France Ethylene Oxide Market Size, Share, and COVID-19 Impact Analysis, By Type (Ethanolamine, Ethylene Glycol, Glycol Ethers, Ethoxylates, and Others), By End Use (Pharmaceuticals, Textile, Automotive, Food & Beverages, Agriculture, Personal Care, and Others), and France Ethylene Oxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsFrance Ethylene Oxide Market Size Insights Forecasts to 2035

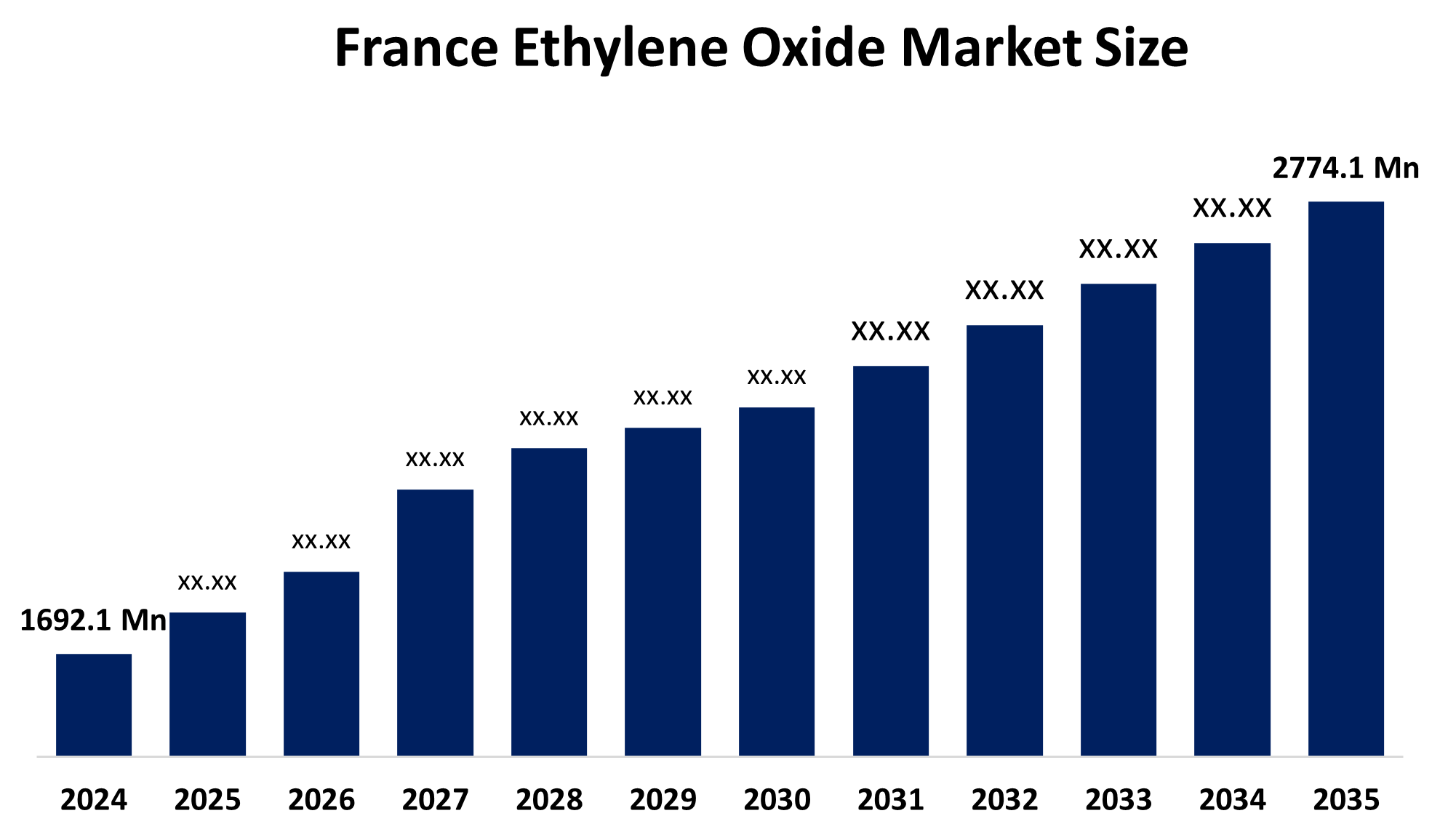

- The France Ethylene Oxide Market Size Was Estimated at USD 1,692.1 Million in 2024

- The France Ethylene Oxide Market Size is Expected to Grow at a CAGR of Around 4.6% from 2025 to 2035

- The France Ethylene Oxide Market Size is Expected to Reach USD 2,774.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Ethylene Oxide Market Size is Anticipated to Reach USD 2,774.1 Million by 2035, Growing at a CAGR of 4.6% from 2025 to 2035. The France ethylene oxide market is driven by strong demand from the chemical and petrochemical industries, particularly for producing ethylene glycol, surfactants, and ethanol amines. Growth in automotive, construction, textiles, pharmaceuticals, and personal care sectors, along with rising use in antifreeze and detergents, continues to support market expansion.

