Germany Antidiabetics Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (GLP-1 Receptor Agonists and Insulin), By Diabetes Type (Type 1 and Type 2), By Route of Administration (Oral and Intravenous), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Germany Antidiabetics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Antidiabetics Market Size Insights Forecasts to 2035

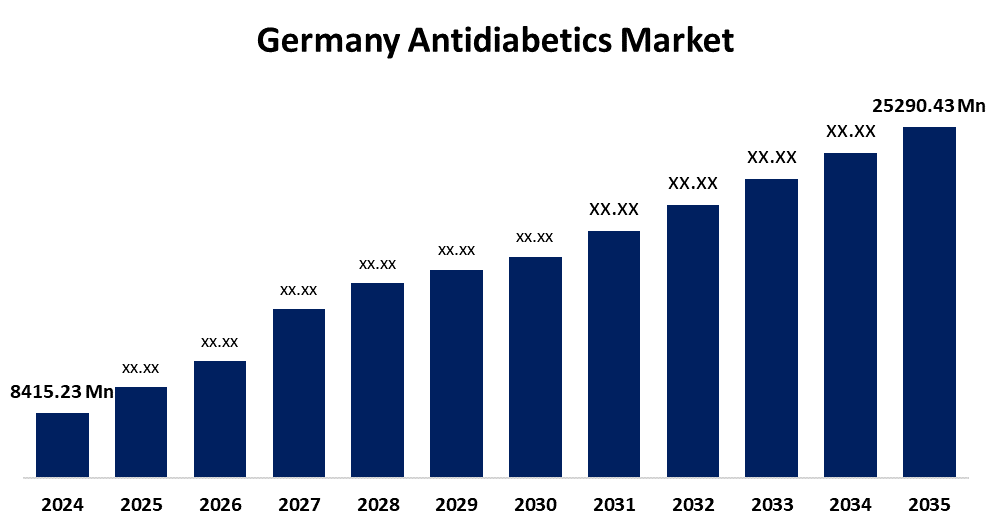

- The Germany Antidiabetics Market Size Was Estimated at USD 8415.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.52% from 2025 to 2035

- The Germany Antidiabetics Market Size is Expected to Reach USD 25,290.43 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Germany Antidiabetics Market Size is anticipated to Reach USD 25290.43 Million by 2035, Growing at a CAGR of 10.52% from 2025 to 2035. Rising diabetes prevalence, improvements in SGLT2 inhibitors and GLP-1 receptor agonists, and growing use of combination therapy are the main drivers of the antidiabetics market. The proliferation of biosimilar insulin, regulatory approvals, and cardiovascular advantages all contribute to market growth.

Market Overview

The antidiabetics market includes a variety of industries that develop, manufacture, market and distribute medicines for the treatment of diabetes especially Type 1 and Type 2 diabetes plays a particularly prominent role in improving outcomes for patients. It should be noted, better outcomes lead to better quality of life, reduced healthcare spend, and reduced co-morbidities developing as a result of the diabetes condition. The growing awareness of diabetes, the continually rising incidence of diabetes, and further developments in therapeutics present large scale opportunities for the antidiabetics market, there is a variety of mechanisms by which governments are supporting the antidiabetics market as well subsidies, public awareness campaigns, funding for innovation in research and innovation. In fact, a clear antidiabetic market plan would include successful outcomes through all of these strategies which reduce the disease burden on society, public health, and the healthcare system. The provision of diagnosis and disease management ultimately contributes to the enhancement of antidiabetic medications within health necessity and can provide the opportunity for subsequent future health enhancements of knowledge within education and potential.

Report Coverage

This research report categorizes the market for Germany antidiabetics market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany antidiabetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany antidiabetics market.

