Global Fused Mullite Market Size, Share, and COVID-19 Impact Analysis, By Type (Refractory Grade, Ceramic Grade, and Others), By Application (Glass, Steel, Refractories, Electronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Fused Mullite Market Insights Forecasts to 2035

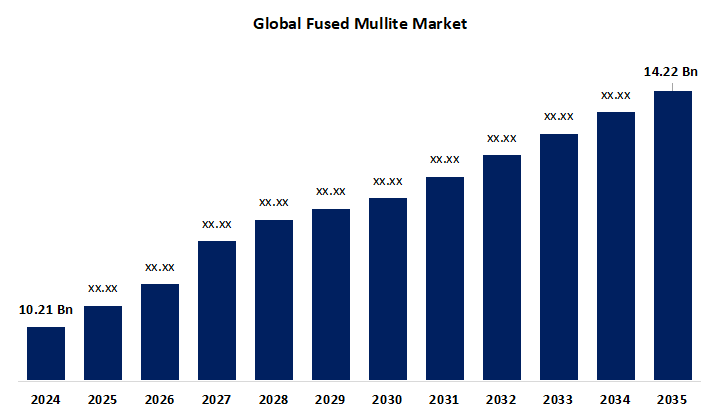

- The Global Fused Mullite Market Size Was Estimated at USD 10.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.06% from 2025 to 2035

- The Worldwide Fused Mullite Market Size is Expected to Reach USD 14.22 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global fused mullite market size was worth around USD 10.21 billion in 2024 and is predicted to grow to around USD 14.22 billion by 2035 with a compound annual growth rate (CAGR) of 3.06% from 2025 and 2035. The growing need for high-performance materials, environmentally friendly production methods, and continuous advancements in thermal-resistant technologies are driving the fused mullite market, which offers opportunities in the advanced ceramics, electronics, and aerospace industries.

Market Overview

The global industrial segment devoted to the manufacturing, distribution, and usage of fused mullite, a high-purity alumino-silicate substance created by fusing silica and alumina at high temperatures, is known as the fused mullite market. Fused mullite is used extensively in the production of glass, ceramics, refractory materials, and sophisticated industrial components because of its remarkable thermal stability, low thermal expansion, and resistance to chemical corrosion. The fused mullite market offers a range of product grades, including conventional and high-purity versions, designed to satisfy the needs of industries like construction, steel, electronics, and aerospace.

The market for fused mullite is full of opportunities, especially for R&D projects that aim to improve product performance and broaden applications. Growing demand for high-temperature fused mullite refractory products across a range of end-use sectors, including electronics, steel, and glass, is propelling the fused mullite market. The growth of businesses that need high-performance refractory materials is driving the need for the fused mullite market. The factors driving the growth of the fused mullite market are the growing number of uses and advantages that fused mullite provides.

Report Coverage

This research report categorizes the fused mullite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fused mullite market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fused mullite market.

Global Fused Mullite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.06% |

| 2035 Value Projection: | USD 14.22 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Doral, Tosoh Corp, Saint-Gobain, TAM Ceramics, Cera Industries, Pred Materials, Monofrax LLC, Washington Mills, KT Refractories, Alkane Resources, Electro Abrasives, Cumi Murugappa, Imerys Fused Minerals, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The continuous research and development initiatives to enhance ceramic material production techniques are anticipated to contribute to the market's expansion. Infrastructure development, growing industrialization, and the growing demand for high-performance, long-lasting materials that can survive harsh operating conditions are the main factors driving this market's growth. The need for fused mullite is anticipated to increase as industries continue to develop, fueled by its capacity to satisfy the exacting requirements of mode production. One major reason driving the market is the growing need for strong, lightweight materials in the automotive and construction sectors.

Restraining Factors

Environmental laws, competition from alternative refractory materials with similar mechanical and thermal capabilities, high manufacturing costs, and restricted raw material availability are the main reasons that restrict the fused mullite market.

Market Segmentation

The fused mullite market share is classified into type and application.

- The refractory grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the fused mullite market is divided into refractory grade, ceramic grade, and others. Among these, the refractory grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. High-temperature alumina oxide or refractory grade fused silica are other names for a particular kind of refractory grade. This material is frequently utilized in sectors like steel, glass, and others since it has the highest heat resistance among the many varieties.

- The glass segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the fused mullite market is divided into glass, steel, refractories, electronics, and others. Among these, the glass segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Glass uses fused mullite to increase its resistance to heat shock. Extreme temperature variations lessen the chance of breakage due to this material's strong strength and low coefficient of expansion.

Regional Segment Analysis of the Fused Mullite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the fused mullite market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the fused mullite market over the predicted timeframe. The region's high demand for fused mullite is the reason behind North America's expanding manufacturing sector. North America's largest region is the United States. Furthermore, the high demand for fused mullite in North America can be due to the region's expanding industrial sector. The growing manufacturing sector in North America is the reason for the strong demand for fused mullite. Additionally, the growing number of manufacturing businesses in North America could be the reason for the region's strong demand for fused mullite.

Asia Pacific is expected to grow at a rapid CAGR in the fused mullite market during the forecast period. Growing industrial applications and rising demand for high-performance refractory materials are driving the Asia Pacific region. It is anticipated that substantial improvements in manufacturing infrastructure and growing expenditures in important end-use industries, including electronics, ceramics, and metallurgy, will further drive market expansion. Furthermore, it is projected that Asia Pacific's developing economies will be essential to enhancing the region's market position internationally.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fused mullite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Doral

- Tosoh Corp

- Saint-Gobain

- TAM Ceramics

- Cera Industries

- Pred Materials

- Monofrax LLC

- Washington Mills

- KT Refractories

- Alkane Resources

- Electro Abrasives

- Cumi Murugappa

- Imerys Fused Minerals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fused mullite market based on the below-mentioned segments:

Global Fused Mullite Market, By Type

- Refractory Grade

- Ceramic Grade

- Others

Global Fused Mullite Market, By Application

- Glass

- Steel

- Refractories

- Electronics

- Others

Global Fused Mullite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the fused mullite market over the forecast period?The global fused mullite market is projected to expand at a CAGR of 3.06% during the forecast period.

-

2.What is the market size of the fused mullite market?The global fused mullite market size is expected to grow from USD 10.21 billion in 2024 to USD 14.22 billion by 2035, at a CAGR of 3.06% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the fused mullite market?North America is anticipated to hold the largest share of the fused mullite market over the predicted timeframe.

Need help to buy this report?