France Portable Medical Devices Market Size, Share, By Product (Cutting and Dissecting Instruments, Tissue Handling and Manipulation Instruments, Access and Insertion Instruments, and Others), By End Use (Hospitals and Outpatient Facilities), and France Neurosurgical Instruments Market Insights, Industry Trend, Forecasts to 2035

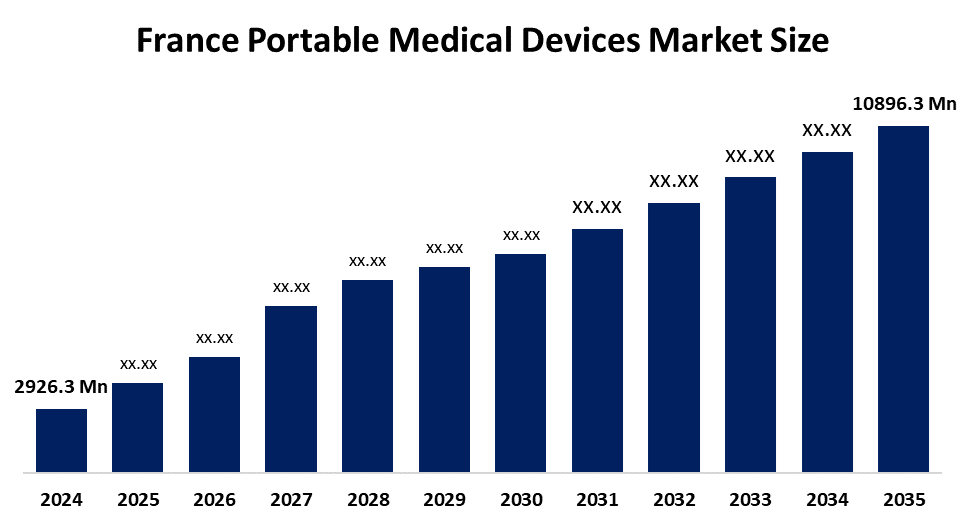

Industry: Healthcare- France Portable Medical Devices Market Size 2024: USD 2926.3 Mn

- France Portable Medical Devices Market Size 2035: USD 10896.3 Mn

- France Portable Medical Devices Market CAGR 2024: 12.7%

- France Portable Medical Devices Market Segments: Product and Application.

Get more details on this report -

France Portable Medical Devices Market Size refers to the market for compact, lightweight, and simple medical devices that can be used in various settings such as hospitals, clinics, home healthcare, and emergencies. Such devices facilitate the monitoring, diagnosing, and treating of patients in real-time, thus enhancing mobility, remote care, and the overall healthcare system's efficiency in France. The market continues to expand due to factors such as the growing incidence of chronic diseases, rising need for remote patient monitoring and home healthcare, innovations in portable diagnostics, and increasing attention to patient-centric care and healthcare efficiency in France.

The portable medical devices market in France is becoming more significant as a result of the increasing prevalence of chronic diseases and an aging population that requires continuous monitoring and care outside traditional healthcare facilities. The adoption of remote patient monitoring, wearable sensors, and telehealth technologies is a direct consequence of the rising need to manage such conditions as cardiovascular disease, diabetes, and respiratory illnesses in a way that is both efficient and convenient. The French healthcare system is going digital and has put in place various initiatives to speed up telehealth, remote monitoring, and connected medical devices as a means of care coordination and patient outcomes improvement.

The next opportunities in the market are largely the result of the continuous government support and funding for digital health innovation. The France 2030 Health Innovation Plan is one such example where a significant portion of the investment is allocated to digital healthcare technologies and research programs, such as PEPR Santé Numérique, with a 60 million budget to support disruptive health tech solutions. The various programs aimed at promoting telemedicine reimbursement, the remote monitoring pilots like ETAPES, and the national digital health infrastructure expansion are some of the measures that facilitate the adoption of portable medical devices in clinical practice and home care all over France.

France Portable Medical Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2926.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.7% |

| 2035 Value Projection: | USD 10896.3 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Medtronic plc, Philips Healthcare, GE HealthCare Technologies Inc., Siemens Healthineers AG, Abbott Laboratories, Boston Scientific Corporation, ResMed Inc., Omron Healthcare Co., Ltd., Withings (a Nokia Health brand), Dexcom, Inc.,and others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the France Portable Medical Devices Market:

France portable medical devices market is largely influenced by the increase in the number of chronic diseases, a growing elderly population that is in need of continuous monitoring, and a rising demand for home-based and remote patient care. Innovations in wireless connectivity, wearables, and miniaturized diagnostics are some of the factors that constitute the technological advancements. Besides that, the government being supportive of digital health and telemedicine adoption also helps to speed up the market growth throughout France.

