France Biodegradable Electronics Polymers Market Size, Share, and COVID-19 Impact Analysis, By Polymer (Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Polycaprolactone (PCL), and Others), By Application (Flexible Electronics, Printed Electronics, Disposable Electronics, Consumer Electronics Components, and Others), and France Biodegradable Electronics Polymers Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsFrance Biodegradable Electronics Polymers Market Size Insights Forecasts to 2035

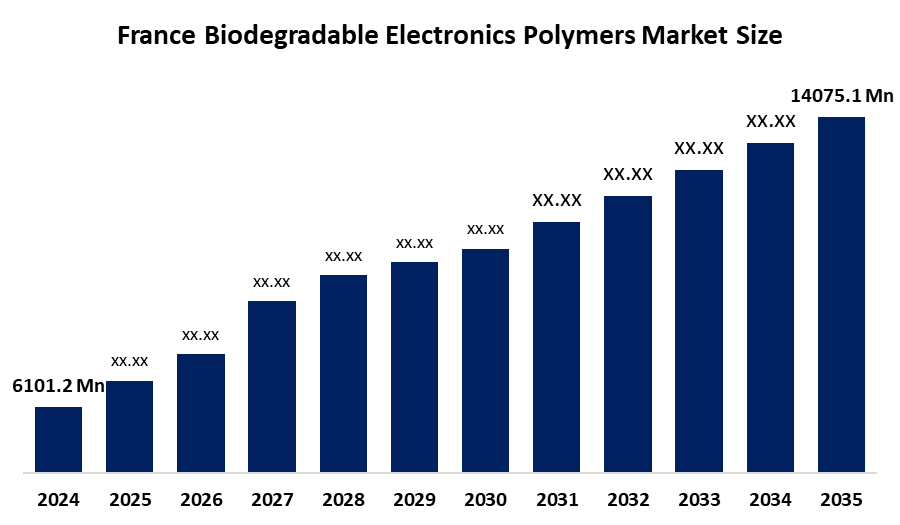

- The France Biodegradable Electronics Polymers Market Size Was Estimated at USD 6,101.2 Million in 2024

- The France Biodegradable Electronics Polymers Market Size is Expected to Grow at a CAGR of Around 7.9% from 2025 to 2035

- The France Biodegradable Electronics Polymers Market Size is Expected to Reach USD 14,075.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Biodegradable Electronics Polymers Market Size is anticipated to reach USD 14,075.1 million by 2035, growing at a CAGR of 7.9% from 2025 to 2035. The France Biodegradable Electronics Polymers Market Size is driven by strict environmental and e-waste regulations, rising demand for sustainable and eco-friendly electronic materials, and growing use of biodegradable polymers in wearable devices, medical electronics, flexible circuits, and IoT applications, supported by strong R&D and sustainability initiatives.

Market Overview

France Biodegradable Electronics Polymers Market Size is an industry that concentrates on the research, manufacture, and use of polymer materials that are capable of being broken down by biological agents or are bio-based in electronic applications. Such polymers are engineered to break down naturally after their functional life, thereby helping to lessen e-waste and pollution. Besides, these polymers are employed in making flexible electronics, wearable gadgets, medical implants, sensors, and disposable electronic components, thus helping France to meet its sustainability and circular economy objectives.

France’s embrace of biodegradable electronics polymers is to a great extent a reflection of the population demands, the increasing consumption of electronics, and the escalating e-waste challenges in the country. With more than 65 million inhabitants and widespread usage of consumer electronics, wearables, and medical devices, France is under growing pressure to find ways to cut down on both long-term electronic waste and its environmental impact. Biodegradable polymers are a boon to several problems, such as toxic e-waste buildup, landfilling burden, and a very limited recycling capacity; these issues have been exacerbated by the ever-increasing short lifecycle of electronic products in the healthcare, sensor, and smart packaging sectors, which show the market's significance and indispensability.

Government support acts as the key factor deciding the speed at which this market grows. Under France 2030, the French government has pledged €54 billion for innovation, and green materials, bio-based polymers, and sustainable electronics have been considerably funded. Industry adoption is being facilitated by various factors such as regulations, R&D grants, and sustainability incentives, which also put biodegradable electronics polymers as a top priority, an industry-ready market that fits perfectly with France’s climate, innovation, and circular economy objectives.

Report Coverage

This research report categorizes the market for the France Biodegradable Electronics Polymers Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France Biodegradable Electronics Polymers Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France Biodegradable Electronics Polymers Market Size.

