Global Gastroenteritis Testing Market Size, Share, and COVID-19 Impact Analysis, By Disease Strains (Bacterial Strains, Viral Strains, and Parasitic Strains), By Product Type (Reagent Kits, Sequencing Kits, and Equipment), By Testing Methods (Immunoassay Testing, Conventional Testing, and Molecular Diagnostic Testing), By End-User (Hospitals, Clinics/Medical Centers, Research Institutes, and Diagnostic Laboratories), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Gastroenteritis Testing Market Insights Forecasts to 2035

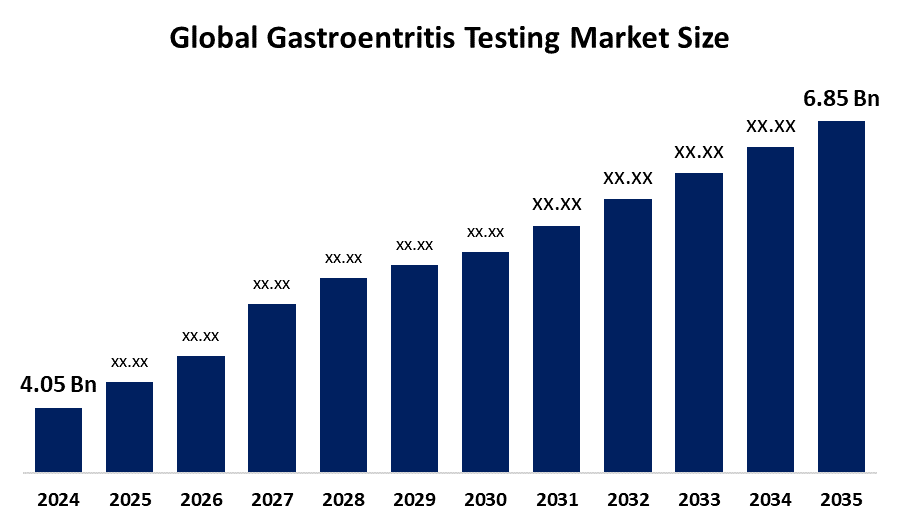

- The Global Gastroenteritis Testing Market Size Was Estimated at USD 4.05 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.89% from 2025 to 2035

- The Worldwide Gastroenteritis Testing Market Size is Expected to Reach USD 6.85 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global Gastroenteritis Testing Market Size was worth around USD 4.05 Billion in 2024 and is predicted to grow to around USD 6.85 Billion by 2035 with a compound annual growth rate (CAGR) of 4.89% from 2025 and 2035. The market for gastroenteritis testing has a number of opportunities to grow due to advancements, including biosensors for early virus diagnosis associated with gastroenteritis.

Market Overview

The Global Gastroenteritis Testing Market Size industry focuses on the products and services for diagnosing the cause of gastroenteritis, a stomach and intestinal inflammation. Acute gastroenteritis caused by the norovirus, which is the most common cause of diarrhea and vomiting, affects 19-21 million people and causes around 900 deaths. In most cases, viral gastroenteritis lasts for less than 1 week, without the need for medical intervention. Stool test is performed to identify the presence of viral infections like norovirus and rotavirus, along with other health conditions affecting the digestive system. Further, there is a changing inclination towards syndromic diagnostics in clinical microbiology, for faster detection and more informed clinical decision-making in disease management.

Innovation and market expansion are anticipated as a result of major players' growing R&D investment strategies and collaborations between government health agencies, private laboratories, and biotechnology firms. Further, the integration of advanced technologies for enabling rapid, sensitive, and comprehensive pathogen detection is driving a huge surge in the market. For instance, metagenomic next-generation sequencing (mNGS) enables the identification of all pathogens in a sample in a single test, without introducing target detection bias.

Report Coverage

This research report categorizes the gastroenteritis testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the gastroenteritis testing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the gastroenteritis testing market.

Driving Factors

The Market Size for Gastroenteritis Testing is significantly driven by the growing prevalence of gastrointestinal disorders. As per the Centers for Disease Control (CDC), viral gastroenteritis infections are the third leading cause of death in children younger than five, accounting for over 200,000 deaths per year globally. The growing advancements in gastroenteritis testing, including FilmArray GI panel for enhancing diagnostic accuracy and reducing unnecessary antibiotic use, aid in propelling market growth.

Restraining Factors

The Gastroenteritis Testing Market Size is restricted by the limited accessibility and increased cost of advanced diagnostic platforms in low-resource settings. Further, the lack of infrastructure and trained workforce is challenging the gastroenteritis testing market.

