Global Fuel Cell Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Component (Fuel Stacks, Humidifiers, Air Compressor, Fuel Compressor, Power Conditioners, Others), By Vehicle Type (LCV, HCV, Passenger Vehicles, Buses, Trucks, Forklift, E-Bikes, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Automotive & TransportationGlobal Fuel Cell Vehicle Market Insights Forecasts to 2030

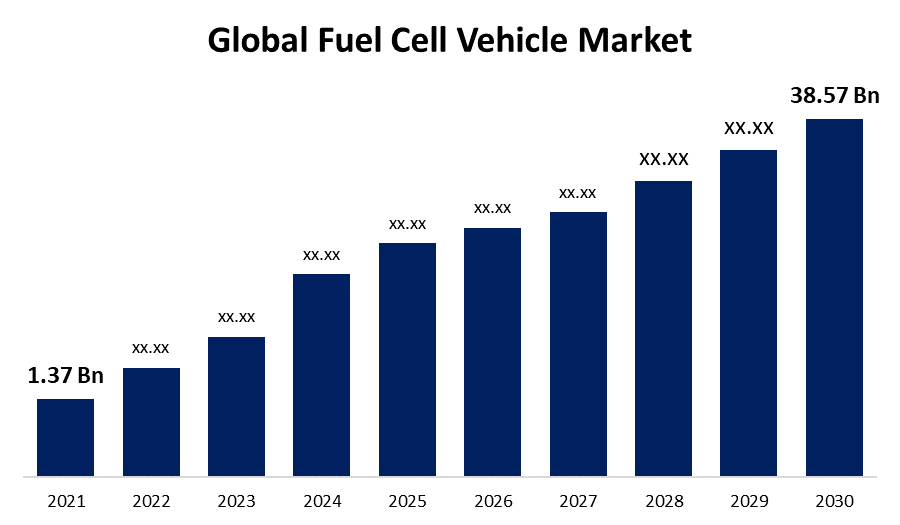

- The Fuel Cell Vehicle Market Size was valued at USD 1.37 Billion in 2021.

- The Market is growing at a CAGR of 44.9% from 2022 to 2030

- The Worldwide Fuel Cell Vehicle Market is expected to reach USD 38.57 Billion by 2030

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Fuel Cell Vehicle Market is expected to reach USD 38.57 Billion by 2030, at a CAGR of 44.9% during the forecast period 2022 to 2030.

A fuel cell car, sometimes known as a fuel cell electric vehicle, is a battery powered automobile that makes use of a fuel cell to drive its onboard electric engine, sometimes in conjunction with a compact battery or ultracapacitor. In general, fuel cells in automotive produce electricity by utilizing oxygen from the air with pressurized hydrogen. By the end of 2020, 31,225 passenger hydrogen-powered fuel cell electric vehicles are anticipated to be marketed worldwide. In limited markets, just three fuel cell car models were publicly available: the Honda Clarity Fuel Cell, the Toyota Mirai Present, and the Hyundai Nexo SUV. Furthermore, a fuel cell forklift is an industrial forklift truck powered by a fuel cell that is used to lift and transport products. These commercial forklift FCEVs are widely used in the manufacturing and logistics industries. PEM fuel cells are utilized to power the majority of forklift fuel cells.

In recent years, concerns that pertain to the reduction of greenhouse gas emissions as a global warming mitigation measure have increased global penetration for alternatives to conventional energy sources vehicles. Among the other emerging demands, fuel cell vehicles are gaining popularity owing to advantages in terms of refilling time, range, and minimal greenhouse gas emissions while commuting.

