France Clear Aligners Market Size, Share, By Age (Teens and Adults), By Material (Polyurethane and Plastic Polyethylene Terephthalate Glycol), By End Use (Hospitals, Stand-Alone Practices, Group Practices, and Others), and France Clear Aligners Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Clear Aligners Market Insights Forecasts to 2035

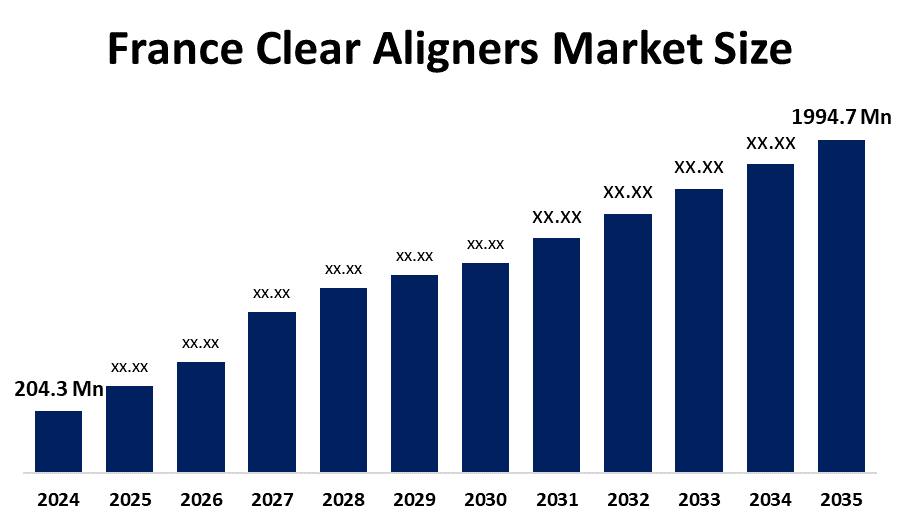

- France Clear Aligners Market Size 2024 USD 204.3 Mn

- France Clear Aligners Market Size 2035 USD 1994.7 Mn

- France Clear Aligners Market CAGR 2024 23.02%

- France Clear Aligners Market Segments: Age, Material, and End Use

Get more details on this report -

The France clear aligners market includes the sale of transparent, removable orthodontic appliances used to straighten teeth and correct dental misalignment among children, adolescents, and adults through dental clinics and orthodontic practices across France. The market’s growth is primarily driven by the rising demand for aesthetic and comfortable orthodontic solutions, increasing awareness of oral health and cosmetic dentistry, technological advancements in polyurethane materials, digital scanning, and 3D-printed aligner fabrication, as well as improved access to dental care due to the growing number of dental practices nationwide.

Demand for clear aligners in France is closely associated with the prevalence of oral health conditions, as nearly one-third of the population suffers from malocclusion. The incidence is particularly high among adolescents, while demand is also increasing among adults seeking discreet and aesthetic orthodontic treatments. This demand is further supported by public oral health initiatives such as programs led by Santé publique France and the 100% Santé reform, which allocated approximately €108 million to expand free dental checkups for children. These initiatives promote early detection of orthodontic issues, indirectly boosting the adoption of clear aligners across France.

The France clear aligners market is undergoing continuous transformation driven by technological advancements, including 3D digital scanning, AI-based treatment planning, and 3D printing, which enhance treatment precision, customization, and efficiency. Innovations in transparent and durable materials, along with the adoption of remote monitoring and tele-orthodontics, are improving patient comfort, reducing treatment duration, and supporting the overall expansion of the clear aligners market throughout France.

France Clear Aligners Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 204.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 23.02% |

| 2035 Value Projection: | USD 1994.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Age,By Material,By End Use |

| Companies covered:: | Align Technology, Straumann Group, Dentsply Sirona, 3M, Denstply Sirona, SmileDirectClub, Orchestrate, AngelAlign, Candid, Essix, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the France Clear Aligners Market:

The France clear aligners market is driven by factors such as the increasing demand for aesthetically pleasing and discreet orthodontic solutions, the rising prevalence of dental misalignment, and growing awareness of oral health. Technological advancements, including digital scanning, AI-driven treatment planning, and 3D printing, along with the increasing number of adult orthodontic treatments and the expansion of dental clinic networks, are further supporting market growth across France.

