France Endometriosis Treatment Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Pain Medication and Hormone Therapy), By Drug Class (NSAIDs, Gonadotropin-Releasing Hormone, Oral Contraceptive, and Others), Route of Administration (Injectable and Oral), and France Endometriosis Treatment Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Endometriosis Treatment Market Size Insights Forecasts to 2035

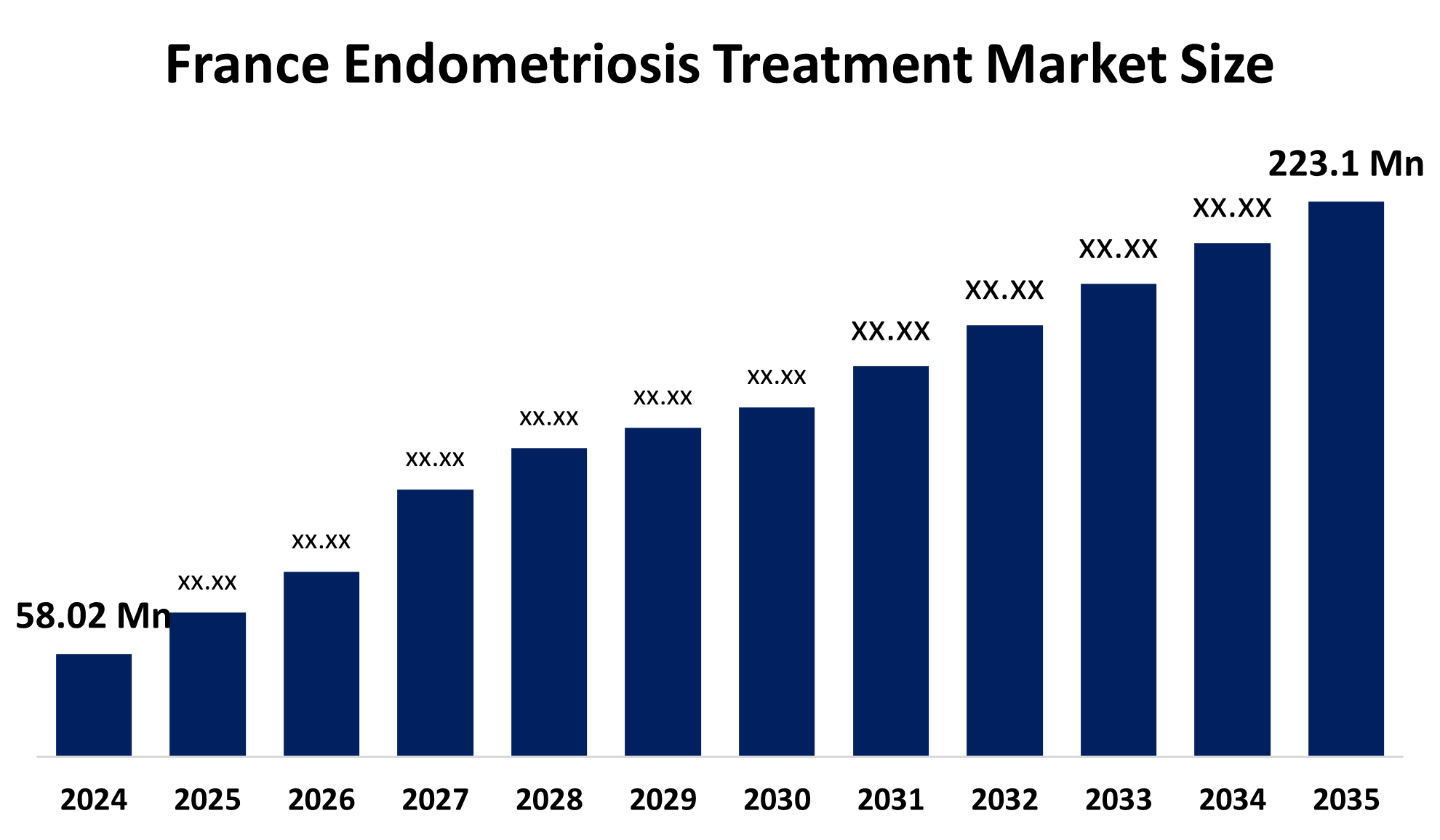

- The France Endometriosis Treatment Market Size Was Estimated at USD 58.02 Million in 2024

- The France Endometriosis Treatment Market Size is Expected to Grow at a CAGR of Around 13.03% from 2025 to 2035

- The France Endometriosis Treatment Market Size is Expected to Reach USD 223.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Endometriosis Treatment Market Size is Anticipated to Reach USD 223.1 Million by 2035, Growing at a CAGR of 13.03% from 2025 to 2035. The France endometriosis treatment market is driven by the rising prevalence and improved diagnosis of endometriosis, growing awareness among women and healthcare professionals, advancements in diagnostic and treatment options, and strong government support through national health policies that improve access to care and encourage innovation.

Market Overview

The France Endometriosis Treatment Market Size refers to the range of medical, surgical, and supportive therapies used to diagnose, manage, and treat endometriosis in women. It includes hormonal therapies (e.g., oral contraceptives, GnRH agonists/antagonists), pain management drugs (NSAIDs), surgical interventions, and emerging targeted treatments, delivered through hospitals, clinics, and specialty centers across France to reduce symptoms, improve fertility, and enhance quality of life.

