Global Furniture, Fixtures, and Equipment (FF&E) Market Size, Share, and COVID-19 Impact Analysis, by Product (Furniture, Fixtures, and Equipment), by End Use (Hotels & Hospitality, Hospitals & Healthcare Facilities, Corporate Offices, Retail Spaces, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa), Forecast 2025-2035

Industry: Consumer GoodsGlobal Furniture, Fixtures, and Equipment Market Insights Forecasts to 2035

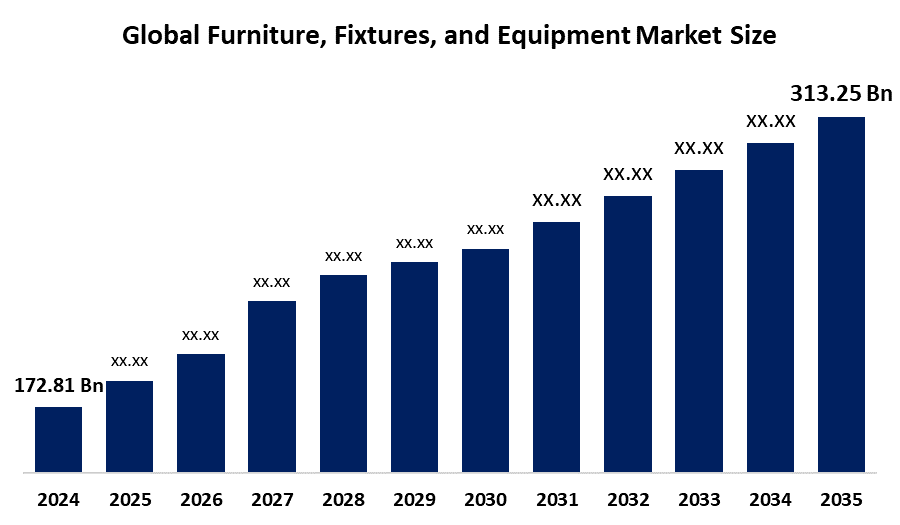

- The Global Furniture, Fixtures, and Equipment Market Size Was Estimated at USD 172.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.56% from 2025 to 2035

- The Worldwide Furniture, Fixtures, and Equipment Market Size is Expected to Reach USD 313.25 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Global Furniture, Fixtures, and Equipment (FF&E) Market Size was valued at approximately USD 172.81 Billion in 2024 and is projected to reach around USD 313.25 Billion by 2035, Growing at a compound annual growth rate (CAGR) of 5.56% from 2025 to 2035. The FF&E market is expected to witness significant growth driven by the increasing adoption of smart and sustainable furniture, rising demand from the hospitality and commercial construction sectors, and growing trends toward customized interior solutions.

Market Overview

The FF&E market encompasses movable furniture, fixtures, and equipment used in commercial, hospitality, healthcare, and residential spaces to enhance functionality, comfort, and aesthetics. Rising investments in hotels, offices, hospitals, and retail infrastructure are driving demand globally. Governments are promoting sustainable and ergonomic designs through regulations and incentives, encouraging adoption of eco-friendly, modular, and technologically integrated solutions. Increasing urbanization, modernization of workplaces, and growth in the hospitality and healthcare sectors are key growth drivers. Advancements in materials, smart furniture, and customization options are enabling innovative offerings that meet evolving consumer preferences. Additionally, the trend toward energy-efficient, space-saving, and durable products is supporting broader market expansion across regions.

Report Coverage

This research report categorizes the furniture, fixtures, and equipment market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the furniture, fixtures, and equipment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the furniture, fixtures, and equipment market.

