France Ocular Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Intraocular Lens, Corneal Implants, Orbital Implants, Glaucoma implants, Ocular Prosthesis, and Others), By Application (Glaucoma Surgery, Oculoplasty, Drug Delivery, Age-Related Macular Degeneration, Aesthetic Purpose, and Others), By End Use (Hospitals, Specialty Eye Institutes, Clinics, and Others), and France Ocular Implants Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Ocular Implants Market Size Insights Forecasts to 2035

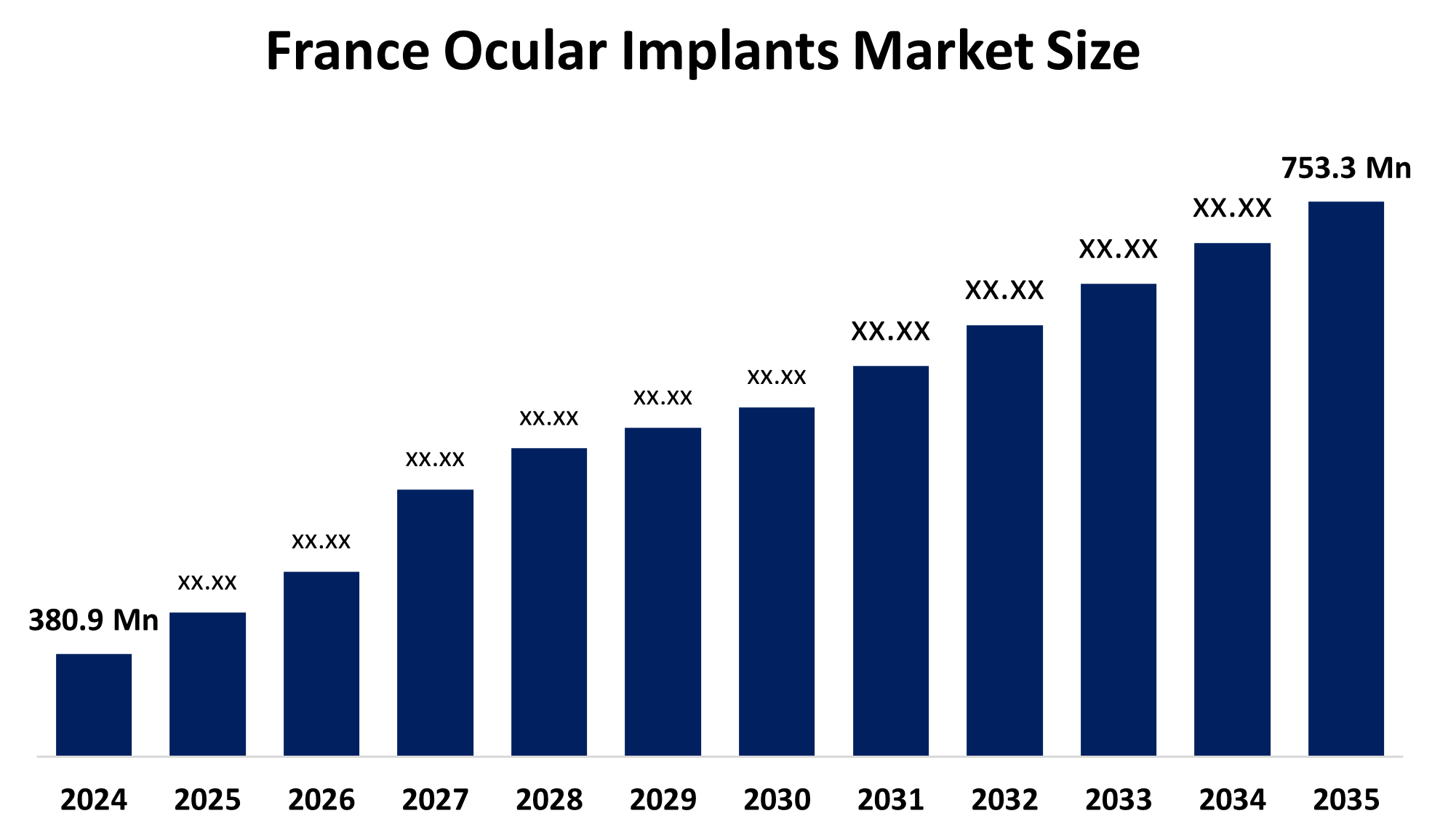

- The France Ocular Implants Market Size Was Estimated at USD 380.9 Million in 2024.

