Germany Baby Diapers Market Size, Share, By Product (Non-Disposable Diapers and Disposable Diapers), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacies & Drug Stores, Specialty Stores, Online, and Others), Germany Baby Diapers Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsGermany Baby Diapers Market Size Insights Forecasts to 2035

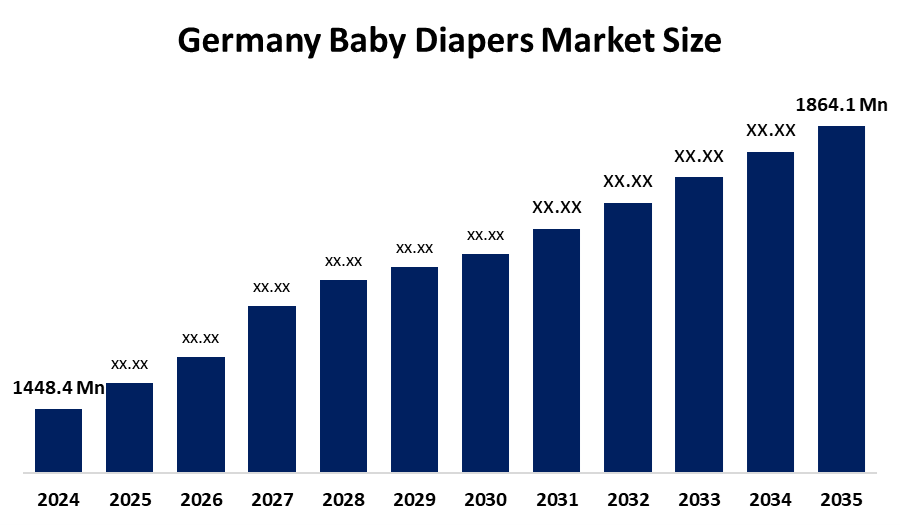

- Germany Baby Diapers Market Size 2024: USD 1448.4 Mn

- Germany Baby Diapers Market Size 2035: USD 1864.1 Mn

- Germany Baby Diapers Market Size CAGR 2024: 2.32%

- Germany Baby Diapers Market Size Segments: Product and Distribution Channel.

Get more details on this report -

The Germany Baby Diapers Market Size comprises the manufacturing and distribution of absorbent hygiene products designed for infants and toddlers to manage bodily waste effectively. These products ranging from standard disposable nappies to sustainable cloth alternatives—are essential personal care items characterized by their high absorption capacity, leak protection, and skin-friendly materials. Additionally, there is a significant shift toward premiumization, with parents increasingly seeking high-performance "pants" or "pull-up" styles that offer greater mobility for active toddlers compared to traditional taped diapers.

The German government, through the Federal Environment Agency, promotes sustainability via certifications like the "Blue Angel" (Blauer Engel) ecolabel, which sets strict criteria for the exclusion of hazardous chemicals and the use of sustainable pulp. Simultaneously, private initiatives and many German municipalities offer "cloth diaper subsidies", providing financial reimbursements to parents who choose reusable options to reduce landfill waste.

Technological advancements are revolutionizing the German diaper sector through the integration of smart technology and material science. Innovation is currently focused on "smart diapers" equipped with IoT sensors that monitor moisture levels and infant health metrics, alerting parents via smartphone applications.

Germany Baby Diapers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1448.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 2.32 % |

| 2035 Value Projection: | USD 1864.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Procter & Gamble Germany, Dirk Rossmann GmbH, dm-drogerie markt GmbH, Hipp GmbH & Co. Vertrieb KG, Ontex Healthcare Germany GmbH, Essity GmbH, Kimberly-Clark Germany, Vyld, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the Germany Baby Diapers Market Size:

The Germany Baby Diapers Market Size is primarily driven by the high awareness of infant hygiene, strong healthcare infrastructure, and rising demand for premium and skin-friendly products. Higher disposable incomes and the willingness of parents to spend on quality baby care products further fuel demand. Additionally, well-established retail networks and growing penetration of e-commerce platforms enhance product accessibility across urban and semi-urban regions.

The Germany Baby Diapers Market Size is restrained by declining birth rates in Germany and the relatively high cost of premium and eco-friendly diapers. Environmental concerns related to disposable diaper waste and strict regulations on product materials also limit expansion, especially for manufacturers relying on conventional plastic-based diapers.

Opportunities lie in the development of sustainable, biodegradable, and reusable diaper solutions. Innovation in plant-based materials, smart diapers with wetness indicators, and expansion of online subscription models can attract environmentally conscious and convenience-seeking parents, supporting long-term market growth.

Market Segmentation

The Germany Baby Diapers Market Size share is classified into product and distribution channel.

By Product:

The German baby diaper market is divided by product into non-disposable diapers and disposable diapers. Among these, the disposable diapers segment is projected to grow at the fastest CAGR during the forecast period. Parents prefer disposable diapers because they effectively stop leaks, particularly at night, and the growing number of environmentally friendly disposable choices has helped solve environmental concerns.

By Distribution Channel:

The Germany Baby Diapers Market Size is divided by distribution channel into supermarkets & hypermarkets, pharmacies & drug stores, specialty stores, online, and others. Among these, the supermarkets & hypermarkets segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. These retail models provide accessibility and convenience. Because these stores offer reasonable prices, frequent promotions, and the opportunity to evaluate many brands and product kinds in one place, parents choose to buy baby diapers in bulk from them.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany Baby Diapers Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Baby Diapers Market Size:

- Procter & Gamble Germany

- Dirk Rossmann GmbH

- dm-drogerie markt GmbH

- Hipp GmbH & Co. Vertrieb KG

- Ontex Healthcare Germany GmbH

- Essity GmbH

- Kimberly-Clark Germany

- Vyld

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Baby Diapers Market Size based on the below-mentioned segments:

Germany Baby Diapers Market Size, By Product

- Non-Disposable Diapers

- Disposable Diapers

Germany Baby Diapers Market Size, By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacies & Drug Stores

- Specialty Stores

- Online

- Others

Frequently Asked Questions (FAQ)

-

What is the market size and growth outlook of the Germany Baby Diapers Market Size?The market was valued at USD 1,448.4 million in 2024 and is expected to reach USD 1,864.1 million by 2035, growing at a CAGR of 2.32% during the forecast period.

-

Which product segment dominates the Germany Baby Diapers Market Size?Disposable diapers dominate the market and are projected to grow at the fastest CAGR due to convenience, high absorbency, leak protection, and increasing availability of eco-friendly disposable options.

-

What are the key factors driving market growth in Germany?High awareness of infant hygiene, strong healthcare infrastructure, rising demand for premium and skin-friendly diapers, higher disposable incomes, and expanding e-commerce penetration drive market growth.

-

What are the major restraints affecting the market?Declining birth rates, high costs of premium and sustainable diapers, environmental concerns over disposable waste, and strict material regulations limit market expansion.

-

Which distribution channel holds the largest market share?Supermarkets and hypermarkets hold the largest share due to bulk purchasing options, competitive pricing, frequent promotions, and wide product availability under one roof.

-

Who are the key players in the Germany Baby Diapers Market Size?Key players include Procter & Gamble Germany, Dirk Rossmann GmbH, dm-drogerie markt GmbH, Hipp GmbH & Co. Vertrieb KG, Ontex Healthcare Germany GmbH, Essity GmbH, Kimberly-Clark Germany, and Vyld.

Need help to buy this report?