Global Furniture, Fixtures, and Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 172.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.56% |

| 2035 Value Projection: | USD 313.25 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By End Use |

| Companies covered:: | •Kimball International Inc., • Global Furniture Group, • Steelcase Inc., • Herman Miller Inc., • Haworth Inc., • Stryker Corporation, • Ashley Furniture Industries, Inc., • Inter IKEA Systems B.V., • Häfele, • Kinnarps Group, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Furniture, Fixtures, and Equipment (FF&E) market is driven by increasing investments in commercial, hospitality, healthcare, and residential infrastructure, which boost demand for functional and aesthetically appealing furniture solutions. Rising urbanization and workplace modernization are encouraging the adoption of ergonomic and space-efficient designs. Government initiatives promoting sustainable and eco-friendly materials further support market growth. Additionally, growing consumer preference for smart, customizable, and technologically integrated furniture is enhancing adoption. Expansion across hotels, hospitals, and retail sectors, coupled with innovations in durable and energy-efficient products, continues to fuel global demand for advanced FF&E solutions.

Restraining Factors

High costs associated with premium and customized furniture, extended lead times, and complex installation processes limit market adoption. Furthermore, the availability of low-cost alternatives and fluctuations in raw material prices act as restraints on market growth.

Market Segmentation

The furniture, fixtures, and equipment market share is classified into product and end use.

- The furniture segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on product type, the FF&E market is categorized into furniture, fixtures, and equipment. Among these, the furniture segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by extensive usage of beds, seating, tables, and storage solutions across commercial and residential spaces. Furniture remains essential for interior functionality and aesthetics, particularly in the hospitality and office sectors.

The equipment segment is also projected to grow at a notable CAGR, supported by the increasing adoption of smart, energy-efficient appliances and operational tools.

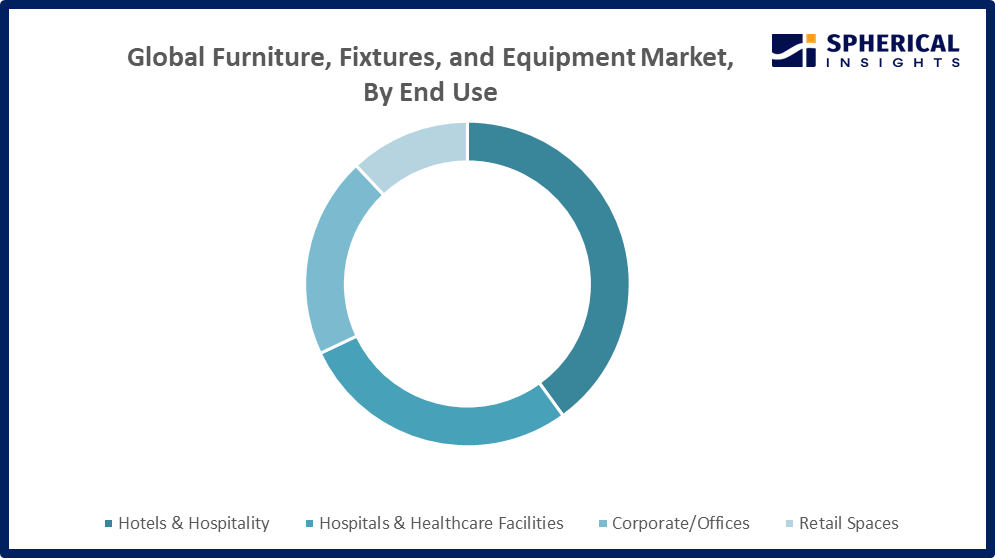

- The hotels & hospitality segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on product type, the FF&E market is categorized into furniture, fixtures, and equipment. Among these, the furniture segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by extensive usage of beds, seating, tables, and storage solutions across commercial and residential spaces. Furniture remains essential for interior functionality and aesthetics, particularly in the hospitality and office sectors.

The equipment segment is also projected to grow at a notable CAGR, supported by the increasing adoption of smart, energy-efficient appliances and operational tools.

Get more details on this report -

Regional Segment Analysis of the Furniture, Fixtures, and Equipment Market

-

North America (U.S., Canada, Mexico)

-

Europe (Germany, France, the U.K., Italy, Spain, and Rest of Europe)

-

Asia-Pacific (China, Japan, India, and Rest of APAC)

-

South America (Brazil and Rest of South America)

-

Middle East & Africa (UAE, South Africa, and Rest of MEA)

The Asia-Pacific region is anticipated to hold the largest market share in the global Furniture, Fixtures, and Equipment (FF&E) market over the forecast period. This dominance is attributed to rapid urbanization, expansion of hospitality and commercial infrastructure, and growth in healthcare and retail sectors. Rising disposable incomes, increasing tourism, and modernization of offices and hotels are driving strong demand for functional, aesthetically appealing, and technologically integrated FF&E solutions across the region.

