Global Generative AI In Telecom Market Size, Share, and COVID-19 Impact Analysis, By Type (Text-based, Image-based, and Voice-based), By Application (Enhanced Customer Satisfaction, Automated Monitoring Solutions, Manage Dynamic Networks, Improve Network Performance, Network Security and Fraud Mitigation, and Network Orchestration), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Generative AI In Telecom Market Analysis

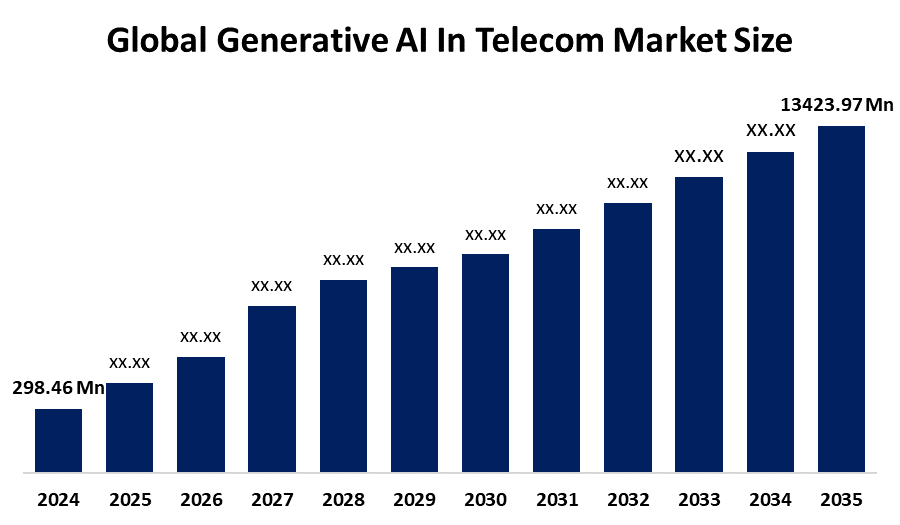

- The Global Generative AI In Telecom Market Size Was Estimated at USD 298.46 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 41.34% from 2025 to 2035

- The Worldwide Generative AI In Telecom Market Size is Expected to Reach USD 13423.97 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Generative AI in Telecom Market Size was worth around USD 298.46 Million in 2024, growing to USD 422.58 Million in 2025, and is predicted to grow to around USD 13423.97 million by 2035 with a compound annual growth rate (CAGR) of 41.34% from 2025 to 2035. The generative AI in the telecom market is developing at a rapid pace, driven by the need for richer customer experience through personalized customer care and chatbots, optimized network operations through automation and self-optimization, cost savings through effective use of resources, and proactive security with enhanced threat detection. The growing complexity of 5G networks and IoT also necessitates scalable, AI-based solutions for effective management of data and growth.

Global Generative AI In Telecom Market Forecast and Revenue Outlook

- 2024 Market Size: USD 298.46 Million

- 2025 Market Size: USD 422.58 Million

- 2035 Projected Market Size: USD 13423.97 Million

- CAGR (2025-2035): 41.34%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The generative AI in telecom refers to the utilization of AI systems, particularly large language models (LLMs) and generative models, which can generate content (text, voice, image), mimic conversations, predict behavior, and automate decisions, particularly within telecommunications networks, operations, customer interaction, security, and services. Applications are network optimization, predictive maintenance, AI chatbots, fraud detection, tailored offers, and automating BSS/OSS systems in telecom. The market is propelled by accelerated deployment of 5G and increasing demand for network bandwidth and low latency, expansion of IoT and edge computing, expanding digital penetration and building smart cities, customer expectation of faster, more personalized service, and cost pressure to operate.

Opportunities include incorporating generative AI into 5G and future 6G networks, leveraging the edge for real-time inference, accessing emerging markets in Asia-Pacific, Latin America, the Middle East & Africa, new top-line growth through AI-native services, increasing demand for domain-specific models (telco-tailored), and riding smart city and IoT growth. Some of the key players, such as IBM, Microsoft, AWS, Nokia, Ericsson, Huawei, and others, create telco-specific AI models, collaborate with CSPs, and implement AI in telecom operations. The Karnataka government intends to initiate a state-level AI Mission under the Karnataka IT Policy 2025-30 that will concentrate on regulatory, skilling, and innovation frameworks for AI, particularly generative AI, with close alignment with the Centre's IndiaAI programme.

