Global Gas Analyzer Systems Market Size, Share, and COVID-19 Impact Analysis, By Technology (Electrochemical, Paramagnetic, Zirconia (ZR), Non-Dispersive IR (NDIR), and Others), By End Use (Oil & Gas, Chemical & petrochemical, Healthcare, Research, Water & wastewater, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Gas Analyzer Systems Market Size Insights Forecasts to 2035

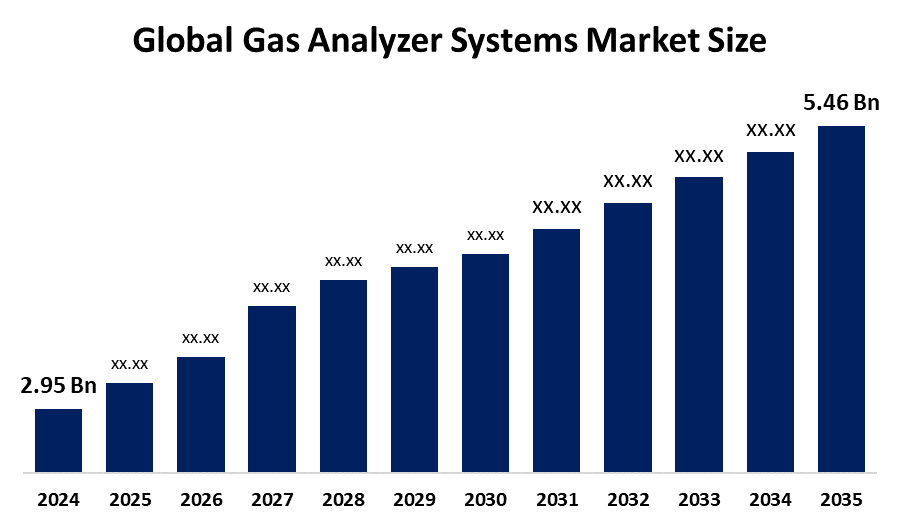

- The Global Gas Analyzer Systems Market Size Was Estimated at USD 2.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.76% from 2025 to 2035

- The Worldwide Gas Analyzer Systems Market Size is Expected to Reach USD 5.46 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Gas Analyzer Systems Market Size was worth around USD 2.95 Billion in 2024, Growing to USD 3.10 Billion in 2025, and is predicted to Grow to around USD 5.46 Billion by 2035 with a compound annual growth rate (CAGR) of 5.76% from 2025 to 2035. The market for gas analyzer systems is expanding due to growing environmental regulations, expanding industrial monitoring of emissions, and real-time gas detection needs in industries such as oil & gas, chemicals, and power generation. Technological innovation and consciousness about workplace safety also fuel adoption in developing and developed economies.

Global Gas Analyzer Systems Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.95 Billion

- 2025 Market Size: USD 3.10 Billion

- 2035 Projected Market Size: USD 5.46 Billion

- CAGR (2025-2035): 5.76%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The term global gas analyzer systems market is used to refer to the business of dealing with equipment for sensing, monitoring, and analyzing the gas concentration in different environments. The systems are necessary for purposes of safety, regulatory compliance, and process optimization in oil & gas, chemicals, power generation, healthcare, environment monitoring, and manufacturing industries. Gas analysers help to identify poisonous gases, quantify emissions, and track air quality, and are crucial to mitigate environmental and health hazards. Market growth is influenced by mounting environmental regulations, the necessity of managing industrial emissions, and heightened occupational safety concerns. Demand for real-time monitoring and employment of emerging technologies such as IoT and AI also stimulates market growth.

There are opportunities within emerging markets where urbanization and industrialization are quickly closing the gap with developed countries, generating a need for safety compliance and pollution monitoring. Also, the transition to sustainable energy and more stringent emissions regulations offers long-term growth potential. Some of the major market players are ABB, Siemens, Honeywell, Emerson Electric, and Thermo Fisher Scientific, who keep innovating in product development and global reach. Gazprom's 2025–2029 program focuses on improvement in metrological support for gas transportation through progress in systems for monitoring gas volume and physical-chemical properties, providing higher accuracy, technological progress, and efficiency in pipeline operation.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the gas analyzer systems market during the forecast period.

