France Diabetes-Associated Ophthalmic Treatment Market Size, Share, By Application (Dry Eye Syndrome, Glaucoma, Eye Allergy & Infection, Diabetic Retinopathy, Diabetic-Associated Macular Degeneration, Uveitis, and Others), By Type (Drugs and Devices), By End Use (Hospitals, Ophthalmic Centers, Ambulatory Centers, and Others), and France Diabetes-Associated Ophthalmic Treatment Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Diabetes-Associated Ophthalmic Treatment Market Insights Forecasts to 2035.

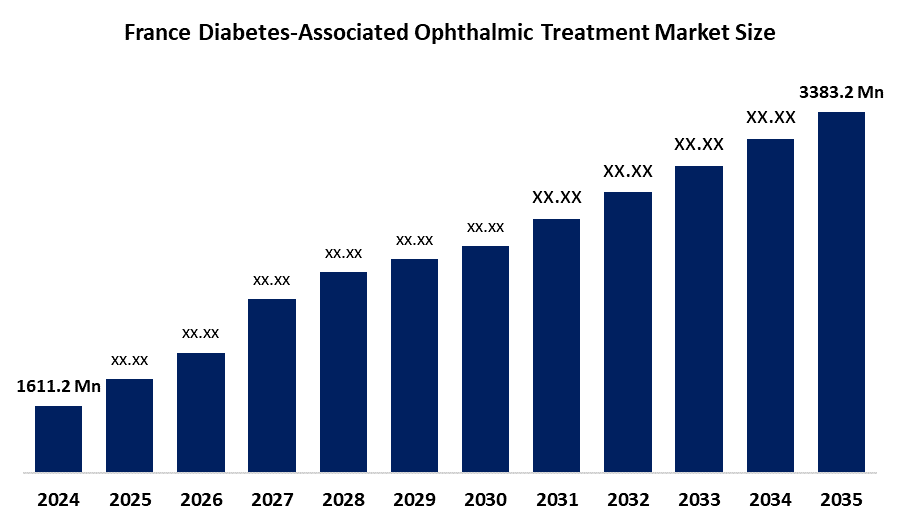

- France Diabetes-Associated Ophthalmic Treatment Market Size 2024: USD 1,611.2 Mn

- France Diabetes-Associated Ophthalmic Treatment Market Size 2035: USD 3,383.2 Mn

- France Diabetes-Associated Ophthalmic Treatment Market CAGR 2024: 6.98%

- France Diabetes-Associated Ophthalmic Treatment Market Segments: Application, Type, and End Use

Get more details on this report -

The France diabetes-associated ophthalmic treatment market is a part of the healthcare industry that deals with the identification, care, and treatment of eye diseases resulting from diabetes, such as diabetic retinopathy, diabetic macular edema, cataracts, and glaucoma. The market covers the use of anti-VEGF agents, corticosteroids, laser therapies, surgeries, and diagnostic imaging tools. The market is propelled by the increasing incidence of diabetes and the escalating demand for the prevention of diabetes-related vision loss in France.

France is a significant market for the diabetes-associated ophthalmic treatment industry, given its substantial diabetes burden and the resulting complications in vision. The diabetes population in France is over 4 million. It means that diabetes accounts for around 6-7% of the population, and the figure keeps going up due to aging and lifestyle changes. Studies on the clinical side show that almost a third of diabetic patients have diabetic retinopathy. About 7-10% of them are at risk of diabetic macular edema, which is the major cause of vision loss. The rise in the prevalence of eye disorders related to diabetes, therefore, coupled with the imperative need for early diagnosis and long-term treatment, unequivocally points to diabetes-associated ophthalmic treatments as being the most critical in saving eyesight and lowering the rate of disability in the French population.

New opportunities for expanded access for patients to anti-VEGF therapies, laser and surgery options, and artificial intelligence (AI)-assisted diagnostic devices to improve patient outcomes and the reduction of disease progression exist. Through the Health Innovation Plan (France 2030 Health Innovation Plan), the French government has allocated approximately €7.5 billion towards the development of medical innovation, including ophthalmology, diagnostics, and chronic disease management, including diabetic retinopathy.

In addition to government support for research and the development of such technology as AI-supported diagnostics, the French National Health Insurance (Assurance Maladie) has also provided full reimbursement for diabetic retinopathy screening and treatment, and has provided targeted funding for tele-ophthalmology for early detection of diabetic patients. These government programs/policies strengthen the support of adoption, research, and access to treatments for diabetes-associated ophthalmic disease in France.

