Germany Biological Seed Treatment Market Size, Share, and COVID-19 Impact Analysis, By Product (Microbial, Botanicals, and Others), By Function (Seed Protection and Seed Enhancement), and Germany Biological Seed Treatment Market Industry Trend, Forecasts to 2035

Industry: Consumer GoodsGermany Biological Seed Treatment Market Insights Forecasts to 2035

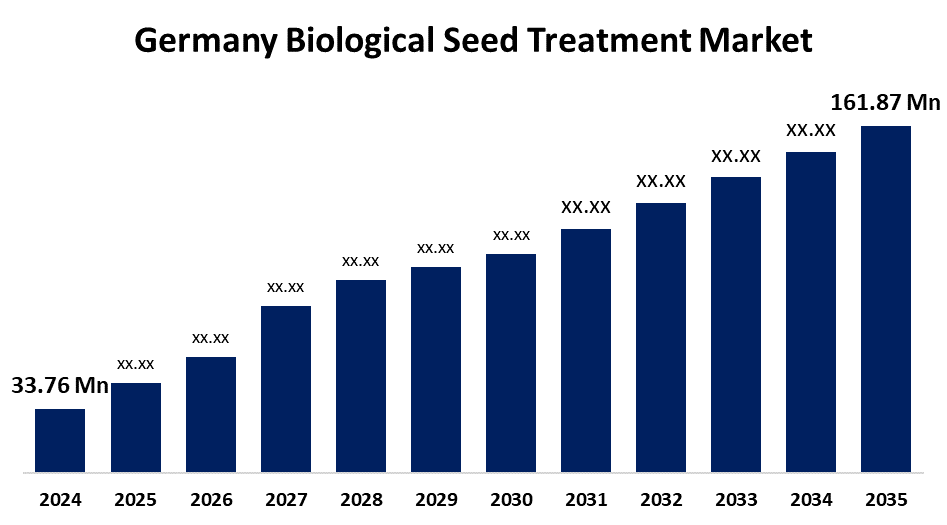

- The Germany Biological Seed Treatment Market Size Was Estimated at USD 33.76 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.32% from 2025 to 2035

- The Germany Biological Seed Treatment Market Size is Expected to Reach USD 161.87 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Biological Seed Treatment Market Size is anticipated to reach USD 161.87 Million by 2035, growing at a CAGR of 15.32% from 2025 to 2035. The increasing demand for chemical-free crops will drive industry growth in the coming years. A shift in consumer trends towards improving personal health and choosing healthier food options will likely boost product demand.

Market Overview

The biological seed treatment market focuses on natural organisms or materials such as microbes, plant extracts, and organic materials to protect seeds and increase their growth potential. The biological seed treatments include improved seed germination, resistance to pests and diseases, improved nutrient uptake, and less reliance on chemical pesticides, and are environmentally friendly and sustainable. The biological seed treatment market is driven by growing demand for organic and sustainable farming, increasing acknowledgement of soil health, and advancing biotechnology. Government initiatives in Germany and EU member states, including support for organic farmers, banning chemical treatment, and funding for bio-based agriculture research, are contributing to increased adoption. These initiatives support sustainable agriculture and environmental protection while opportunities arise in the biological seed treatment market.

Report Coverage

This research report categorizes the market for Germany biological seed treatment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany biological seed treatment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany biological seed treatment market.

Germany Biological Seed Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 33.76 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 15.32% |

| 2035 Value Projection: | USD 161.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Function |

| Companies covered:: | BASF SE, Bayer AG, Syngenta AG, Corteva agriscience, Nufarm Belchim, Humintech, KWS SAAT, SE and Co.KAaG, and others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing demand for sustainable and environmentally friendly farming practices. The growing worries of chemical pesticide residue and soil depletion are pressuring growers into using biological alternatives. Increased knowledge of seed and soil health, together with progress in microbial and biotechnology research, further drives market growth. Supportive governmental regulations and subsidies also encourage the uptake of organic production techniques.

Restraining Factors

Inconsistent performance under varying environmental conditions also hinders farmer confidence. Additionally, lack of awareness and technical knowledge among small-scale farmers slows adoption. High initial development and registration costs for new biological treatments further challenge market entry. Regulatory complexities and the slower action of biologicals compared to chemicals also limit wider acceptance in large-scale conventional farming systems.

Market Segmentation

The Germany biological seed treatment market share is classified into product and function.

- The microbials segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany biological seed treatment market is segmented by product into microbials, botanicals, and others. Among these, the microbials segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The increasing demand for sustainable and eco-friendly farming solutions. Microbial treatments, including bacteria and fungi, enhance seed germination, improve nutrient uptake, and protect against soil-borne diseases. Their effectiveness in promoting plant health without harmful chemicals aligns with growing organic farming practices.

- The seed protection segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany biological seed treatment market is segmented by function into seed protection and seed enhancement. Among these, the seed protection segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising demand for safer alternatives to chemical pesticides. Biological protectants offer effective defense against pathogens, pests, and diseases during early plant development, ensuring better crop establishment. As environmental concerns and regulatory restrictions on synthetic chemicals increase, farmers are turning to bio-based solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany biological seed treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Key Companies

- BASF SE

- Bayer AG

- Syngenta AG

- Corteva agriscience

- Nufarm Belchim

- Humintech

- KWS SAAT SE and Co.KAaG

- others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany biological seed treatment market based on the below-mentioned segments:

Germany Biological Seed Treatment Market, By Product

- Microbials

- Botanicals

- Others

Germany Biological Seed Treatment Market, By Function

- Seed Protection

- Seed Enhancement

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Biological Seed Treatment Market in 2024?A: The Germany Biological Seed Treatment Market size was estimated USD 33.76 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Biological Seed Treatment Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 15.32% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Biological Seed Treatment Market?A: Key players include BASF SE, Bayer AG, Syngenta AG, Corteva Agriscience, Nufarm GmbH & Co KG, Certis Belchim, Humintech, KWS SAAT SE & Co. KGaA, Evologic Technologies, Syngenta Seedcare, Others.

-

Q.4: What are the main drivers of growth in the Germany Biological Seed Treatment Market?A: The growing worries of chemical pesticide residue and soil depletion are pressuring growers into using biological alternatives.

-

Q.5: What is the main restraining of growth in the Germany Biological Seed Treatment Market?A: High initial development and registration costs for new biological treatments further challenge market entry.

Need help to buy this report?