Germany Audiology Devices Market Size, Share, and COVID-19 Impact Analysis, By Technology (Digital and Analog), By Age Group (Pediatrics and Adults), By Product (Cochlear Implants and Hearing Aids), and Germany Audiology Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Audiology Devices Market Insights Forecasts to 2035

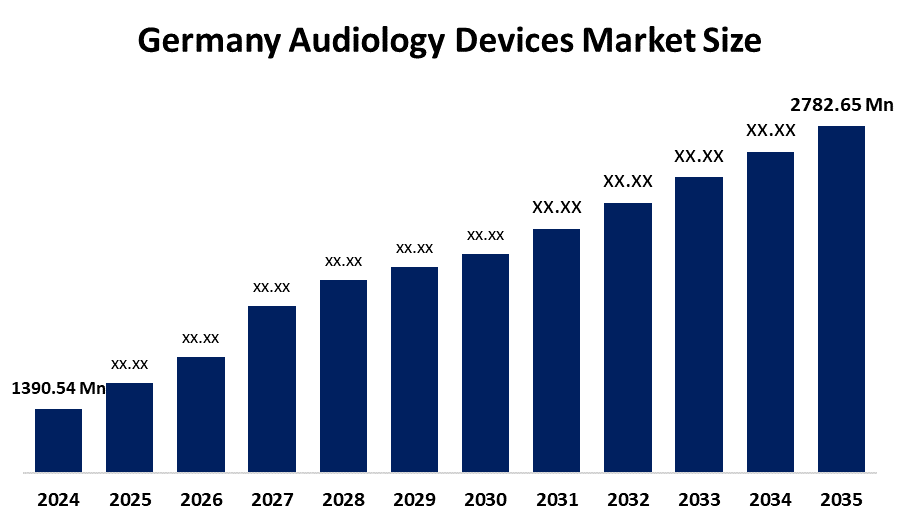

- The Germany Audiology Devices Market Size Was Estimated at USD 1390.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.51% from 2025 to 2035

- The Germany Audiology Devices Market Size is Expected to Reach USD 2782.65 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Audiology Devices Market Size is anticipated to reach USD 2782.65 Million by 2035, growing at a CAGR of 6.51% from 2025 to 2035. The growing geriatric population, rising prevalence of hearing disorders, and supportive government initiatives for easy access to hearing aids.

Market Overview

The audiology devices market relates to creating and selling medical devices for the diagnosis, monitoring, and treatment of hearing disorders, such as hearing aids, cochlear implants, bone-anchored hearing systems, and audiometers. Hearing aids, for instance, provide benefits such as improved hearing ability, enhanced communication, improvements in quality of life, and early detection of hearing loss. There are several major opportunities for market growth, such as increased awareness of hearing health, an increasing prevalence of elderly populations, and advancements in digital and wireless technology. In addition, government incentives, such as subsidized hearing aids, public health campaigns, and early screening programs, promote access to hearing care for patients and the demand for audiology devices. The current regulatory environment, support for research, and inclusion of audiology services in national health systems will continue to strengthen the demand for audiology devices, especially in aging, and noise experience populations.

Report Coverage

This research report categorizes the market for Germany audiology devices market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany audiology devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany audiology devices market.

Germany Audiology Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1390.54 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.51% |

| 2035 Value Projection: | USD 2782.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Technology, By Age Group and By Product |

| Companies covered:: | Audia Akustik, Horluchs, Qnexys, Auritec, Geers, Hansaton, Audio Service, Pro Akustik GmbH & Co KG, Fielmann, auric Management, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of hearing loss is especially in the senior citizen demographic. Heightened awareness on diagnosis and treatment at an earlier stage, combined with advances in digital hearing innovations, drive the uptake of hearing devices. Government initiatives promoting hearing screening for newborns, support for elderly citizens, and community-based rehab or other medical services for the elderly will also foster increased demand for hearing devices. Continuous vape innovations, such as Bluetooth capability, rechargeable batteries, or AI functionality, improve the experience and access.

Restraining Factors

The elevated expense of sophisticated hearing devices limits their use for many individuals, particularly in low- and middle-income regions. Compensatory policies and low insurance coverage also inhibit use. Social stigma connected to hearing aid use further dissuades patients. In addition, lack of public knowledge concerning hearing loss and limited access to audiology services, especially in rural areas, limit market growth.

Market Segmentation

The Germany audiology devices market share is classified into technology, age group, and product.

- The digital segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany audiology devices market is segmented by technology into digital and analog. Among these, the digital segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its advanced features, including noise reduction, speech enhancement, and wireless connectivity. These devices offer superior sound quality and customization compared to analog alternatives, making them highly preferred by users and audiologists. Growing awareness of hearing health, an aging population, and rising demand for discreet, tech-enabled solutions drive adoption.

- The pediatrics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany audiology devices market is segmented by age group into pediatrics and adults. Among these, the pediatrics segments held a significant share in 2024 and are expected to grow at a significant CAGR during the forecast period. The rising incidence of congenital and early-onset hearing loss among children. Early diagnosis and intervention are critical for speech and cognitive development, driving demand for advanced pediatric hearing aids and cochlear implants. Government-supported newborn hearing screening programs and increased parental awareness further boost adoption.

- The cochlear implants segments dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany audiology devices market is segmented by product into cochlear implants and hearing aids. Among these, the cochlear implants segments dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their effectiveness in treating severe to profound hearing loss, especially when hearing aids are insufficient. Increasing prevalence of hearing impairment, strong reimbursement policies, and rising awareness of advanced treatment options drive demand. Technological advancements, such as wireless connectivity and improved sound processing, enhance user outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany audiology devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Audia Akustik

- Horluchs

- Qnexys

- Auritec

- Geers

- Hansaton

- Audio Service

- Pro Akustik GmbH & Co KG

- Fielmann

- auric Management

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany audiology devices market based on the below-mentioned segments:

Germany Audiology Devices Market, By Technology

- Digital

- Analog

Germany Audiology Devices Market, By Age Group

- Pediatrics

- Adults

Germany Audiology Devices Market, By Product

- Cochlear Implants

- Hearing Aids

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Audiology Devices Market in 2024?A: The Germany Audiology Devices Market size was estimated USD 1390.54 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Audiology Devices Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 6.51% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Audiology Devices Market?A: Key players include Audia Akustik, Horluchs, Qnexys, Auritec, Geers, Hansaton, Audio Service, Pro Akustik GmbH & Co KG, Fielmann, auric Management

-

Q.4: What are the main drivers of growth in the Germany Audiology Devices Market?A: The rising incidence of hearing loss is especially in the senior citizen demographic. Heightened awareness on diagnosis and treatment at an earlier stage, combined with advances in digital hearing innovations, drive the uptake of hearing devices.

-

Q.5: What is the main restraining of growth in the Germany Audiology Devices Market?A: The elevated expense of sophisticated hearing devices limits their use for many individuals, particularly in low- and middle-income regions.

Need help to buy this report?