France Nebulizers Market Size, Share, and COVID-19 Impact Analysis, By Type (Jet, Mesh, Ultrasonic, and Others), By End Use (Hospitals & Clinics, Emergency Centers, Home Healthcare, and Others), and France Nebulizers Market Size Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Nebulizers Market Insights Forecasts to 2035

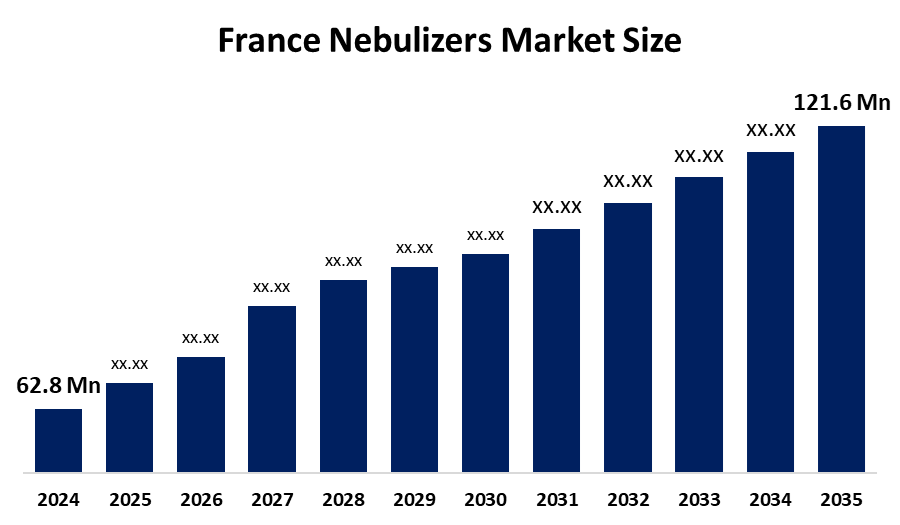

- The France Nebulizers Market Size Was Estimated at USD 62.8 Million in 2024.

- The France Nebulizers Market Size is Expected to Grow at a CAGR of Around 6.2% from 2025 to 2035.

- The France Nebulizers Market Size is Expected to Reach USD 121.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Nebulizers Market Size is Anticipated to Reach USD 121.6 Million by 2035, Growing at a CAGR of 6.2% from 2025 to 2035. The market is driven by France’s well-established healthcare system, favorable reimbursement policies, the increasing prevalence of respiratory diseases such as asthma and COPD, a growing elderly population, and the rising adoption of technologically advanced and portable nebulizers.

Market Overview

The France Nebulizers Market Size focuses on the supply of medical devices used to deliver medication in aerosol form for respiratory treatments across hospitals, clinics, and homecare settings in France. The market includes various types of nebulizers, such as jet, ultrasonic, and mesh nebulizers, which are primarily used to treat respiratory conditions including asthma, COPD, and other pulmonary disorders.

The health conditions in France have made nebulizers an essential device in the country’s medical market. More than 8 million people in France suffer from respiratory diseases, including asthma, COPD, and chronic lung infections. Asthma affects approximately 6–7% of the population, accounting for over 4 million patients, while COPD impacts about 3–3.5 million people, particularly the elderly. Overall, more than 10% of the French population lives with some form of chronic respiratory condition, primarily due to aging, smoking, and air pollution. This substantial disease burden has led to sustained demand for inhalation therapies, making nebulizers indispensable in both hospital settings and home-care management of respiratory disorders across France.

The French government’s support for the nebulizer market stems from national healthcare and research initiatives aimed at improving respiratory health and advancing medical innovation. Through programs such as France 2030 and Innovation Santé 2030, the government provides substantial funding for healthcare research, medical device development, and the industrialization of advanced health technologies. This support indirectly promotes innovation and production within the nebulizer market.

In addition, public health authorities place strong emphasis on the prevention, diagnosis, and management of respiratory diseases such as asthma and COPD, leading to more effective inhalation therapies. Government funding for biomedical research, university hospitals, and well-equipped respiratory research centers further facilitates the development and validation of advanced respiratory devices, including nebulizers, across France.

