France Foreign Exchange Market Size, Share, and COVID-19 Impact Analysis, By Type (Currency Swap, Outright Forward and FX Swaps, and FX Options), By Counterparty (Reporting Dealers, Other Financial Institutions, and Non-financial Customers), and France Foreign Exchange Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialFrance Foreign Exchange Market Insights Forecasts to 2035

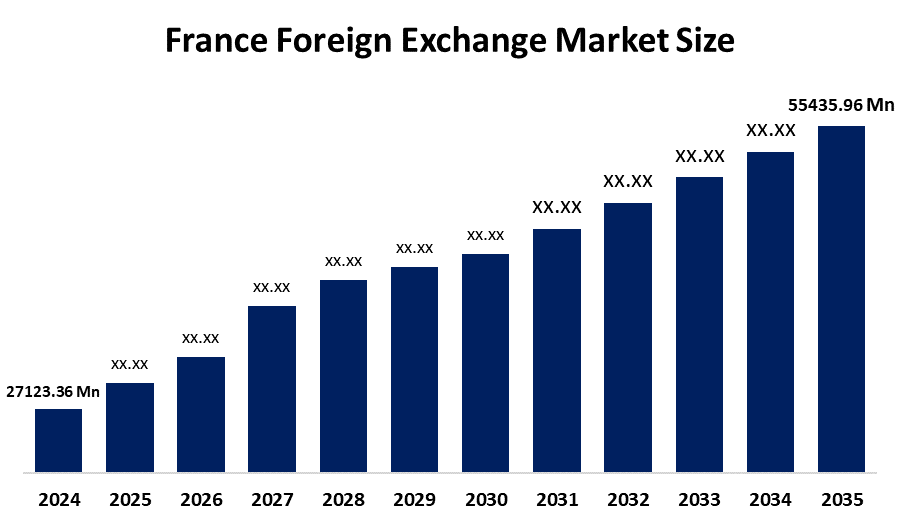

- The France Foreign Exchange Market Size was estimated at USD 27123.36 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.71% from 2025 to 2035

- The France Foreign Exchange Market Size is Expected to Reach USD 55435.96 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Foreign Exchange Market is anticipated to reach USD 55435.96 million by 2035, growing at a CAGR of 6.71% from 2025 to 2035. The market is driven by the nation's robust trade ties both inside and outside the Eurozone, especially its substantial import and export volume in industries like luxury goods, energy, and aerospace.

Market Overview

The Foreign Exchange Market Size in France represents the system of loosely connected individuals and institutions engaged in the global trading of currencies for the purposes of international transactions, investing, and general economic activity. This market provides an essential function in determining exchange rates for the euro against other currencies in the world based on trade flows, capital flows, and monetary policy conditions. Additionally, the market for foreign exchange services in France presents attractive investment opportunities, given the rising international trade activities, the growing tourism industry, and the growth of e-commerce. It can be profitable to invest in fintech companies that are providing new solutions to currency exchange and cross-border payments, given the need for more efficient and cost-effective foreign exchange services. In addition, investing in existing banks or financial institutions with a strong presence in the foreign exchange market in France can offer stable returns on investment. Moreover, the ongoing digital transformation in the financial services sector can provide a way to invest in technology-driven blockchain based platforms or mobile apps that can assist in conducting currency exchange transactions seamlessly. In conclusion, the France foreign exchange services market offers multiple investment opportunities for those who are looking for exposure to a new, dynamic, and emerging sector.

Report Coverage

This research report categorizes the market for the France foreign exchange market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France foreign exchange market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France foreign exchange market.

France Foreign Exchange Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 27123.36 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.71% |

| 2035 Value Projection: | USD 55435.96 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Counterparty |

| Companies covered:: | Market Players, Investors, End-users, Government Authorities, Consulting and Research Firm, Venture capitalists, Value-Added Resellers (VARs), and Other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The development of the France foreign exchange market is supported by several essential factors, including strong integration into the Eurozone, significant trade ties, and its status as a leading financial location. Increased cross-border capital flows, growing corporate demand for currency risk hedging, and growth in fintech and algorithmic trading have contributed to increased liquidity and efficiency. Further, positive policies to promote FX transactions that are transparent and secure, as well as France’s ongoing involvement and growth in global investment and export activities, will contribute to continued growth in the market.

Restraining Factors

Regulatory changes that affect the industry, growing competition from fintech and traditional financial institutions, and volatile exchange rates that impact profitability are some of the major issues facing the French foreign exchange services market. Adherence to strict regulations increases operational risk for established businesses and creates barriers to entry for new ones by complicating and costing operations.

Market Segmentation

The France foreign exchange market share is classified into type and counterparty.

- The currency swap segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France foreign exchange market is segmented by type into currency swap, outright forward and FX swaps, and FX options. Among these, the currency swap segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by a rise in international investments, a rise in the need for long-term hedging tools, and an increase in interest rate volatility worldwide. Currency swaps are a strategic tool for maximizing funding costs and matching liabilities with revenue streams as financial institutions and multinational corporations look to better manage currency and interest rate exposure.

- The reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France foreign exchange market is segmented by counterparty into reporting dealers, other financial institutions, and non-financial customers. Among these, the reporting dealers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to its crucial role in supplying liquidity across international FX markets and facilitating high-volume interdealer transactions. Growing demand for sophisticated derivatives, transparency-promoting regulatory changes, and heightened hedging activity in the face of interest rate and geopolitical volatility are all predicted to accelerate growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France foreign exchange market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Societe Generale Corporate & Investment Banking (SGCIB)

- BNP Paribas

- Crédit Agricole CIB

- Natixis

- La Banque Postale Asset Management

- Others

Recent Developments:

- In September 2025, The Banque de France’s 2025 projections had incorporated the new EU–US trade agreement, which was expected to stabilize tariffs on French exports. This was anticipated to influence FX flows and hedging strategies for exporters.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Foreign Exchange Market based on the below-mentioned segments:

France Foreign Exchange Market, By Type

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

France Foreign Exchange Market, By Counterparty

- Reporting Dealers

- Other Financial Institutions

Non-financial Customers

Frequently Asked Questions (FAQ)

-

What is the France foreign exchange market size?France Foreign Exchange Market is expected to grow from USD 27123.36 million in 2024 to USD 55435.96 million by 2035, growing at a CAGR of 6.71% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?France's strong trade flows, Eurozone integration, growing demand for currency hedging, fintech adoption, regulatory transparency, and increased cross-border investments that improve market liquidity and institutional participation are some of the major growth drivers.

-

What factors restrain the France foreign exchange market?Market expansion and short-term investor confidence are hampered by a number of restraining factors, such as regulatory complexity, geopolitical uncertainties, limited retail participation, eurozone monetary dependencies, and exposure to global interest rate fluctuations.

-

Who are the key players in the France foreign exchange market?Societe Generale Corporate & Investment Banking (SGCIB), BNP Paribas, Crédit Agricole CIB, Natixis

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?