France Inflammatory Bowel Disease Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Crohn’s Disease and Ulcerative Colitis), By Drug Class (Amino Salicylates, Corticosteroids, TNF Inhibitors, IL Inhibitors, Anti-integrin, JAK Inhibitors, and Others), By Route of Administration (Oral and Injectable), By Distribution Channel (Retail Pharmacies and Hospital Pharmacies), and France Inflammatory Bowel Disease Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Inflammatory Bowel Disease Treatment Market Size Insights Forecasts to 2035

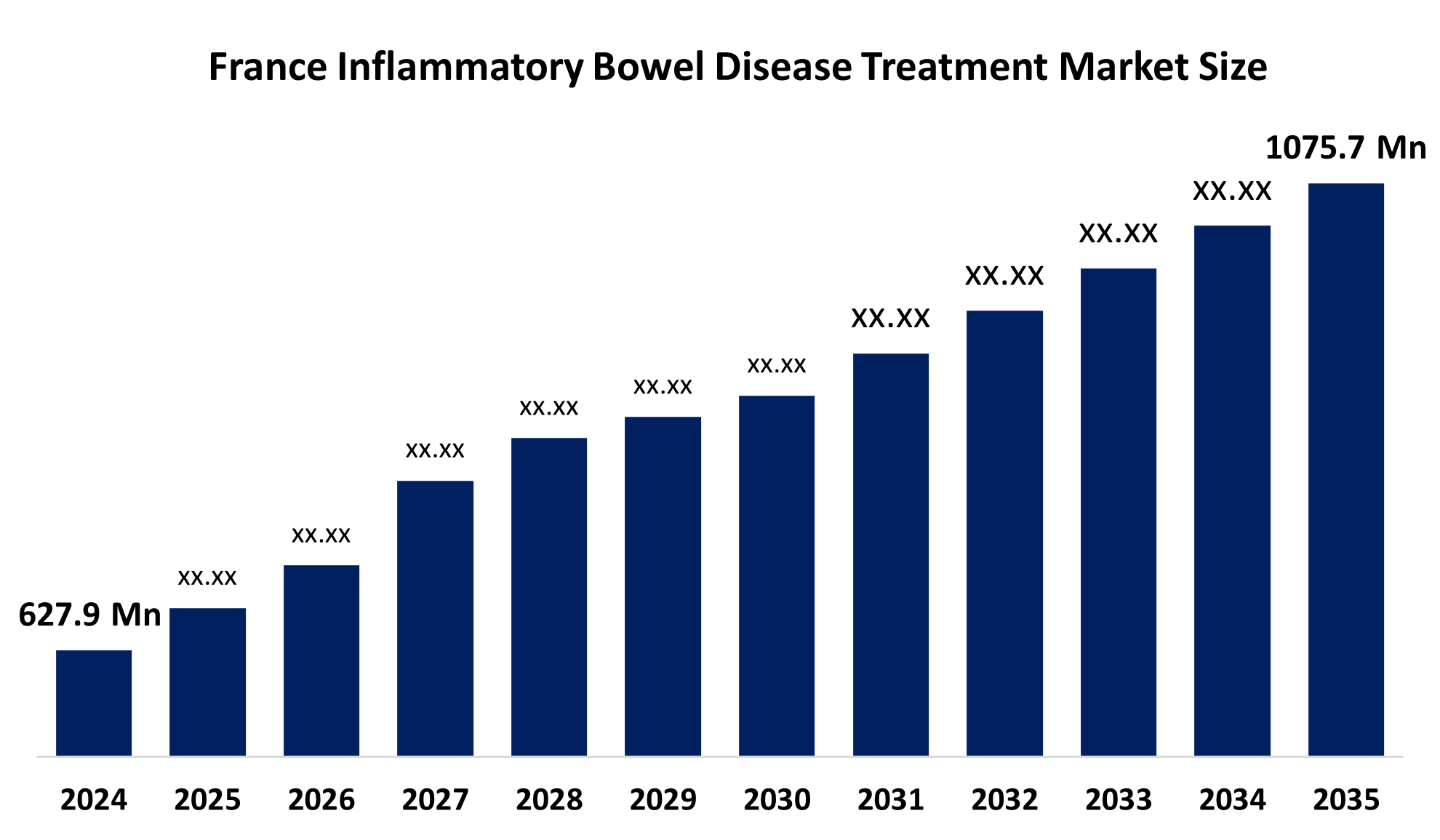

- The France Inflammatory Bowel Disease Treatment Market Size Was Estimated at USD 627.9 Million in 2024

- The France Inflammatory Bowel Disease Treatment Market Size is Expected to Grow at a CAGR of Around 5.02% from 2025 to 2035