Report Coverage

This research report categorizes the France Nebulizers Market Size based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France nebulizers market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France nebulizers market.

France Nebulizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 62.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.2% |

| 2035 Value Projection: | 121.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | PARI GmbH, Omron, Drive DeVilbiss Healthcare, Philips Respironics, Yuwell, Leyi, Folee, Medel S.p.A, Briggs Healthcare, 3A Health Care, PARI GmbH, GF Health Products, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Nebulizers Market Size is driven by the rising prevalence of chronic respiratory diseases such as asthma and COPD, largely due to an aging population and increased exposure to air pollution and smoking-related conditions. France’s robust healthcare infrastructure, near-universal health insurance coverage, and favorable reimbursement policies support the widespread use of nebulizers in both hospital and home-care settings. Additionally, technological advancements—particularly in portable and mesh nebulizers along with government support for healthcare innovation and respiratory research, are further contributing to market growth.

The France Nebulizers Market Size faces challenges from the growing preference for alternative inhalation devices, including metered-dose inhalers and dry powder inhalers, which many patients consider more portable and convenient. Moreover, the high cost of advanced nebulizers and their accessories, along with ongoing maintenance and cleaning expenses, may hinder adoption, especially within the home-care sector.

Market Segmentation

The France Nebulizers Market Size share is categorized by type and end use.

- The jet segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Nebulizers Market Size is segmented by type into jet, mesh, ultrasonic, and others. Among these, the jet segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The jet segment's growth is due to its proven reliability and cost-effectiveness. It is widely used in hospitals and home-care settings across all age groups. Its compatibility with various respiratory medications further supports its strong adoption and market growth.

- The hospitals & clinics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France Nebulizers Market Size is segmented by end use into hospitals & clinics, emergency centers, home healthcare, and others. Among these, the hospitals & clinics segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hospitals’ & clinics’ segmental growth is driven by the high prevalence of respiratory diseases and the need for supervised medication administration. Widespread availability of advanced nebulizer devices and established treatment protocols further drive its adoption. This makes hospitals and clinics the primary end users in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France nebulizers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PARI GmbH

- Omron

- Drive DeVilbiss Healthcare

- Philips Respironics

- Yuwell

- Leyi

- Folee

- Medel S.p.A

- Briggs Healthcare

- 3A Health Care

- PARI GmbH

- GF Health Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Medline today announced the latest addition to its respiratory care portfolio, the Hudson RCI TurboMist small volume nebulizer. Delivering medication treatments in as quickly as three minutes, TurboMist is designed to be the fastest small-volume nebulizer on the market.

- In April 2023, Berry showcases advanced inhalation devices in France, highlighting innovations in dry powder and pressurized inhalers with built-in sensors. Sustainable, user-friendly designs aim to improve patient adherence, safety, and environmental impact, reinforcing leadership in respiratory drug delivery.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Nebulizers Market based on the below-mentioned segments:

France Nebulizers Market, By Type

- Jet

- Mesh

- Ultrasonic

- Others

France Nebulizers Market, By End Use

- Hospitals & clinics

- Emergency Centers

- Home Healthcare

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France nebulizers market size in 2024?The France nebulizer market size was estimated at USD 62.8 million in 2024.

-

2. What is the projected market size of the France nebulizers market by 2035?The France nebulizers market size is expected to reach USD 121.6 million by 2035.

-

3. What is the CAGR of the France nebulizers market?The France nebulizers market size is expected to grow at a CAGR of around 6.2% from 2024 to 2035.

-

4. What are the key growth drivers of the France nebulizers market?Increasing incidences of respiratory diseases like asthma and COPD, an elderly population, and the mounting use of technologically advanced and portable nebulizers.

-

5. Which end-use segment dominated the market in 2024?The hospitals & clinics segment dominated the market in 2024.

-

6. Which type of segment accounted for the largest market share in 2024?The jet segment accounted for the largest market share in 2024.

-

7. What segments are covered in the France nebulizers market report?The France nebulizers market is segmented on the basis of type and end-use.

Need help to buy this report?