Key Market Insights

- North America is expected to account for the largest share in the generative AI in telecom market during the forecast period.

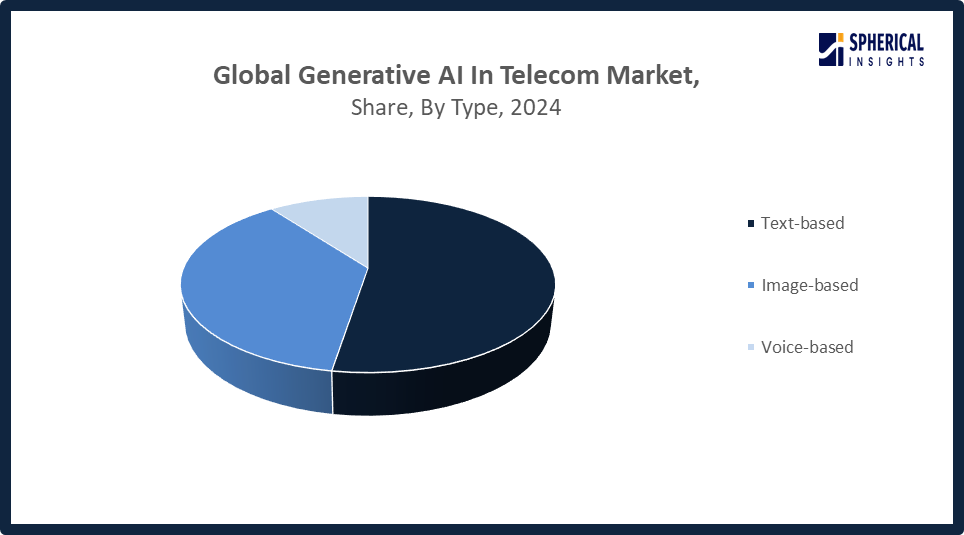

- In terms of type, the text-based segment is projected to lead the generative AI in telecom market throughout the forecast period

- In terms of application, the enhanced customer satisfaction segment captured the largest portion of the market

Generative AI In Telecom Market Trends

- Telecom companies are adopting AI chatbots to enhance customer service and support.

- Generative AI is driving advanced network optimization for faster, more reliable telecom services.

- AI-powered predictive maintenance reduces downtime and operational costs for telecom providers.

- Personalized marketing and service recommendations are being powered by generative AI insights.

- Integration of generative AI with 5G and edge computing is creating new telecom opportunities.

Report Coverage

This research report categorizes the generative AI in telecom market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the generative AI in telecom market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the generative AI in telecom market.

Global Generative AI In Telecom Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 298.46 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 41.34% |

| 2035 Value Projection: | USD 13423.97 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | NVIDIA Corporation, IBM Corporation, Cresta, Amazon Web Services, Microsoft Corporation, Xaltius Pte. Ltd., Macquarie Group Limited, Oracle Corporation, C3.ai, Inc., Deutsche Telekom AG, Amdocs, Huawei Technologies Co, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving factors

The market for global generative AI in telecom is fueled by 5G deployment, IoT expansion, customer needs, cost savings, and AI technology improvements. 5G network deployment delivers higher speeds and lower latency, which supports sophisticated AI-driven services. Accelerated growth in IoT adds connected devices, requiring smarter network control. Increasing customer expectations drive telecoms to provide customized, real-time solutions. Moreover, AI minimizes operational expenses by automating processes, and continued AI technology development increases capability and innovation across the industry.

The third meeting of ITU-T Focus Group on AI Native for Telecommunication Networks (FG-AINN) was inaugurated in New Delhi on June 11, 2025, organised by the Telecommunication Engineering Centre under India’s Department of Telecommunications.

Restraining Factor

A number of restraints confront the global generative AI in the telecom market, including high expense, data privacy, lack of qualified talent, and regulatory issues. Adoption is restricted by high deployment costs, particularly for smaller telecommunications companies. Data privacy is a concern due to the handling of sensitive data. Limited availability of skilled personnel impedes advancement, and regulatory complexities generate uncertainty and hinder AI integration in telecommunications networks.

Market Segmentation

The global generative AI in telecom market is divided into type and application.

