Germany Breast Cancer Drug Market Size, Share, and COVID-19 Impact Analysis, By Therapy (Hormonal Therapy, Targeted Therapy, Chemotherapy, Immunotherapy, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others), and Germany Breast Cancer Drug Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Breast Cancer Drug Market Size Insights Forecasts to 2035

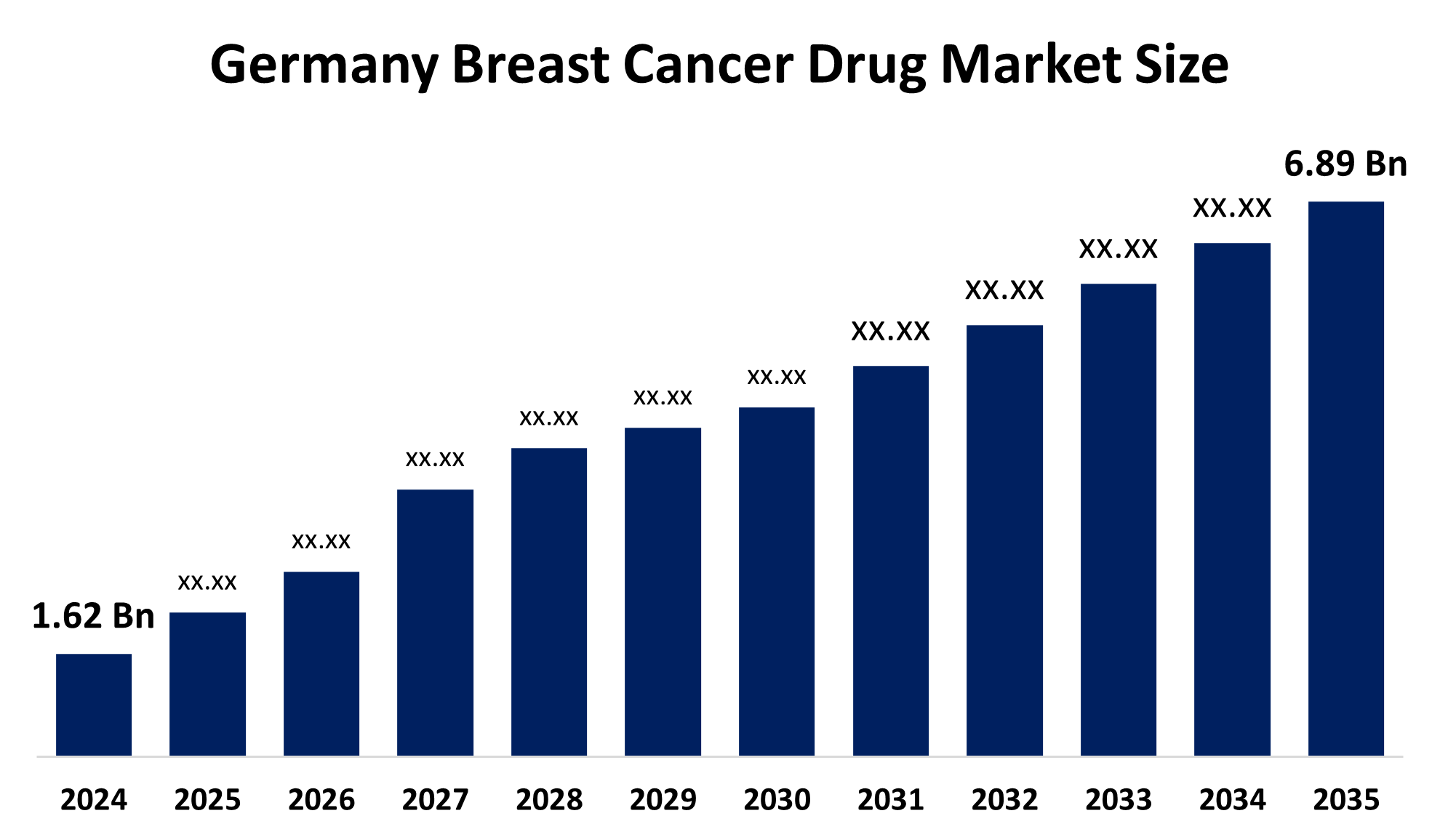

- Germany Breast Cancer Drug Market Size 2024: USD 1.62 Billion

- Germany Breast Cancer Drug Market Size 2035: USD 6.89 Billion

- Germany Breast Cancer Drug Market CAGR 2024: 14.07 %

- Germany Breast Cancer Drug Market Segments: Therapy and Distribution Channel.

Get more details on this report -

The Germany Breast Cancer Drug Market Size represents a critical segment of the national healthcare infrastructure, encompassing pharmaceutical interventions designed to inhibit the growth and spread of malignant cells in breast tissue. As a cornerstone of the German oncology landscape, this market is characterized by a sophisticated regulatory environment and a high standard of patient care. Current trends indicate a significant shift from traditional systemic treatments toward precision medicine, where therapies are tailored to individual genetic profiles.

