Germany Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid, and Gas), By End Use (Agriculture, Textile, Mining, Pharmaceutical, Refrigeration, and Others), and Germany Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsGermany Ammonia Market Size Insights, Forecasts Report To 2035

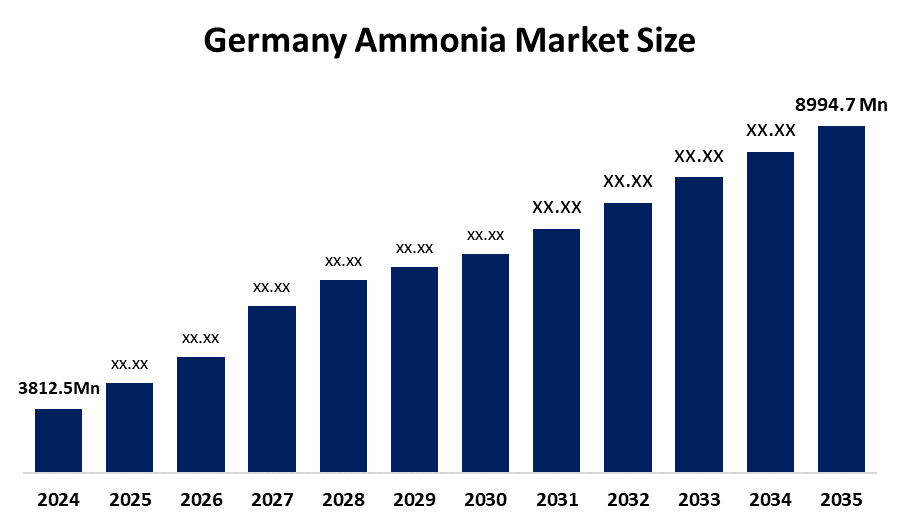

- The Germany Ammonia Market Size Was Estimated At USD 3812.5 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 8.12% From 2025 To 2035

- The Germany Ammonia Market Size Is Expected To Reach USD 8994.7 Million By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany ammonia market size is anticipated to reach USD 8994.7 million by 2035, growing at a CAGR of 8.12% from 2025 to 2035. The ammonia market in Germany is driven by rising fertilizer demand, green ammonia projects, the growth of the hydrogen economy, industrial decarbonization objectives, the integration of renewable energy sources, and robust government backing for sustainable chemical production.

Market Overview

The Germany ammonia market size refers to the production, distribution, and consumption of ammonia used across multiple industries. Ammonia serves as a fundamental component in the manufacturing of fertilizers, various chemical products, pharmaceutical items, refrigeration systems, explosives, and wastewater treatment facilities. In Germany, increasing requirements for agricultural output and industrial chemical production, and the shift to green ammonia for hydrogen storage and low-carbon energy systems, drive market expansion and technological progress.

The German government supports the ammonia market size through the National Hydrogen Strategy, which aims to establish 10 GW of electrolyzer capacity by 2030 with €9 billion in funding. The H2Global program, which provides over €900 million, supports green ammonia imports while hydrogen import schemes, decarbonization incentives, and infrastructure investments create sustainable ammonia production and usage pathways.

BASF has launched its green ammonia production facility in Ludwigshafen using ISCC+ certification to verify its renewable energy output. Uniper and other energy firms are securing long-term green ammonia supply deals, while hydrogen-to-ammonia infrastructure and cracking tech advance domestic supply chains. The future opportunities will arise from increasing green ammonia production and developing import terminals, and establishing hydrogen economy systems for decarbonized industrial and energy operations.

Report Coverage

This research report categorizes the market size for the Germany ammonia market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany ammonia market.

Germany Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3812.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 8.12% |

| 2023 Value Projection: | USD 8994.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Type |

| Companies covered:: | BASF SE, SKW Stickstoffwerke Piesteritz GmbH, K+S AG, Yara GmbH & Co. KG, thyssenkrupp Uhde, Siemens Energy, Brenntag SE, Uniper SE, EnBW Energie Baden Württemberg AG, RELANA Spedition und Logistik GmbH, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammonia market size in Germany is driven by the agricultural fertilizer demand, which continues to grow, and green ammonia adoption increases for decarbonization purposes, the hydrogen economy expands, and Germany implements its strict climate targets. The government provides support through its hydrogen strategies, subsidies, and infrastructure investments, which enable companies to expand their operations. The market continues to grow because industrial sectors use ammonia for various applications in chemicals and pharmaceuticals, energy storage, and hydrogen transportation.

Restraining Factors

The ammonia market size in Germany is mostly constrained by the fact that green ammonia production costs remain high, energy prices fluctuate, environmental laws are enforced, carbon compliance expenses must be paid, domestic hydrogen production is insufficient, and infrastructure problems exist. The market depends on ammonia and hydrogen imports to meet its large-scale needs.

Market Segmentation

The Germany ammonia market share is classified into type and end use.

- The liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany ammonia market size is segmented by type into liquid, and gas. Among these, the liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Because of its ease of storage and transportation, significant demand from the chemical and fertilizer sectors, extensive industrial use, and appropriateness for large-scale distribution and export applications, liquid ammonia dominates the German ammonia market.

- The agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Germany ammonia market size is segmented by end use into agriculture, textile, mining, pharmaceutical, refrigeration, and others. Among these, the agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because ammonia is widely used in fertilizer manufacture to increase crop yields, the agriculture sector dominates the German ammonia market. Sustained consumption and market expansion are fueled by a strong demand for nitrogen-based fertilizers, sophisticated farming techniques, and the need for food security.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany ammonia market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- SKW Stickstoffwerke Piesteritz GmbH

- K+S AG

- Yara GmbH & Co. KG

- thyssenkrupp Uhde

- Siemens Energy

- Brenntag SE

- Uniper SE

- EnBW Energie Baden-Württemberg AG

- RELANA Spedition und Logistik GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2026, a long-term renewable ammonia offtake deal (up to 500,000 t/yr) is signed by Uniper and AM Green.

- In October 2024, Yara supports the hydrogen economy by opening a new ammonia import terminal in Brunsböllel.

- In February 2025, a €2.5 billion green hydrogen import auction involving ammonia derivatives is held in Germany.

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany ammonia market based on the below-mentioned segments:

Germany Ammonia Market, By Type

- Liquid

- Gas

Germany Ammonia Market, By End Use

- Agriculture

- Textile

- Mining

- Pharmaceutical

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

What is the Germany ammonia market size?Germany ammonia market size is expected to grow from USD 3812.5 million in 2024 to USD 8994.7 million by 2035, growing at a CAGR of 8.12% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by agricultural fertilizer demand, which continues to grow, and green ammonia adoption increases for decarbonization purposes, the hydrogen economy expands, and Germany implements its strict climate targets.

-

What factors restrain the Germany ammonia market?Constraints include the fact that green ammonia production costs remain high, energy prices fluctuate, environmental laws are enforced, and carbon compliance expenses must be paid.

-

How is the market segmented by type?The market is segmented into liquid, and gas.

-

Who are the key players in the Germany ammonia market?Key companies include BASF SE, SKW Stickstoffwerke Piesteritz GmbH, K+S AG, Yara GmbH & Co. KG, thyssenkrupp Uhde, Siemens Energy, Brenntag SE, Uniper SE, EnBW Energie Baden‑Württemberg AG, RELANA Spedition und Logistik GmbH, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?