France Infertility Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Gonadotrophins, Aromatase Inhibitors, Selective Estrogen Receptor Modulators (SERMs), Dopamine Agonists, and Others), By End Use (Women and Men), By Distribution Channel (Hospital Pharmacy and Specialty & Retail Pharmacy), and France Infertility Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Infertility Drugs Market Insights Forecasts to 2035

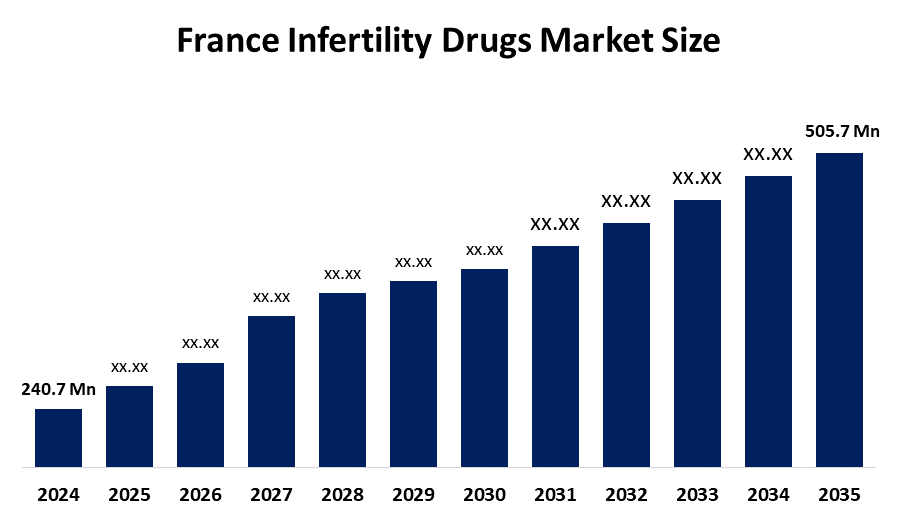

- The France Infertility Drugs Market Size Was Estimated at USD 240.7 Million in 2024

- The France Infertility Drugs Market Size is Expected to Grow at a CAGR of Around 6.98% from 2025 to 2035

- The France Infertility Drugs Market Size is Expected to Reach USD 505.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Infertility Drugs Market Size is anticipated to reach USD 505.7 Million by 2035, Growing at a CAGR of 6.98% from 2025 to 2035. The France infertility drugs market is driven by rising infertility rates, increasing demand for assisted reproductive technologies (ART), growing awareness of reproductive health, expanding access to fertility clinics, and government support for fertility treatments. The use of advanced hormonal therapies and ovulation stimulants also boosts market growth.

Market Overview

The France infertility drugs market refers to the market of pharmaceutical products that are utilized for the purpose of diagnosis, management, and treatment of infertility in men and women. It covers over-the-counter and prescription drugs, such as hormonal therapies, ovulation stimulants, gonadotrophins, and other fertility-supporting drugs to help conception, and also various assisted reproductive technologies like in vitro fertilization (IVF). The market is influenced by the rising prevalence of infertility, the increase in awareness of reproductive health, and the availability of fertility clinics, as well as government-supported treatment programs in France.

France is witnessing a surge in infertility cases, as more than 3.5 million people here are affected by this problem, and nearly 25% of couples of childbearing age are not able to conceive even after one year of regular unprotected intercourse. This situation has led to a very high demand for infertility treatments and drugs. Delaying parenthood, unhealthy lifestyle, and pollution are some of the factors that have pushed the infertility rate higher. These factors indeed require a higher usage of ovulation stimulants, hormonal therapies, and assisted reproductive technologies (ART). It is estimated that nearly 3.7% of the babies born in France are the result of ART, a figure aligning with the increasing medical help that people are seeking for pregnancy.

The market for infertility drugs in France was estimated to be worth around USD 240.7 million in 2024 and is anticipated to grow to approximately USD 505.7 million by 2035, with a CAGR of 6.98%, thus mirroring the expanding clinical demand as well as the increased number of patients opting for the treatment. An important factor in this regard is the government aid. For instance, the French national healthcare system covers four IVF attempts along with the drugs. This policy change has significantly increased the availability and, thereby, the use of fertility treatments. Also, research activities such as the "Women's Health, Couples' Health" program under the France 2030 initiative are focusing their efforts on infertility issues and gene partnerships to discover novel causes of infertility, hearing from over 3 million people, as the problem of infertility is one of the major public health challenges. This combination of an extensive need, strong reimbursement schemes, and targeted research backing is setting up the France infertility drugs market for persistent growth, thus offering a new range of opportunities for pharmaceutical innovation, greater patient outreach, and improved therapeutic options.

Report Coverage

This research report categorizes the market for the France infertility drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France infertility drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France infertility drugs market.