- The France Inflammatory Bowel Disease Treatment Market Size is Expected to Reach USD 1075.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Inflammatory Bowel Disease Treatment Market Size is Anticipated to reach USD 1075.7 Million by 2035, Growing at a CAGR of 5.02% from 2025 to 2035. The France inflammatory bowel disease treatment market is driven by the increasing number of people with Crohns disease and ulceration colitis, rising awareness and early diagnosis of IBD, the growing use of advanced therapies such as biologist and targeted drugs, and an aging population prone to gastrointestinal disorders. Government initiatives, reimbursement support, and clinical guidelines also promote the adoption of effective IBD treatments across the country.

Market Overview

The France Inflammatory Bowel Disease Treatment Market Size represents a market for the supply of drugs and therapies that aim to control and treat chronic inflammations of the bowels, mainly caused by Crohn's disease and ulcerative colitis in France. The range of the market covers the use of biologics, small molecules, corticosteroids, immunomodulators, and supportive therapies that become aimed at making inflammations less severe, controlling symptoms, inducing remission, and also preventing complications. The market is extensive and reaches hospitals, specialty clinics, and retail pharmacies, with its demand being affected by the prevalence of the disease, the healthcare system, clinical guidelines, and government policies on reimbursement.

Inflammatory bowel disease (IBD), which comprises Crohn's disease and ulcerative colitis, exerts a significant health burden in France, with about 250,000 individuals estimated to be affected nationwide. These diseases cause chronic inflammation of the digestive tract, may result in pain, diarrhea, and hospital visits, and are sometimes accompanied by surgeries. They are followed through long-term registries such as EPIMAD; thus, from 1988 to 2017, almost 22,879 new IBD cases were recorded only in Northern France, and the incidence has been increasing for both Crohn's disease and ulcerative colitis continuously. Consequently, by 2030, approximately 0.6% of the local population might be IBD patients, which essentially reflects disease persistence in children, adolescents, and women and highlights the importance of the inflammatory bowel disease (IBD) treatment market in France.

French research projects and registries funded by public health institutions and partnerships like ALGO and IBD are investigating disease mechanisms and outcomes by using national health data to measure the effectiveness of therapies. There are also campaigns like World IBD Day 2025, which is a day dedicated to communication among medical professionals, patients, and the public with the aim of emphasizing not only the physical but also the psychological impacts of the diseases, thereby facilitating more talk and support for those living with IBD. The diseases, together with ongoing clinical innovation and organized care delivery, make inflammatory bowel disease treatment a pivotal part of France’s digestive disease landscape.

Report Coverage

This research report categorizes the market for the France Inflammatory Bowel Disease Treatment Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France inflammatory bowel disease treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France inflammatory bowel disease treatment market.

France Inflammatory Bowel Disease Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 627.9 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.02% |

| 2035 Value Projection: | USD 1075.7 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By Drug Class |

| Companies covered:: | AbbVie Inc., Johnson & Johnson (Janseen Biotech, Inc.), Takeda Pharmaceutical company Limited, Pfizer Inc., UCB S. A., Novartis AG, Biogen Inc., Amgen Inc., Eli Lilly and Company, Sanofi S. A., Bristol Myers Squibb Company, Allergan plc, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The France Inflammatory Bowel Disease Treatment Market Size is driven by factors such as increased incidences of Crohn's disease and ulcerative colitis, improved diagnosis and awareness, and the higher usage of advanced therapies like biologics and targeted drugs. In addition, a robust healthcare infrastructure, full reimbursement coverage, and ongoing clinical research also contribute to the widespread treatment uptake throughout the country.

Restraining Factors

The France Inflammatory Bowel Disease Treatment Market Size is restrained by the high cost of biologic and advanced therapies, which exerts pressure on healthcare budgets. Other factors include the risk of side effects and the concern for the long-term safety of immunosuppression drugs. Also, some patients do not respond to certain treatments, thus resulting in therapy switching or drug discontinuation.

Market Segmentation

The France inflammatory bowel disease treatment market share is classified into type, drug class, route of administration, and distribution channel.

- The Crohn’s disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Inflammatory Bowel Disease Treatment Market Size is segmented by type into Crohn’s disease and ulcerative colitis. Among these, the Crohn’s disease segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Crohn’s disease segment is growing because it has a higher prevalence in France, requires long-term and often lifelong treatment, and increasingly relies on costly advanced therapies such as biologics and targeted drugs. Frequent disease relapses and hospital-based care also contribute to higher treatment spending.

