France Pediatric Orthopedic Devices Market Size, Share, By Product (Joint Replacement/Orthopedic Implants, Trauma, Sports Medicine, Spine, and Others), By End Use (Hospitals and Outpatient Facilities), and France Pediatric Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Pediatric Orthopedic Devices Market Size Insights Forecasts to 2035

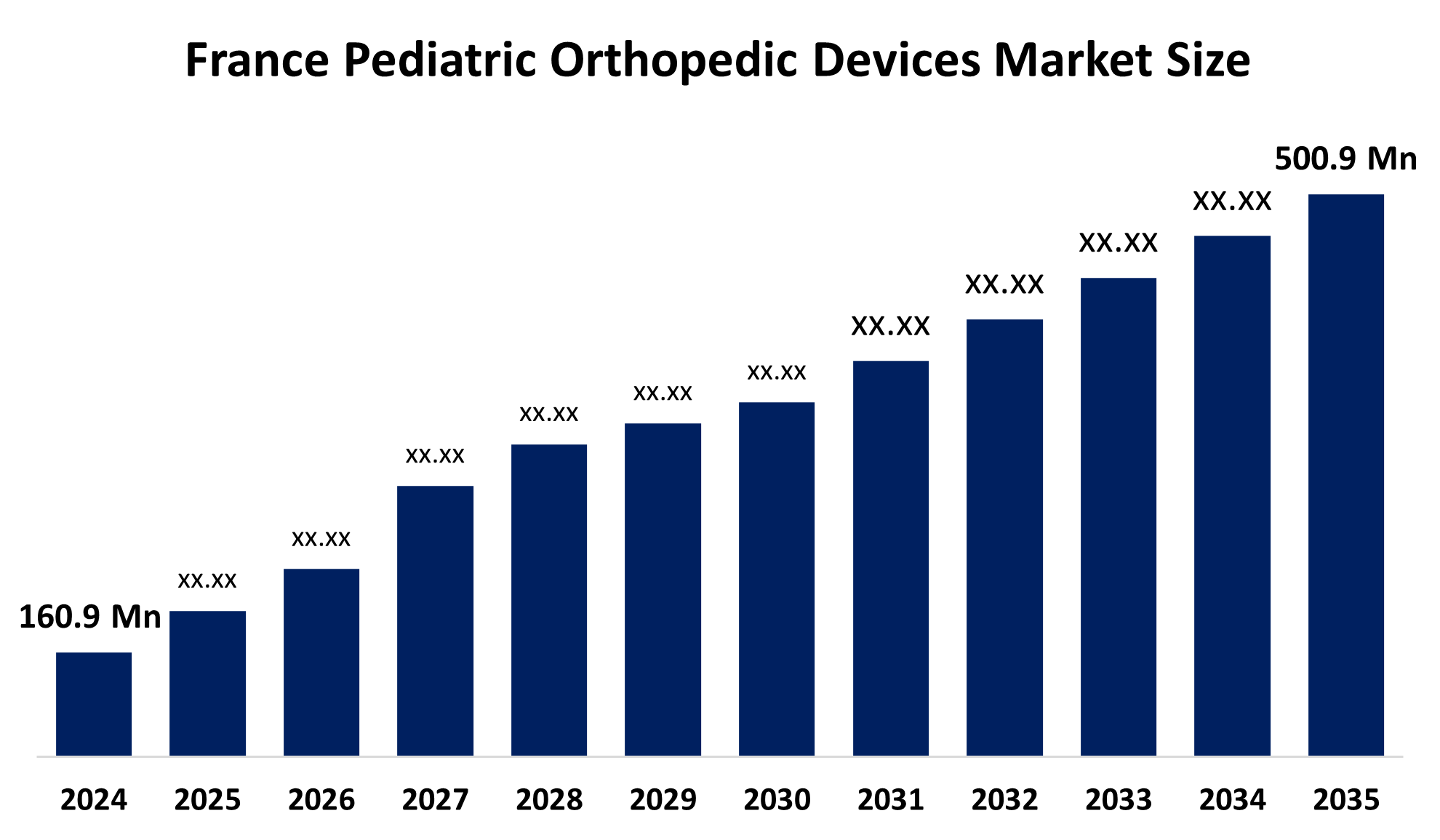

- France Pediatric Orthopedic Devices Market Size 2024: USD 160.9 Mn

- France Pediatric Orthopedic Devices Market Size 2035: USD 500.9 Mn

- France Pediatric Orthopedic Devices Market CAGR 2024: 10.88%

- France Pediatric Orthopedic Devices Market Segments: Product and End Use

Get more details on this report -

The France Pediatric Orthopedic Devices Market Size describes the portion of the medical devices industry that concentrates on the creation, production, and use of orthopedic implants, braces, and supportive equipment that are specially made for diagnosing, treating, and managing musculoskeletal disorders and injuries in children. This market covers the devices utilized for congenital deformities, growth, related conditions, trauma, and pediatric bone disorders, which are the main factors behind the healthy skeletal development and mobility of the pediatric population in France.

France presents favorable conditions for the adoption of pediatric orthopedic devices, mainly due to the health needs of its pediatric population. Children aged 0-14 years make up almost 18% of the population of France, and a large number of them suffer from congenital musculoskeletal disorders, such as scoliosis, clubfoot, and limb deformities. Research has shown that idiopathic scoliosis affects about 23% of children, and pediatric trauma cases resulting from sports and accidental falls are still prevalent. Moreover, the increased survival rates of premature infants and children with neuromuscular disorders contribute to the rise of long-term orthopedic care needs. These factors unquestionably emphasize the escalating demand and significance of pediatric orthopedic devices in France to ensure healthy growth, mobility, and early intervention.

