France Foot and Ankle Devices Market Size, Share, By Product (Bracing & Support, Joint Implants, Soft Tissue Orthopedic Devices, Orthopedic Fixation, Prosthetics, and Others), By Application (Hammertoe, Trauma, Osteoarthritis, Rheumatoid Arthritis, Neurological Disorders, Bunions, Osteoporosis, and Others), and France Foot and Ankle Devices Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Foot and Ankle Devices Market Insights Forecasts to 2035.

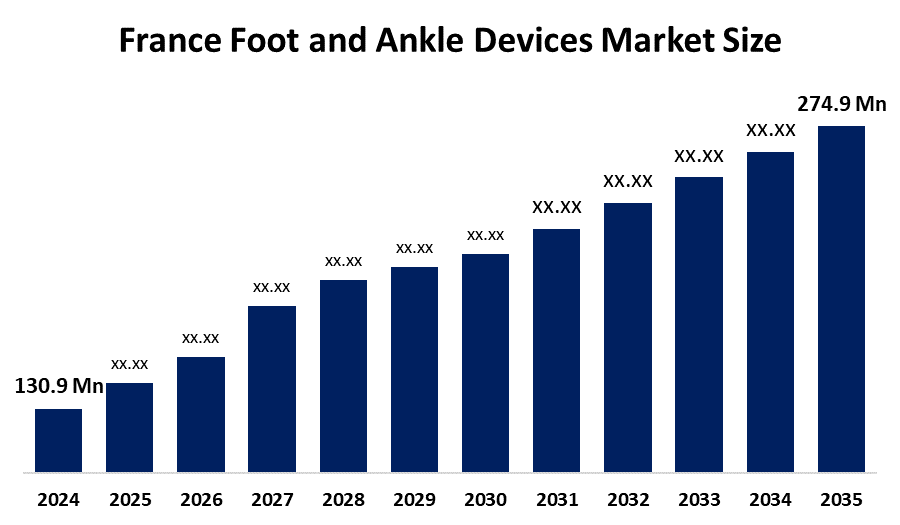

- France Foot and Ankle Devices Market Size 2024: USD 130.9 Mn

- France Foot and Ankle Devices Market Size 2035: USD 274.9 Mn

- France Foot and Ankle Devices Market CAGR 2024: 6.98%

- France Foot and Ankle Devices Market Segments: Product and Application

Get more details on this report -

The France foot and ankle devices market is a segment of the medical devices industry that comprises the products used in the diagnosis, treatment, and management of foot and ankle disorders, injuries, and deformities. The market covers implants, fixation devices, prosthetics, orthotics, braces, and surgical instruments used in trauma, sports injuries, arthritis, diabetic foot complications, and corrective orthopedic procedures, which are performed in hospitals, clinics, and specialty orthopedic centers in France.

France's imperative for foot and ankle apparatuses is significantly determined by the health profile of its population. The country has more than 12 million people who are 65 years old and above; thus, the prevalence of osteoarthritis, osteoporosis, and mobility-related foot and ankle disorders has increased. Moreover, about 3.5 million people are diabetic, and many of them may develop diabetic foot ulcers and related complications that require orthopedic support or surgical intervention. Participation in sports and road accidents has, thus, become a major contributor to the high incidence of ankle fractures and ligament injuries. The elderly population that is growing, the chronic diseases that are on the rise, and the active lifestyles are the factors that have made the demand for advanced foot and ankle devices in France important and sustained.

Market demands and potential are largely influenced by breakthroughs in intelligent wearable orthoses, minimally invasive surgical instruments, and personalized implants, all of which will become a reality through clinical research and EU-funded projects like the SmartANKLE mechatronic ankle and foot orthosis project. This project, which is supported with more than 1.5 million euros under the Marie Sklodowska Curie Actions, is aimed at the development of advanced gait-assistance solutions. On a national level, the French government's France 2030 Health Innovation Plan has set aside €400 million specifically for the segment of innovative medical devices as part of a larger €7.5 billion health innovation fund.

France Foot and Ankle Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 130.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.98% |

| 2035 Value Projection: | USD 274.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product By Application, |

| Companies covered:: | DePuy Synthes, Stryker, Wright Medical, Zimmer Biomet, Arthrex, Smith Nephew, Acumed, Extremity Medical, Vilex, Otto Bock HealthCare, Osteotec, Integra LifeSciences, Tornier N.V, DeRoyal Industries,and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the France Foot and Ankle Devices Market:

The France foot and ankle devices market is driven by various factors such as an aging population, a rise in the number of cases of diabetes and related foot complications, and a growing incidence of sports and trauma injuries. The market growth is also supported by technological advancements in minimally invasive surgeries and a strong healthcare infrastructure with the provision of reimbursements.

