France Retinal Vein Occlusion Treatment Market Size, Share, and COVID-19 Impact Analysis, By Disease Type (Central Retinal Vein Occlusion (CRVO) and Branch Retinal Vein Occlusion (BRVO)), By Treatment (Corticosteroid Drugs and Anti-vascular Endothelial Growth Factor), By End User (Hospital & Clinics and Retail Pharmacies), and France Retinal Vein Occlusion Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Retinal Vein Occlusion Treatment Market Insights Forecasts to 2035

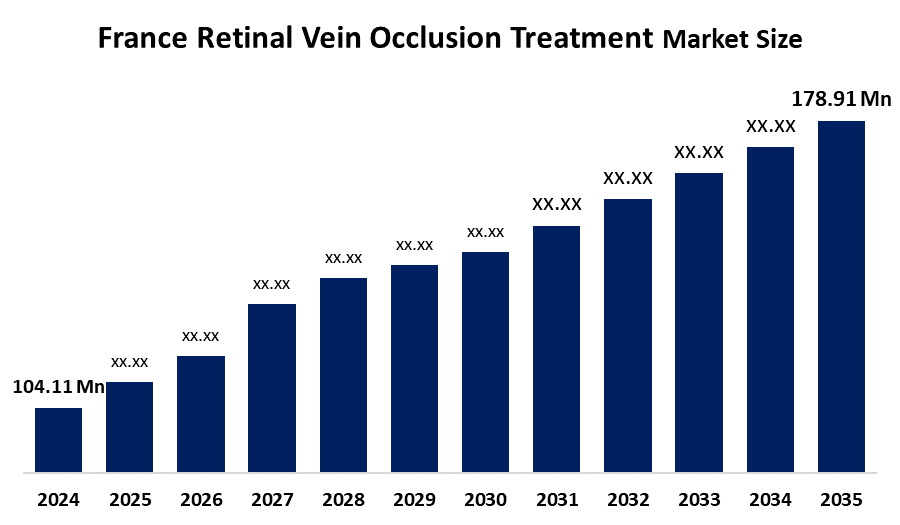

- The France Retinal Vein Occlusion Treatment Market Size Was Estimated at USD 104.11 Million in 2024

- The France Retinal Vein Occlusion Treatment Market Size is Expected to Grow at a CAGR of Around 5.05% from 2025 to 2035

- The France Retinal Vein Occlusion Treatment Market Size is Expected to Reach USD 178.91 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Retinal Vein Occlusion Treatment Market Size Is Anticipated To Reach USD 178.91 Million By 2035, Growing At A CAGR of 5.05% from 2025 to 2035. The France retinal vein occlusion treatment market is driven by the rising prevalence of age-related eye disorders, increasing incidence of diabetes, hypertension, and cardiovascular diseases, and growing awareness of early diagnosis and vision-saving treatments. The widespread use of anti-VEGF therapies, corticosteroid implants, and advanced retinal imaging, along with strong ophthalmology infrastructure and reimbursement support, is further boosting market growth.

Market Overview

The France Retinal Vein Occlusion (RVO) Treatment Market Size comprises the whole industry associated with diagnosing, managing, and treating retinal vein occlusion, which is a condition that can lead to loss of vision and is caused by the obstruction of retinal veins. The market covers the use of anti-VEGF drugs, corticosteroid therapies, laser photocoagulation, and supportive ophthalmic procedures, as well as the pharmaceutical companies, medical device manufacturers, hospitals, and ophthalmology clinics in France offering such treatments.

France faces a growing burden of retinal vein occlusion (RVO) due to its aging population and the high prevalence of diabetes, hypertension, and cardiovascular diseases, which are key risk factors for RVO. More than 20% of the French population is aged 60 and above, a demographic highly susceptible to retinal vascular disorders. Vision impairment caused by untreated RVO significantly affects quality of life and productivity, creating a strong need for early diagnosis and timely treatment. Increasing patient awareness, routine eye screenings, and the availability of effective therapies such as anti-VEGF injections and corticosteroid implants underline the importance of adopting advanced RVO treatments across hospitals and ophthalmology clinics in France.

Government support strongly reinforces market adoption. Inserm’s annual budget of €1.225 billion (2025) supports biomedical and ophthalmology research, while the Hospital Clinical Research Program (PHRC) allocates €90 million annually for clinical studies. Additionally, Retina France has invested €28 million in retinal research, alongside national health insurance reimbursement, ensuring accessibility and sustained growth of retinal vein occlusion (RVO) treatments in France.

Report Coverage

This research report categorizes the market for the France retinal vein occlusion treatment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France retinal vein occlusion treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France retinal vein occlusion treatment market.

France Retinal Vein Occlusion Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 104.11 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.05% |

| 2035 Value Projection: | USD 178.91 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Disease Type, By Treatment |

| Companies covered:: | Regeneron Pharmaceuticals, Inc. F. Hoffmann-La Roche Ltd. Bayer AG Novartis AG AbbVie Inc. Samsung Biopics Co., Ltd. Amgen Inc. Sandoz International GmbH Bio con Biologics Ltd. Eye Point Pharmaceuticals, Inc. Averie Pharmaceuticals, Inc. Kodiak Sciences Inc. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Retinal Vein Occlusion (RVO) Treatment Market Size is driven by the growing elderly population, rising prevalence of diabetes, hypertension, and cardiovascular diseases, and increasing awareness of early diagnosis and vision-saving treatments. Strong adoption of anti-VEGF therapies and corticosteroid implants, advanced retinal imaging, well-established ophthalmology infrastructure, and public health insurance reimbursement further support market growth in France.