The market for fuel cell vehicles is currently in its early stages of implementation and expansion. Honda now sells FCVs in Japan, in addition to Toyota. Together with regular automobiles and buses, scooters powered by FCs have been announced as a prototype. To boost efficiency, hydrogen fuel cell vehicle manufacturers are broadening their applicability to heavy commercial trucks. According to this tendency, FCVs powered by fuel cells are projected to emerge in the future. By 2030, hydrogen is expected to be used in a variety of modes of transportation, including Heavy vehicles, buses, and rail, as well as in the initial phase of commercial shipping and aircraft. According to our research, there might be up to 6TWh of demand for environmentally friendly hydrogen from transportation in 2030.

COVID-19 Impact Fuel Cell Vehicle Market

The impact of the COVID-19 pandemic on the fuel cell vehicle market was inevitable, as it has been on practically almost every sector in the market. However, the electric vehicle (EV) market is expanding rapidly because of the fast-growing acceptance and adoption of mild-hybrid electric automobiles throughout the globe. Also, as a result of the pandemic, global sales of fuel cell vehicles fell precipitously. So, whilst business returns to normal, the marketplace is expected to continue growing in the coming years.

Global Fuel Cell Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 1.37 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 44.9% |

| 2030 Value Projection: | USD 38.57 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Vehicle Type, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Daimler AG, Hyster-Yale Materials Handling, Honda Motors Co. Ltd., Plug Power, Volkswagen AG, Toyota Motor Corporation, Nissan Motor Corporation, Hyundai Motor Group, Dana Limited, Ballard Power System Inc., Hydrogenics, Volvo AB, General Motors, BMW AG, US Hybrid, Nikola Corporation, Audi AG, EvoBus GmbH, Xiamen King Long Motor Co. Ltd., Shanghai Shenli Technology Co., Ltd. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Market Dynamics

Key Market Drivers

In recent years, the transition from traditional fuel cars to environmentally friendly vehicles has driven demand for fuel cell vehicles. Additional major factors influencing market expansion include stringent environmental legislation, the introduction of subsidies and incentive programs for alternate fuels, and toxic gases pollutants from automobiles with internal combustion engines. The efficiency of these fuel cell vehicles is expected to increase as fuel cell technology progresses.

The fuel cell electric vehicle market is steadily growing associated with increased demand for fuel efficient, high performance, and low emission vehicles, in addition to robust laws and restrictions on vehicular emission, lower cost of batteries, and increasing expenses for fuel. The infrastructure for electric vehicles is also being invested in by a majority of governments throughout the world, including subsidies as well as direct investments in communal hydrogen filling stations. The availability of hydrogen stations is expanding, and countries like China, which have a strong supply chain for parts like motor drives, fuel cells, and others, continue to impact the passenger vehicle and advanced electric bus industries.

Continuously increasing gasoline prices and government efforts around the world to create knowledge and understanding of fuel cell electric vehicles are expected to drive the adoption of electric vehicles over the projected timeframe. The government's support for the incorporation and deployment of hydrogen filling stations is expected to further drive the expansion of the fuel cell vehicle market. The primary goal of the governments of industrialized countries is to create a strategic strategy for the commercialization of fuel cell technology. Many countries hope to have a nationwide network of hydrogen recharging stations in place by 2030.

Key Market Challenges

The fuel cell vehicles are costly, and the price of hydrogen in some regions is excessive, limiting the expansion of the fuel cell vehicle market. Additionally, most of the world's infrastructure is limited or insufficient to handle hydrogen distribution. Furthermore, the cost of producing hydrogen fuel cell automobiles is higher than that of producing conventional vehicles. It necessitates the use of a catalyst, particularly platinum, which is quite expensive, raising the manufacturing costs. Several of the currently available fuel cell technologies are in the prototype stage and have not yet been approved. Besides from just that, it is struggling to compete with battery electric vehicles and plug-in hybrid electric vehicles, which have been gaining popularity and obstructing market development.

Market Segmentation

Component Type Insights

The fuel stacks accounted the largest market share of more than 43% over the forecast period.