The France Pediatric Orthopedic Devices Market Size is anticipated to expand gradually in light of congenital musculoskeletal disorder cases, pediatric trauma, and growth-related orthopedic conditions like scoliosis and hip dysplasia. The increased adoption of minimally invasive surgeries, growth-friendly implants, and customized orthopedic solutions accentuates the upcoming demand for advanced pediatric-specific devices. France's robust healthcare infrastructure, universal reimbursement system, and the growing number of pediatric specialty centers boost the market uptake. Recent scenarios indicate a higher consumption of orthopedic devices in hospitals due to sports injuries and accidental falls among children.

Furthermore, government backing through the France 2030 plan, which provides around USD 450 million for innovative medical devices and MedTech research, is an indirect advantage for pediatric orthopedic device development by offering funds for R&D, clinical studies, and innovation, thus paving the way for long-term market growth opportunities.

Market Dynamics of the France Pediatric Orthopedic Devices Market:

The France Pediatric Orthopedic Devices Market Size is largely driven by the increasing occurrence of congenital conditions such as scoliosis and clubfoot, as well as the rise in pediatric trauma due to sports and falls. The trend of using growth-friendly and minimally invasive orthopedic devices helps to achieve better results. The availability of well-developed healthcare services and universal reimbursement contributes to easy access to these products. In addition, the market demand is also elevated by the increasing awareness of early diagnosis.

The market for pediatric orthopedic devices in France is restrained by the exorbitant prices of specialized pediatric implants and surgeries, which may constrain hospital budgets. The imposition of stringent regulatory and clinical approval requirements significantly prolongs the time taken for product launches and stifles innovation. Furthermore, a shortage of pediatric orthopedic specialists and a tendency to opt for non-surgical treatment in cases of mild symptoms also act as barriers to the expansion of the market.

The France Pediatric Orthopedic Devices Market Size offers future opportunities through the development of growth-friendly and customizable implants that are tailored to children's anatomy. Minimally invasive surgeries, 3D printing, and smart orthotic devices are expected to significantly improve patient outcomes. The government support for MedTech innovation will be instrumental in fostering research and market expansion in the sector.