France Diabetes-Associated Ophthalmic Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,611.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.98% |

| 2035 Value Projection: | USD 3,383.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 153 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End Use, By Type |

| Companies covered:: | Novartis AG, Regeneron Pharmaceuticals, Inc., F. Hoffmann-La Roche Ltd, Bayer AG, Alcon Inc., Johnson & Johnson Services, Inc., Bausch Health Companies Inc., Pfizer Inc., AbbVie Inc., Carl Zeiss Meditec AG, Topcon Corporation, Abbott Laboratories,and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the France Diabetes-Associated Ophthalmic Treatment Market:

The France diabetes-associated ophthalmic treatment market is driven by the increase in the number of people diagnosed with diabetes, as well as the growing rate of the incidence of diabetic eye disorders, including retinopathy and macular edema. The increase in early screening, improved diagnosis, and access to new drug therapies is also helping to increase the rate at which people are adopting treatments. The market is also being augmented by well-developed healthcare systems and robust reimbursement policies in France.

The France diabetes-associated ophthalmic treatment market faces restraints due to the cost of advanced treatments like anti-VEGF repeated injections, as well as low compliance over time and limited availability to meet the demand of patients for diagnosis and treatments for diabetes-related eye cancer.

Future opportunities in the France diabetes-associated ophthalmic treatment market include the adoption of long-acting drug therapies and next-generation anti-VEGF treatments to reduce treatment burden. Expansion of AI-based diagnostics and tele-ophthalmology screening will improve early detection. Ongoing investment in innovative research and integrated diabetes care is expected to further enhance treatment outcomes.

Market Segmentation

The France Diabetes-Associated Ophthalmic Treatment Market share is classified into application, type, and end use.

By Application:

The France diabetes-associated ophthalmic treatment market is divided by application into dry eye syndrome, glaucoma, eye allergy & infection, diabetic retinopathy, diabetic-associated macular degeneration, uveitis, and others. Among these, the diabetic retinopathy segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The diabetic retinopathy segment dominates because of its high prevalence among diabetic patients, the need for regular screening and long-term treatment, and strong reimbursement and national screening programs in France, leading to higher diagnosis and treatment rates.

By Type:

The France diabetes-associated ophthalmic treatment market is divided by type into drugs and devices. Among these, the drugs segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The drug’s segmental dominance is due to the high adoption of anti-VEGF and steroid therapies, the need for repeated treatments, and strong reimbursement support for diabetes-related eye diseases in France.

By End Use:

The France diabetes-associated ophthalmic treatment market is divided by end use into hospitals, ophthalmic clinics, ambulatory surgical centers (ASCs), and others. Among these, the hospitals segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The hospital’s segmental growth is due to the availability of advanced diagnostic and treatment infrastructure, higher patient inflow for complex diabetic eye conditions, and access to multidisciplinary diabetes care, along with strong reimbursement support in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France diabetes-associated ophthalmic treatment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Diabetes-Associated Ophthalmic Treatment Market:

- Novartis AG

- Regeneron Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Alcon Inc.

- Johnson & Johnson Services, Inc.

- Bausch Health Companies Inc.

- Pfizer Inc.

- AbbVie Inc.

- Carl Zeiss Meditec AG

- Topcon Corporation

- Abbott Laboratories

- Others

Recent Developments in France Diabetes-Associated Ophthalmic Treatment Market:

- In November 2025, Sandoz launched its Afqlir (aflibercept) biosimilar across Europe, including France, offering a more affordable anti-VEGF treatment for retinal diseases such as diabetic macular edema and diabetic retinopathy, expanding accessible care options in the France diabetes-associated ophthalmic treatment market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Diabetes-Associated Ophthalmic Treatment market based on the below-mentioned segments:

France Diabetes-Associated Ophthalmic Treatment Market, By Application

- Dry Eye Syndrome

- Glaucoma

- Eye Allergy & Infection

- Diabetic Retinopathy

- Diabetic-Associated Macular Degeneration

- Uveitis

- Others

France Diabetes-Associated Ophthalmic Treatment Market, By Type

- Drugs

- Devices

France Diabetes-Associated Ophthalmic Treatment Market, By End Use

- Hospitals

- Ophthalmic Centers

- Ambulatory Centers

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France diabetes-associated ophthalmic treatment market size in 2024?The France diabetes-associated ophthalmic treatment market size was estimated at USD 1,611.2 million in 2024.

-

2. What is the projected market size of the France diabetes-associated ophthalmic treatment market by 2035?The France diabetes-associated ophthalmic treatment market size is expected to reach USD 3,383.2 million by 2035.

-

3. What is the CAGR of the France diabetes-associated ophthalmic treatment market?The France diabetes-associated ophthalmic treatment market size is expected to grow at a CAGR of around 6.98% from 2024 to 2035.

-

4. What are the key growth drivers of the France diabetes-associated ophthalmic treatment market?Increase in the number of people diagnosed with diabetes, as well as the growing rate of the incidence of diabetic eye disorders. The increase in early screening improved diagnosis. The market is also being augmented by well-developed healthcare systems and robust reimbursement policies in France.

-

5. Which application segment dominated the market in 2024?The diabetic retinopathies segment dominated the market in 2024.

-

6. What segments are covered in the France diabetes-associated ophthalmic treatment market report?The France diabetes-associated ophthalmic treatment market is segmented on the basis of application, type, and end use.

Need help to buy this report?