However, the France clear aligners market faces several restraints, including the high cost of treatment compared to traditional braces, limited reimbursement coverage for adult orthodontic care, and the need for high patient compliance to achieve effective outcomes. In addition, complex orthodontic cases may still require conventional treatment methods, which can restrict the adoption of clear aligners in certain patient segments.

Looking ahead, the French clear aligners market is expected to benefit from multiple innovations. These include the continued integration of AI in treatment planning, advancements in 3D printing technologies, and the development of customizable smart materials that enhance fit, comfort, and overall treatment outcomes. The expansion of tele-orthodontics and the use of remote monitoring tools are expected to improve patient convenience and extend access to care in remote and underserved regions. Moreover, the increasing focus on oral aesthetics and the growing number of adults seeking discreet orthodontic solutions will continue to support the market’s long-term growth.

Market Segmentation

The France Clear Aligners Market share is classified into age, material, and end use.

By Age:

The France clear aligners market is segmented by age into teens and adults. Among these segments, adults accounted for the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period. The growth of the adult segment is driven by the increasing demand for aesthetic and discreet orthodontic solutions, rising awareness of dental appearance, higher disposable incomes, and a strong preference for removable aligners that seamlessly fit into professional and social lifestyles.

By Material:

The France clear aligners market is segmented by material into polyurethane and plastic polyethylene terephthalate glycol (PETG). Among these, the polyurethane segment held the largest market share in 2024 and is expected to grow at a notable CAGR during the forecast period. This dominance is attributed to polyurethane’s superior elasticity, durability, and ability to deliver consistent orthodontic forces. In addition, polyurethane offers enhanced comfort, greater transparency, and higher resistance to wear compared to alternative materials, further supporting its widespread adoption.

By End Use:

The France clear aligners market is segmented by end use into hospitals, stand-alone practices, group practices, and others. Among these segments, stand-alone practices accounted for the largest market share in 2024 and are expected to grow at a significant CAGR during the forecast period. The dominance of the stand-alone practices segment is attributed to the large number of independent dental and orthodontic clinics, the provision of personalized patient care, faster treatment decision-making, and the increasing adoption of digital scanning and in-house aligner planning technologies across France.

Competitive Analysis:

The report provides a comprehensive analysis of the key organizations operating in the France clear aligners market, along with a comparative assessment based on product offerings, business overviews, geographic presence, corporate strategies, segment-wise market share, and SWOT analysis. In addition, the report includes an in-depth evaluation of recent news and developments, covering product launches, technological innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and other strategic initiatives. This comprehensive approach enables a clear assessment of the overall competitive landscape of the market.

Top Key Companies in France Clear Aligners Market:

- Align Technology

- Straumann Group

- Dentsply Sirona

- 3M

- Denstply Sirona

- SmileDirectClub

- Orchestrate

- AngelAlign

- Candid

- Essix

- Others

Recent Developments in France Clear Aligners Market:

-

In September 2025, Medit announced the launch of Medit Aligners, a premium digital clear aligner solution integrated with the Medit Orthodontic Suite. This solution is designed to streamline treatment planning and production processes, enabling faster workflows and enhanced patient experiences.

-

In October 2025, the Straumann Group announced strategic partnerships with Smartee and DentalMonitoring to strengthen ClearCorrect clear aligner capabilities. These collaborations focus on AI-powered remote treatment monitoring, offering significant benefits to orthodontic practices across France.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Clear Aligners Market based on the following criteria:

France Clear Aligners Market, By Age

- Adults

- Teens

France Clear Aligners Market, By Material

- Polyurethane

- Plastic Polyethylene Terephthalate Glycol

France Clear Aligners Market, By End Use

- Hospitals

- Stand-Alone Practices

- Group Practices

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France clear aligners market size in 2024?The France clear aligners market size was estimated at USD 204.3 million in 2024.

-

2. What is the projected market size of the France clear aligners market by 2035?The France clear aligners market size is expected to reach USD 1994.7 million by 2035.

-

3. What is the CAGR of the France clear aligners market?The France clear aligners market size is expected to grow at a CAGR of around 23.02% from 2024 to 2035.

-

4. What are the key growth drivers of the France clear aligners market?The increasing need for aesthetically pleasing and discreet orthodontic solutions, the rising incidence of dental misalignment, the growing oral health awareness, and innovations in technology.

-

5. Which age segment dominated the market in 2024?The adult segment dominated the market in 2024.

-

6. What segments are covered in the France clear aligners market report?The France clear aligners market is segmented on the basis of age, material, and end use.

Need help to buy this report?