France Intraoral Cameras Market Size, Share, and COVID-19 Impact Analysis, By Product (Intraoral Wand and Single-Lens Reflex), By Technology (USB Camera, Fiber Optic Camera, Wireless Cameras, and Others), By End Use (Hospital and Dental Clinic), and France Intraoral Cameras Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Intraoral Cameras Market Insights Forecasts to 2035

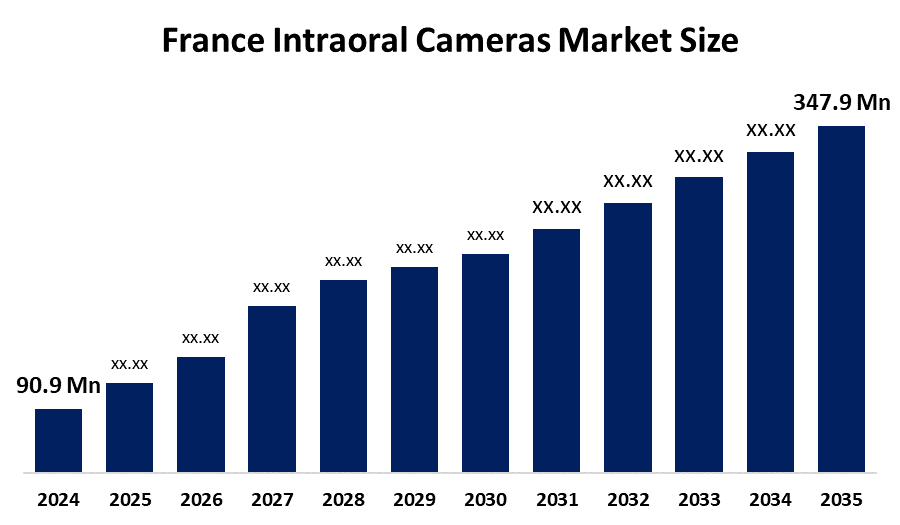

- The France Intraoral Cameras Market Size Was Estimated at USD 90.9 Million in 2024.

- The Market Is Expected To Grow At a CAGR of Around 12.98% From 2025 to 2035.

- The France Ntraoral Cameras Market Size Is Projected To Reach USD 347.9 Million by 2035.

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The France Intraoral Cameras Market Size Is Anticipated To Reach USD 347.9 Million By 2035, Growing At a CAGR of 12.98% From 2025 To 2035. Market growth is driven by the increasing adoption of digital dental technologies, rising awareness of oral health, and the expansion of dental clinics. Technological advancements such as high-resolution imaging, wireless connectivity, and integration with digital dental workflows are further boosting market demand.

Market Overview

The France Intraoral Cameras Market Size includes medical imaging instruments used by dental professionals to capture detailed images of the oral cavity. These cameras assist in diagnosing dental conditions, treatment planning, and patient education by providing high-resolution visualizations of teeth, gums, and other oral structures. The market covers both wired and wireless handheld intraoral cameras, along with systems integrated into digital dental workflows. Market expansion is driven by continuous imaging innovations, growing dental awareness, and the increasing adoption of preventive and minimally invasive dentistry practices in France.

The France Intraoral Cameras Market Size is supported by the country’s significant oral health burden and rising dental care demand. Nearly 99% of adults aged 35–44 in France have experienced dental caries, while over 30% of adults suffer from untreated oral conditions, highlighting the need for accurate diagnostic tools. Around half of the adult population is affected by periodontal disease, with oral health issues worsening with age, particularly among the growing elderly population. In addition, millions of dental consultations are recorded annually in France, driven by preventive care, restorative treatments, and cosmetic dentistry. These factors emphasize the importance of advanced diagnostic solutions such as intraoral cameras for early detection, effective treatment planning, and improved patient communication across dental clinics and hospitals.

Report Coverage

This Research Report Categorizes the France Intraoral Cameras Market Size based on product, technology, and end use, forecasting revenue growth and analyzing trends across each segment. The report examines key growth drivers, opportunities, and challenges influencing the market. It also includes recent market developments and competitive strategies such as expansions, product launches, partnerships, mergers, and acquisitions. Key market players are profiled, and their core competencies across different segments are analyzed to present a clear competitive landscape.

France Intraoral Cameras Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 347.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.98% |

| 2035 Value Projection: | USD 347.9 Million By 2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Technology |

| Companies covered:: | Dentsply Sirona, Carestream Dental, Acteon Group, Owandy Radiology, Planmeca Oy, KaVo Kerr (Danaher), Durr Dental, Envista Holdings (DEXIS), SOTA Imaging, Schick Technologies, and Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Intraoral Cameras Market Size is driven by the widespread adoption of digital dentistry, increasing oral health awareness, and the growing number of dental clinics. Innovations including high-resolution imaging, wireless camera systems, and integration with dental software support early diagnosis, minimally invasive treatments, and enhanced patient education.

Restraining Factors

Market Growth is restrained by the high cost of advanced intraoral camera systems, which may limit adoption among smaller dental practices. Additionally, maintenance and calibration requirements, along with the need for trained professionals to operate and interpret imaging systems, present operational challenges.