France Endometriosis Treatment Market Size is underpinned by a significant unmet health need. Endometriosis affects about 10% of women of reproductive age in France, equivalent to roughly 1.5-2 million women, many of whom suffer chronic pelvic pain, infertility, and reduced quality of life due to delayed diagnosis and symptom management challenges. The average diagnostic delay can span several years, highlighting gaps in early detection and effective care, which drives demand for improved medical and surgical treatments.

The France government has recognized endometriosis as a public health priority and launched a National Endometriosis Strategy aimed at enhancing diagnosis, care pathways, and research collaboration across clinical and scientific stakeholders. Embedded within this strategy are research and innovation goals, with proposals to invest around 30 million in coordinated endometriosis and infertility research over several years to better define epidemiology, risk factors, and treatment outcomes. Additionally, formal recognition of endometriosis as a long-term condition ensures state coverage of care costs, reducing financial barriers and encouraging patients to seek timely treatment. These population health pressures, combined with government support and evolving research initiatives, underscore the importance and growth potential of the endometriosis treatment market in France.

Report Coverage

This research report categorizes the market for the France Endometriosis Treatment Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France endometriosis treatment market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France endometriosis treatment market.

France Endometriosis Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 58.02 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.03% |

| 2035 Value Projection: | USD 223.1 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Treatment, By Drug Class |

| Companies covered:: | AbbVie Inc., Bayer AG, Pfizer Inc., AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Myovant Sciences Ltd., Ferring Pharmaceuticals, Ipsen, Sanofi S.A., ObsEva SA, and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The France Endometriosis Treatment Market Size is driven by the high prevalence of endometriosis affecting around 1.5–2 million women, rising awareness and earlier diagnosis, increasing demand for effective pain and fertility management, advancements in hormonal and minimally invasive treatments, and strong government support through the National Endometriosis Strategy, improved reimbursement, and funding for research and innovation.

Restraining Factors

The France Endometriosis Treatment Market Size is restrained by delayed and complex diagnosis, limited availability of curative therapies, side effects associated with long-term hormonal treatments, high treatment costs for advanced care, and unequal access to specialized endometriosis centers, which can slow the timely adoption of effective treatments.

Market Segmentation

The France endometriosis treatment market share is classified into treatment, drug class, and route of administration.

- The hormone therapy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Endometriosis Treatment Market Size is segmented by treatment into pain medication and hormone therapy. Among these, the hormone therapy segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hormone therapy segment is growing because it is the first-line and most widely prescribed treatment for managing endometriosis symptoms in France. Hormone therapies effectively reduce estrogen levels, control lesion growth, relieve chronic pain, and lower recurrence risk, while benefiting from strong clinical acceptance, reimbursement support, and continuous innovation in safer, long-term treatment options.

- The gonadotropin-releasing hormone segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Endometriosis Treatment Market Size is segmented by drug class into NSAIDs, gonadotropin-releasing hormone, oral contraceptives, and others. Among these, the gonadotropin-releasing hormone segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The gonadotropin-releasing hormone segment is growing because GnRH agonists and antagonists are highly effective in suppressing estrogen production, which helps reduce endometrial lesion growth and chronic pelvic pain.

- The oral segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Endometriosis Treatment Market Size is segmented by route of administration into injectable and oral. Among these, the oral segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The oral segment is growing because oral therapies offer high patient convenience, easy self-administration, better treatment adherence, and lower healthcare costs compared to injectables. Widely prescribed oral contraceptives, oral GnRH antagonists, and pain medications, along with strong physician preference for non-invasive treatments, are driving growth in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France Endometriosis Treatment Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- Bayer AG

- Pfizer Inc.

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Myovant Sciences Ltd.

- Ferring Pharmaceuticals

- Ipsen

- Sanofi S.A.

- ObsEva SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In February 2025, French health authorities fast-tracked reimbursement of the Ziwig Endotest saliva diagnostic test for 25,000 women across 80 medical centers in France, improving early endometriosis detection and supporting better treatment outcomes.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Endometriosis Treatment Market Size based on the below-mentioned segments:

France Endometriosis Treatment Market, By Type

- Pain Medication

- Hormone Therapy

France Endometriosis Treatment Market, By Drug Class

- NSAIDs

- Gonadotropin Releasing Hormone

- Oral Contraceptive

- Others

France Endometriosis Treatment Market, By Drug Class

- Injectable

- Oral

Frequently Asked Questions (FAQ)

-

1.What is the France endometriosis treatment market size in 2024?The France endometriosis treatment market size was estimated at USD 58.02 million in 2024.

-

2.What is the projected market size of the France endometriosis treatment market by 2035?The France endometriosis treatment market size is expected to reach USD 223.1 million by 2035.

-

3.What is the CAGR of the France endometriosis treatment market?The France endometriosis treatment market size is expected to grow at a CAGR of around 13.03% from 2024 to 2035.

-

4.What are the key growth drivers of the France endometriosis treatment market?The France endometriosis treatment market is driven by the rising prevalence and improved diagnosis of endometriosis, growing awareness among women and healthcare professionals, advancements in diagnostic and treatment options, and strong government support through national health policies that improve access to care and encourage innovation.

-

5.Which drug class segment dominated the market in 2024?The gonadotropin-releasing hormone segment dominated the market in 2024.

-

6.What segments are covered in the France endometriosis treatment market report?The France endometriosis treatment market is segmented on the basis of type, drug class, and route of administration.

-

7.Who are the key players in the France endometriosis treatment market?Key companies include AbbVie Inc., Bayer AG, Pfizer Inc., AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Myovant Sciences Ltd., Ferring Pharmaceuticals, Ipsen, Sanofi S.A., ObsEva SA, and others.

-

8.Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?