Global Fried Chicken Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whole Fried Chicken, Fried Chicken Wings, Fried Chicken Tenders, Fried Chicken Sandwiches, Boneless Fried Chicken), By Distribution Channel (Restaurants, Fast Food Outlets, Food Trucks, Supermarkets, Online Delivery Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Food & BeveragesGlobal Fried Chicken Market Insights Forecasts to 2035

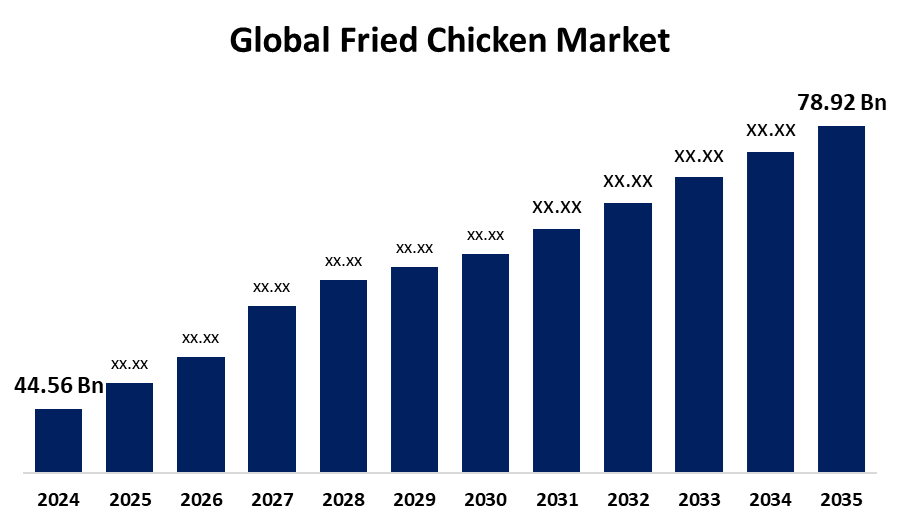

- The Global Fried Chicken Market Size Was Estimated at USD 44.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.33% from 2025 to 2035

- The Worldwide Fried Chicken Market Size is Expected to Reach USD 78.92 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global fried chicken market size was worth around USD 44.56 Billion in 2024 and is predicted to grow to around USD 78.92 Billion by 2035 with a compound annual growth rate (CAGR) of 5.33% from 2025 and 2035. The fried chicken market is driven by rising demand for convenient, ready-to-eat foods, the rapid expansion of fast-food chains and delivery services, product innovation with diverse flavors, increasing disposable incomes in emerging markets, and its strong cultural popularity as a social and casual dining favorite.

Market Overview

The fried chicken market refers to the industry involved in producing, distributing, and selling fried chicken products. The primary aim of the fried chicken market is to satisfy the rising consumer demand for tasty, affordable, and accessible meal options that fit fast-paced lives. Additionally, it focuses on continuous innovation, including flavor diversification and healthier alternatives, to attract and retain customers across different regions and demographics. It is a versatile and flavorful meal enjoyed by a broad audience, suitable for various occasions ranging from casual snacking to social gatherings. It provides a rich source of protein, appealing to consumers looking for satisfying and quick meal solutions. Moreover, innovations in the fried chicken market focus on healthier cooking techniques like air frying, the introduction of plant-based alternatives, new flavor profiles catering to regional tastes, and enhanced packaging for better convenience and freshness. These advancements help brands stay competitive, address health concerns, and meet the dynamic preferences of modern consumers, ensuring continued market growth.

Report Coverage

This research report categorizes the fried chicken market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the fried chicken market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the fried chicken market.

Global Fried Chicken Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 44.56 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.33% |

| 2035 Value Projection: | 78.92 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Product Type, By Distribution Channel, By Region and COVID-19 Impact Analysis |

| Companies covered:: | KFC, Popeyes Louisiana Kitchen, Chick-fil-A, Bojangles’ Famous Chicken ’n Biscuits, Church’s Chicken, Raising Cane’s Chicken Fingers, Wingstop, Zaxby’s, Jollibee, El Pollo Loco, Bonchon Chicken, Nando’s and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Busy lifestyles and urbanization have heightened consumers’ preference for convenient, ready-to-eat meals that require minimal preparation. Fried chicken perfectly fits this demand due to its quick cooking time and availability at fast-food outlets and delivery services. This convenience factor appeals to working professionals, students, and families seeking flavorful, satisfying meals without the hassle of cooking, significantly boosting the fried chicken market globally. Moreover, brands are innovating with new flavors, healthier recipes, and diverse formats such as boneless chicken, sandwiches, and spicy variants. This variety appeals to different consumer tastes, attracting a broader customer base and sustaining market momentum.