- In terms of technology, the electrochemical segment is projected to lead the gas analyzer systems market throughout the forecast period

- In terms of end use, the oil & gas segment captured the largest portion of the market

Gas Analyzer Systems Market Trends

- Real-time monitoring solutions are gaining popularity across industries.

- Increasing environmental regulations are driving demand for advanced gas analyzer systems.

- Demand is rising in emerging economies due to rapid industrialization.

- Integration of IoT and AI is enhancing system efficiency and data analysis.

- Portable and wireless gas analyzers are becoming more widespread.

Report Coverage

This research report categorizes the gas analyzer systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the gas analyzer systems market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the gas analyzer systems market.

Global Gas Analyzer Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.76% |

| 2035 Value Projection: | USD 5.46 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | ABB Ltd., Horiba, Emerson Electric, AMETEK, Honeywell International, General Electric, Siemens AG, Thermo Fisher Scientific, Servomex, Teledyne, Nova Analytical Systems, Yokogawa Electric Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

Strong environmental laws, industrial emission monitoring, workplace safety, and innovation motivate market growth. Tough global environmental laws force companies to contain harmful emissions, boosting demand for precise gas analyzer systems to meet regulatory requirements. Industrial emission monitoring on an ongoing basis identifies leaks and controls pollutants, enhancing efficiency and reducing environmental hazards. Workplace safety improves with gas analyzers that sense toxic or explosive gases, preventing accidents. Moreover, IoT and AI-based technology support real-time, accurate monitoring, driving market growth.

Restraining Factor

High expense, complicated maintenance, shortage of skilled staff, and calibration issues restrained the gas analyzer systems market. The advanced gas analyzer system's high expense restricts adoption, particularly for small businesses. Complicated maintenance procedures raise operational downtime and costs. Insufficiently skilled staff impede proper system operation and interpretation of data. Regular calibration requirements contribute to time and cost pressures.

Market Segmentation

The global gas analyzer systems market is divided into technology and end use.

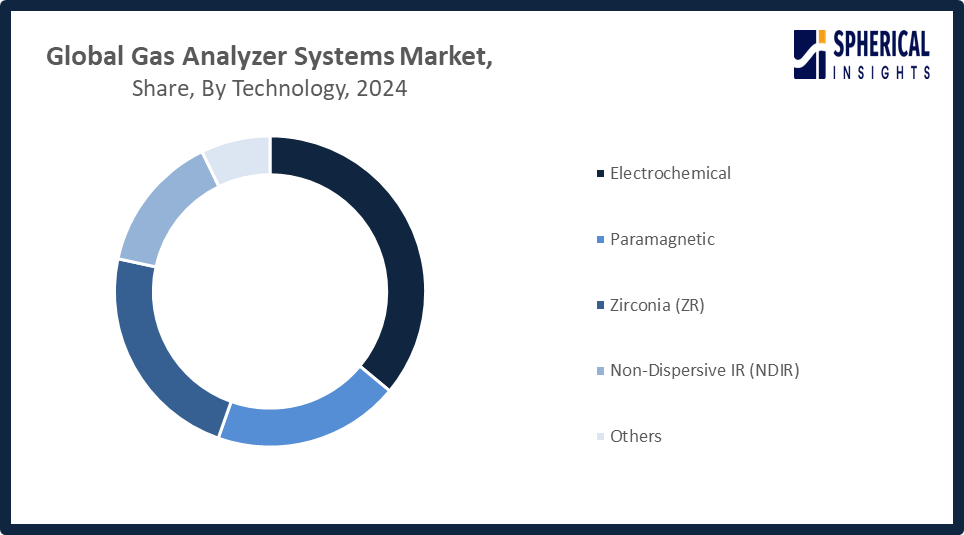

Global Gas Analyzer Systems Market, By Technology:

Why did the electrochemical segment dominate the gas analyzer systems market in 2024?

The electrochemical segment was the most prevalent in the gas analyzer systems market in 2024, accounting for over 31.6% market share, attributed to its high sensitivity, affordability, and ability to sense harmful gases such as carbon dioxide and oxygen in industries. Its small size, low power consumption, and extensive use in industrial safety and environmental monitoring also increased its market share.

Get more details on this report -

The non-dispersive IR (NDIR) segment in the gas analyzer systems market is expected to grow at the fastest CAGR over the forecast period. The NDIR segment accounts for a 20.1% market share, developing the most rapidly due to its accuracy, low maintenance, and capability of sensing more than one gas. Its non-destructive sensor technology appeals to various industries, and demand for trusted, real-time gas monitoring and environmental protection drives the sector.

