Germany Car Subscription Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (IC Powered Vehicle, and Electric Vehicle), By Subscription Period (1 to 6 Months, 6 to 12 Months, and More Than 12 Months), and Germany Car Subscription Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationGermany Car Subscription Market Size Insights Forecasts to 2035

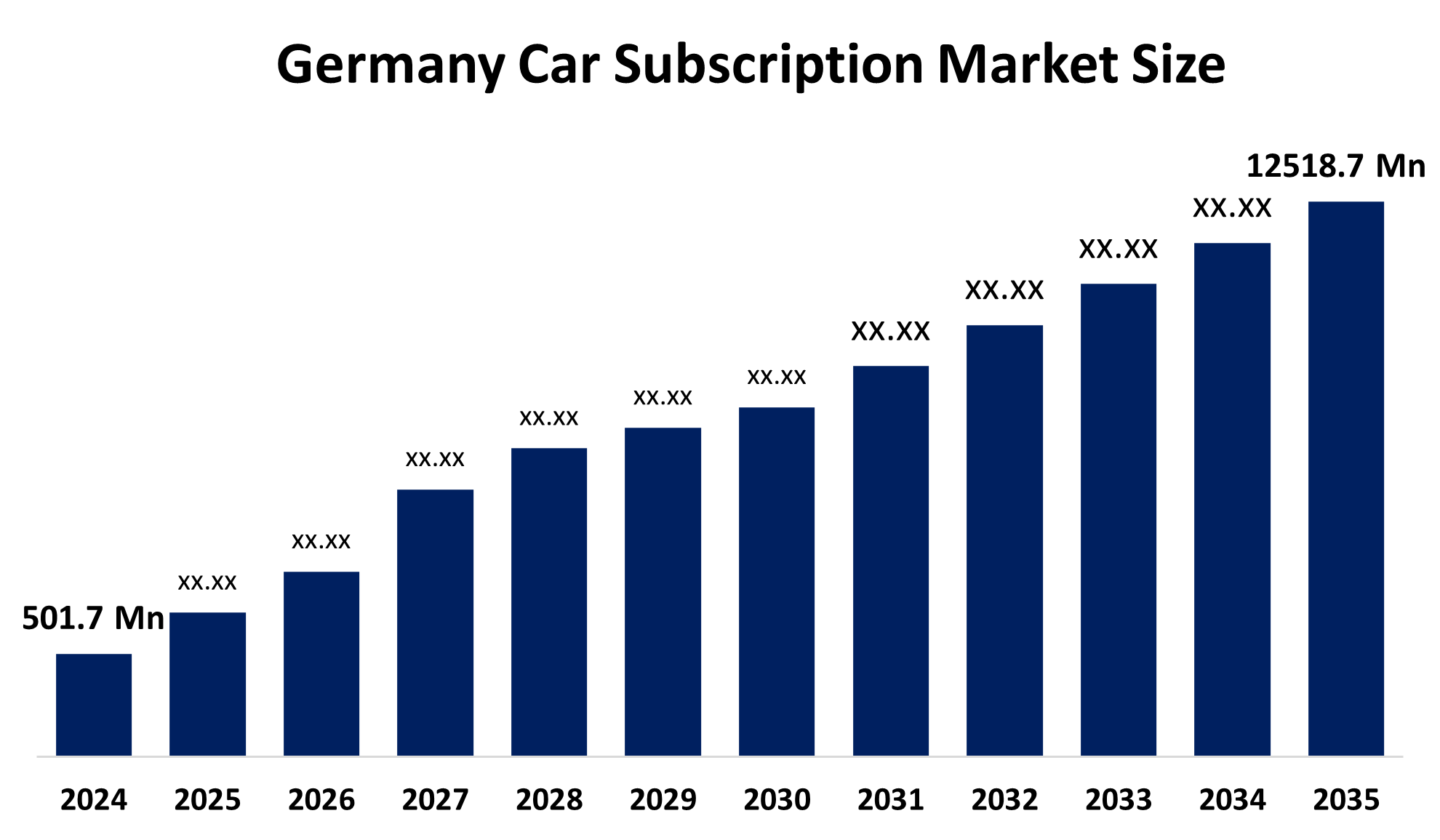

- Germany Car Subscription Market Size 2024: USD 501.7 Million

- Germany Car Subscription Market Size 2035: USD 12518.7 Million

- Germany Car Subscription Market CAGR 2024: 33.97%

- Germany Car Subscription Market Segments: Vehicle Type and Subscription Period.

Get more details on this report -

The Germany Car Subscription Market Size refers to a service-based model where consumers pay a recurring monthly fee to access a vehicle without the long-term commitments associated with purchasing or leasing. This "usership over ownership" model typically includes all-inclusive costs such as insurance, maintenance, road taxes, and depreciation within a single price point. The market is characterized by high demand for flexibility, a shift toward digital-first consumer journeys, and a growing appetite for electric vehicles (EVs).

