Germany Aluminum Alloys Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Wrought Alloys, Cast Alloys, and Aluminium Lithium Alloys), By Form (Sheets, Plates, Extrusions, and Foils), By Application (Automotive, Aerospace, Construction, Marine, and Electrical), By End-use (Industrial, Consumer Electronics, and Transportation), and Germany Aluminium Alloys Market, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsGermany Aluminum Alloys Market Insights Forecasts To 2035

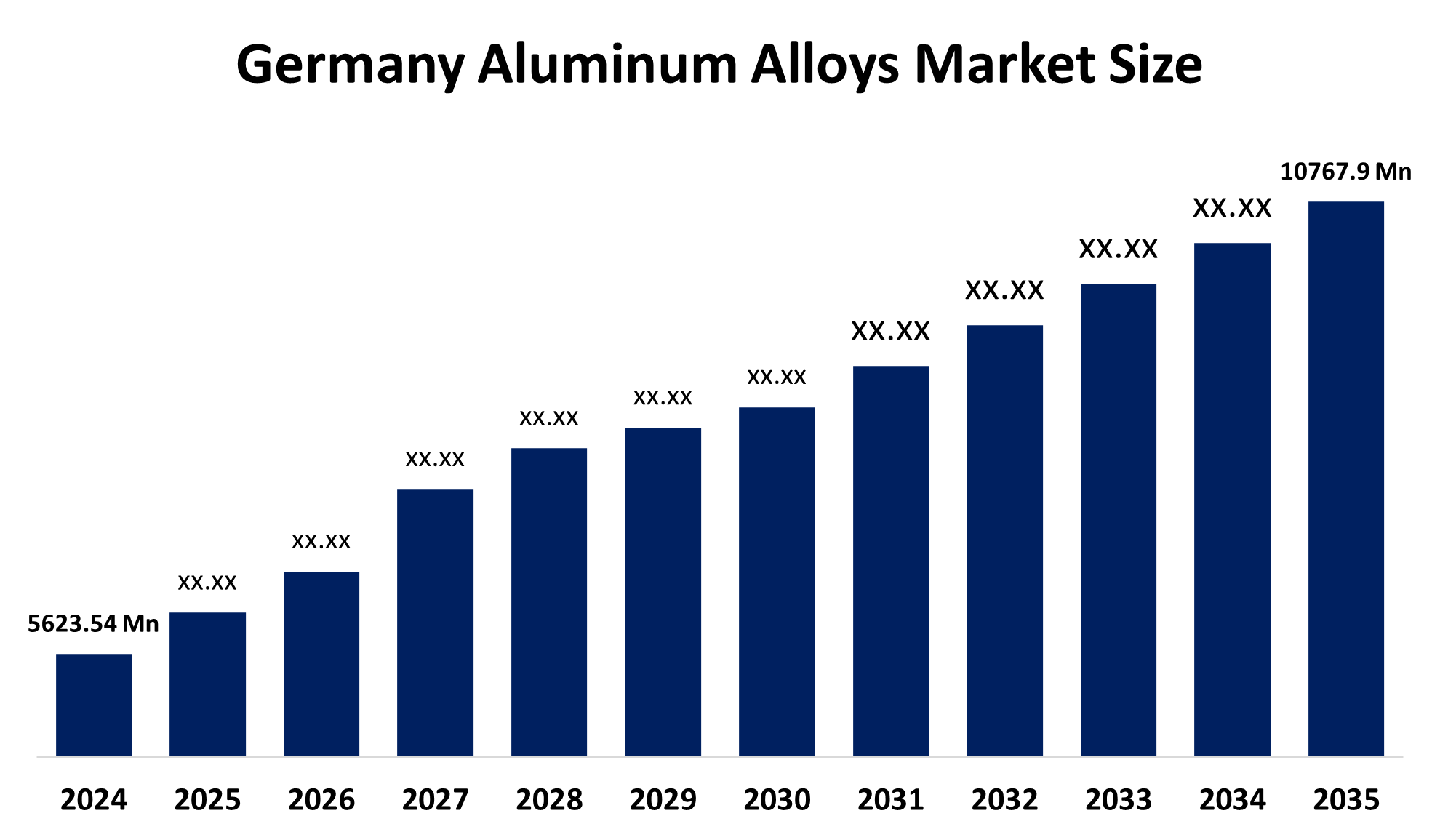

- The Germany Aluminium Alloys Market Size Was Estimated at USD 5623.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The Germany Aluminium Alloys Market Size is Expected to Reach USD 10767.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Aluminium Alloys Market is Anticipated To Reach USD 10767.9 Million by 2035, Growing at a CAGR of 6.08% from 2025 to 2035. The noteworthy developments in the aluminum alloy market at the moment are being driven by a number of variables. One of the primary factors propelling the market is the growing need for lightweight materials in a variety of industries, such as aerospace, automotive, and construction.

Market Overview

The aluminum alloys arena relates to activities that involve the fabrication and commercialization of metal composites containing primarily aluminium and additional alloying elements such as copper, magnesium, or silicon to improve strength, durability, or corrosion resistance. Aluminium alloys have been used in a variety of verticals and industries such as automotive, aerospace, construction, electronics, and industrial. It possesses properties and attributes such as light weight, high conductivity, recyclable, and superior performance in extreme environmental conditions. The upswing in demand for fuel-efficient vehicles, electric mobility, and sourcing sustainable materials is raising market opportunities. The German government has stepped up efforts with new initiatives including the Green New Deal, financing the manufacture of electric vehicles, modernizing existing infrastructure, and providing new incentives for using advanced materials especially aluminium alloys. These initiatives are simultaneously advancing industrial competitiveness while transitioning towards achieving carbon neutrality.

