France Surgical Microscopes Market Size, Share, and COVID-19 Impact Analysis, By Type (On-Casters, Wall-Mounted, Tabletop, Ceiling-Mounted, and Others), By Application (Ophthalmology, Neurosurgery & Spine Surgery, ENT Surgery, Dentistry, Urology, and Others), By End User (Hospital and Physician Clinics), and France Surgical Microscopes Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Surgical Microscopes Market Size Insights Forecasts to 2035

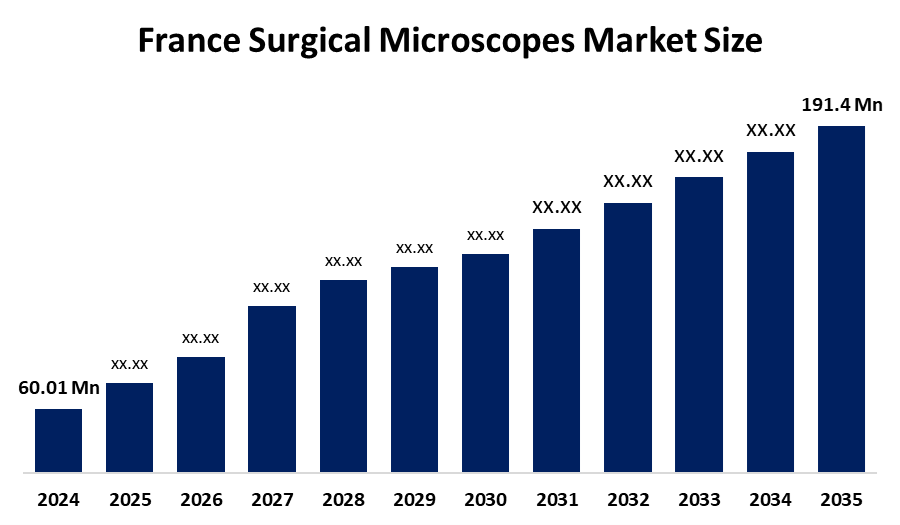

- The France Surgical Microscopes Market Size Was Estimated at USD 60.01 Million in 2024.

- The France Surgical Microscopes Market Size is Expected to Grow at a CAGR of Around 11.12% from 2025 to 2035.

- The France Surgical Microscopes Market Size is Expected to Reach USD 191.4 Million by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Surgical Microscopes Market Size is Anticipated to Reach USD 191.4 Million by 2035, Growing at a CAGR of 11.12% from 2025 to 2035. The France Surgical Microscopes Market Size is driven by rising demand for minimally invasive and precision surgeries, an aging population, technological advancements like 3D imaging and robotic-assisted systems, and supportive healthcare infrastructure and reimbursement policies.

Market Overview

The France Surgical Microscopes Market Size comprises advanced optical and imaging equipment used by surgeons to perform precise procedures across various medical specialties, including ophthalmology, neurosurgery, ENT, and dental surgery. These microscopes provide high magnification, bright illumination, and enhanced visualization, often integrated with digital imaging, 3D visualization, and robotic-assisted systems. Such features enable minimally invasive surgeries, improved surgical precision, and better patient outcomes in hospitals, clinics, and specialized surgical centers across France.

France’s population health profile and high level of surgical activity underscore the need for surgical microscopes, as a large number of precision procedures are performed across the country. Nearly 1 million cataract surgeries were conducted in France in 2023, with volumes expected to increase steadily over the next five years due to an aging population and improved access to healthcare. As a result, ophthalmic procedures represent one of the most common surgical interventions in the country.

The incidence of cataract surgery in France is higher than in many other EU countries, at approximately 1,417 procedures per 100,000 inhabitants, indicating strong demand for advanced hospital equipment such as surgical microscopes. In addition, anesthesia statistics show that millions of surgical procedures are performed annually across various medical specialties, including ophthalmology and ENT, highlighting a sustained base of surgical demand. Precision visualization tools therefore play a crucial role in improving outcomes for complex and minimally invasive surgeries across France.

The France Surgical Microscopes Market Size is supported by several government initiatives under the France 2030 program, which allocates funding for innovation, industrialization, and clinical validation of medical devices. Programs such as Grands Défis, along with research funded by organizations like INSERM, support advancements in surgical technologies, imaging, and robotics. These initiatives create opportunities for the development, adoption, and integration of advanced surgical microscopes in hospitals and specialized surgical centers across France.

Report Coverage

This research report categorizes the France Surgical Microscopes Market Size by various segments and regions, forecasts revenue growth, and analyzes trends across each submarket. The report examines key growth drivers, opportunities, and challenges influencing the market. It also includes recent market developments and competitive strategies—such as expansions, product launches, developments, partnerships, mergers, and acquisitions—to illustrate the competitive landscape. Furthermore, the report strategically identifies and profiles key market players and analyzes their core competencies across each sub-segment of the France surgical microscopes market.

