France Electrophysiology Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Diagnostic Catheters, Laboratory Devices, Access Devices, Ablation Catheters, and Others), By Indication (Atrial Fibrillation and Non-Atrial Fibrillation), By End Use (Inpatient Facilities and Outpatient Facilities), and France Electrophysiology Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Electrophysiology Devices Market Insights Forecasts to 2035

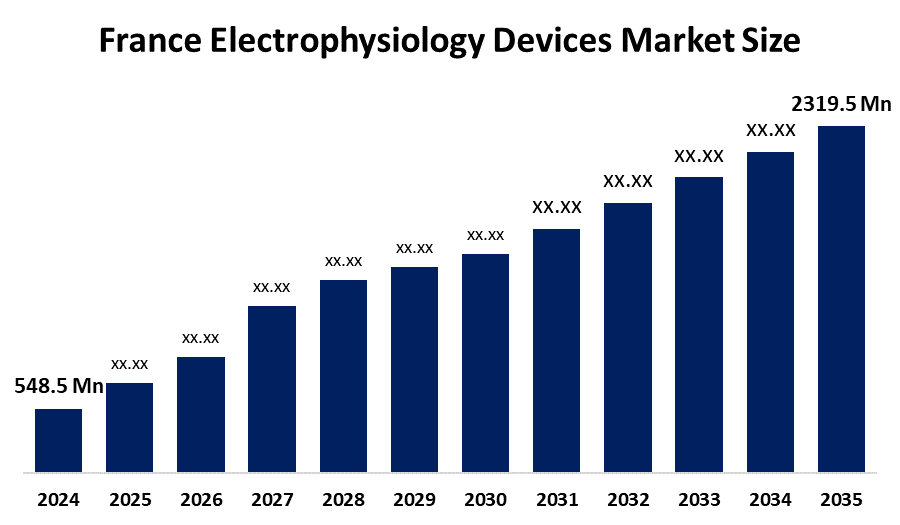

- The France Electrophysiology Devices Market Size Was Estimated at USD 548.5 Million in 2024.

- The France Electrophysiology Devices Market Size is Expected to Grow at a CAGR of Around 14.01% from 2025 to 2035.

- The France Electrophysiology Devices Market Size is Expected to Reach USD 2319.5 Million by 2035.

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The France Electrophysiology Devices Market Size Is Anticipated To Reach USD 2319.5 Million By 2035, Growing At A CAGR Of 14.01% From 2025 To 2035. The France electrophysiology devices market is driven by the rising prevalence of cardiac arrhythmias, an aging population, and increasing adoption of minimally invasive electrophysiology procedures such as catheter ablation. Growth is further supported by technological advancements in mapping and ablation systems, a well-established healthcare infrastructure, favorable reimbursement policies, and growing clinical expertise in advanced cardiac care.

Market Overview

The France Electrophysiology Devices Market Size is a segment of the country’s medical devices industry that focuses on the development, manufacturing, distribution, and utilization of devices designed to diagnose, monitor, and treat electrical disorders of the heart, such as cardiac arrhythmias. These devices include electrophysiology diagnostic catheters, ablation catheters, mapping and navigation systems, and related accessories. They are primarily used in hospitals and specialized cardiac centers for electrophysiological studies and interventional procedures.France faces a high and growing burden of cardiac rhythm disorders, largely driven by demographic shifts and lifestyle changes. Approximately 2.7 million people in France suffer from major cardiac rhythm and conduction disorders, including over 2 million cases of atrial fibrillation a condition strongly associated with stroke, heart failure, and increased mortality. Arrhythmia-related hospitalizations place significant strain on the healthcare system, and the country’s aging population is expected to further increase disease prevalence in the coming years.At the same time, the adoption of minimally invasive electrophysiology procedures, such as catheter ablation supported by advanced mapping and navigation systems, is becoming standard clinical practice. Collectively, these factors highlight the expanding role of electrophysiology devices within the French healthcare system, contributing to improved diagnosis, treatment, and long-term management of cardiac arrhythmias.

Report Coverage

This Research Report Categorizes The France Electrophysiology Devices Market Size based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France electrophysiology devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France electrophysiology devices market.

France Electrophysiology Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2319.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 14.01% |

| 2023 Value Projection: | USD 2319.5 Million By 2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Indication |

| Companies covered:: | Biosense Webster, St. Jude Medical, Boston Scientific, Medtronic, Abbott Laboratories, Siemens Healthineers, Philips Healthcare, and GE Healthcare Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Electrophysiology Devices Market Size In France is driven by the rising prevalence of cardiac arrhythmias, particularly atrial fibrillation, along with the country’s aging population. Market growth is further supported by the increasing adoption of minimally invasive procedures such as catheter ablation, enabled by technological advancements in mapping and ablation systems.In addition, France’s well-developed healthcare infrastructure, patient-friendly reimbursement policies, and the growing availability of skilled electrophysiology professionals are contributing to increased demand for advanced electrophysiology devices across hospitals and specialized cardiac care centers.