France Pediatric Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 160.9 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.88% |

| 2035 Value Projection: | USD 500.9 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | OrthoPediatrics Corp., Stryker Corporation, Zimmer Biomet Holdings, Inc., Johnson & Johnson (DePuy Synthes), Smith & Nephew plc, Arthrex, Inc., Medtronic plc, NuVasive, Inc., WishBone Medical, Pega Medical, Orthofix Medical Inc., and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The France Pediatric Orthopedic Devices Market share is classified into product and end use.

By Product:

The France Pediatric Orthopedic Devices Market Size is divided by product into joint replacement/orthopedic implants, trauma, sports medicine, spine, and others. Among these, the trauma segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The trauma segment dominates because of the high incidence of fractures and injuries caused by sports activities, accidental falls, and road accidents among children. Increased participation in physical and recreational activities and the need for rapid fracture fixation using pediatric-specific implants further drive the strong demand for trauma devices.

By End Use:

The France Pediatric Orthopedic Devices Market Size is divided by end use into hospitals and outpatient facilities. Among these, the hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospital’s segmental growth is due to the high volume of pediatric trauma and complex orthopedic surgeries performed in hospital settings. Hospitals are equipped with advanced surgical infrastructure, specialized pediatric orthopedic surgeons, and access to reimbursement support, driving higher adoption and continued growth of pediatric orthopedic devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France Pediatric Orthopedic Devices Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Pediatric Orthopedic Devices Market:

- OrthoPediatrics Corp.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Johnson & Johnson (DePuy Synthes)

- Smith & Nephew plc

- Arthrex, Inc.

- Medtronic plc

- NuVasive, Inc.

- WishBone Medical

- Pega Medical

- Orthofix Medical Inc.

- Others

Recent Developments in France Pediatric Orthopedic Devices Market:

- In August 2025, OrthoPediatrics Corp. launched its new 3P Pediatric Plating Platform Hip System, designed to improve fixation precision for pediatric femur fractures and deformities, marking a significant innovation that can benefit trauma care in the France Pediatric Orthopedic Devices Market Size.

- In November 2025, OrthoPediatrics expanded its Specialty Bracing portfolio with the PediHip Rigid Brace and PediHip Modular Abduction System for treating developmental hip dysplasia in young children, enhancing solutions available in the France Pediatric Orthopedic Devices Market Size.

- In April 2025, OrthoPediatrics announced that C-Pro Direct joined its OP Specialty Bracing portfolio, adding the ADM modular orthosis for clubfoot treatment and strengthening access to advanced pediatric bracing solutions within the France Pediatric Orthopedic Devices Market Size.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Pediatric Orthopedic Devices Market Size based on the below-mentioned segments:

France Pediatric Orthopedic Devices Market, By Product

- Joint Replacement/Orthopedic Implants

- Trauma

- Sports Medicine

- Spine

- Others

France Pediatric Orthopedic Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Frequently Asked Questions (FAQ)

-

1.What is the France pediatric orthopedic devices market size in 2024?The France pediatric orthopedic devices market size was estimated at USD 160.9 million in 2024.

-

2.What is the projected market size of the France pediatric orthopedic devices market by 2035?The France pediatric orthopedic devices market size is expected to reach USD 500.9 million by 2035.

-

3.What is the CAGR of the France pediatric orthopedic devices market?The France pediatric orthopedic devices market size is expected to grow at a CAGR of around 10.88% from 2024 to 2035.

-

4.What are the key growth drivers of the France pediatric orthopedic devices market?The increasing occurrence of congenital conditions such as scoliosis and clubfoot. The trend of using growth-friendly and minimally invasive orthopedic devices. The availability of well-developed healthcare and increasing awareness of early diagnosis.

-

5.Which product segment dominated the market in 2024?The trauma segment dominated the market in 2024.

-

6.What segments are covered in the France pediatric orthopedic devices market report?The France pediatric orthopedic devices market is segmented on the basis of product and end use.

Need help to buy this report?