France Postmenopausal Osteoporosis Treatment Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Branded and Generics), By Drug Class (Bisphosphonates, Parathyroid Hormone Therapy, Calcitonin, Selective Estrogen Inhibitors Modulator (SERM), Rank Ligand Inhibitors, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and France Postmenopausal Osteoporosis Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Postmenopausal Osteoporosis Treatment Market Insights Forecasts to 2035

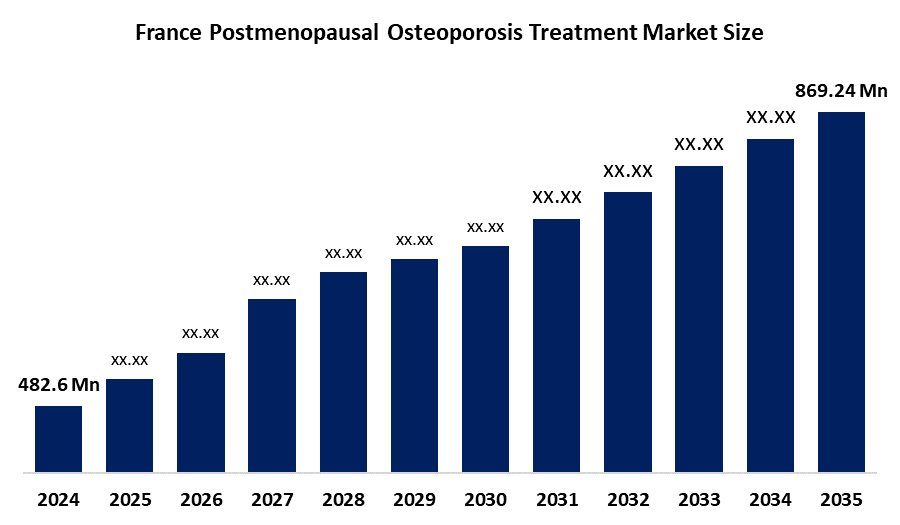

- The France Postmenopausal Osteoporosis Treatment Market Size Was Estimated at USD 482.6 Million in 2024

- The France Postmenopausal Osteoporosis Treatment Market Size is Expected to Grow at a CAGR of Around 5.05% from 2025 to 2035

- The France Postmenopausal Osteoporosis Treatment Market Size is Expected to Reach USD 869.24 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France postmenopausal osteoporosis treatment market size is anticipated to reach USD 869.24 million by 2035, growing at a CAGR of 5.05% from 2025 to 2035. The France postmenopausal osteoporosis treatment market is driven by rising osteoporosis cases in postmenopausal women, an aging population, growing awareness of bone health, vitamin D and calcium deficiencies, and increased adoption of advanced therapies and preventive treatments.

Market Overview

The France postmenopausal osteoporosis treatment market encompasses therapies and medications used to prevent, manage, and treat osteoporosis in postmenopausal women. This market includes bisphosphonates, hormone replacement therapy (HRT), monoclonal antibodies, selective estrogen receptor modulators (SERMs), and calcium and vitamin D supplements. It covers the research, manufacturing, distribution, and sales of these treatments across hospitals, clinics, pharmacies, and specialty care centers in France.

Market growth is primarily driven by the high rate of bone density loss, increased fracture risk among postmenopausal women, and rising awareness of bone health. France bears a substantial burden of postmenopausal osteoporosis, affecting nearly 4 million people, of whom approximately 80% are women. Each year, around 484,000 fragility fractures occur, leading to disability, loss of independence, and increased mortality among older adults. Despite the availability of effective therapies, more than two million high-risk women remain untreated, highlighting a significant treatment gap and the urgent need for improved osteoporosis management.

Looking ahead, the market offers strong growth opportunities as France’s aging population fuels demand for preventive care, early diagnosis, and advanced treatments, including bisphosphonates, hormone therapies, SERMs, and biologics. Supportive government initiatives such as full reimbursement for osteoporosis screening and treatment, along with healthcare policies prioritizing musculoskeletal health—are expected to enhance adoption and awareness. Coupled with ongoing research and clinical innovation, these factors position France’s postmenopausal osteoporosis treatment market for sustained growth and strategic importance.

Report Coverage

This research report categorizes the market for the France postmenopausal osteoporosis treatment market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France postmenopausal osteoporosis treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France postmenopausal osteoporosis treatment market.