France Surgical Microscopes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 60.01 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.12% |

| 2035 Value Projection: | 191.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Carl Zeiss Meditec AG, Leica Microsystems (Danaher Corporation), Olympus Corporation, Topcon Corporation, Alcon Inc. (Novartis AG), Haag Streit Group, Synaptive Medical, Global Surgical Corporation, Takagi Seiko Co., Ltd., ATMOS MedizinTechnik GmbH & Co. KG, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Surgical Microscopes Market Size is driven by several factors, foremost among them the growing demand for minimally invasive and precision surgeries across specialties such as ophthalmology, neurosurgery, and ENT. An aging population has led to a higher prevalence of conditions such as cataracts and neurological disorders, thereby increasing the need for advanced surgical procedures. In addition, technological innovations—including 3D visualization, digital imaging, and robotic-assisted systems—enhance surgical accuracy, efficiency, and patient outcomes, further accelerating market adoption.

Restraining Factors

TheFrance Surgical Microscopes Market Size faces challenges due to the high cost of advanced surgical microscopes and their ongoing maintenance, which can limit adoption among small clinics and budget-constrained hospitals. In addition, operating complex imaging and robotic-assisted systems requires specialized training, potentially hindering implementation. Furthermore, the availability of alternative surgical technologies and lower-cost imaging devices may reduce demand for high-end surgical microscopes.

Market Segmentation

The France surgical microscopes market share is categorized by type, application, and end user.

- The on-casters segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France surgical microscopes market is segmented by type into on-casters, wall-mounted, tabletop, ceiling-mounted, and others. Among these, the on-casters segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The on-casters segment's growth is due to its portability, flexibility, and ease of use across multiple operating rooms. It provides high-precision visualization for ophthalmology, ENT, and neurosurgery. Its cost-effectiveness compared to ceiling-mounted systems encourages adoption, while compatibility with advanced imaging and digital integration further drives growth in hospitals and surgical centers.

- The ophthalmology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France surgical microscopes market is segmented by application into ophthalmology, neurosurgery & spine surgery, ENT surgery, dentistry, urology, and others. Among these, the ophthalmology segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The ophthalmology segmental growth is driven by the high volume of eye surgeries, particularly cataract procedures, an aging population, and the increasing prevalence of vision-related disorders. The need for precision and magnification in delicate ophthalmic surgeries makes surgical microscopes essential. Additionally, advancements in digital imaging, 3D visualization, and minimally invasive surgical techniques enhance surgical accuracy and outcomes, further boosting the adoption of microscopes in ophthalmology across hospitals and specialized eye care centers in France.

- The hospital segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France surgical microscopes market is segmented by end user into hospital and physician clinics. Among these, the hospital segment held the largest market share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The hospital’s segmental growth is due to the high number of complex and high-volume surgeries performed in hospitals, including ophthalmology, neurosurgery, and ENT procedures. Hospitals have the infrastructure, trained personnel, and resources to adopt advanced surgical microscopes, including ceiling-mounted and digitally integrated systems. Additionally, hospitals serve as primary centers for minimally invasive and precision surgeries, driving continuous demand for high-performance microscopes to improve surgical accuracy and patient outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France surgical microscopes market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carl Zeiss Meditec AG

- Leica Microsystems (Danaher Corporation)

- Olympus Corporation

- Topcon Corporation

- Alcon Inc. (Novartis AG)

- Haag Streit Group

- Synaptive Medical

- Global Surgical Corporation

- Takagi Seiko Co., Ltd.

- ATMOS MedizinTechnik GmbH & Co. KG

- Others

-

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

-

In February 2024, Hanoi French Hospital in northern Vietnam became the first hospital in the region to install the advanced ZEISS KINEVO 900 surgical microscope system. The system enhances surgical capabilities, precision, and patient outcomes through cutting-edge 3D visualization and robotic-assisted technology.

-

In December 2025, Leica Microsystems introduced advanced neurosurgical microscopes, including the ARveo 8 system. These microscopes feature 3D visualization, augmented reality, and fluorescence imaging, improving precision in complex brain and spine surgeries while supporting real-time guidance, enhanced workflow efficiency, and surgical training.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Surgical Microscopes Market based on the below-mentioned segments:

France Surgical Microscopes Market, By Type

- On-Casters

- Wall-Mounted

- Tabletop

- Ceiling-Mounted

- Others

France Surgical Microscopes Market, By Application

- Ophthalmology

- Neurosurgery & Spine Surgery

- ENT Surgery

- Dentistry

- Urology

- Others

France Surgical Microscopes Market, By End User

- Hospital

- Physician Clinics

Frequently Asked Questions (FAQ)

-

1. What is the France surgical microscopes market size in 2024?The France surgical microscopes market size was estimated at USD 60.01 million in 2024.

-

2. What is the projected market size of the France surgical microscopes market by 2035?The France surgical microscopes market size is expected to reach USD 191.4 million by 2035.

-

3. What is the CAGR of the France surgical microscopes market?The France surgical microscopes market size is expected to grow at a CAGR of around 11.12% from 2024 to 2035.

-

4. What are the key growth drivers of the France surgical microscopes market?Rising demand for minimally invasive and precision surgeries, an aging population, technological advancements like 3D imaging and robotic-assisted systems, and supportive healthcare infrastructure and reimbursement policies.

-

5. Which application segment dominated the market in 2024?The ophthalmology segment dominated the market in 2024.

-

6. Which type of segment accounted for the largest market share in 2024?The on-casters segment accounted for the largest market share in 2024.

-

7. What segments are covered in the France surgical microscopes market report?The France surgical microscopes market is segmented on the basis of type, application, and end-user.

Need help to buy this report?