France Infertility Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 240.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.98% |

| 2035 Value Projection: | USD 505.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Drug Class, By End Use |

| Companies covered:: | Merck & Co., Inc., Ferring Pharmaceuticals, Organon & Co., Bayer AG, Teva Pharmaceutical Industries Ltd, Sanofi S.A., Pfizer Inc., Abbott Laboratories, Novartis AG, Mankind Pharma, Zydus Cadila / Zydus Lifesciences, Eli Lilly and Company, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France infertility drugs market is driven by various factors. These include the increased incidence of infertility, the demand for assisted reproductive technologies (ARTs), the heightened awareness in the area of reproductive health, governmental support and reimbursement policies, as well as the development of new fertility drugs. All these elements together contribute to the acceleration of the market growth.

Restraining Factors

The France infertility drugs market is restrained by some challenges, such as the high costs of treatments, the strict regulatory approvals, the potential side effects of fertility medications, the social stigma around infertility, and the lack of awareness in some populations. All of these factors can restrict the access of patients and consequently slow down the growth of the market.

Market Segmentation

The France infertility drugs market share is classified into drug class, end use, and distribution channel.

- The gonadotrophins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France infertility drugs market is segmented by drug class into gonadotrophins, aromatase inhibitors, selective estrogen receptor modulators (SERMs), dopamine agonists, and others. Among these, the gonadotrophins segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The gonadotrophins segment is growing because these drugs are highly effective in stimulating ovulation, making them essential for women undergoing fertility treatments, including in vitro fertilization (IVF). Strong clinical adoption, inclusion in national fertility treatment protocols, and government reimbursement policies in France further support their widespread use and market dominance.

- The women segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France infertility drugs market is segmented by end use into women and men. Among these, the women segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The women’s segment is growing because female infertility is more commonly treated with medications such as ovulation stimulants, gonadotrophins, and hormonal therapies, which are widely used in assisted reproductive technologies (ART) like IVF. A strong clinical focus on women’s fertility, a higher prevalence of female infertility factors, and government-supported treatment programs in France drive the growth of this segment.

- The specialty & retail pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France infertility drugs market is segmented by distribution channel into hospital pharmacy and specialty & retail pharmacy. Among these, the specialty & retail pharmacy segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The specialty & retail pharmacy segment is growing because infertility drugs are widely dispensed through these channels for easy patient access, allowing women and men to obtain prescribed fertility medications conveniently. Strong partnerships with clinics, government reimbursement schemes, and increasing awareness of fertility treatments also support the segment’s revenue growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France infertility drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck & Co., Inc.

- Ferring Pharmaceuticals

- Organon & Co.

- Bayer AG

- Teva Pharmaceutical Industries Ltd

- Sanofi S.A.

- Pfizer Inc.

- Abbott Laboratories

- Novartis AG

- Mankind Pharma

- Zydus Cadila / Zydus Lifesciences

- Eli Lilly and Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In December 2023, IBSA Pharma launched Gonadotropin Chorionic IBSA 5,000 IU, a new injectable fertility drug in France to induce ovulation and support women with ovulation-related infertility, representing a key advancement in infertility treatment options.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France infertility drugs market based on the below-mentioned segments:

France Infertility Drugs Market, By Drug Class

- Gonadotrophins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Others

France Infertility Drugs Market, By End Use

- Women

- Men

France Infertility Drugs Market, By Distribution Channel

- Hospital Pharmacy

- Specialty & Retail Pharmacy

Frequently Asked Questions (FAQ)

-

1.What is the France infertility drugs market size in 2024?The France infertility drugs market size was estimated at USD 240.7 million in 2024.

-

2.What is the projected market size of the France infertility drugs market by 2035?The France infertility drugs market size is expected to reach USD 505.7 million by 2035.

-

3.What is the CAGR of the France infertility drugs market?The France infertility drugs market size is expected to grow at a CAGR of around 6.98% from 2024 to 2035.

-

4.What are the key growth drivers of the France infertility drugs market?The France infertility drugs market is driven by rising infertility rates, increasing demand for assisted reproductive technologies (ART), growing awareness of reproductive health, expanding access to fertility clinics, and government support for fertility treatments. The use of advanced hormonal therapies and ovulation stimulants also boosts market growth.

-

5.Which end-use segment dominated the market in 2024?The women segment dominated the market in 2024.

-

6.What segments are covered in the France infertility drugs market report?The France infertility drugs market is segmented on the basis of drug class, end use, and distribution channel.

-

7.Who are the key players in the France infertility drugs market?Key companies include Merck & Co., Inc., Ferring Pharmaceuticals, Organon & Co., Bayer AG, Teva Pharmaceutical Industries Ltd, Sanofi S.A., Pfizer Inc., Abbott Laboratories, Novartis AG, Mankind Pharma, Zydus Cadila / Zydus Lifesciences, Eli Lilly and Company, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?