France Cyber Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Packaged and Stand-alone), By Component (Solution and Services), and France Cyber Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialFrance Cyber Insurance Market Insights Forecasts to 2035

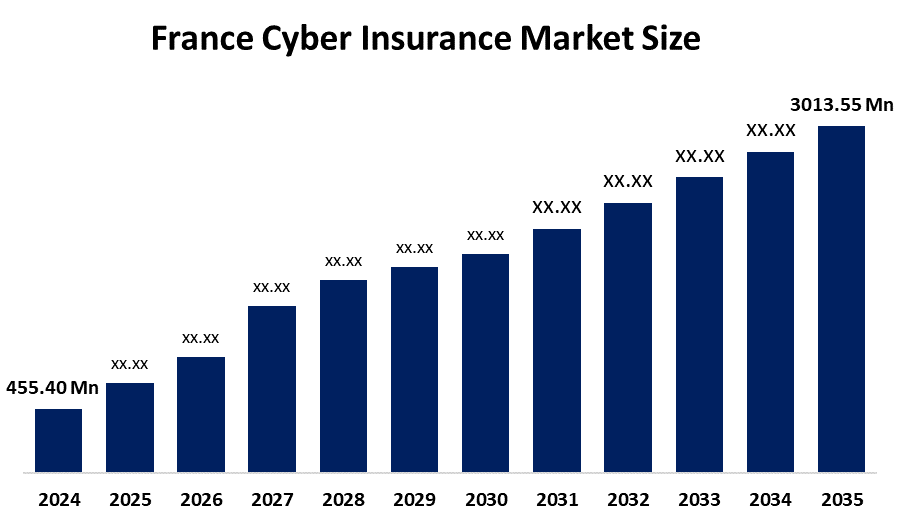

- The France Cyber Insurance Market Size was estimated at USD 455.40 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 18.74% from 2025 to 2035

- The France Cyber Insurance Market Size is Expected to Reach USD 3013.55 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Cyber Insurance Market is anticipated to reach USD 3013.55 million by 2035, growing at a CAGR of 18.74% from 2025 to 2035. An important factor driving the market is the growing use of digital technologies brought on by an increase in cyberthreats.

Market Overview

The Cyber Insurance Market Size in France refers to the network of insurers, reinsurers, and providers of services that cover organizations, institutions, and individuals against cyber risks, such as data breaches, ransomware and business interruption. The cyber insurance market assists organizations, institutions, and individuals to manage the risks associated with digital vulnerabilities by providing the underwriting of cyber exposures and recovery. Additionally, significant opportunities exist in the French cyber insurance market as a result of growing industry-wide digital transformation, stricter GDPR regulations, and rising enterprise and small business awareness of cyber risk. The need for specialized insurance plans, risk analytics tools, and incident response services is growing as cyberthreats get more complex. Additionally, the rise in cloud adoption, remote work infrastructure, and fintech ecosystems makes it easier for insurers to come up with new ideas and attract new clientele, making France a major center for expansion in the European cyber insurance market.

Report Coverage

This research report categorizes the market for the France cyber insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cyber insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cyber insurance market.

France Cyber Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 455.40 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 18.74% |

| 2035 Value Projection: | USD 3013.55 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Insurance Type, By Component |

| Companies covered:: | Market Players, Investors, End-users, Government Authorities, Consulting and Research Firm, Venture capitalists, Value-Added Resellers (VARs), and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the cyber insurance market in France is driven by the dramatic rise of ransomware attacks, phishing attempts, and data breaches in both the private and public sectors. Organizations of all shapes and sizes want improved financial protection against cyber risks, and this has led to a continuous increase in the purchase of policies. Smaller and mid-sized companies, which may not have applied insurance coverage once their businesses became digital in nature, are now moving cyber coverage to the top of their needs lists as their digital exposures increase. Regulatory requirements, such as the requirement for entities to comply with GDPR, is also a factor. With the surge in incident, insurance firms are developing more niche products to compensate for losses associated with business interruption, data restoration, legal fees and even ransom payments. The increased reliance on digital infrastructure in sectors such as finance, health and manufacturing further illustrates the need for protection. More firms now see cyber coverage as essential opposed to optional due to increasing awareness, and so insurance firms must compete by broadening coverage and improving their risk assessment capabilities.

Restraining Factors

The French cyber insurance market is affected by a variety of restrictive factors, including low awareness with SMEs, the complexity of underwriting due to an evolving threat environment, and inability to measure their exposure to cyber risks. Additionally, the lack of standard policy forms, along with reluctance by insurers to provide coverage for systemic risks like supply chain vulnerabilities or geopolitical cyber risks, complicates the expansion of the cyber insurance market.

Market Segmentation

The France cyber insurance market share is classified into insurance type and component.

- The stand-alone segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cyber insurance market is segmented by insurance type into packaged and stand-alone. Among these, the stand-alone segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to there is a growing need for specialized risk coverage, especially in the areas of digital liability, tech E&O, and cyber. Businesses are choosing more and more customized policies that provide exact defense against changing risks, legal liabilities, and business interruptions. Advances in risk modeling, increased knowledge of the advantages of standalone policies, and insurer innovation in underwriting frameworks all contribute to this change by making these products more widely available and applicable.

- The solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France cyber insurance market is segmented by component into solution and services. Among these, the solution segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Since of the growing need for automated underwriting tools, sophisticated risk analytics, and integrated cyber insurance platforms. Scalable, technologically advanced solutions are being prioritized by businesses in order to handle intricate cyberthreats, operational resilience, and regulatory compliance. Adoption is further boosted by the emergence of AI-powered risk modeling, real-time threat detection, and adaptable policy frameworks, which establish the solution segment as a pillar of efficiency and innovation in the changing cyber insurance market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cyber insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA XL

- SCOR SE

- Groupama Assurances Mutuelles

- MAIF

- La Banque Postale Assurances IARD

- Others

Recent Developments:

- In April 2025, Resilience had launched Tech E&O coverage in the UK and EU for enterprises with €25M+ revenue, supported by Accredited Insurances. With limits up to €10M, the offering had addressed rising business interruption risks, strengthening cyber insurance options for large firms across European technology sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Cyber Insurance Market based on the below-mentioned segments:

France Cyber Insurance Market, By Insurance Type

- Packaged

- Stand-alone

France Cyber Insurance Market, By Component

- Solution

- Services

Frequently Asked Questions (FAQ)

-

What is the France cyber insurance market size?France Cyber Insurance Market is expected to grow from USD 455.40 million in 2024 to USD 3013.55 million by 2035, growing at a CAGR of 18.74% during the forecast period 2025-2035

-

What are the key growth drivers of the market?The demand for customized insurance solutions among French businesses and institutions, the rise in cyber threats, the stricter data protection laws, the increased digitization of various industries, and the growing awareness of cyber risk exposure are the main growth drivers.

-

What factors restrain the France cyber insurance market?French market scalability and wider adoption are hampered by a number of restraining factors, such as SMEs' low awareness, complex underwriting, changing threat landscapes, a lack of standardized policies, and difficulties measuring cyber risk exposure.

-

Who are the key players in the France cyber insurance market?AXA XL, SCOR SE, Groupama Assurances Mutuelles, MAIF, La Banque Postale Assurances IARD, Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?