- The France Ocular Implants Market Size is Expected to Grow at a CAGR of Around 6.4% from 2025 to 2035.

- The France Ocular Implants Market Size is Expected to Reach USD 753.3 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Ocular Implants Market Size is Anticipated to Reach USD 753.3 Million by 2035, Growing at a CAGR of 6.4% from 2025 to 2035. The France ocular implants market is driven by the rising prevalence of vision-impairing conditions such as cataracts and glaucoma, an aging population, increased awareness and screening programs, advancements in ocular implant technologies such as premium IOLs and advanced surgical techniques, and improving healthcare infrastructure and reimbursement policies that support greater access to vision-restoring procedures.

Market Overview

The France Ocular Implants Market Size is a healthcare industry that is primarily focused on the creation, production, and clinical usage of the devices that serve as eye implants or help the eye’s natural structures to restore lost sight or to make the vision better. This comprises intraocular lenses (IOLs), which are the most common ones to be placed after cataract surgery, corneal implants for keratoconus and presbyopia, glaucoma implants for the management of the increased intraocular pressure, and retinal implants in the case of retinal disorders like retinitis pigmentosa. The market in France is driven by the elderly population, a growing number of diseases leading to the loss of vision, technological advancements in ocular implants, increasing awareness and screening activities, and better healthcare facilities, all of which are instrumental in facilitating access to vision-restoring surgeries.

The France Ocular Implants Market Size is mainly influenced by the high number of eye-related diseases in the population. There are about 1.7 million consumers in France with a visual impairment of moderate to severe vision loss or even blindness. The most common cause of vision loss, which is cataracts, affects approximately 1.5 million individuals, thus leading to the frequent requirement of intraocular lens (IOL) implants in the surgical treatment. About 8% of the population is affected by age-related macular degeneration (AMD). Besides, nearly 1.2 million people receive treatment for high intraocular pressure, which is the major risk factor for glaucoma. In its advanced stages, glaucoma may require the implantation of devices for its treatment. An aging population combined with a high prevalence of vision-impairing conditions and a well-established surgical infrastructure are some of the factors that highlight the need for ocular implants and their growing importance in France.

Report Coverage

This research report categorizes the France Ocular Implants Market Size based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France Ocular Implants Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France ocular implants market.

France Ocular Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 380.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.4% |

| 2035 Value Projection: | USD 753.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Alcon Inc., Johnson & Johnson Vision (AMO), Carl Zeiss Meditec AG, Bausch & Lomb, STAAR Surgical Company, Hoya Surgical Optics, Ophtec BV, HumanOptics AG, IOLTECH SA, Medicontur Medical Engineering, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The France Ocular Implants Market Size is primarily driven by the increasing number of elderly people and the growing prevalence of vision disorders such as cataracts and glaucoma. The expansion of the market is also enabled by innovations in technology for intraocular and retinal implants, awareness and screening programs, healthcare infrastructure improvement, and attractive reimbursement policies that, in combination, facilitate access to the procedures that restore vision.

Restraining Factors

The France Ocular Implants Market Size is influenced by some restraining factors such as the expensive advanced ocular implants and surgical procedures, the risk of post-surgical complications like infections or implant rejection, and the limited adoption of premium implants caused by affordability issues. Besides that, unawareness of certain patient segments and dependence on skilled ophthalmic surgeons can also hinder the market expansion.