The Federal Ministry of Health, through programs like the National Decade Against Cancer, provides significant funding for oncology research and infrastructure development. Private sector involvement is equally vigorous, with major pharmaceutical companies collaborating with clinical trial groups such as the German Breast Group (GBG) to accelerate the bench-to-bedside transition of novel compounds.

Technological advancement remains the primary catalyst for evolution within the Germany Breast Cancer Drug Market Size. The integration of artificial intelligence (AI) and machine learning in drug discovery processes has significantly shortened development timelines for new molecules. Furthermore, advancements in biotechnology have led to the creation of next-generation hormone therapies and immunotherapies that can bypass traditional drug resistance mechanisms.

Market Dynamics of the Germany Breast Cancer Drug Market:

The Germany Breast Cancer Drug Market Size is driven by the demand for medication therapy is driven by an aging female population, increased screening rates, early detection, and an increasing incidence of breast cancer. Also, market expansion is supported by robust reimbursement under universal healthcare, quick acceptance of biologic and targeted medications, ongoing R&D investments, rising survival rates, and growing usage of personalized medicine.

The Germany Breast Cancer Drug Market Size is restrained by high costs of innovative biologics, pricing pressure from government cost-containment strategies, and drawn-out regulatory and reimbursement procedures. In addition, adverse-effect concerns, low awareness in rural areas, and patent expiries that lead to generic competition.

The expansion of the personalized medicine segment and the development of biosimilars offer significant growth opportunities for manufacturers in the German market. There is also a rising potential for digital health applications that complement drug therapy, such as AI-driven platforms that optimize dosage and monitor patient adherence in home-care settings.

Germany Breast Cancer Drug Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.62 billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.84% |

| 2035 Value Projection: | USD 14.07 billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Therapy, By Distribution Channel |

| Companies covered:: | Bayer AG, Boehringer Ingelheim, BioNTech SE, MorphoSys AG, Merck KGaA, Siemens Healthineers, Heidelberg Pharma AG, MagForce AG and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Germany breast cancer drug market share is classified into therapy and distribution channels.

By Therapy:

The Germany Breast Cancer Drug Market Size is segmented by therapy into hormonal therapy, targeted therapy, chemotherapy, immunotherapy, and others. Among these, the targeted therapy segment held the largest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to the increase in tailored therapeutic choices, such as CDK4/6 inhibitors and HER2-directed treatments. The broad use of these treatments is encouraged by the growing emphasis on precision medicine, which customizes treatments based on molecular profiling.

By Distribution Channel:

The Germany Breast Cancer Drug Market Size is segmented by distribution channel into hospital pharmacies, retail pharmacies, and others. Among these, the hospital pharmacies held the largest revenue share in 2024 and are expected to grow at a substantial CAGR during the predicted period. Hospital pharmacy infrastructure is necessary because treatments for breast cancer, such as injectable targeted therapy, biologics, and combination regimens, are administered under supervision in hospital settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany Breast Cancer Drug Market Size, along with a comparative evaluation primarily based on their Protein offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Protein development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Breast Cancer Drug Market:

- Bayer AG

- Boehringer Ingelheim

- BioNTech SE

- MorphoSys AG

- Merck KGaA

- Siemens Healthineers

- Heidelberg Pharma AG

- MagForce AG

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value Added Resellers

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Breast Cancer Drug Market Size based on the below-mentioned segments:

Germany Breast Cancer Drug Market, By Therapy

- Hormonal Therapy

- Targeted Therapy

- Chemotherapy

- Immunotherapy

- Others

Germany Breast Cancer Drug Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current size of the Germany breast cancer drug market?A: The Germany breast cancer drug market was valued at USD 1.62 billion in 2024 and is projected to grow steadily during the forecast period.

-

Q: What is the expected growth rate of the Germany breast cancer drug market?A: The market is expected to grow at a compound annual growth rate (CAGR) of 14.07% from 2025 to 2035.

-

Q: Which factors are driving the growth of the Germany breast cancer drug market?A: Key growth drivers include the rising incidence of breast cancer, an aging female population, increased screening and early diagnosis, strong reimbursement policies, advancements in targeted therapies, and growing adoption of personalized medicine.

-

Q: Which therapy segment dominates the Germany breast cancer drug market?A: The targeted therapy segment held the largest revenue share in 2024 due to widespread use of HER2-targeted therapies, CDK4/6 inhibitors, and antibody–drug conjugates.

-

Q: Which distribution channel holds the largest market share in Germany?A: Hospital pharmacies dominate the market, as most breast cancer treatments, such as biologics and injectable targeted therapies, are administered under hospital supervision.

-

Q: Who are the key players in the Germany breast cancer drug market?A: Major companies include Daiichi Sankyo Company, Limited, Eisai Co., Ltd., Takeda Pharmaceutical Company, Taiho Pharmaceutical, Kyowa Kirin Co., Ltd., Chugai Pharmaceutical Co., Ltd., and Sumitomo Pharma, among others.

Need help to buy this report?