France Dental Implants Market Size, Share, and COVID-19 Impact Analysis, By Type (Titanium and Zirconia), By Fixture Surface Treatments (SLA & SL Active, Anodized Surfaces, Nano-Textured Surfaces, and Others), By Implant Design (Tapered and Parallel-Walled), and France Dental Implants Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Dental Implants Market Insights Forecasts to 2035

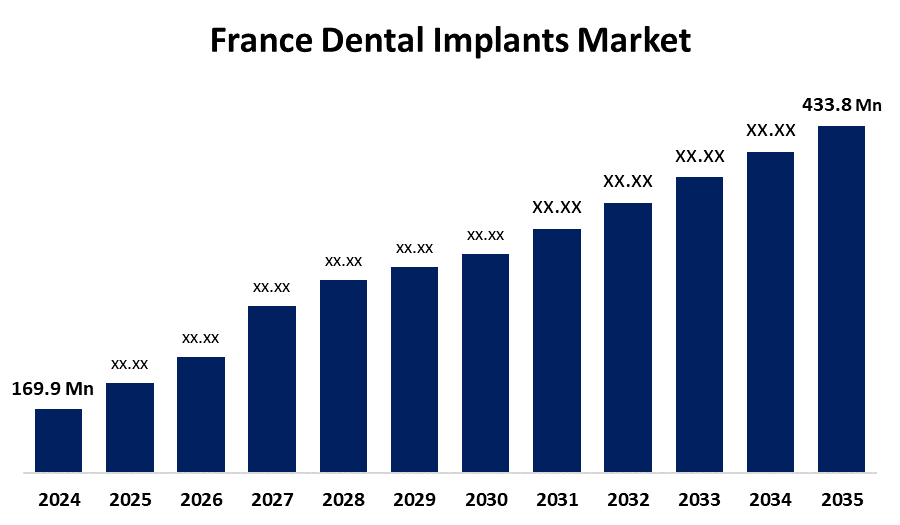

- The France Dental Implants Market Size Was Estimated at USD 169.9 Million in 2024.

- The France Dental Implants Market Size is Expected to Grow at a CAGR of Around 8.9% from 2025 to 2035.

- The France Dental Implants Market Size is Expected to Reach USD 433.8 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France dental implants market size is anticipated to reach USD 433.8 million by 2035, growing at a CAGR of 8.9% from 2025 to 2035. The market is driven by the increasing prevalence of dental diseases, rising tooth loss due to aging and lifestyle factors, growing awareness of oral health, and technological breakthroughs in dental implants. Moreover, the market is further boosted by the rising trend of aesthetic dentistry, increased disposable income, and the expansion of the dental care sector in both urban and rural areas.

Market Overview

The France dental implants market refers to the market for artificial tooth roots surgically placed into the jawbone to support replacement teeth, such as crowns, bridges, or dentures, within the French healthcare sector. These implants are used to restore missing teeth, improve oral function, and enhance aesthetics for patients suffering from tooth loss due to decay, trauma, periodontal disease, or aging. The market encompasses products (titanium and zirconia implants), surgical instruments, digital dentistry solutions, and associated dental services provided by clinics, hospitals, and specialized dental centers across France.

France faces a considerable oral health burden, which highlights the growing demand for the dental implants market. A significant portion of the population suffers from untreated dental diseases, as more than 36% of individuals aged five and above have untreated caries in permanent teeth. Additionally, there is a high prevalence of periodontal disease among adults, leading to tooth loss and an increased need for restorative treatments. Edentulism (toothlessness) is particularly common among older adults in France. With approximately 20% of the population aged over 65, this age group is more prone to tooth loss due to dental diseases, thereby increasing the demand for dental implants and other prosthetic solutions.

Oral health surveys indicate that France ranks among the lowest European countries in terms of the percentage of people who have retained all of their natural teeth. A large proportion of adults have dental restorations and implants, with over 10% of the population already having 1–5 dental implants. This high disease burden, rising tooth loss, and growing adoption of implants clearly highlight the expansion of the dental implants market. Dental implants provide both functional and aesthetic solutions, helping to improve oral health and overall quality of life in France.

