Germany Biodegradable Plastic Market Size, Share, By Process (Starch Based, PLA, PBAT, PBS, PHA, And Others), By End Use (Packaging, Agriculture, Textiles, Consumer Goods, And Others), And Germany Biodegradable Plastic Market Insights, Industry Trend, Forecasts to 2035.

Industry: Specialty & Fine ChemicalsGermany Biodegradable Plastic Market Insights Forecasts Report to 2035

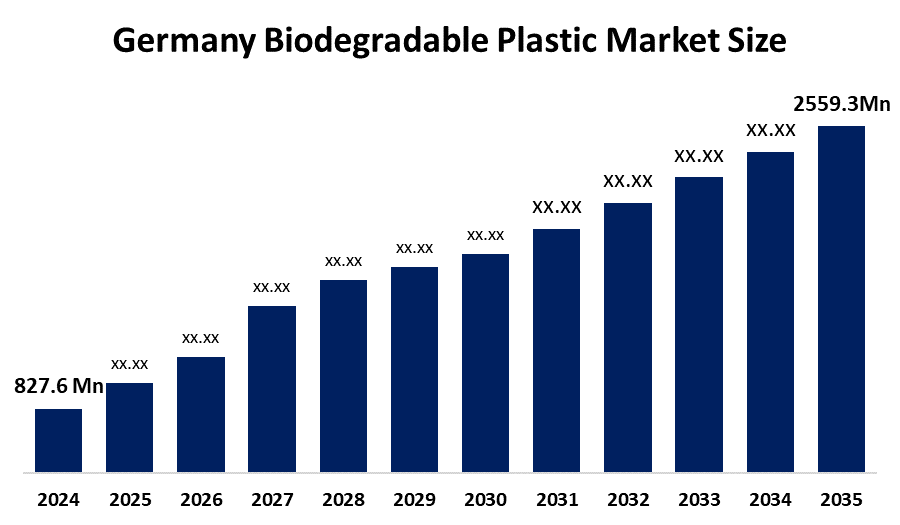

- Germany Biodegradable Plastic Market Size 2024: USD 827.6 Mn

- Germany Biodegradable Plastic Market Size 2035: USD 2559.3 Mn

- Germany Biodegradable Plastic Market Size CAGR 2024: 10.81%

- Germany Biodegradable Plastic Market Size Segments: Process And End Use

Get more details on this report -

Germany Biodegradable Plastic Market Size encompasses of an sector with new type of plastic made from plant-based materials that can decompose naturally include starch-based materials, PLA, PHA, PBS and PBAT, and others. These materials can be used to make packaging, agricultural film, disposable items and consumer goods. The growth of Germany's market for biodegradable plastics is driven by growing number of consumers choosing environmentally friendly products, increased public awareness regarding the issue of plastic pollution, increased governmental regulations to promote environmentally friendly products, continued investment by corporations into research and development (R&D) to improve product performance and reduce costs associated with biodegradable plastics, and the availability of a complete recycling and composting system throughout Germany for the proper disposal of biodegradable product waste.

The biodegradable plastic in Germany are backed by government support, including the government entities, The Packaging Act requires the creation of higher recycling rates and an extended producer responsibility for packaging waste. The Packaging Act incentivizes companies to use sustainable materials such as biodegradable plastics. As a result, Germany achieved a 90.3% recycling rate for packaging waste in 2022, far exceeding the EU Target and demonstrating successful implementation of government policy, which is essential for increasing the use of biodegradable plastics.

As technology advances, Germany biodegradable plastic providers are developing high-performance biodegradable polymers with developed biopolymers that demonstrate significantly improved mechanical strength and barrier properties, the use of new biotechnological processes, coupled with the advancement of industrial composting compatibility, provides better end-of-life options for biodegradable plastics. As a result of these technological advances, the Germany biodegradable plastic market is adopted by multiple end users across all sector and further propelling the market growth.

Germany Biodegradable Plastic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2559.3 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | USD 827.6 Million |

| 2023 Value Projection: | USD 2559.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 181 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Process, By End Use |

| Companies covered:: | BASF SE (Germany), NatureWorks LLC, Novamont S.p.A., FKuR Kunststoff GmbH, Total Corbion PLA, Covestro AG, Mitsubishi Chemical Corporation, Amcor plc, Alpla Werke Alwin Lehner GmbH, Evonik Industries AG, BIOTEC Biologische Naturverpackungen GmbH &Co. KG, Braskem S.A., Danimer Scientific, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Germany Biodegradable Plastic Market:

The Germany Biodegradable Plastic Market Size is driven by growing number of consumers choosing environmentally friendly products, increased public awareness regarding the issue of plastic pollution, increased governmental regulations, continued investment by corporations into research and development (R&D) to improve product performance and reduce costs associated with biodegradable plastics, and the availability of a complete recycling and composting system throughout Germany for the proper disposal of biodegradable product waste.