Global Generative AI In Telecom Market, By Type:

What made text-based the dominant segment in the generative AI in the telecom market?

The text-based segment is anticipated to dominate the telecom generative AI market, holding approximately 47% of the market share, including AI models trained on extensive text datasets such as customer requests and network logs. Its main application is improving customer service and support by creating contextually appropriate, meaningful text-based conversations and responses within the telecom industry.

Get more details on this report -

The image-based segment in the generative AI in telecom market is expected to grow at the fastest CAGR over the forecast period. The image-based segment of the market, reaching an approximate market share of 15%, for generative AI in telecom is rapidly growing due to the increasing need for visual network diagnostics, automatic surveillance, and AI-based content creation for customer interaction and marketing.

Global Generative AI In Telecom Market, By Application:

Why did the enhanced customer satisfaction segment account for the largest share in 2024?

The enhanced customer satisfaction segment is leading and capturing approximately 43% of the market due to telecommunications operators leveraging generative AI to cross-analyze customer information, such as usage behavior and preferences, creating customized service offers. AI models propose individually customized plans and promotions, enhancing satisfaction. Virtual assistants and AI-driven chatbots also offer proactive, customized customer care, further enhancing engagement and loyalty.

The automated monitoring solutions segment in the generative AI in telecom market is expected to grow at the fastest CAGR over the forecast period. The automated monitoring solutions segment of the generative AI in telecom market with an approximate market share of 20%. It is rapidly growing with the highest CAGR, as demand for real-time network optimization, lower operational expenses, proactive fault identification, and higher service reliability through smart automation will continue to rise.

Regional Segment Analysis of the Global Generative AI In Telecom Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Generative AI In Telecom Market Trends

Get more details on this report -

Why is North America expected to hold the largest share of the global generative AI in telecom market over the forecast period?

North America is dominating, with an approximate market share of 38% the global telecom generative AI market due to its mature technological ecosystem, high rates of adoption of AI technologies, and large investments in research and development. Dominance of top telecom players and AI firms, supportive government policies, and strong digital transformation efforts also support the market growth. Early adoption of 5G networks increases the adoption of generative AI solutions in the region.

What are the key trends shaping the U.S. generative AI in the telecom market?

Major trends influencing the U.S. generative AI in telecom market are the implementation of AI-driven customer support, network automation, large language model integration, data analytics enhancement, and the extensive deployment of 5G, fueling enhanced efficiency and customer-centric services.

Asia Pacific Generative AI In Telecom Market Trends

What factors are contributing to the Asia Pacific's rapid growth in generative AI in the telecom market?

Rapid growth in generative AI in the telecom market across the Asia Pacific, with an estimated market share of around 27% is fueled by accelerated digital transformation and the growing 5G infrastructure, forming a solid underpinning for adopting AI. Governments throughout the region are heavily investing in smart city initiatives and IoT rollouts, which are dependent largely on generative AI for automation and data analysis. Furthermore, growing investments in telecom infrastructure and greater smartphone penetration support demand for AI-driven customer service solutions. Multilingual AI models are also promoted due to the various languages and dialects of the region, further fueling growth and adoption in the telecom industry.

Why is India emerging as a key market for generative AI in telecom?

India is becoming a prominent market for generative AI in telecom due to fast-paced digitalization, robust government efforts, expanding telecom infrastructure, and rising adoption of AI-powered customer service solutions. Besides, high population and high adoption of technology contribute to demand and innovation.

In September 2024, India launched BharatGen, a government funded initiative under NM ICPS to develop multimodal foundational models. It focuses on generating content in Indian languages, promoting data sovereignty, linguistic diversity, and open-source AI for national digital empowerment.

Why is generative AI rapidly advancing in China’s telecom market?

Generative AI is quickly gaining momentum in China's telecom industry owing to robust government support, massive investments in 5G and AI infrastructure, network integration with AI, and the building of industry-specific large language models.

What are the emerging trends in Japan's generative AI telecom sector?

Some of the trends in Japan's generative AI telecom industry include AI-native network architectures, integration of digital twins for optimizing the network, greater focus on protecting data, and building local AI solutions adapted to peculiar market and regulatory conditions.

What key growth trends are shaping Europe’s generative AI in the telecom sector?

