclonal antibodies and vaccines. Among these, the monoclonal antibodies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising demand for targeted therapies in cancer, autoimmune, and infectious diseases. Continuous bioprocessing enhances production efficiency and consistency, supporting large-scale manufacturing. Increased R&D investment and strong biopharmaceutical pipeline.

- The pharmaceutical & biotechnology companies segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany continuous bioprocessing market is segmented by end-use into pharmaceutical & biotechnology companies, CMOs & CROs, and research & academic institutes. Among these, the pharmaceutical & biotechnology companies segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. The strong focus on biologics development, process efficiency, and cost reduction. Increased investment in innovative therapeutics, robust manufacturing infrastructure, and demand for faster production timelines support adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany continuous bioprocessing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany continuous bioprocessing market based on the below-mentioned segments:

Germany Continuous Bioprocessing Market, By Product

- Instruments

- Consumables & Reagents

Germany Continuous Bioprocessing Market, By Application

- Monoclonal Antibodies

- Vaccines

Germany Continuous Bioprocessing Market, By End-use

- Pharmaceutical & Biotechnology Companies

- CMOs & CROs

- Research & Academic Institutes

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Continuous Bioprocessing Market in 2024?A: The Germany Continuous Bioprocessing Market size was estimated USD 24.54 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Continuous Bioprocessing Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 18.63% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Continuous Bioprocessing Market?A: Key players include Sartorius AG, Merck KGaA, Eppendorf SE, bbi‑biotech, Solida Biotech, Rentschler Biopharma SE, GEA Group (engineering / process systems), Just – Evotec Biologics, ProBioGen, Thermo Fisher Scientific Inc. (German presence / operations)

-

Q.4: What are the main drivers of growth in the Germany Continuous Bioprocessing Market?A: The growing demand for biopharmaceuticals, such as monoclonal antibodies (mAbs) and vaccines, as well as cell and gene therapies, is driven by an aging population and chronic diseases.

-

Q.5: What is the main restraining of growth in the Germany Continuous Bioprocessing Market?A: The substantial initial investments required for specialized equipment, automation, and facility improvements may dissuade smaller firms from engaging.

Need help to buy this report?