Germany Antidiabetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8415.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.52% |

| 2035 Value Projection: | USD 25290.43 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drug Class, By Diabetes and COVID-19 Impact Analysis |

| Companies covered:: | Boehringer Ingelheim, Bayer AG, Novo Nordisk A/S, Sanofi (Sanofi Aventis), AstraZeneca, Eli Lilly and Company, Merck & Co., Inc., Pfizer Inc., Takeda Pharmaceutical Company Ltd, Bristol-Myers Squibb, Novartis AG, Teva Pharmaceutical Industries Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of diabetes largely driven by aging populations, sedentary lifestyles, and poor diets. Rising awareness surrounding diabetes management and better formulations of drugs also serves the market more positively. The growing adoption of insulin and oral antidiabetic drugs contributes to the expansion as well. Government support, improved healthcare infrastructure, and an increase in research and development investment are additional catalysts to growth.

Restraining Factors

High medication costs, especially for new, complex formulations may create access for patients, particularly in low-income areas, creating inequities in diabetes care. Stringent requirements and long-noted regulatory approval times for new drugs create barriers to entry and added costs for manufacturers. The antidiabetics market has various obstacles that could disrupt growth of the market.

Market Segmentation

The Germany antidiabetics market share is classified into drug class, diabetes type, route of administration, and distribution channel.

- The GLP-1 receptor agonists segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany antidiabetics market is segmented by drug class into GLP-1 receptor agonists and insulin. Among these, the GLP-1 receptor agonists segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The combined advantages in weight loss and glycemic control, both of which are essential for the management of type 2 diabetes. These medications, which include semaglutide and liraglutide, decrease stomach emptying, increase insulin secretion, and inhibit glucagon. Their popularity has been further reinforced by the cardiovascular benefits they have shown in significant clinical trials.

- The type 1 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany antidiabetics market is segmented by diabetes type into type 1 and type 2. Among these, the type 1 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. In continuous glucose monitoring devices, insulin delivery systems, and heightened knowledge of early illness detection and treatment. Patient outcomes and adherence are being improved by advancements in insulin analogs and better access to medication.

- The intravenous segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany antidiabetics market is segmented by route of administration into oral and intravenous. Among these, the intravenous segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Intravenous injection was commonly used in hospitals and emergency rooms for its quick therapeutic effects, particularly for patients who needed glycemic control right away. Improved access to healthcare facilities in emerging nations and rising hospitalization rates associated with complications from diabetes further bolstered the segment's growth.

- The hospital pharmacies segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany antidiabetics market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period. A large number of prescriptions are written and given in hospital settings, particularly for patients in need of combination medications or specialized diabetes care. Additionally, hospitals serve as the main treatment facilities for patients with recent diagnoses and those who have serious problems, which results in a rise in the prescription of antidiabetic medications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany antidiabetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boehringer Ingelheim

- Bayer AG

- Novo Nordisk A/S

- Sanofi (Sanofi Aventis)

- AstraZeneca

- Eli Lilly and Company

- Merck & Co., Inc.

- Pfizer Inc.

- Takeda Pharmaceutical Company Ltd

- Bristol-Myers Squibb

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Others

Key Target Audience

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany antidiabetics market based on the below-mentioned segments:

Germany Antidiabetics Market, By Drug Class

- GLP-1 Receptor Agonists

- Insulin

Germany Antidiabetics Market, By Diabetes Type

- Type 1

- Type 2

Germany Antidiabetics Market, By Route of Administration

- Oral

- Intravenous

Germany Antidiabetics Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Antidiabetics Market in 2024?A: The Germany Antidiabetics Market size was estimated USD 8415.23 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Antidiabetics Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 10.52% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Antidiabetics Market?A: Key players include Boehringer Ingelheim, Bayer AG, Novo Nordisk A/S, Sanofi (Sanofi Aventis), AstraZeneca, Eli Lilly and Company, Merck & Co., Inc., Pfizer Inc., Takeda Pharmaceutical Company Ltd, Bristol‑Myers Squibb, Novartis AG, Teva Pharmaceutical Industries Ltd., Others

-

Q.4: What are the main drivers of growth in the Germany Antidiabetics Market?A: The rising prevalence of diabetes largely driven by aging populations, sedentary lifestyles, and poor diets.

-

Q.5: What is the main restraining of growth in the Germany Antidiabetics Market?A: High medication costs, especially for new, complex formulations may create access for patients, particularly in low-income areas, creating inequities in diabetes care.

Need help to buy this report?