Market Overview

The France Ethylene Oxide Market Size involves the production, distribution, and consumption of ethylene oxide in France. This is mostly used as a major intermediate in the manufacturing of ethylene glycol, surfactants, detergents, ethanol amines, solvents, and specialty chemicals, which in turn are used in the automotive, construction, pharmaceutical, personal care, and industrial sectors.

France's market adoption of ethylene oxide is primarily influenced by its population of about 67 million and the strong downstream demand from healthcare, construction, automotive, textiles, and consumer goods sectors. Ethylene oxide is crucial for the manufacture of ethylene glycol (used in antifreeze and PET resins), surfactants (used in detergents and personal care), and sterilization agents that find extensive applications in hospitals and medical devices. Given that France is home to one of the largest pharmaceutical and personal care industries in Europe and also has a strong automotive and construction sector, stable industrial consumption highlights the market's necessity and its long-term significance.

The French government backs the ethylene oxide market with strong industrial and R&D actions, especially through the France 2030 scheme, pledging a total of €38 billion for industrial innovation, decarbonization, and advanced chemicals. Besides this, the chemical sector benefits from more than €2 billion in yearly R&D investment, chemical recycling and circular economy projects are supported by €500 million, and there is also financing from ADEME and Bpifrance, which together foster sustainable production, modernization, and the long-term competitiveness of the chemical sector.

Report Coverage

This research report categorizes the market for the France Ethylene Oxide Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France ethylene oxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France ethylene oxide market.

France Ethylene Oxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,692.1 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 2,774.1 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Air Liquide, TotalEnergies, BASF SE, INEOS Group, LyondellBasell Industries, Mitsui Chemicals, Shell Chemicals, BP (British Petroleum), ExxonMobil Chemical, Formosa Plastics Corporation, Chevron Phillips Chemical Company, SABIC and Other Key players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The France Ethylene Oxide Market Size is driven by the rise in consumption of ethylene glycol, surfactants, and ethanol amines. These uses are associated with the growth of various industries such as automotive, construction, textiles, pharmaceuticals, and personal care. The market is expected to uphold a continual growth pace with the increased usage of detergents, antifreeze, medical sterilization, and packaging, in addition to a persistent industrial expansion.

Restraining Factors

The France Ethylene Oxide Market Size is restrained by a number of challenges, which include high production costs, risks of flammability and toxicity, and strict environmental and safety regulations. Also, the industry's reliance on the availability of ethylene feedstock and fluctuating raw material prices are the other factors that significantly hamper rapid growth and new production facility investments.

Market Segmentation

The France ethylene oxide market share is classified into type and end use.

- The ethylene glycol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Ethylene Oxide Market Size is segmented by type into ethanolamine, ethylene glycol, glycol ethers, ethoxylates, and others. Among these, the ethylene glycol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ethylene glycol segment is growing because it is a key intermediate for antifreeze, PET resins, and polyester fibers, which are widely used in the automotive, textile, and packaging industries. Rising demand for polyester products and sustainable packaging solutions in France drives its continuous market expansion.

- The personal care segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Ethylene Oxide Market Size is segmented by end use into pharmaceuticals, textiles, automotive, food & beverages, agriculture, personal care, and others. Among these, the personal care segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The personal care segment is growing because ethylene oxide is a key raw material for surfactants, emulsifiers, and ethoxylates used in soaps, shampoos, lotions, and cosmetics. Rising consumer demand for hygiene and skincare products in France drives consistent market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France Ethylene Oxide Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- TotalEnergies

- BASF SE

- INEOS Group

- LyondellBasell Industries

- Mitsui Chemicals

- Shell Chemicals

- BP (British Petroleum)

- ExxonMobil Chemical

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company

- SABIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Ethylene Oxide Market Size based on the below-mentioned segments:

France Ethylene Oxide Market, By Type

- Ethanolamine

- Ethylene Glycol

- Glycol Ethers

- Ethoxylates

- Others

France Ethylene Oxide Market, By End Use

- Pharmaceuticals

- Textile

- Automotive

- Food & Beverages

- Agriculture

- Personal Care

- Others

Frequently Asked Questions (FAQ)

-

1.What is the France ethylene oxide market size in 2024?The France ethylene oxide market size was estimated at USD 1,692.1 million in 2024.

-

2.What is the projected market size of the France ethylene oxide market by 2035?The France ethylene oxide market size is expected to reach USD 2,774.1 million by 2035.

-

3.What is the CAGR of the France ethylene oxide market?The France ethylene oxide market size is expected to grow at a CAGR of around 4.6% from 2024 to 2035.

-

4.Which end-use segment dominated the market in 2024?The personal care segment dominated the market in 2024.

-

5.What segments are covered in the France ethylene oxide market report?The France ethylene oxide market is segmented on the basis of type and end use.

-

6.Who are the key players in the France ethylene oxide market?Key companies include Air Liquide, TotalEnergies, BASF SE, INEOS Group, LyondellBasell Industries, Mitsui Chemicals, Shell Chemicals, BP (British Petroleum), ExxonMobil Chemical, Formosa Plastics Corporation, Chevron Phillips Chemical Company, SABIC, and others.

-

7.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?