Global Gas Analyzer Systems Market, By End Use:

What factors contributed to the dominance of the oil & gas segment in the market?

The oil & gas market led the gas analyzer systems market with 36.5% share, as a result of strict environmental regulations calling for ongoing emissions monitoring and leak detection. Demands for safety and process improvement, together with the industry's vast network of pipeline and refinery structures, propel the widespread usage. Further contributing to the leadership of the segment are growing exploration efforts and advancements in analyzer systems technology.

The chemical & petrochemical segment in the gas analyzer systems market is expected to grow at the fastest CAGR over the forecast period. The petrochemical & chemical segment is slated to expand most rapidly, holding the 20.3% market share, due to increasing industrial automation, stringent environmental regulations, and rising demand for accurate gas monitoring to ensure safety and optimize process efficiency.

Regional Segment Analysis of the Global Gas Analyzer Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Gas Analyzer Systems Market Trends

Get more details on this report -

Why is the Asia Pacific region expected to hold the largest share of the global gas analyzer systems market?

The Asia Pacific region is anticipated to have the largest 37% market share of the world's gas analyzer systems market due to stringent industrialization and urbanization in China, India, and Southeast Asia. Rising environmental laws and government policies aimed at reducing pollution are creating a need for precise gas monitoring solutions. Increased investments in manufacturing, energy, and infrastructure sectors also drive market growth. The growing industrial base in the region, combined with technological developments and increased awareness regarding workplace security, further underlines long-term market dominance.

In October 2024, the second Asia Zero-Emission Community (AZEC) Leaders’ Summit convened to align Asia’s growth with climate goals, focusing on renewables, zero-emission power, and advancing carbon capture and storage technologies.

Why is industrial growth influencing the demand for gas analyzer systems in India?

Industrial development in India raises the demand for emission monitoring and safety assurance, pushing the demand for gas analyzer systems. Growing manufacturing and energy sectors demand precise gas detection to meet regulations and minimize environmental and health hazards.

What are the major trends influencing gas analyzer system adoption in China?

Key trends in China are tighter environmental regulations, urbanization and rapid industrialization, greater emphasis on air quality monitoring, implementation of advanced technologies such as IoT, and rising investment in energy and manufacturing industries, fueling gas analyzer system adoption.

Why is the gas analyzer systems market evolving in Japan?

The Japanese gas analyzer systems market is changing in response to strict environmental policies, increased focus on industrial safety, technological advancements, and expanding demand for precise emission monitoring across industries such as automotive, manufacturing, and energy industries to curtail pollution and increase efficiency.

North America Gas Analyzer Systems Market Trends

What factors are driving the rapid growth of the gas analyzer systems market in North America?

Multiple factors drive the strong growth of North America's gas analyzer systems market, approximately 32% of market share, such as rigorous environmental laws by regulatory bodies, such as the EPA, necessitating ongoing industrial emissions monitoring, compelling industries to invest in sophisticated gas analyzers. The region's well-developed oil & gas, chemical, and power generation sectors are highly dependent on these systems for safety and regulation. Moreover, increased awareness of workplace safety and the inclusion of breakthrough technologies such as IoT and AI for instantaneous data analysis add to operational efficiency. Government policies promoting green practices add to market demand further, and North America is a rapidly expanding market.

What key trends are shaping the gas analyzer systems market in the U.S.?

Some of the significant trends driving the U.S. gas analyzer systems market are tighter environmental regulations, more demand for real-time monitoring, advancements in technology such as IoT integration, more emphasis on workplace safety, and more adoption across industries such as oil & gas, chemicals, and healthcare.

The US DOT’s PHMSA is granting $85.9 million to states for inspecting pipelines and underground gas storage, covering over 85% of the nation’s 3.3 million miles of infrastructure.

Europe Gas Analyzer Systems Market Trends

What factors are driving the growth of gas analyzer systems in the European market?

The European gas analyzer systems market growth is stimulated by robust environmental regulations to curb emissions, industrial automation, and the growing demand for precise and real-time monitoring of gases. Government policies boosting sustainability, advancements such as IoT and AI connectivity, and awareness of workplace safety also drive adoption in industries like manufacturing, oil & gas, and chemicals.