Get more details on this report -

North America is expected to register a rapid CAGR during the forecast period. Market growth in this region is supported by high refurbishment and renovation rates in hotels and office spaces, expanding healthcare infrastructure, increasing demand for ergonomic and smart furniture, and strong adoption of sustainable and technologically advanced FF&E solutions across both commercial and residential sectors.

Competitive Analysis

The report provides a comprehensive analysis of key companies in the global Furniture, Fixtures, and Equipment (FF&E) market. It includes a comparative evaluation based on product offerings, business overviews, geographic presence, corporate strategies, segment market share, and SWOT analysis. Additionally, the report highlights recent company developments, such as product innovations, joint ventures, partnerships, mergers & acquisitions, and strategic alliances, enabling a thorough assessment of market competition.

Key Companies in the Furniture, Fixtures, and Equipment Market

-

Kimball International Inc.

-

Global Furniture Group

-

Steelcase Inc.

-

Herman Miller Inc.

-

Haworth Inc.

-

Stryker Corporation

-

Ashley Furniture Industries, Inc.

-

Inter IKEA Systems B.V.

-

Häfele

-

Kinnarps Group

Key Target Audience

-

Market Players

-

Investors

-

End-users

-

Government Authorities

-

Consulting and Research Firms

-

Venture Capitalists

-

Value-Added Resellers (VARs)

Recent Development

-

In December 2025, Häfele showcased innovative furniture technology and smart design at SICAM 2025, featuring connected lighting systems, ultra-thin fittings, advanced connectors, and app-controlled electronic solutions that combine functionality, aesthetics, and sustainability for modern interiors.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the FF&E market as follows:

Global Furniture, Fixtures, and Equipment Market, By Product

- Furniture

- Fixtures

- Equipment

Global Furniture, Fixtures, and Equipment Market, By End Use

- Hotels & Hospitality

- Hospitals & Healthcare Facilities

- Corporate/Offices

- Retail Spaces

- Others

Global Furniture, Fixtures, and Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the furniture, fixtures, and equipment market over the forecast period?The global furniture, fixtures, and equipment market is projected to expand at a CAGR of 5.56% during the forecast period.

-

2. What is the market size of the furniture, fixtures, and equipment market?The global furniture, fixtures, and equipment market size is expected to grow from USD 172.81 billion in 2024 to USD 313.25 billion by 2035, at a CAGR of 5.56% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the furniture, fixtures, and equipment market?Asia Pacific is anticipated to hold the largest share of the furniture, fixtures, and equipment market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global furniture, fixtures, and equipment market?furniture, fixtures, and equipment (FF&E) market include Kimball International Inc., Global Furniture Group, Steelcase Inc., Herman Miller Inc., Haworth Inc., Stryker Corporation, Ashley Furniture Industries, Inc., Inter IKEA Systems B.V., Häfele, and Kinnarps Group.

-

5. What factors are driving the growth of the furniture, fixtures, and equipment market?Rising commercial and hospitality infrastructure, urbanization, modernization of offices, tourism growth, demand for ergonomic and smart furniture, and sustainability initiatives drive FF&E market growth.

-

6. What are the market trends in the furniture, fixtures, and equipment market?Key FF&E market trends include smart and connected furniture, sustainable materials, modular and customizable designs, ergonomic workplace solutions, technology integration, multifunctional pieces, and increasing demand in hospitality and healthcare sectors.

-

7. What are the main challenges restricting the wider adoption of the furniture, fixtures, and equipment market?The main challenges restricting wider adoption of the FF&E market include high costs of premium and customized furniture, long lead times, complex installation processes, fluctuating raw material prices, and competition from low-cost alternatives, which limit accessibility and slow market expansion

Need help to buy this report?