Market Segmentation

The France Ocular Implants Market Size, share is categorized by product, application, and end use.

- The glaucoma implants segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Ocular Implants Market Size is segmented by product into intraocular lens, corneal implants, orbital implants, glaucoma implants, ocular prosthesis, and others. Among these, the glaucoma implants segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The glaucoma implants segment's growth is due to the increasing prevalence of glaucoma and related vision impairments in France, the rising adoption of minimally invasive glaucoma surgeries (MIGS), and the growing preference for advanced intraocular pressure–lowering devices. Additionally, technological advancements in implant design, increased awareness about early diagnosis and treatment, and improved access to ophthalmic healthcare facilities further drive the demand for glaucoma implants.

- The glaucoma surgery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France Ocular Implants Market Size is segmented by application into glaucoma surgery, oculoplasty, drug delivery, age-related macular degeneration, aesthetic purpose, and others. Among these, the glaucoma surgery segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The glaucoma surgery segmental growth is driven by the rising prevalence of glaucoma in France, increasing adoption of minimally invasive glaucoma surgery (MIGS) procedures, and the growing demand for advanced intraocular pressure–reducing implants. Additionally, technological innovations in glaucoma implants, greater awareness about early diagnosis and treatment, and improved access to specialized ophthalmic care further support the segment’s expansion.

- The hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Ocular Implants Market Size is segmented by end use into hospitals, specialty eye institutes, clinics, and others. Among these, the hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospitals segment's growth is due to the high patient inflow for ophthalmic procedures, the availability of advanced surgical infrastructure and specialized ophthalmology departments, and the ability to perform complex ocular implant surgeries. Additionally, hospitals often serve as referral centers for advanced glaucoma, cataract, and retinal treatments, driving the demand for ocular implants in clinical settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France Ocular Implants Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alcon Inc.

- Johnson & Johnson Vision (AMO)

- Carl Zeiss Meditec AG

- Bausch & Lomb

- STAAR Surgical Company

- Hoya Surgical Optics

- Ophtec BV

- HumanOptics AG

- IOLTECH SA

- Medicontur Medical Engineering

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2025, Alcon announced that its Clareon Vivity intraocular lens (IOL) received the CE mark approval and began commercial rollout in Europe, including France, offering an extended range of vision and presbyopia correction with advanced Clareon lens material.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Ocular Implants Market Size based on the below-mentioned segments:

France Ocular Implants Market, By Product

- Intraocular Lens

- Corneal Implants

- Orbital Implants

- Glaucoma implants

- Ocular Prosthesis

- Others

France Ocular Implants Market, By Application

- Glaucoma Surgery

- Oculoplasty

- Drug Delivery

- Age-Related Macular Degeneration

- Aesthetic Purpose

- Others

France Ocular Implants Market, By End Use

- Hospitals

- Specialty Eye Institutes

- Clinics

- Others

Frequently Asked Questions (FAQ)

-

1.What is the France ocular implants market size in 2024?The France ocular implants market size was estimated at USD 380.9 million in 2024.

-

2.What is the projected market size of the France ocular implants market by 2035?The France Ocular Implants market size is expected to reach USD 753.3 million by 2035.

-

3.What is the CAGR of the France ocular implants market?The France ocular implants market size is expected to grow at a CAGR of around 6.4% from 2024 to 2035.

-

4.What are the key growth drivers of the France ocular implants market?Rising prevalence of vision‑impairing conditions such as cataracts and glaucoma, an aging population, increased awareness and screening programs, advancements in ocular implant technologies such as premium IOLs, and advanced surgical techniques.

-

5.Which application segment dominated the market in 2024?The glaucoma surgery segment dominated the market in 2024.

-

6.Which product segment accounted for the largest market share in 2024?The glaucoma implants segment accounted for the largest market share in 2024.

-

7.What segments are covered in the France ocular implants market report?The France ocular implants market is segmented on the basis of product, application, and end use.

Need help to buy this report?