The France market for portable medical devices is restrained by the high device and maintenance costs, issues of data privacy and cybersecurity, as well as strict requirements for regulatory approval. Besides, there is a restriction in the reimbursement of some remote monitoring devices, difficulties in integration with existing healthcare IT systems, and user training requirements. All these factors prevent the widespread adoption of such devices.

The France portable medical devices market has strong future opportunities as demand grows for wearable sensors, connected monitoring systems, and telehealth-enabled devices that support remote care and chronic disease management. Integration of AI, advanced analytics, and interoperability with electronic health records will enhance clinical insights and workflow efficiency. Continued government initiatives for digital health innovation and reimbursement support for remote monitoring services will further accelerate adoption and market expansion.

Market Segmentation

The France Portable Medical Devices Market share is classified into product and application.

By Product:

The France portable medical devices market is divided by product into smart wearable medical devices, diagnostic imaging, therapeutics, monitoring devices, and others. Among these, the monitoring devices segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The monitoring devices segment dominates because of the high demand for continuous patient monitoring in chronic disease management, widespread adoption of home-based and remote patient monitoring solutions, and strong integration of connected vital-sign devices in hospitals and home care settings across France.

By Application:

The France portable medical devices market is divided by application into gynecology, cardiology, gastrointestinal, urology, neurology, respiratory, orthopedics, and others. Among these, the cardiology segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The cardiology segment’s dominance is due to the high prevalence of cardiovascular diseases, strong demand for continuous heart monitoring devices such as portable ECGs and wearable monitors, and increased adoption of remote cardiac care and early diagnosis solutions across hospitals and home care settings in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France portable medical devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Portable Medical Devices Market:

- Medtronic plc

- Philips Healthcare

- GE HealthCare Technologies Inc.

- Siemens Healthineers AG

- Abbott Laboratories

- Boston Scientific Corporation

- ResMed Inc.

- Omron Healthcare Co., Ltd.

- Withings (a Nokia Health brand)

- Dexcom, Inc.

- Others

Recent Developments in France Portable Medical Devices Market:

- In October 2025, Withings, a French health tech company, expanded its portfolio with advanced smart health trackers and connected devices, supported by investments focused on innovation and international expansion.

- In December 2025, MicroPort CRM launched the SmartView Connect Mobile App in Europe, including France, enabling remote monitoring of patients with compatible cardiac devices through Bluetooth-enabled smartphones, improving connected cardiac care and patient engagement.

- In March 2024, RDS secured CE mark for its MultiSense remote patient monitoring wearable patch, a continuous monitoring solution designed for real-time physiological tracking in hospital and home settings, marking an important regulatory milestone before broader commercialization

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical insights has segmented the France Portable Medical Devices market based on the below-mentioned segments:

France Portable Medical Devices Market, By Product

- Smart Wearable Medical Devices

- Diagnostic Imaging

- Therapeutics

- Monitoring Devices

- Others

France Portable Medical Devices Market, By Application

- Gynecology

- Cardiology

- Gastrointestinal

- Urology

- Neurology

- Respiratory

- Orthopedics

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France portable medical devices market size in 2024?The France portable medical devices market size was estimated at USD 2926.3 million in 2024.

-

2. What is the projected market size of the France portable medical devices market by 2035?The France portable medical devices market size is expected to reach USD 10896.3 million by 2035.

-

3. What is the CAGR of the France portable medical devices market?The France portable medical devices market size is expected to grow at a CAGR of around 12.7% from 2024 to 2035.

-

4. What are the key growth drivers of the France portable medical devices market?Increase in the number of chronic diseases, a growing elderly population, and a rising demand for home-based and remote patient care. Innovations in wireless connectivity, wearables, and technological advancements.

-

5. Which product segment dominated the market in 2024?The monitoring devices segment dominated the market in 2024.

-

6. What segments are covered in the France portable medical devices market report?The France portable medical devices market is segmented on the basis of product and application.

Need help to buy this report?