- The TNF inhibitors segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Inflammatory Bowel Disease Treatment Market Size is segmented by drug class into amino salicylates, corticosteroids, TNF inhibitors, IL inhibitors, anti-integrins, JAK inhibitors, and others. Among these, the TNF inhibitors segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The TNF inhibitors segment is growing because these drugs are highly effective in controlling moderate to severe inflammatory bowel disease, reducing flare-ups, and maintaining long-term remission. Their wide clinical acceptance, strong treatment outcomes, and reimbursement support in France continue to drive higher usage.

- The injectable segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Inflammatory Bowel Disease Treatment Market Size is segmented by route of administration into oral and injectable. Among these, the injectable segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The injectable segment is growing because many advanced IBD therapies, especially biologics such as TNF inhibitors and IL inhibitors, are administered by injection. These treatments offer better disease control for moderate to severe cases and are widely prescribed in hospitals and specialty care settings across France.

- The hospital pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Inflammatory Bowel Disease Treatment Market Size is segmented by distribution channel into retail pharmacies and hospital pharmacies. Among these, the hospital pharmacies segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospital pharmacies segment is growing because most advanced IBD treatments, including biologics and injectable therapies, are prescribed and administered in hospital settings. Specialized gastroenterology care, close patient monitoring, and reimbursement-linked hospital dispensing further support higher sales through hospital pharmacies in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France Inflammatory Bowel Disease Treatment Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Johnson & Johnson (Janseen Biotech, Inc.)

- Takeda Pharmaceutical company Limited

- Pfizer Inc.

- UCB S. A.

- Novartis AG

- Biogen Inc.

- Amgen Inc.

- Eli Lilly and Company

- Sanofi S. A.

- Bristol Myers Squibb Company

- Allergan plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, French biotech Abivax reported positive Phase 3 trial results for its oral ulcerative colitis drug obefazimod, showing significant clinical remission in moderate to severe IBD patients and boosting its profile as a potential new treatment option in France’s inflammatory bowel disease market.

- In May 2024, Johnson & Johnson Services Inc. announced the first phase 3 results for Tremfya’s Crohn’s disease program. The data from the phase 3 trial demonstrated that Tremfya is superior to Stelara in all the endoscopic patients in the trial pool.

- In February 2023, AbbVie announced that the UK's MHRA approved RINVOQ, a JAK inhibitor, for treating patients with moderate to severe Crohn's disease who had an inadequate response to conventional therapy.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Inflammatory Bowel Disease Treatment Market Size based on the below-mentioned segments:

France Inflammatory Bowel Disease Treatment Market, By Type

- Crohn's Disease

- Ulcerative Colitis

France Inflammatory Bowel Disease Treatment Market, By Drug Class

- Amino Salicylates

- Corticosteroids

- TNF Inhibitors

- IL Inhibitors

- Anti-integrin

- JAK Inhibitors

- Others

France Inflammatory Bowel Disease Treatment Market, By Route of Administration

- Oral

- Injectable

France Inflammatory Bowel Disease Treatment Market, By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

Frequently Asked Questions (FAQ)

-

1.What is the France inflammatory bowel disease treatment market size in 2024?The France inflammatory bowel disease treatment market size was estimated at USD 627.9 million in 2024.

-

2.What is the projected market size of the France inflammatory bowel disease treatment market by 2035?The France inflammatory bowel disease treatment market size is expected to reach USD 1075.7 million by 2035.

-

3.What is the CAGR of the France inflammatory bowel disease treatment market?The France inflammatory bowel disease treatment market size is expected to grow at a CAGR of around 5.02% from 2024 to 2035.

-

4.What are the key growth drivers of the France inflammatory bowel disease treatment market?The France inflammatory bowel disease treatment market is driven by the increasing number of people with Crohn’s disease and ulcerative colitis, rising awareness and early diagnosis of IBD, the growing use of advanced therapies such as biologics and targeted drugs, and an aging population prone to gastrointestinal disorders.

-

5.Which route of administration segment dominated the market in 2024?The injectable segment dominated the market in 2024.

-

6.What segments are covered in the France inflammatory bowel disease treatment market report?The France inflammatory bowel disease treatment market is segmented on the basis of type, drug class, route of administration, and distribution channel.

-

7.Who are the key players in the France inflammatory bowel disease treatment market?Key companies include AbbVie Inc., Johnson & Johnson (Janssen Biotech, Inc.), Takeda Pharmaceutical Company Limited, Pfizer Inc., UCB S.A., Novartis AG, Biogen Inc., Amgen Inc., Eli Lilly and Company, Sanofi S.A., Bristol‑Myers Squibb Company, Allergan plc, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?