France Biodegradable Electronics Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6101.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.9% |

| 2035 Value Projection: | USD 14075.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Polymer, By Application |

| Companies covered:: | NaturePlast, Carbios, Arkema S.A., Elixance, Dionymer, Novamont, NatureWorks LLC, TotalEnergies Corbion PLA, BASF SE, Danimer Scientific, Biome Bioplastics, Toray Industries, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Biodegradable Electronics Polymers Market Size is driven by the imposition of stringent environmental and e-waste regulations, the increased demand for sustainable and bio-based materials in electronics, and the continued proliferation of wearable devices, medical electronics, IoT sensors, and flexible circuits. Substantial government grants to green materials R&D, major breakthroughs in biodegradable conductive polymers, and France's dedication to the circular economy and carbon reduction targets serve as the market growth enabling factors to a great extent.

Restraining Factors

The France Biodegradable Electronics Polymers Market Size is restrained by several challenges, including expensive materials and production, limited capability for large-scale manufacturing, and performance compromises against traditional electronic polymers, especially in terms of durability and conductivity. Moreover, the absence of standardization, elongated commercialization timelines, and conservative adoption by electronics manufacturers additionally hamper the market infiltration, even though there is a robust demand for sustainability.

Market Segmentation

The France Biodegradable Electronics Polymers Market Size share is classified into polymer and application.

- The polylactic acid (PLA) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Biodegradable Electronics Polymers Market Size is segmented by polymer into polylactic acid (PLA), polyhydroxyalkanoates (PHA), polycaprolactone (PCL), and others. Among these, the polylactic acid (PLA) segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The polylactic acid (PLA) segment is growing because it offers excellent biodegradability, good processability, and cost advantages compared to other biodegradable polymers. Its wide availability, compatibility with flexible and disposable electronic components, and increasing use in wearable electronics, medical devices, and eco-friendly circuit substrates, supported by strong R&D and sustainability regulations in France, drive its market dominance and growth.

- The flexible electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Biodegradable Electronics Polymers Market Size is segmented by application into flexible electronics, printed electronics, disposable electronics, consumer electronics components, and others. Among these, the flexible electronics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The flexible electronics segment is growing because of rising demand for lightweight, bendable, and eco-friendly electronic components used in wearable devices, medical sensors, smart packaging, and IoT applications. The ability of biodegradable polymers to support thin, flexible substrates, combined with strong innovation in sustainable electronics and regulatory support in France, drives the dominance of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France Biodegradable Electronics Polymers Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NaturePlast

- Carbios

- Arkema S.A.

- Elixance

- Dionymer

- Novamont

- NatureWorks LLC

- TotalEnergies Corbion PLA

- BASF SE

- Danimer Scientific

- Biome Bioplastics

- Toray Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In April 2025, French start-up Lactips launched CareTips, a 100% bio-based, water-soluble, fully biodegradable polymer that integrates into existing industrial systems as a sustainable alternative to conventional plastics, supporting eco-friendly material use, including future electronics applications in France’s biodegradable polymers market.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Biodegradable Electronics Polymers Market Size based on the below-mentioned segments:

France Biodegradable Electronics Polymers Market Size, By Polymer

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Polycaprolactone (PCL)

- Others

France Biodegradable Electronics Polymers Market Size, By Application

- Flexible Electronics

- Printed Electronics

- Disposable Electronics

- Consumer Electronics Components

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France Biodegradable Electronics Polymers Market Size in 2024?The France Biodegradable Electronics Polymers Market Size was estimated at USD 6,101.2 million in 2024.

-

2. What is the projected market size of the France Biodegradable Electronics Polymers Market Size by 2035?The France Biodegradable Electronics Polymers Market Size is expected to reach USD 14,075.1 million by 2035.

-

3. What is the CAGR of the France Biodegradable Electronics Polymers Market Size?The France Biodegradable Electronics Polymers Market Size is expected to grow at a CAGR of around 7.9% from 2024 to 2035.

-

4. What are the key growth drivers of the France Biodegradable Electronics Polymers Market Size?The France Biodegradable Electronics Polymers Market Size is driven by strict environmental and e-waste regulations, rising demand for sustainable and eco-friendly electronic materials, and growing use of biodegradable polymers in wearable devices, medical electronics, flexible circuits, and IoT applications, supported by strong R&D and sustainability initiatives.

-

5. What segments are covered in the France Biodegradable Electronics Polymers Market Size report?The France Biodegradable Electronics Polymers Market Size is segmented on the basis of polymer and application.

-

6. Who are the key players in the France Biodegradable Electronics Polymers Market Size?Key companies include NaturePlast, Carbios, Arkema S.A., Elixance, Dionymer, Novamont, NatureWorks LLC, TotalEnergies Corbion PLA, BASF SE, Danimer Scientific, Biome Bioplastics, Toray Industries, and others.

-

7. Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?