Restraining Factors

The France Retinal Vein Occlusion (RVO) Treatment Market Size is restrained by the high cost of anti-VEGF injections and implant therapies, the need for frequent repeat treatments, and treatment adherence challenges among elderly patients. Limited access to specialized retinal care in some regions, potential side effects of long-term therapies, and strict regulatory and reimbursement controls can also slow market growth.

Market Segmentation

The France retinal vein occlusion treatment market share is classified into disease type, treatment, and end user.

- The central retinal vein occlusion (CRVO) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Retinal Vein Occlusion Treatment Market Size is segmented by disease type into central retinal vein occlusion (CRVO) and branch retinal vein occlusion (BRVO). Among these, the central retinal vein occlusion (CRVO) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The central retinal vein occlusion (CRVO) segment is growing because CRVO is typically more severe than BRVO, leading to greater vision loss and higher treatment intensity. Patients with CRVO often require frequent anti-VEGF injections and corticosteroid therapies, which drive higher treatment costs and revenue. Additionally, the rising elderly population and increasing prevalence of diabetes and hypertension in France, combined with strong reimbursement support and access to advanced ophthalmic care, further accelerate the growth of the CRVO segment.

- The anti-vascular endothelial growth factor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Retinal Vein Occlusion Treatment Market Size is segmented by treatment into corticosteroid drugs and anti-vascular endothelial growth factor. Among these, the anti-vascular endothelial growth factor segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The anti-vascular endothelial growth factor segment is growing because anti-VEGF therapies are the first-line treatment for retinal vein occlusion, offering superior visual outcomes, rapid reduction of macular edema, and proven clinical efficacy. Widespread use of agents such as ranibizumab, aflibercept, and bevacizumab is driving higher adoption and sustained revenue growth of this segment in France.

- The hospitals & clinics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Retinal Vein Occlusion Treatment Market Size is segmented by end user into hospitals & clinics and retail pharmacies. Among these, the hospitals & clinics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The hospitals & clinics segment is growing because retinal vein occlusion (RVO) requires specialized ophthalmic care, advanced diagnostic imaging, and frequent intravitreal injections that are best delivered in hospital-based and specialty clinic settings. In France, strong healthcare infrastructure, wider availability of retina specialists, reimbursement coverage for anti-VEGF therapies, and increasing patient preference for supervised clinical treatment are accelerating demand through hospitals and clinics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France retinal vein occlusion treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Regeneron Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Novartis AG

- AbbVie Inc.

- Samsung Biopics Co., Ltd.

- Amgen Inc.

- Sandoz International GmbH

- Bio con Biologics Ltd.

- Eye Point Pharmaceuticals, Inc.

- Averie Pharmaceuticals, Inc.

- Kodiak Sciences Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France retinal vein occlusion treatment market based on the below-mentioned segments:

France Retinal Vein Occlusion Treatment Market, By Disease Type

- Central Retinal Vein Occlusion (CRVO)

- Branch Retinal Vein Occlusion (BRVO)

France Retinal Vein Occlusion Treatment Market, By Treatment

- Corticosteroid Drugs

- Anti-vascular Endothelial Growth Factor

France Retinal Vein Occlusion Treatment Market, By End User

- Hospital & Clinics

- Retail Pharmacies

Frequently Asked Questions (FAQ)

-

What is the France retinal vein occlusion treatment market size in 2024?The France retinal vein occlusion treatment market size was estimated at USD 104.11 million in 2024

-

What is the projected market size of the France retinal vein occlusion treatment market by 2035?The France retinal vein occlusion treatment market size is expected to reach USD 178.91 million by 2035

-

What is the CAGR of the France retinal vein occlusion treatment market?The France retinal vein occlusion treatment market size is expected to grow at a CAGR of around 5.05% from 2024 to 2035.

-

What are the key growth drivers of the France retinal vein occlusion treatment market?The France retinal vein occlusion treatment market is driven by the rising prevalence of age-related eye disorders, increasing incidence of diabetes, hypertension, and cardiovascular diseases, and growing awareness of early diagnosis and vision-saving treatments.

-

Which end-use segment dominated the market in 2024?The hospitals & clinics segment dominated the market in 2024.

-

What segments are covered in the France retinal vein occlusion treatment market report?The France retinal vein occlusion treatment market is segmented on the basis of disease type, treatment, and end user.

-

Who are the key players in the France retinal vein occlusion treatment market?Key companies include Regeneron Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Novartis AG, AbbVie Inc., Samsung Bioepis Co., Ltd., Amgen Inc., Sandoz International GmbH, Biocon Biologics Ltd., EyePoint Pharmaceuticals, Inc., Aerie Pharmaceuticals, Inc., Kodiak Sciences Inc., and others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?