Market Segmentation

The France intraoral cameras market share is categorized by product, technology, and end use.

- The intraoral wand segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France intraoral cameras market is segmented by product into intraoral wand and single-lens reflex. Among these, the intraoral wand segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The intraoral wand segment's growth is due to its compact and ergonomic design, which allows dentists to easily capture high-resolution images of the oral cavity. Its ability to integrate with digital dental software, provide real-time imaging, and support minimally invasive diagnostics makes it highly preferred over single-lens reflex cameras. Additionally, the increasing adoption of intraoral wands in private clinics and hospitals for enhanced patient care and treatment planning further drives the segment’s market growth.

- The wireless cameras segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France intraoral cameras market is segmented by technology into USB cameras, fiber optic cameras, wireless cameras, and others. Among these, the wireless cameras segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The wireless cameras segmental growth is driven by their portability, ease of use, and ability to provide high-resolution images without cumbersome cables, which enhances workflow efficiency in dental practices. Additionally, their seamless integration with digital dental software, support for real-time imaging, and growing preference for minimally invasive diagnostics further fuel adoption in hospitals, clinics, and specialty dental centers across France.

- The dental clinic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France intraoral cameras market is segmented by end use into hospital and dental clinic. Among these, the dental clinic segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dental clinic segment's growth is due to the increasing number of private dental practices in France, rising demand for advanced diagnostic tools, and the adoption of digital dentistry solutions to improve patient care. Additionally, dental clinics prefer intraoral cameras for their ease of use, real-time imaging, and ability to enhance patient education, which drives higher adoption compared to hospitals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France intraoral cameras market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dentsply Sirona

- Carestream Dental

- Acteon Group

- Owandy Radiology

- Planmeca Oy

- KaVo Kerr (Danaher)

- Durr Dental

- Envista Holdings (DEXIS)

- SOTA Imaging

- Schick Technologies

- Others

Key Target Audience

- Market players

- Investors

- End users

- Government authorities

- Consulting and research firms

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- June 2024: OMNIVISION launched the OCH2B30 camera module for 3D intraoral dental scanners. The compact CameraCubeChip design and MIPI interface deliver high-quality imaging for benchtop, standalone, and portable scanners.

- November 2022: ACTEON introduced its next-generation C50 intraoral camera at the ADF Congress in Paris, featuring ultra-sharp imaging, advanced autofocus optics, and enhanced diagnostic flexibility.

Market Segments

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Intraoral Cameras Market based on the below-mentioned segments:

France Intraoral Cameras Market, By Product

- Intraoral Wand

- Single-Lens Reflex

France Intraoral Cameras Market, By Technology

- USB Camera

- Fiber Optic Camera

- Wireless Cameras

- Others

France Intraoral Cameras Market, By End Use

- Hospital

- Dental Clinic

Frequently Asked Questions (FAQ)

-

1. What is the France intraoral cameras market size in 2024?The France intraoral cameras market size was estimated at USD 90.9 million in 2024.

-

2. What is the projected market size of the France intraoral cameras market by 2035?The France intraoral cameras market size is expected to reach USD 347.9 million by 2035.

-

3. What is the CAGR of the France intraoral cameras market?The France intraoral cameras market size is expected to grow at a CAGR of around 12.98% from 2024 to 2035.

-

4. What are the key growth drivers of the France intraoral cameras market?Growing adoption of digital dental technologies, rising awareness of oral health, and the expansion of dental clinics. Advances such as high-resolution imaging, wireless connectivity, and integration with digital workflows further boost demand.

-

5. Which technology segment dominated the market in 2024?The wireless cameras segment dominated the market in 2024.

-

6. Which product segment accounted for the largest market share in 2024?The intraoral wand segment accounted for the largest market share in 2024

-

7. What segments are covered in the France intraoral cameras market report?The France intraoral cameras market is segmented on the basis of product, technology, and end use.

-

1. What is the France intraoral cameras market size in 2024?The France intraoral cameras market size was estimated at USD 90.9 million in 2024.

-

2. What is the projected market size of the France intraoral cameras market by 2035?The France intraoral cameras market size is expected to reach USD 347.9 million by 2035.

-

3. What is the CAGR of the France intraoral cameras market?The France intraoral cameras market size is expected to grow at a CAGR of around 12.98% from 2024 to 2035.

-

4. What are the key growth drivers of the France intraoral cameras market?Growing adoption of digital dental technologies, rising awareness of oral health, and the expansion of dental clinics. Advances such as high-resolution imaging, wireless connectivity, and integration with digital workflows further boost demand.

-

5. Which technology segment dominated the market in 2024?The wireless cameras segment dominated the market in 2024.

-

6. Which product segment accounted for the largest market share in 2024?The intraoral wand segment accounted for the largest market share in 2024

-

7. What segments are covered in the France intraoral cameras market report?The France intraoral cameras market is segmented on the basis of product, technology, and end use.

Need help to buy this report?