On the basis of component, the global fuel cell vehicle market is segmented into fuel stacks, humidifiers, air compressor, fuel compressor, power conditioners, and others. Among these, the fuel stacks segment is dominating the market with more than 43% and is expected to continue its dominance over the forecast period. Since platinum is utilized as a catalyst in a fuel stack to improve the electrochemical reaction and enhance the effectiveness of the fuel cell, the fuel stack constitutes the most expensive part of a fuel cell system. As a result, the fuel stack market is expected to generate the most revenues from the vehicle fuel cell market. The maximum power of the fuel cell is determined by the size of the stack. To create additional electricity and power, the amount of fuel cell stacks can be extended. The price for each kWh of power generated lowers as the stack size is increased. As a result, fuel cells are effective for long-distance transportation.

Vehicle Type Insights

The passenger vehicles segment accounted the largest revenue share of more than 68% over the forecast period.

On the basis of vehicle type, the global fuel cell vehicle market is segmented into LCV, HCV, passenger vehicles, buses, trucks, forklift, e-bikes, and others. Among these, the passenger vehicles accounted for the largest revenue share of over 68% over the forecast period. The fuel cell passenger vehicle market is predicted to be driven by the rising widespread adoption and demands for personal mobility, as well as rising concerns about low-emission automobiles. The growing development of passenger automobiles in nations such as Japan and South Korea supports the growth of this segment in the fuel cell vehicle demand. Several companies intend to introduce new vehicles in the foreseeable future, recognizing the immense opportunities in the fuel cell passenger vehicle market. There are several FCEV passenger automobiles on the market, including the Toyota Mirai, Honda Clarity Fuel Cell, Hyundai Nexo SUV, Riversimple RASA, Nissan X-Trail FCEV, and Mercedes-Benz GLC FCEV.

The truck and bus industries are also expected to increase rapidly throughout the forecast period. The fuel cell truck and bus segment is expected to develop due to increased efficiency, longer operating range, and the need to reduce greenhouse gas emissions.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 65% market share over the forecast period due to notable government programs promoting low-emission transportation solutions. The region's rising demand for fuel cell vehicles is primarily attributable to countries such as Japan, China, and South Korea, followed by India and Australia. Because of the large-scale deployment of Japanese fuel cell Micro Cogeneration and Heat Production technologies, this has been a major region of fuel cell development since 2009. Also, government actions in Japan to promote the use of fuel cell vehicles and to assist consumers with vehicle purchases through subsidies are propelling the industry in this region forward.

The Ministry of Knowledge Economy in South Korea is currently undergoing significant initiatives to encourage fuel cells in the country. In accordance with the South Korea Automobile Manufacturers Association, Japan will sell over 2,400 fuel cell vehicles in 2021, with the most of them bought by the government. India is also anticipated to launch open-to-the-public fuel cell promotion campaigns. India's participation is currently visible through the deployment of backup power fuel cell facilities for telecom towers. The Ministry of New and Renewable Energy (MNRE) collaborated with NTPC in February 2020 to propose the commencement of a fuel cell bus project.

Europe is expected to grow the fastest during the forecast period. Prominent European players are always striving for the incorporation of fuel cell systems and fuel cells in passenger as well as commercial vehicles. In addition, the enormous installation of commercial vehicles for both government and private use in France is supporting market growth.

North America is likely to demonstrate consistent growth in the fuel cell vehicle market over the projection period owing to the smaller number of fuel cell vehicles. The availability of competitively priced hydrogen stations in areas where vehicles will be deployed remains a major barrier to the adoption of this technology. To solve this issue, the US Department of Energy (DOE) established H2USA, a public-private partnership involving government agencies, automakers, hydrogen providers, fuel cell companies, national laboratories, and other stakeholders. In mid-2021, the United States had 48 open retail hydrogen stations. In addition, at least 60 stations were in various phases of planned or construction. As the market grows, hydrogen fuelling stations will expand in tandem with car rollout.

List of Key Market Players

- Daimler AG

- Hyster-Yale Materials Handling

- Honda Motors Co. Ltd.