Market Segmentation

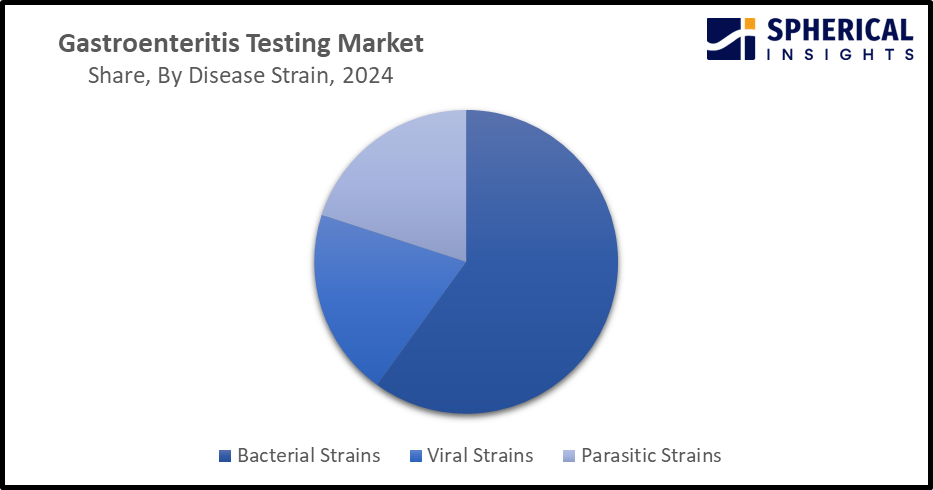

The gastroenteritis testing market share is classified nto disease strains, product type, testing methods, and end-user.

The bacterial strains segment accounted for the largest revenue share of about 54%-60% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the disease strains, the gastroenteritis testing market is divided into bacterial strains, viral strains, and parasitic strains. Among these, the bacterial strains segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Bacterial gastroenteritis is commonly called food poisoning, caused by various factors associated with dietary habits. The common bacteria causing gastroenteritis include E. coli, Salmonella, and Campylobacter. In severe outbreaks, especially in the developing regions with inadequate sanitation, there is a surging need for specific treatment protocols, which results in propelling the market demand in the bacterial strains segment.

Get more details on this report -

- The reagent kits segment accounted for the largest revenue share of 59.7% in 2024 and is anticipated to grow at a significant CAGR during the projected period.

Based on the product type, the gastroenteritis testing market is divided into reagent kits, sequencing kits, and equipment. Among these, the reagent kits segment accounted for the largest revenue share of 59.7% in 2024 and is anticipated to grow at a significant CAGR during the projected period. The segment includes rapid immunoassay strips to sophisticated multiplex PCR panels for identifying pathogen/s. The widespread use of reagent kits for routine diagnostics, along with their ease of use, affordability, and accessibility, is propelling the market.

- The molecular diagnostic testing segment dominated the market with the largest share of about 41.8% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the testing methods, the gastroenteritis testing market is divided into immunoassay testing, conventional testing, and molecular diagnostic testing. Among these,the molecular diagnostic testing segment dominated the market with the largest share of about 41.8% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Several molecular diagnostics methods that rely on nucleic acid amplification and detection have been developed. As compared to clinician-based testing, molecular diagnostics result in a 21% reduction in return healthcare visits. The preference for molecular diagnostic testing due to its superior accuracy, speed, and ability for simultaneous multiple pathogen detection is driving the market.

- Theospitals segment held the largest share of about 42%43% in the gastroenteritis testing market in 2024 and is anticipated to grow at a significant CAGR during the projected period.

Based on the end-user, the gastroenteritis testing market is divided into hospitals, clinics/medical centers, research institutes, and diagnostic laboratories. Among these, the hospitals segment held the largest share of about 42%-43% in the gastroenteritis testing market in 2024 and is anticipated to grow at a significant CAGR during the projected period. In hospitals, an isolation bay or side room is preferably used until the infection is eliminated or excluded. With an increasing number of patient admissions, the surging demand for immediate diagnosis and advanced testing capabilities is propelling the market demand in the hospitals segment.

Regional Segment Analysis of the Gastroenteritis Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the gastroenteritis testing market over the predicted timeframe.

