Germany Agribusiness Market Size, Share, and COVID-19 Impact Analysis, By Production Mode (Conventional, Organic, Regenerative, and Precision / Smart Farming), By Technology Level (Low-tech / traditional farming, Mechanized / Modern, Smart Agriculture, and Biotechnology) and Germany Agribusiness Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureGermany Agribusiness Market Size Insights Forecasts to 2035

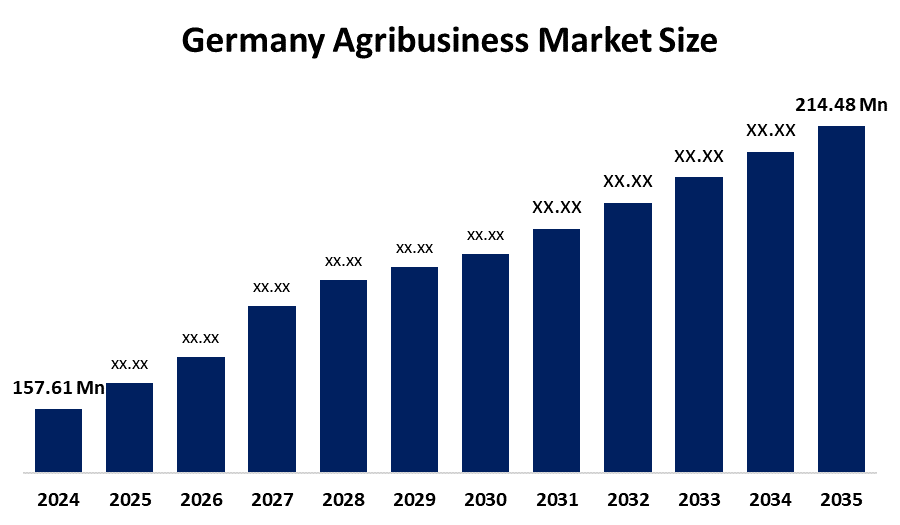

- The Germany Agribusiness Market Size was estimated at USD 157.61 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.84% from 2025 to 2035

- The Germany Agribusiness Market Size is Expected to Reach USD 214.48 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Agribusiness Market Size is anticipated to Reach USD 214.48 Million by 2035, growing at a CAGR of 2.84% from 2025 to 2035. Germany's market is being positively impacted by constant product innovations and strict adherence to EU food safety regulations.

Market Overview

The agribusiness industry of Germany includes the production, processing, and distribution of agricultural products, driven by technology and compliance with EU food safety regulations. It features a strong export focus, broad adoption of precision agriculture and a combination of specialized and family farms. The agribusiness sector benefits from the country’s location at the center of the EU and the competitive retail industry, which has a strong demand for quality products. Additionally, Growing precision farming adoption is driving the expansion of the German agribusiness sector. Global positioning system (GPS)-guided equipment, drones, soil sensors, and data analytics are examples of precision farming technologies that help German farmers keep an eye on crop health, optimize irrigation, and precisely apply pesticides or fertilizers. In keeping with Germany's strong emphasis on organic food production and sustainable agriculture, this focused approach lowers input costs, minimizes environmental impact, and guarantees higher yields.

Report Coverage

This research report categorizes the market for the Germany agribusiness market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany agribusiness market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany agribusiness market.

Germany Agribusiness Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 157.61 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.84% |

| 2035 Value Projection: | USD 214.48 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 149 |

| Segments covered: | By Production Mode, By Technology Level and COVID-19 Impact Analysis |

| Companies covered:: | AGRAVIS Raiffeisen AG, KWS SAAT SE & Co. KGaA, CLAAS Group, BayWa AG, Infarm, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing consumer awareness of food safety and origin, strong government support for sustainable farming methods, and rising investment in agri-tech startups are all factors in Germany's agribusiness market. While EU subsidies and research funding promote innovation in climate-resilient crops and low-emission farming, the nation's sophisticated logistics infrastructure and close proximity to important European markets improve export efficiency.

Restraining Factors

Stricter EU environmental regulations that increase compliance burdens, labor shortages, and rising input costs are some of the restraining factors facing Germany's agribusiness market. Crop yields and livestock health are also at risk due to soil degradation and climate variability. Furthermore, the sustainability of family-run farms is threatened by changing demographics and inadequate succession planning.

Market Segmentation

The Germany agribusiness market share is classified into Production Mode and technology level.

- The conventional segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany agribusiness market is segmented by production type into conventional, organic, regenerative, and precision / smart farming. Among these, the conventional segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by its capacity to meet high volume demand in both domestic and export markets, scalability, and established infrastructure. Its growth is facilitated by steady supply chains, ongoing investments in mechanization, and availability of EU subsidies. Conventional farming is also resilient in the face of changing market conditions because of its integration with the food processing industries and competitive pricing.

- The mechanized / modern segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany agribusiness market is segmented by technology level into low-tech / traditional farming, mechanized / modern, smart agriculture, and biotechnology. Among these, the mechanized / modern segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the integration of digital tools like GPS and automated systems, increased demand for efficiency and scalability, and robust domestic production of agricultural machinery. The transition from traditional to mechanized operations is accelerated by labor shortages and climate challenges, while EU funding and sustainability mandates further promote modernization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany agribusiness market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGRAVIS Raiffeisen AG

- KWS SAAT SE & Co. KGaA

- CLAAS Group

- BayWa AG

- Infarm

- Others

Recent Developments:

- In January 2025, [KG1] The leading agribusiness company ADM expanded its regenerative agriculture program in Germany by offering a program to farmers who grew soybeans, rapeseed, and wheat. The regeneration program was started in partnership with the Berlin agritech start-up Klim and provided financial assistance and agronomic advice to farmers who implemented regenerative agriculture practices like conservation tillage, cover crops, and targeted fertilizer use. Through the collection of comprehensive data and insights from the entire farm, farmers employed more than 30 key performance indicators to evaluate impact.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Agribusiness Market based on the below-mentioned segments:

Germany Agribusiness Market, By Production Mode

- Conventional

- Organic

- Regenerative

- Precision / Smart Farming

Germany Agribusiness Market, By Technology Level

- Low-tech / traditional farming

- Mechanized / Modern

- Smart Agriculture

- Biotechnology

Frequently Asked Questions (FAQ)

-

Q: What is the Germany agribusiness market size?A: Germany Agribusiness Market is expected to grow from USD 157.61 million in 2024 to USD 214.48 million by 2035, growing at a CAGR of 2.84% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Germany's agribusiness market is expected to grow due in large part to the increasing use of precision farming technologies, stricter EU food safety regulations, steady product innovation, and growing consumer demand for resource efficiency and sustainable farming methods.

-

Q: What factors restrain the Germany agribusiness market?A: Tight environmental regulations, growing input costs, labor shortages, dispersed farm structures, and the limited scalability of traditional practices in the face of growing demand for technologically advanced and sustainable agricultural solutions are some of the factors restraining the German agribusiness market.

-

Q: Who are the key players in the Germany agribusiness market?A: AGRAVIS Raiffeisen AG, KWS SAAT SE & Co. KgaA, CLAAS Group, BayWa AG, Infarm, Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?