France Postmenopausal Osteoporosis Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 482.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR5.05% |

| 2035 Value Projection: | USD 869.24 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Drug Class ,By Treatment, By Distribution Channel |

| Companies covered:: | Amgen Inc., Eli Lilly and Company, Novartis AG, Pfizer Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc (GSK), Roche Holding AG, Theramex, Besins Healthcare, Sanofi S.A., Johnson & Johnson,and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France postmenopausal osteoporosis treatment market is driven by high osteoporosis prevalence among postmenopausal women, an aging population, better awareness and early diagnosis, advanced therapies like denosumab and teriparatide, and strong healthcare coverage that improves access to treatment.

Restraining Factors

The France postmenopausal osteoporosis treatment market is restrained by high treatment costs, side effects, and safety concerns of long-term therapies, low patient adherence to medication regimens, and limited awareness in some population segments, which can slow market growth.

Market Segmentation

The France postmenopausal osteoporosis treatment market share is classified into treatment, drug class, and distribution channel.

- The branded segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France postmenopausal osteoporosis treatment market is segmented by treatment into branded and generic. Among these, the branded segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The branded segment is growing because branded osteoporosis therapies offer proven efficacy, higher safety profiles, and strong physician trust, leading to preference among patients and healthcare providers. Brand recognition, innovative drug formulations, and marketing support also drive higher adoption and revenue in France.

- The bisphosphonates segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France postmenopausal osteoporosis treatment market is segmented by drug class into bisphosphonates, parathyroid hormone therapy, calcitonin, selective estrogen inhibitors modulators (SERMs), rank ligand inhibitors, and others. Among these, the bisphosphonates segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The bisphosphonates segment is growing because these drugs are highly effective in preventing bone loss and fractures, are widely recommended by physicians, have a well-established safety profile, and are readily available, making them the preferred first-line treatment for postmenopausal osteoporosis in France.

- The retail pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France postmenopausal osteoporosis treatment market is segmented by distribution channel into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the retail pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The retail pharmacies segment is growing because they offer easy accessibility, convenience, and a wide range of branded and generic osteoporosis medications. Patients prefer retail pharmacies for routine purchases and repeat prescriptions, driving higher sales and revenue in France’s postmenopausal osteoporosis treatment market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France postmenopausal osteoporosis treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- Eli Lilly and Company

- Novartis AG

- Pfizer Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- GlaxoSmithKline plc (GSK)

- Roche Holding AG

- Theramex

- Besins Healthcare

- Sanofi S.A.

- Johnson & Johnson

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France postmenopausal osteoporosis treatment market based on the below-mentioned segments:

France Postmenopausal Osteoporosis Treatment Market, By Treatment

- Branded

- Generics

France Postmenopausal Osteoporosis Treatment Market, By Drug Class

- Bisphosphonates

- Parathyroid Hormone Therapy

- Calcitonin

- Selective Estrogen Inhibitors Modulator (SERM)

- Rank Ligand Inhibitors

- Others

France Postmenopausal Osteoporosis Treatment Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France postmenopausal osteoporosis treatment market size in 2024?The France postmenopausal osteoporosis treatment market size was estimated at USD 482.6 million in 2024.

-

2. What is the projected market size of the France postmenopausal osteoporosis treatment market by 2035?The France postmenopausal osteoporosis treatment market size is expected to reach USD 869.24 million by 2035.

-

3. What is the CAGR of the France postmenopausal osteoporosis treatment market?The France postmenopausal osteoporosis treatment market size is expected to grow at a CAGR of around 5.05% from 2024 to 2035.

-

4. What are the key growth drivers of the France postmenopausal osteoporosis treatment market?The France postmenopausal osteoporosis treatment market is driven by rising osteoporosis cases in postmenopausal women, an aging population, growing awareness of bone health, vitamin D and calcium deficiencies, and increased adoption of advanced therapies and preventive treatments.

-

5. Which drug class segment dominated the market in 2024?The bisphosphonates segment dominated the market in 2024.

-

6. What segments are covered in the France postmenopausal osteoporosis treatment market report?The France postmenopausal osteoporosis treatment market is segmented on the basis of treatment, drug class, and distribution channel.

-

7. Who are the key players in the France postmenopausal osteoporosis treatment market?Key companies include Amgen Inc., Eli Lilly and Company, Novartis AG, Pfizer Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc (GSK), Roche Holding AG, Theramex, Besins Healthcare, Sanofi S.A., Johnson & Johnson, and others.

-

8. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?