Restraining Factors

The France Electrophysiology Devices Market Size is constrained by several factors that hinder its growth. One of the primary challenges is the high cost of electrophysiology devices and procedures, which can limit adoption despite the availability of reimbursement support. Additionally, stringent regulatory requirements and lengthy approval processes may delay the introduction of new technologies.Furthermore, the shortage of skilled electrophysiologists and the need for specialized hospital infrastructure can restrict the number of procedures performed. Risks and potential complications associated with electrophysiology procedures may also reduce patient acceptance in certain cases.

Market Segmentation

The France Electrophysiology Devices Market Size share is categorized by type, indication, and end use.

- The ablation catheters segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Electrophysiology Devices Market Size is segmented by type into diagnostic catheters, laboratory devices, access devices, ablation catheters, and others. Among these, the ablation catheters segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ablation catheters segment's growth is due to the rising prevalence of cardiac arrhythmias, particularly atrial fibrillation, and the growing preference for minimally invasive procedures. Technological advancements, including improved precision and integration with 3D mapping systems, along with increasing clinical expertise and supportive healthcare infrastructure, are driving strong growth for this segment.

- The atrial fibrillation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France Electrophysiology Devices Market Size is segmented by indication into atrial fibrillation and non-atrial fibrillation. Among these, the atrial fibrillation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The atrial fibrillation segmental growth is driven by the high and increasing prevalence of atrial fibrillation, particularly among the aging population. The segment benefits from widespread adoption of catheter ablation and advanced mapping technologies as preferred treatment options over long-term medication. Additionally, growing awareness among physicians and patients and supportive healthcare infrastructure contribute to the segment’s dominant market share and strong projected growth during the forecast period.

- The inpatient facilities segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Electrophysiology Devices Market Size is segmented by end use into inpatient facilities and outpatient facilities. Among these, the inpatient facilities segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The inpatient facilities segment's growth is due to the complex nature of electrophysiology procedures, such as catheter ablations and advanced diagnostic studies, which require specialized hospital settings and continuous patient monitoring. Additionally, higher procedural volumes in hospitals, access to experienced electrophysiologists, and the availability of advanced infrastructure and technologies contribute to the segment’s dominant market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France electrophysiology devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Biosense Webster

- St. Jude Medical

- Boston Scientific

- Medtronic

- Abbott Laboratories

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Biotronik

- Acutus Medical

- Others

Key Target Audience

- Market players

- Investors

- End-users

- Government authorities

- Consulting and research firms

- Venture capitalists

- Value-added resellers (VARs)

Recent Developments

- In August 2023, Boston Scientific received FDA approval for its POLARx™ Cryoablation System, an expandable cryoballoon catheter designed to treat paroxysmal atrial fibrillation. This approval strengthens access to advanced electrophysiology treatment options in France and across the European market.

- In February 2023, Abbott received CE Mark approval in Europe for its TactiFlex™ Ablation Catheter, Sensor Enabled. The device features a flexible tip and contact-force technology for treating atrial fibrillation and is integrated with the EnSite™ X EP System, representing a significant advancement in electrophysiology devices relevant to the France market.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Electrophysiology Devices Market based on the below-mentioned segments:

France Electrophysiology Devices Market, By Type

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

- Ablation Catheters

- Others

France Electrophysiology Devices Market, By Indication

- Atrial Fibrillation

- Non-Atrial Fibrillation

France Electrophysiology Devices Market, By End Use

- Inpatient Facilities

- Outpatient Facilities

Frequently Asked Questions (FAQ)

-

1. What is the France electrophysiology devices market size in 2024?The France electrophysiology devices market size was estimated at USD 548.5 million in 2024.

-

2. What is the projected market size of the France electrophysiology devices market by 2035?The France electrophysiology devices market size is expected to reach USD 2319.5 million by 2035.

-

3. What is the CAGR of the France electrophysiology devices market?The France electrophysiology devices market size is expected to grow at a CAGR of around 14.01% from 2024 to 2035.

-

4. What are the key growth drivers of the France electrophysiology devices market?Rising prevalence of cardiac arrhythmias, an aging population, and increasing adoption of minimally invasive electrophysiology procedures such as catheter ablation. Growth is further supported by technological advancements in mapping and ablation systems.

-

5. Which indication segment dominated the market in 2024?The atrial fibrillation segment dominated the market in 2024.

-

6. Which type segment accounted for the largest market share in 2024?The ablation catheters segment accounted for the largest market share in 2024.

-

7. What segments are covered in the France electrophysiology devices market report?The France electrophysiology devices market is segmented on the basis of type, indication, and end use.

Need help to buy this report?