The federal government’s 2026 EV Incentive Programme, which allocates nearly €3 billion to support climate-friendly mobility, directly benefits the subscription sector by making electric fleets more affordable for providers and users alike. Concurrently, private sector investments, such as FINN’s massive capital raises to expand its electric fleet, are driving the infrastructure needed for widespread market penetration.

Technological advancement is a cornerstone of the Germany Car Subscription Market Size, particularly through the integration of AI-driven fleet management and seamless mobile application interfaces. Furthermore, the rise of blockchain for secure digital contracts and automated credit checks (SCHUFA) has streamlined the onboarding process, allowing German consumers to subscribe to a car in minutes. These innovations are transforming the automotive lifecycle into a software-as-a-service (SaaS) experience, enhancing both operational efficiency and user satisfaction.

Market Dynamics of the Germany Car Subscription Market:

The Germany Car Subscription Market Size is driven by the increasing consumer preference for flexible, "all-in-one" mobility solutions that eliminate the hassles of maintenance and insurance. Additionally, the rising cost of traditional car ownership and the trend toward urbanization in major German cities like Berlin and Munich encourage residents to seek adaptable transportation that matches their changing lifestyle needs.

The Germany Car Subscription Market Size is restrained by the high monthly fees associated with short-term flexibility compared to traditional long-term leasing. Furthermore, strict credit requirements and the complexity of insurance regulations in Germany can limit the accessible customer base. Intense competition among OEMs and third-party providers often leads to narrow profit margins for smaller players.

Significant opportunities exist in the expansion of corporate subscription fleets as businesses look for tax-efficient, flexible employee benefit schemes. Additionally, the integration of used-car subscriptions offers a lower-cost entry point for budget-conscious consumers. Targeting niche segments, such as long-term tourists and digital nomads, presents further untapped growth potential in Germany.

Germany Car Subscription Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 501.7 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 33.97% |

| 2035 Value Projection: | USD 12518.7 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Vehicle Type, By Subscription Period |

| Companies covered:: | FINN, Sixt+ (Sixt SE), Cluno, Miles Mobility, ViveLaCar, Volkswagen Financial Services, BMW Financial Services (Access by BMW), Mercedes-Benz Mobility, Hertz My Car and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Germany car subscription market share is classified into vehicle type and subscription period.

By vehicle type:

The Germany Car Subscription Market Size is segmented by vehicle type into IC powered vehicle, and electric vehicle. Among these, the IC-powered vehicle segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their greater accessibility, cheaper subscription fees, and well-established infrastructure for refueling in both urban and rural regions are the reasons for their supremacy. IC vehicles are the main option for short- and medium-term subscriptions due to their familiarity, higher driving range, and lack of worries regarding charging access.

By Subscription Period:

The Germany Car Subscription Market Size is segmented by subscription period into 1 to 6 months, 6 to 12 months, and more than 12 months. Among these, the 6 to 12 months segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment leads because it strikes the best possible mix between price and versatility, making it appealing to both individual customers and business users. It is perfect for professionals, expats, and organizations looking for reliable mobility without long lease responsibilities because it offers lower monthly prices than short-term subscriptions while avoiding long-term ownership commitments.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany Car Subscription Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Car Subscription Market:

- FINN

- Sixt (Sixt SE)

- Cluno

- Miles Mobility

- ViveLaCar

- Volkswagen Financial Services

- BMW Financial Services (Access by BMW)

- Mercedes-Benz Mobility

- Hertz My Car

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Car Subscription Market Size based on the below-mentioned segments:

Germany Car Subscription Market, By vehicle type

- IC Powered Vehicle

- Electric Vehicle

Germany Car Subscription Market, By Subscription Period

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

Frequently Asked Questions (FAQ)

-

Q: What is the Germany car subscription market size?A: The Germany car subscription market is expected to grow from USD 501.7 million in 2024 to USD 12,518.7 million by 2035, registering a CAGR of 33.97% during the forecast period 2025–2035.

-

Q: What is driving the growth of the Germany car subscription market?A: Growth is driven by rising consumer preference for flexible, all-inclusive mobility solutions, increasing costs of car ownership, urbanization, and the shift toward digital-first, on-demand services.

-

Q: Which vehicle type dominates the Germany car subscription market?A: IC powered vehicles dominate the market due to their wider availability, lower subscription costs, established refueling infrastructure, and suitability for short- and medium-term subscriptions.

-

Q: Which subscription period holds the largest market share?A: The 6 to 12 months subscription period holds the largest share as it offers an optimal balance between affordability and flexibility for individuals and corporate users.

-

Q: What are the key challenges faced by the market?A: Key challenges include high monthly fees compared to traditional leasing, strict credit requirements, complex insurance regulations, and intense competition impacting profit margins.

-

Q: Who are the key players in the Germany car subscription market?A: Key players include FINN, Sixt+, Volkswagen Financial Services, BMW Financial Services, Mercedes-Benz Mobility, Cluno, ViveLaCar, Hertz My Car, and others.

Need help to buy this report?