The Germany biodegradable plastic market size is restrained by the high production costs of raw materials and specialized processing methods, lack of established infrastructure for effective waste management, less robust supply chain , and competition from conventional plastics limit the uptake of biodegradable options.

The future of Germany biodegradable plastic market size is bright and promising, with versatile opportunities emerging from the increase in demand for sustainable packaging products and packaging in food, retail, and e-commerce development of the industrial composting and circular economy infrastructure will create opportunities for increased adoption of biodegradable plastics, technical advancements in the area of bio-based feed-stocks and waste-derived polymers provide biodegradable plastic manufacturers with new ways to reduce costs while producing environmentally friendly products; continued government policies to encourage investment in sustainable technologies and the EU’s 2020 environmental targets further enable and encourage investment in commercialization efforts within the biodegradable plastic market; and continued use of biodegradable plastics in agricultural, horticultural, and medical applications continue to provide new avenues for exploiting the market within Germany.

Market Segmentation

The Germany Biodegradable Plastic Market share is classified into process and end use.

By Process:

The Germany Biodegradable Plastic Market Size is divided by process into starch based, PLA, PBAT, PBS, PHA, and Others. Among these, the starch based segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Renewable sourcing which is widely available, cost effective, versatile process to enhance mechanical strength, durability, and moisture resistant and strong demand for sustainable packaging, all contribute to the starch based segment's largest share and higher spending on biodegradable plastic when compared to other process.

By End Use:

The Germany Biodegradable Plastic Market Size is divided by end use into packaging, agriculture, textiles, consumer goods, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of high environmental concerns, willing to pay a premium for eco-friendly products, with strong waste management alignment in Germany making it a practical choice, and continuous technological advancements enhancing their suitability for food packaging and other goods.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany biodegradable plastic market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Biodegradable Plastic Market:

- BASF SE (Germany)

- NatureWorks LLC

- Novamont S.p.A.

- FKuR Kunststoff GmbH

- Total Corbion PLA

- Covestro AG

- Mitsubishi Chemical Corporation

- Amcor plc

- Alpla Werke Alwin Lehner GmbH

- Evonik Industries AG

- BIOTEC Biologische Naturverpackungen GmbH &Co. KG

- Braskem S.A.

- Danimer Scientific

- Others

Recent Developments in Germany Biodegradable Plastic Market:

In October 2025, TotalEnergies Corbion announced a new collaboration with IMCD, a distribution partner in Germany, to strengthen the presence and accessibility of its Luminy PLA biodegradable plastic in the German market.

In November 2024, BASF SE launched a new midsole technology called CircleCELL in collaboration with Mount to Coast, utilizing its new biomass-balanced ecoflex BMB biopolymer. The product enhances performance for running shoes while promoting sustainability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Decisio has segmented the Germany biodegradable plastic market based on the below-mentioned segments:

Germany Biodegradable Plastic Market, By Process

- Starch Based

- PLA

- PBAT

- PBS

- PHA

- Others

Germany Biodegradable Plastic Market, By End Use

- Packaging

- Agriculture

- Textiles

- Consumer Goods

- Others

Frequently Asked Questions (FAQ)

-

What is the Germany biodegradable plastic market size?Germany biodegradable plastic market is expected to grow from USD 827.6 million in 2024 to USD 2559.3 million by 2035, growing at a CAGR of 10.81% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising environmental awareness, growing public concern over plastic pollution, stringent government regulations on single-use plastics, waste reduction, adoption of biodegradable alternatives, increasing corporate sustainability goals and commitments to carbon neutrality, shift toward eco-friendly materials, continuous technological advancements are improving material performance and cost efficiency, making biodegradable plastics more commercially viable.

-

What factors restrain the Germany biodegradable plastic market?Constraints include the high production costs compared to conventional plastics, limited industrial composting infrastructure, lower heat resistance and durability restrict use in demanding applications, and consumer confusion and competition from recyclable traditional plastics hinder wider adoption.

-

How is the market segmented by process?The market is segmented into starch based, PLA, PBAT, PBS, PHA, and Others.

-

Who are the key players in the Germany biodegradable plastic market?Key companies include BASF SE (Germany), NatureWorks LLC, Novamont S.p.A., FKuR Kunststoff GmbH, Total Corbion PLA, Covestro AG, Mitsubishi Chemical Corporation, Amcor plc, Alpla Werke Alwin Lehner GmbH, Evonik Industries AG, BIOTEC Biologische Naturverpackungen GmbH &Co. KG, Braskem S.A., Danimer Scientific, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?