France Commercial Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, and Others), By Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises), and France Commercial Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialFrance Commercial Insurance Market Size Insights Forecasts to 2035

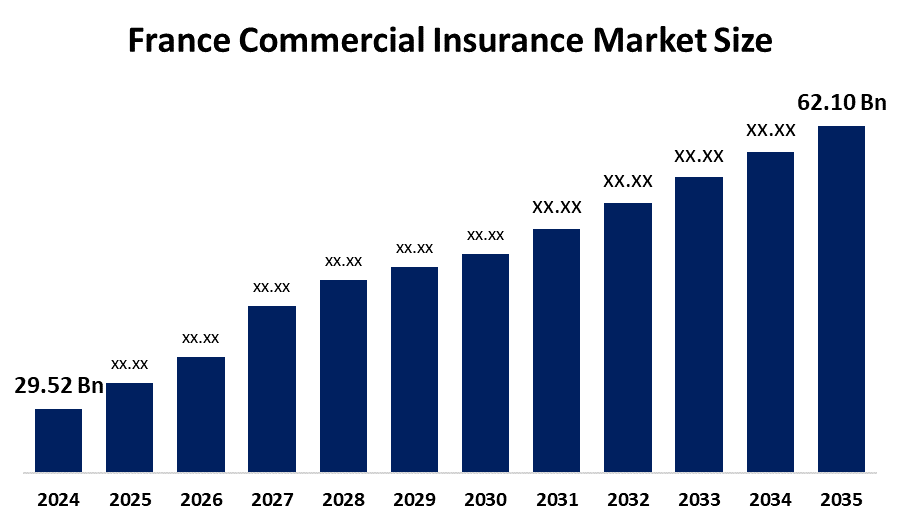

- The France Commercial Insurance Market Size was estimated at USD 29.52 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.99% from 2025 to 2035

- The France Commercial Insurance Market Size is Expected to Reach USD 62.10 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Commercial Insurance Market Size is anticipated to Reach USD 62.10 Billion by 2035, growing at a CAGR of 6.99% from 2025 to 2035. Growing risk awareness, digital transformation, and exposures related to climate change are the main drivers of growth.

Market Overview

The commercial insurance sector in France provides businesses with risk transfer solutions that protect them against financial loss resulting from property damage, liability claims, cyber losses, and business interruptions. Such risk transfer products foster business resilience and compliance across multiple industries or sectors. Additionally, one major development has been the requirement for insurers to maintain stronger capital reserves, which has improved the industry’s resilience against financial shocks. Alongside this, there is growing emphasis on sustainable finance, pushing insurance companies to integrate environmental and social governance criteria into their offerings. Climate-related risk modeling is now becoming part of portfolio strategies, particularly as extreme weather events create higher claims exposure. These adjustments are not only aligning the market with European Union directives but also building confidence among corporate clients who expect insurers to meet global standards. The regulatory focus on digitalization is also driving changes, with guidance encouraging the adoption of secure online platforms for claims processing and customer communication. Industry players are responding by investing in technology that meets compliance benchmarks while improving efficiency.

Report Coverage

This research report categorizes the market for the France commercial insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France commercial insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France commercial insurance market.

France Commercial Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.52 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.99% |

| 2035 Value Projection: | USD 62.10 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 173 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Type, By Enterprise Size and COVID-19 Impact Analysis |

| Companies covered:: | AXA Group, CNP Assurances, Groupama, MAIF, Macif, Allianz France, Generali France, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Market growth is fueled by increasing awareness of risk, the speed of digital transformation, climate-related risks, needs for regulatory compliance, and demand for cyber, liability, and property coverages. Growth is also supported by advancements in data analytics and customized SME solutions.

Restraining Factors

The hindering factors are complicated regulatory obligations, high levels of competition, levels of awareness with SMEs, pricing pressures, and slow adoption of digitalization. Legacy systems and the risk landscape evolving also present barriers to innovation and efficiency within the French commercial insurance space.

Market Segmentation

The France commercial insurance market share is classified into type and enterprise size.

- The liability insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France commercial insurance market is segmented by type into liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others. Among these, the liability insurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to heightened corporate responsibility across industries, more stringent regulatory frameworks, and an increase in litigation risks. As risk environments change, businesses are giving professional, product, and cyber liability coverage top priority. Demand for more specialized liability solutions is also being driven by digital exposure and ESG compliance.

- The large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France commercial insurance market is segmented by enterprise size into large enterprises and small and medium-sized enterprises. Among these, the large enterprises segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increased exposure to intricate liability, cyber, and operational risks. In order to comply with legal requirements, protect their assets, and maintain business operations, these companies require extensive coverage. Advanced risk management solutions are also becoming more popular as a result of digital transformation and ESG compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France commercial insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA Group

- CNP Assurances

- Groupama

- MAIF

- Macif

- Allianz France

- Generali France

- Others

Recent Developments:

- In July 2025, Descartes Insurance had expanded its portfolio in France by launching Credit and Political Risk Insurance, appointing experienced leaders to manage the class. This development had strengthened France’s commercial insurance market by diversifying coverage, supporting corporate clients, and enhancing resilience against global investment and counterparty risks

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Commercial Insurance Market based on the below-mentioned segments:

France Commercial Insurance Market, By Type

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

France Commercial Insurance Market, By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

Frequently Asked Questions (FAQ)

-

Q: What is the France commercial insurance market size?A: The France Commercial Insurance Market is expected to grow from USD 29.52 billion in 2024 to USD 62.10 billion by 2035, growing at a CAGR of 6.99% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Increased risk awareness, the need for regulatory compliance, digital transformation, climate-related exposures, growing cyber threats, and the growing use of customized insurance solutions by big businesses and new business models are some of the main factors propelling growth.

-

Q: What factors restrain the France commercial insurance market?A: Complex regulations, fierce competition in the market, traditional insurers' limited digital adoption, pricing pressures, and SMEs' lack of knowledge about comprehensive coverage requirements and changing risk management solutions are some of the restraining factors

-

Q: Who are the key players in the France commercial insurance market?A: AXA Group, CNP Assurances, Groupama, MAIF, Macif, Allianz France, Generali France, Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?