In November 2023, the European Commission partnered with 12 countries and the East Mediterranean Gas Forum to advance a global framework for measuring, monitoring, reporting, and verifying greenhouse gas emissions, focusing especially on methane reduction and transparency.

Why is the gas analyzer systems market expanding in Germany?

The gas analyzer systems market is growing in Germany due to stringent environmental rules, robust industrial growth, greater emphasis on emission tracking, technological progress, and growing demand for workplace safety and eco-friendly industry practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global gas analyzer systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Gas Analyzer Systems Market Include

- ABB Ltd.

- Horiba

- Emerson Electric

- AMETEK

- Honeywell International

- General Electric

- Siemens AG

- Thermo Fisher Scientific

- Servomex

- Teledyne

- Nova Analytical Systems

- Yokogawa Electric Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In September 2025, Emerson introduced the Rosemount CX2100 In Situ Oxygen Analyzer to optimize combustion, reduce emissions, lower energy costs, and improve safety across industries like power, chemical, petrochemical, pulp and paper, refining, and mining.

- In March 2025, Thermo Fisher Scientific launched the MarqMetrix All-In-One X Process Raman Analyzer for safe, real-time, in-line chemical analysis in hazardous environments across oil and gas, chemical, polymer, and pharmaceutical industries.

- In December 2024, ABB exported 85% of its integrated gas analyzer systems from its Bengaluru facility, supporting global energy sectors. As part of the "Make in India" initiative, these systems reached countries like Argentina and, UAE, and ongoing projects span Canada and Australia.

- In December 2024, Emerson launched the Rosemount 470XA Gas Chromatograph to simplify natural gas analysis in custody transfer and various process applications.

- In November 2023, Honeywell launched its 100% hydrogen-capable EI5 smart gas meter in Europe, supporting the European Green Deal goals after successful pilots in the Netherlands, advancing sustainable and efficient gas measurement solutions.

- In June 2022, SERVOMEX launched the SERVOTOUGH SpectraExact 2500, an advanced photometric gas analyzer built on the legacy of its iconic predecessor, promising enhanced accuracy and performance in gas analysis.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the gas analyzer systems market based on the following segments:

Global Gas Analyzer Systems Market, By Technology

- Electrochemical

- Paramagnetic

- Zirconia (ZR)

- Non-Dispersive IR (NDIR)

- Others

Global Gas Analyzer Systems Market, By End Use

- Oil & Gas

- Chemical & petrochemical

- Healthcare

- Research

- Water & wastewater

- Others

Global Gas Analyzer Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the gas analyzer systems market over the forecast period?The global gas analyzer systems market is projected to expand at a CAGR of 5.76% during the forecast period.

-

2. What is the market size of the gas analyzer systems market?The global gas analyzer systems market size is expected to grow from USD 2.95 billion in 2024 to USD 5.46 billion by 2035, at a CAGR 5.76% of during the forecast period 2025-2035.

-

3. What is the gas analyzer systems market?The gas analyzer systems market involves the development, manufacturing, and sale of devices that measure the concentration and quality of specific gases in a mixture.

-

4. Which region holds the largest share of the gas analyzer systems market?Asia Pacific is anticipated to hold the largest share of the gas analyzer systems market over the predicted timeframe.

-

5. What factors are driving the growth of the gas analyzer systems market?The growth of the gas analyzer systems market is driven by stricter environmental regulations, the need for industrial process optimization and safety, advancements in sensor technology and IoT integration, increased demand in the healthcare sector for patient monitoring, and growing global concerns about air quality and climate change.

-

6. What are the main challenges restricting the wider adoption of the gas analyzer systems market?The main challenges restricting the wider adoption of gas analyzer systems include high initial and maintenance costs, technical limitations related to sensor accuracy and durability, and operational complexities that require skilled personnel.

-

7. Who are the top 10 companies operating in the global gas analyzer systems market?The major players operating in the gas analyzer systems market are ABB Ltd., Horiba, Emerson Electric, AMETEK, Honeywell International, General Electric, Siemens AG, Thermo Fisher Scientific, Servomex, Teledyne, Nova Analytical Systems, Yokogawa Electric Corporation, and Others.

-

8. What are the market trends in the gas analyzer systems market?Key trends in the gas analyzer systems market include a surge in demand due to stricter environmental regulations, increased focus on workplace safety, and expanding applications in healthcare, automotive, and chemical industries.

Need help to buy this report?