- Plug Power

- Volkswagen AG

- Toyota Motor Corporation

- Nissan Motor Corporation

- Hyundai Motor Group

- Dana Limited

- Ballard Power System Inc.

- Hydrogenics

- Volvo AB

- General Motors

- BMW AG

- US Hybrid

- Nikola Corporation

- Audi AG

- EvoBus GmbH

- Xiamen King Long Motor Co. Ltd.

- Shanghai Shenli Technology Co., Ltd.

Key Market Developments

- On January 2023, Nikola Company has announced a Letter of Intent with GP JOULE, a system provider for integrated energy solutions based in Reussenkoege, Germany, for an order of 100 Class 8, heavy-duty Nikola Tre hydrogen Fuel Cell Electric Vehicles (FCEVs). Nikola Tre FCEVs in the European 622 model will be produced at a joint venture between Nikola and Iveco Group in Ulm, Germany. Thirty of the initial 100 Nikola Tre FCEVs are scheduled to arrive at GP JOULE by 2024. The remaining 70 vehicles will be delivered in 2025, with the option for GP JOULE to acquire them through GATE - Green & Advanced Transport Ecosystem, Iveco Group's all-inclusive electric truck rental model.

- On March 2023, Plug Power Inc., a leading provider of turnkey hydrogen solutions for the global green hydrogen economy, has announced the expansion of its GenKey service to allow fuel cell adoption for warehouses with fewer than 100 electric forklifts. The Plug Power is reducing the barriers that previously existed for fleets of 40 to 100 forklifts, such as capital, manpower, space limits, and the issues connected with hydrogen fuel source and delivery. Clients with fewer than 100 electric forklifts can simply install hydrogen fuel cells, enhancing productivity while saving space and lowering carbon emissions. When compared to battery alternatives, Plug's fuel cells offer significant cost reductions. When compared to batteries, customers can save up to $260,000 and as much as $1 million every year.

- In June 2022, Hyundai Motor announced that their improved hydrogen-powered Nexo SUV would be available in 2024. The company has decided that mass production and sales of its new Nexo will commence in the second half of 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global fuel cell vehicle market based on the below-mentioned segments:

Fuel Cell Vehicle Market, Component Type Analysis

- Fuel Stacks

- Humidifiers

- Air Compressor

- Fuel Compressor

- Power Conditioners

- Others

Fuel Cell Vehicle Market, Vehicle Type Analysis

- LCV

- HCV

- Passenger Vehicles

- Buses

- Trucks

- Forklift

- E-Bikes

- Others

Fuel Cell Vehicle Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the fuel cell vehicle market?The global fuel cell vehicle market is expected to grow from USD 1.37 Billion in 2021 to USD 38.57 Billion by 2030, at a CAGR of 44.9% during the forecast period 2021-2030.

-

2. Which are the major key players in the global fuel cell vehicle market?Daimler AG, Hyundai Motor Group, Plug Power, Volvo AB, General Motors, BMW AG, US Hybrid, Audi AG, EVBus GmbH, Xiamen King Long Motor Co. Ltd.

-

3. Which segment dominated the fuel cell vehicle market share?The passenger vehicle segment in vehicle type dominated the fuel cell vehicle market in 2021 and accounted for a revenue share of over 68%.

-

4. Which region is dominating the fuel cell vehicle market?North America is dominating the fuel cell vehicle market with more than 65% market share.

-

5. What are the factors driving the fuel cell vehicle market?Important factors driving the growth of the fuel cell vehicle market include rising worries about worrisome pollution levels, more emphasis on the adoption of FCEVs due to their pollution-free qualities, and increased government financing for hydrogen filling stations.

-

6. Which segment holds the largest market share of the fuel cell vehicle market?The fuel stacks segment based on component type holds the largest market share of the Fuel Cell Vehicle market.

Need help to buy this report?