Trendy growth drivers of Europe's generative AI in telecom are rising adoption of AI for network automation and predictive maintenance, a high focus on data privacy and support for regulations such as GDPR, investment in 5G and edge computing, and collaboration among telecom players and AI startups to create innovative customer service and operational efficiency solutions.

Why is Germany emerging as a leader in generative AI within the telecom sector?

Germany is becoming a leader in telecom generative AI through the strength of government support, a robust R&D ecosystem, strategic industry alliances, leading AI deployment in network operations, and a data security and compliance focus.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global generative AI in telecom market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Generative AI In Telecom Market Include

- NVIDIA Corporation

- IBM Corporation

- Cresta

- Amazon Web Services

- Microsoft Corporation

- Xaltius Pte. Ltd.

- Macquarie Group Limited

- Oracle Corporation

- C3.ai, Inc.

- Deutsche Telekom AG

- Amdocs

- Huawei Technologies Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, C3 AI launched C3 Agentic AI Websites, a new product that transforms any website into an intelligent, conversational platform, now live on C3 AI’s site and available for businesses.

- In July 2025, Accenture and Microsoft announced a joint investment in generative AI-driven cyber solutions to help organizations reduce threats, streamline tools, and lower operational costs through advanced AI capabilities.

- In June 2025, Amdocs released a whitepaper, AI Verticalization for Telcos, defining standards for advanced, trustworthy, and autonomous telco AI agents that transform customer engagement and network operations for communications service providers.

- In March 2025, EY launched EY.ai Telecom Agents, an AI-powered suite for telecom providers covering finance, network, customer service, and content management. Built on NVIDIA’s full-stack AI platform, it integrates NIM microservices, NeMo tools, and RAG-enabled Blueprints.

- In July 2024, C3 AI launched C3 Generative AI for Government Programs, helping governments deliver accurate information about programs such as healthcare and financial aid, simplifying complex processes and improving access for millions of citizens and residents.

- In April 2024, Oracle enhanced its generative AI capabilities amid rising cloud competition. The AI boom, sparked by Chatbot, is increasing demand for cloud services and data centers to support data-intensive AI model training.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the generative AI in telecom market based on the following segments:

Global Generative AI In Telecom Market, By Type

- Text-based

- Image-based

- Voice-based

Global Generative AI In Telecom Market, By Application

- Enhanced Customer Satisfaction

- Automated Monitoring Solutions

- Manage Dynamic Networks

- Improve Network Performance

- Network Security and Fraud Mitigation

- Network Orchestration

Global Generative AI In Telecom Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the generative AI in telecom market over the forecast period?The global generative AI in telecom market is projected to expand at a CAGR of 41.34% during the forecast period.

-

2. What is the market size of the generative AI in telecom market?The global generative AI in telecom market size is expected to grow from USD 298.46 million in 2024 to USD 13423.97 million by 2035, at a CAGR 41.34% of during the forecast period 2025-2035.

-

3. What is the generative AI in telecom market?The generative AI in the telecom market refers to the application of advanced AI technologies, such as Large Language Models (LLMs), by telecommunications providers to create new content and insights to improve network operations, enhance customer service, and boost overall efficiency.

-

4. Which region holds the largest share of the generative AI in telecom market?North America is anticipated to hold the largest share of the generative AI in telecom market over the predicted timeframe.

-

5. What factors are driving the growth of generative AI in the telecom market?The growth of generative AI in telecom is driven by rising demand for automated customer support, network optimization, increasing 5G adoption, enhanced data analytics, and the need for cost-efficient, intelligent telecom operations.

-

6. What are the main challenges restricting wider adoption of generative AI in the telecom market?Key challenges include data privacy concerns, high implementation costs, a lack of skilled talent, regulatory issues, and integration complexities with existing systems.

-

7. Who are the top 10 companies operating in the global generative AI in telecom market?The major players operating in the generative AI in telecom market are NVIDIA Corporation, IBM Corporation, Cresta, Amazon Web Services, Microsoft Corporation, Xaltius Pte. Ltd., Macquarie Group Limited, Oracle Corporation, C3.ai, Inc., Deutsche Telekom AG, Amdocs, Huawei Technologies Co., and Others.

-

8. What are the market trends in the generative AI in telecom market?Key trends include integration into core business workflows, increased automation, and a significant projected market size increase, though challenges such as data accuracy and hallucinations need careful management to avoid impacting decision-making.

Need help to buy this report?