The France foot and ankle devices market is restrained by the high costs of advanced implants and surgical procedures, which often restrict patient access. Strict regulatory approvals and extended product launch timelines also delay market expansion. Moreover, post-surgical complications and the inclination towards non-surgical treatments hamper the adoption of devices.

Future opportunities in the France foot and ankle devices market include the innovations of anatomically tailored implants through 3D printing and bioresorbable materials that, in turn, enhance surgical outcomes. The market can expand its treatment offerings and efficiency by the rising use of minimally invasive techniques, digital surgical planning tools, and robot-assisted procedures. Moreover, a greater understanding of early intervention and the broadening of outpatient orthopedic services also opens up new possibilities for market expansion.

Market Segmentation

The France Foot and Ankle Devices Market share is classified into product and application.

By Product:

The France foot and ankle devices market is divided by product into bracing & support, joint implants, soft tissue orthopedic devices, orthopedic fixation, prosthetics, and others. Among these, the orthopedic fixation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The orthopedic fixation segment dominates because of the high number of foot and ankle fractures caused by trauma, sports injuries, and osteoporosis in the aging population. Advanced fixation technologies and wide use in surgical procedures further drive its strong market share and growth.

By Application:

The France foot and ankle devices market is divided by application into hammertoe, trauma, osteoarthritis, rheumatoid arthritis, neurological disorders, bunions, osteoporosis, and others. Among these, the trauma segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The trauma segmental growth is due to the high incidence of road accidents, sports injuries, and accidental falls, particularly among the elderly population. The increasing number of fracture fixation surgeries and growing adoption of advanced orthopedic implants further support the strong growth of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France foot and ankle devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Foot and Ankle Devices Market

- DePuy Synthes

- Stryker

- Wright Medical

- Zimmer Biomet

- Arthrex

- Smith Nephew

- Acumed

- Extremity Medical

- Vilex

- Otto Bock HealthCare

- Osteotec

- Integra LifeSciences

- Tornier N.V

- DeRoyal Industries

- Others

Recent Developments in France Foot and Ankle Devices Market:

- In March 2024, Enovis Foot & Ankle announced the exclusive distribution of SynchroMedical’s ToeGrip and EXray implants in France, expanding access to advanced PEEK-based forefoot and small-fragment fixation solutions and strengthening innovation within the France foot and ankle devices market.

- In December 2024, the Hospices Civils de Lyon team performed the first French INBONE revision ankle prosthesis surgery, using customized 3D-printed Prophecy guides to enhance precision. This marks a significant advancement in complex ankle arthroplasty care in France.

- In November 2025, Enovis Foot & Ankle will become the exclusive French distributor of SynchroMedical’s ToeGrip and EXray PEEK implants from October 1, strengthening advanced forefoot and small-fragment fixation offerings in the France foot and ankle devices market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Foot and Ankle Devices market based on the below-mentioned segments:

France Foot and Ankle Devices Market, By Product

- Bracing & Support

- Joint Implants

- Soft Tissue Orthopedic Devices

- Orthopedic Fixation

- Prosthetics

- Others

France Foot and Ankle Devices Market, By Application

- Hammertoe

- Trauma

- Osteoarthritis

- Rheumatoid Arthritis

- Neurological Disorders

- Bunions

- Osteoporosis

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France foot and ankle devices market size in 2024?The France foot and ankle devices market size was estimated at USD 130.9 million in 2024.

-

2. What is the projected market size of the France foot and ankle devices market by 2035?The France foot and ankle devices market size is expected to reach USD 274.9 million by 2035.

-

3. What is the CAGR of the France foot and ankle devices market?The France foot and ankle devices market size is expected to grow at a CAGR of around 6.98% from 2024 to 2035.

-

4. What are the key growth drivers of the France foot and ankle devices market?An aging population, a rise in the number of cases of diabetes and related foot complications, and a growing incidence of sports and trauma injuries. Technological advancements in minimally invasive surgeries and a strong healthcare infrastructure.

-

5. Which product segment dominated the market in 2024?The orthopedic fixation segment dominated the market in 2024.

-

6. What segments are covered in the France foot and ankle devices market report?The France foot and ankle devices market is segmented on the basis of product and application.

Need help to buy this report?