Restraining Factors

Rising awareness about health issues like obesity, heart disease, and high cholesterol linked to fried foods discourages frequent consumption of fried chicken. Consumers are shifting towards healthier, low-fat, and baked alternatives, which limits demand growth for traditional fried chicken products and pressures brands to innovate healthier options. Moreover, fried chicken is typically high in calories and unhealthy fats, making it less appealing to health-conscious consumers. This impacts market growth, especially in regions where wellness trends are strong. The negative perception of fried foods drives consumers to seek alternative protein sources, reducing overall fried chicken consumption.

Market Segmentation

The fried chicken market share is classified into product type and distribution channel.

- The fried chicken wings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the fried chicken market is divided into whole fried chicken, fried chicken wings, fried chicken tenders, fried chicken sandwiches, and boneless fried chicken. Among these, the fried chicken wings segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to fried chicken wings being widely enjoyed as a snack or appetizer, especially during social gatherings, sports events, and parties. Their bite-sized nature makes them easy to share, boosting their appeal. This social and casual consumption drives strong demand, making wings a dominant product type in the fried chicken market.

- The fast-food outlets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the fried chicken market is divided into restaurants, fast food outlets, food trucks, supermarkets, and online delivery services. Among these, the fast-food outlets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to fast food outlets offering fast, convenient meals that cater to busy lifestyles. Customers prefer quick service without compromising on taste, making fried chicken a popular choice. The ready availability and speedy preparation make fast food outlets the go-to option for fried chicken, boosting their market share significantly.

Regional Segment Analysis of the Fried Chicken Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the fried chicken market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the fried chicken market over the predicted timeframe. North America, especially the U.S., is home to iconic fried chicken brands like KFC, Popeyes, and Chick-fil-A. These companies have a long-standing presence and widespread reach, operating thousands of outlets across the region. Their aggressive marketing, frequent product innovation, and deep-rooted consumer trust have established a loyal customer base. This brand dominance ensures consistent sales, keeping North America ahead in the global fried chicken market.

Asia Pacific is expected to grow at a rapid CAGR in the fried chicken market during the forecast period. Global brands like KFC, Popeyes, and Jollibee are aggressively expanding in the Asia-Pacific region through franchising and tailored offerings. These brands localize menus adding spicier coatings, rice combos, or region-specific sauces that appeal to local preferences. Additionally, increased investments in delivery services and digital platforms enhance accessibility, making fried chicken more available to a broader audience. These strategies are helping to accelerate market penetration and consumer adoption.

Europe is predicted to hold a significant share of the fried chicken market throughout the estimated period. Europe has a long-standing fast-food culture, with consumers readily embracing fried chicken as a popular quick-service meal. Countries like the UK, Germany, and France have a high demand for convenient, flavorful foods. The presence of well-established international chains alongside local brands creates a competitive and mature market, driving consistent consumption. Europeans' increasing preference for dining out and takeaways further supports the steady growth of fried chicken in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the fried chicken market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KFC

- Popeyes Louisiana Kitchen

- Chick-fil-A

- Bojangles' Famous Chicken 'n Biscuits

- Church's Chicken

- Raising Cane's Chicken Fingers

- Wingstop

- Zaxby's

- Jollibee

- El Pollo Loco

- Bonchon Chicken

- Nando's

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Kroger recently enhanced its Home Chef Fried Chicken, introducing a double-breaded, hand-dipped recipe featuring 18 spices, including garlic, paprika, and thyme. The updated breading incorporates tapioca and potato starches for improved crunch and texture. To complement the recipe, Kroger has adopted a new paper gable box packaging with venting holes and a window, designed to maintain the chicken's crispiness and provide a clear view of the product. These changes aim to offer customers a fresher, more flavorful fried chicken experience.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fried chicken market based on the below-mentioned segments:

Global Fried Chicken Market, By Product Type

- Whole Fried Chicken

- Fried Chicken Wings

- Fried Chicken Tenders

- Fried Chicken Sandwiches

- Boneless Fried Chicken

Global Fried Chicken Market, By Distribution Channel

- Restaurants

- Fast Food Outlets

- Food Trucks

- Supermarkets

- Online Delivery Services

Global Fried Chicken Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the fried chicken market over the forecast period?The global fried chicken market is projected to expand at a CAGR of 5.33% during the forecast period.

-

2. What is the market size of the fried chicken market?The global fried chicken market size is expected to grow from USD 44.56 Billion in 2024 to USD 78.92 Billion by 2035, at a CAGR of 5.33% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the fried chicken market?North America is anticipated to hold the largest share of the fried chicken market over the predicted timeframe.

Need help to buy this report?