North America is anticipated to hold the largest share of about 40% revenue share in the gastroenteritis testing market over the predicted timeframe. The market ecosystem in North America is strong, due to investment in the healthcare sector, with increasing innovation and application of advanced technologies. The market demand for gastroenteritis testing has been driven by the region's well-established healthcare infrastructure and accessibility to clinical laboratories. The United States is capturing the largest revenue share of 78.5% in the North America gastroenteritis testing market, owing to increasing research on advanced gastroenteritis diagnostics. For instance, in July 2025, the Journal of Clinical Microbiology published a research article on Multicenter evaluation of the QIAstat-Dx Gastrointestinal Panel 2, a multiplex PCR platform for the diagnosis of acute gastroenteritis’.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of 23.5% in the gastroenteritis testing market during the forecast period. The Asia Pacific area has a thriving market for gastroenteritis testing due to increasing advancements in gastroenterological diagnostics with innovative AI-assisted technology by the health-tech startups. Further, increasing collaborations with research organizations is contributing to propelling market growth. For instance, in December 2024, the Indian Council of Medical Research (ICMR) signed a technology transfer agreement with Molbio Diagnostics Pvt. Ltd., licensing the commercialization of EnViro-Q, a multiplex real-time RT-PCR assay for detecting enteric viruses. India accounted for the largest revenue share of the gastroenteritis testing market in the Asia Pacific region, driven by government support for combating diarrheal diseases and growing awareness about infectious disease diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the gastroenteritis testing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BD

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GSK plc

- Novartis AG

- AstraZeneca

- Johnson & Johnson Private Limited

- Sun Pharmaceutical Industries Ltd.

- Merck & Co., Inc.

- Lilly

- Amgen Inc.

- Hainan Poly Co. Ltd

- WOCKHARDT

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Hologic, Inc. announced that the U.S. Food and Drug Administration (FDA) had granted 510(k) clearance for the Panther Fusion Gastrointestinal (GI) Bacterial and Expanded Bacterial Assays.

- In January 2025, RNT Health Insights, a Chandigarh-based health-tech startup advances gastroenterological diagnostics with its innovative AI-assisted technology, aimed at improving early detection and survival outcomes for esophageal cancer patients.

Global Gastroenteritis Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.05 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.89% |

| 2035 Value Projection: | USD 6.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End-User, By Product Type |

| Companies covered:: | BD, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, Pfizer Inc., GSK plc, Novartis AG, AstraZeneca, Johnson & Johnson Private Limited, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Lilly, Amgen Inc., Hainan Poly Co. Ltd, WOCKHARDT and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the gastroenteritis testing market based on the below-mentioned segments:

Global Gastroenteritis Testing Market, By Disease Strains

- Bacterial Strains

- Viral Strains

- Parasitic Strains

Global Gastroenteritis Testing Market, By Product Type

- Reagent Kits

- Sequencing Kits

- Equipment

Global Gastroenteritis Testing Market, By Testing Methods

- Immunoassay Testing

- Conventional Testing

- Molecular Diagnostic Testing

Global Gastroenteritis Testing Market, By End-User

- Hospitals

- Clinics/Medical Centers

- Research Institutes

- Diagnostic Laboratories

Global Gastroenteritis Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the gastroenteritis testing market?The global gastroenteritis testing market size is expected to grow from USD 4.05 Billion in 2024 to USD 6.85 Billion by 2035, at a CAGR of 4.89% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the gastroenteritis testing market?North America is anticipated to hold the largest share of the gastroenteritis testing market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Gastroenteritis Testing Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.89% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Gastroenteritis Testing Market?Key players include BD, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, Pfizer Inc., GSK plc, Novartis AG, AstraZeneca, Johnson & Johnson Private Limited, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Lilly, Amgen Inc., Hainan Poly Co. Ltd, and WOCKHARDT.

-

5. Can you provide company profiles for the leading gastroenteritis testing manufacturers?Yes. For example, Thermo Fisher Scientific Inc. is the world leader in serving science, with annual revenue of approximately $40 billion, enabling customers to make the world healthier, cleaner and safer. Bio-Rad Laboratories, Inc. provides the healthcare industry with innovative and useful products that help life science researchers accelerate the discovery process and medical diagnostic labs obtain faster, better results.

-

6. What are the main drivers of growth in the gastroenteritis testing market?The growing prevalence of gastrointestinal disorders, along with the surging advancements for enhancing diagnostic accuracy, are major market growth drivers of the gastroenteritis testing market.

-

7. What challenges are limiting the gastroenteritis testing market?The limited accessibility & affordability in low-resource settings, as well as the lack of infrastructure and trained workforce, remain key restraints in the gastroenteritis testing market.

-

Q: What is the Japan casein market size?A: Japan Casein market size is expected to grow from USD 171.4 million in 2024 to USD 240.1 million by 2035, growing at a CAGR of 3.11% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing demand for high-protein food and beverage products, especially in the areas of sports nutrition and functional foods.

-

Q: What factors restrain the Japan casein market?A: Constraints include by high costs of production and fluctuations in raw material prices, consumer lactose intolerance, and competition from plant-based proteins.

-

Q: How is the market segmented by product type?A: The market is segmented into rennet casein and acid casein.

-

Q: Who are the key players in the Japan casein market?A: Key companies include Lacto Japan Co., Ltd., Snow Brand Milk Products Co., Ltd., and Nosawa & Co., Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?