Report Coverage

This research report categorizes the market for Germany aluminium alloys market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany aluminium alloys market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany aluminium alloys market.

Germany Aluminum Alloys Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 5623.54 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.08% |

| 2035 Value Projection: | USD 10767.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Form, By Application, By End-use |

| Companies covered:: | Aluminium Norf, VDM Metals Holding, Zapp Group, Trimet Aluminium SE, Hydro Aluminium Deutschland, Hydro Aluminium Extrusion Deutschland, Hydro Aluminium High Purity, Erbsloh Aktiengesellschaft, Almatis, Anton Hurtz GmbH & Co. KG, HASE, Aluminium Contract Manufacturers, Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The automotive, aerospace, and construction industries are moving towards lightweight and durable materials. The growth of electric vehicles and fuel efficiency standards increase the use of aluminium alloys, especially their strength-to-weight ratio. Additionally, the huge growth of industrial automation and infrastructure projects indicates more demand for aluminium as material.

Restraining Factors

Competition from alternate materials like carbon fibre composites and high-strength plastics that sometimes can achieve superior performance in some applications also constrains aluminium alloy adoption. Environmental pressures from strict regulations and the cost of manufacture have added burdens to producers and could create a difficulty in achieving growth as the cost of compliance and alloying can influence cost effectiveness.

Market Segmentation

The Germany aluminum alloys market share is classified into product type, form, application, and end-use.

- The wrought alloys segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany aluminum alloys market is segmented by product type into wrought alloys, cast alloys, and aluminium lithium alloys. Among these, the wrought alloys segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Exceptional mechanical qualities and versatility in a range of applications, including building and transportation, wrought alloys are widely used to satisfy industry demands for strong, lightweight materials.

- The plates segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany aluminum alloys market is segmented by form into sheets, plates, extrusions, and foils. Among these, the plates segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Applications needing structural stability, which are frequently found in the military and aerospace industries, greatly benefit from plates. Extrusions are essential because they offer distinctive forms and patterns that meet the demands of contemporary architecture.

- The automotive segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany aluminum alloys market is segmented by application into automotive, aerospace, construction, marine, and electrical. Among these, the automotive segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising electric vehicle production, lightweight vehicle demand, and government emission regulations. Aluminum's strength-to-weight ratio makes it ideal for reducing vehicle weight, enhancing fuel efficiency, and meeting sustainability goals.

- The industrial segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany aluminum alloys market is segmented by end-use into industrial, consumer electronics, and transportation. Among these, the industrial segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period. The robust demand from the manufacturing, machinery, and infrastructure sectors. Aluminum alloys offer durability, corrosion resistance, and lightweight properties, making them ideal for industrial applications. Continued investments in industrial automation and infrastructure development are expected to drive significant growth in this segment over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany aluminum alloys market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aluminium Norf

- VDM Metals Holding

- Zapp Group

- Trimet Aluminium SE

- Hydro Aluminium Deutschland

- Hydro Aluminium Extrusion Deutschland

- Hydro Aluminium High Purity

- Erbsloh Aktiengesellschaft

- Almatis

- Anton Hurtz GmbH & Co. KG

- HASE

- Aluminium Contract Manufacturers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany aluminum alloys market based on the below-mentioned segments:

Germany Aluminum Alloys Market, By Product Type

- Wrought Alloys

- Cast Alloys

- Aluminium Lithium Alloys

Germany Aluminum Alloys Market, By Form

- Sheets

- Plates

- Extrusions

- Foils

Germany Aluminum Alloys Market, By Application

- Automotive

- Aerospace

- Construction

- Marine

- Electrical

Germany Aluminum Alloys Market, By End-use

- Industrial

- Consumer Electronics

- Transportation

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Germany Aluminum Alloys Market in 2024?The Germany Aluminum Alloys Market size was estimated USD 5623.54 Million in 2024.

-

2. What is the forecasted CAGR of the Germany Aluminum Alloys Market from 2024 to 2035?The market is expected to grow at a CAGR of around 6.08% during the period 2024–2030.

-

3. Who are the top 10 companies operating in the Germany Aluminum Alloys Market?Key players include Aluminium Norf, VDM Metals Holding, Zapp Group, Trimet Aluminium SE, Hydro Aluminium Deutschland, Hydro Aluminium Extrusion Deutschland, Hydro Aluminium High Purity, Erbsloh Aktiengesellschaft, Almatis, Anton Hurtz GmbH & Co. KG, HASE, Aluminium Contract Manufacturers, Others.

-

4. What are the main drivers of growth in the Germany Aluminum Alloys Market?The automotive, aerospace, and construction industries are moving towards lightweight and durable materials.

-

5. What are the main restraining of growth in the Germany Aluminum Alloys Market?Competition from alternate materials like carbon fibre composites and high-strength plastics that sometimes can achieve superior performance in some applications also constrains aluminum alloy adoption.

Need help to buy this report?