Report Coverage

This research report categorizes the France dental implants market by various segments and regions, forecasting revenue growth and analyzing trends across each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the market. Recent developments and competitive strategies—such as expansions, product launches, partnerships, mergers, and acquisitions—are included to illustrate the competitive landscape. Additionally, the report strategically identifies and profiles key market players and evaluates their core competencies across each sub-segment of the France dental implants market.

France Dental Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 169.9 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.9% |

| 2035 Value Projection: | USD 433.8 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Straumann, Danaher, Dentsply, Zimmer Biomet, Osstem, Henry Schein, Dentium, DIO, Neobiotech, And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France dental implants market is driven by increasing tooth loss and the rising prevalence of dental diseases, along with growing awareness of oral health and its aesthetic importance. Technological innovations and minimally invasive implant techniques enhance patient satisfaction and treatment outcomes. Furthermore, the expansion of the dental care sector and rising disposable income levels are encouraging greater adoption of dental implants across France.

Restraining Factors

The France dental implants market is restrained by high treatment costs and limited insurance coverage, strict regulatory requirements, technical complexity requiring skilled clinicians, patient hesitation or preference for cheaper alternatives, and intense competition among market players.

Market Segmentation

The France dental implants market share is categorized by type, fixture surface treatments, and implant design.

- The titanium segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France dental implants market is segmented by type into titanium and zirconia. Among these, the titanium segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The titanium segment's growth is due to its high biocompatibility, durability, and long-term success rates, making it the preferred choice for dental implant procedures in France. Titanium implants are widely supported by clinical evidence, offer excellent osseointegration, and are compatible with various prosthetic solutions, which drives their strong adoption among dentists and patients.

The SLA & SL active segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France dental implants market is segmented by fixture surface treatments into SLA & SL active, anodized surfaces, nano-textured surfaces, and others. Among these, the SLA & SL active segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The SLA & SL active segmental growth is driven by its enhanced surface roughness and bioactivity, which promote faster and stronger osseointegration, leading to higher implant success rates. These surface treatments reduce healing time, improve stability, and lower the risk of implant failure, making them highly preferred by dental professionals and patients in France.

- The tapered segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France dental implants market is segmented by implant design into tapered and parallel-walled. Among these, the tapered segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The tapered segment's growth is due to its enhanced primary stability, ease of placement in varied bone conditions, and suitability for immediate loading procedures. Tapered implants closely mimic the natural tooth root shape, improving patient outcomes and making them highly preferred by dental surgeons in France.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France dental implants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Straumann

- Danaher

- Dentsply

- Zimmer Biomet

- Osstem

- Henry Schein

- Dentium

- DIO

- Neobiotech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Dental Implants Market based on the below-mentioned segments:

France Dental Implants Market, By Type

- Titanium

- Zirconia

France Dental Implants Market, By Fixture Surface Treatments

- SLA & SL active

- Anodized Surfaces

- Nano-Textured Surfaces

- Others

France Dental Implants Market, By Implant Design

- Tapered

- Parallel-Walled

Frequently Asked Questions (FAQ)

-

1.What is the France dental implants market size in 2024?The France dental implants market size was estimated at USD 169.9 million in 2024.

-

2.What is the projected market size of the France dental implants market by 2035?The France dental implants market size is expected to reach USD 433.8 million by 2035.

-

3.What is the CAGR of the France dental implants market?The France dental implants market size is expected to grow at a CAGR of around 8.9% from 2024 to 2035.

-

4.What are the key growth drivers of the France dental implants market?Increasing awareness of oral health and the technological breakthrough in implants. Moreover, the market is getting boosted by the trendy aesthetic dentistry, the increased disposable income, and the development of the dental care sector, both in urban and rural areas.

-

5.Which fixture surface treatments segment dominated the market in 2024?The SLA & SL active segment dominated the market in 2024.

-

6.Which type segment accounted for the largest market share in 2024?The titanium segment accounted for the largest market share in 2024.

-

7.What segments are covered in the France dental implants market report?The France dental implants market is segmented on the basis of type, fixture surface treatments, solution type, and implant design.

Need help to buy this report?