France Bancassurance Market Size, Share, and COVID-19 Impact Analysis, By product Type (Life Bancassurance and Non-Life Bancassurance), By Model Type (Pure Distributor, Exclusive Partnership, Financial Holding, and Joint Venture), and France Bancassurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialFrance Bancassurance Market Size Insights Forecasts to 2035

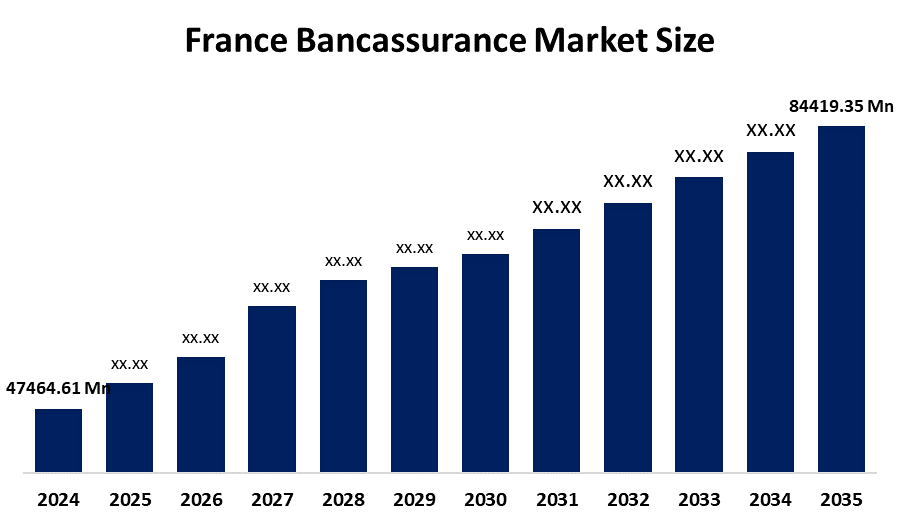

- The France Bancassurance Market Size was estimated at USD 47464.61 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.37% from 2025 to 2035

- The France Bancassurance Market Size is Expected to Reach USD 84419.35 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Bancassurance Market Size is anticipated to Reach USD 84419.35 Million by 2035, growing at a CAGR of 5.37% from 2025 to 2035. The market benefits from regulatory clarity, demographic changes, and financial signaling to facilitate long-term financial planning, while bancassurance is at the heart of the French financial system, being driven by universal banks and their insurer subsidiaries.

Market Overview

The bancassurance market in France refers to the combined sale of insurance products through a bank distribution model, which is extensively used by banks in France. This is using the bank's customers and infrastructure to offer insurance options on life, health, and savings. Additionally, the rapid growth of the aged population alters retirement income planning, while difficulties in the structural funding of public pensions determines the greater need for households to seek to supplement state benefits with private annuities, as well as endowment, and savings products. Bancassurers create unit-linked and euro-denominated life contracts, providing a degree of 'safety,' with the added benefit of potential investment upside. These products are often tailored to take advantage of France's favourable tax treatment of life insurance and retirement products. A major French banking and insurance conglomerate, Groupe BPCE reported a 26% increase in earnings for 2024, bringing contributions from almost all retail business lines including insurance, payments, and financial solutions. The attractiveness of tax deferrals, ease of inheritance planning, and the flexibility of payout options create emission from the middle- and upper-income households. Medical costs continue to rise, including the need for coverage for supplemental medical expenses, while increasingly, bancassurers are including health and critical illness riders attached to savings or long-term savings policies.

Report Coverage

This research report categorizes the market for the France bancassurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France bancassurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France bancassurance market.

France Bancassurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47464.61 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.37% |

| 2035 Value Projection: | USD 84419.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 184 |

| Tables, Charts & Figures: | 149 |

| Segments covered: | By product Type, By Model Type and COVID-19 Impact Analysis |

| Companies covered:: | AXA Group, BNP Paribas Cardif, Crédit Agricole Assurances, CNP Assurances, Société Générale Assurances, SCOR SE, Amundi, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The dominance of universal banks and their integrated insurance subsidiaries, which expedite product distribution and customer access, is driving the bancassurance market in France. The need for life and retirement insurance solutions is increased by demographic aging and growing healthcare costs, while regulatory clarity promotes transparency and trust. Its growth trajectory is also supported by financial incentives for long-term savings and the integrated function of bancassurance in financial planning.

Restraining Factors

The French bancassurance market is constrained by changing regulatory frameworks that require more compliance and transparency, which could make operations more complicated. Traditional bancassurance models are under threat from digital disruption and the emergence of insurtechs, which puts pressure on banks to update their antiquated systems.

Market Segmentation

The France bancassurance market share is classified into product type and model type.

- The life bancassurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France bancassurance market is segmented by product type into life bancassurance and non-life bancassurance. Among these, the life bancassurance segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by an aging population and rising life expectancy, which has increased demand for protection products, long-term savings, and retirement planning. With the aid of digital integration and individualized advisory services, banks cross-sell life insurance products by utilizing their large customer base and trust. While economic uncertainty increases interest in capital-protection and guaranteed-return products, regulatory incentives and tax benefits also promote the adoption of life insurance. All of these elements support the segment's growth trajectory.

- The exclusive partnership segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France bancassurance market is segmented by model type into pure distributor, exclusive partnership, financial holding, and joint venture. Among these, the exclusive partnership segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by banks' and insurers' operational synergy, which makes it possible for smooth product integration and customer targeting. These collaborations lower distribution costs, facilitate regulatory framework compliance, and increase brand loyalty and trust. The model gains from digital transformation, which enables banks to use data-driven insights to customize insurance offerings. Furthermore, the exclusivity guarantees steady product quality and strategic alignment, which promotes profitability and long-term client retention.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France bancassurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA Group

- BNP Paribas Cardif

- Crédit Agricole Assurances

- CNP Assurances

- Société Générale Assurances

- SCOR SE

- Amundi

- Others

Recent Developments:

- In August 2024, Crédit Agricole Assurances reported that its H1 revenue totaled €23.1 billion (USD 25.2 billion), reflecting an 11.2% year-on-year increase. Net inflows reached €2.5 billion, driven by a rebound in euro funds and robust savings inflows. Net income group share exceeded €1.03 billion (USD 1.12 billion), up 8.8% compared to H1 2023. Life insurance outstandings stood at €337.9 billion (USD 369 billion), with unit-linked products representing 29.5%. The group maintained a strong Solvency II ratio of 200%.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Bancassurance Market based on the below-mentioned segments:

France Bancassurance Market, By Product Type

- Life Bancassurance

- Non-Life Bancassurance

France Bancassurance Market, By Model Type

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Frequently Asked Questions (FAQ)

-

Q: What is the France bancassurance market size?A: The France Bancassurance Market is expected to grow from USD 47464.61 million in 2024 to USD 84419.35 million by 2035, growing at a CAGR of 5.37% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Integrated bank-insurer models, the growing need for health and life insurance, the need for clear regulations, aging populations, digital distribution, and financial incentives that promote retirement planning and long-term savings are some of the major growth drivers.

-

Q: What factors restrain the France bancassurance market?A: Restraining factors include low-interest rate sensitivity, limited product differentiation, insurtech digital disruption, complex regulations, changing consumer preferences, and operational difficulties integrating banking and insurance platforms across legacy systems.

-

Q: Who are the key players in the France bancassurance market?A: AXA Group, BNP Paribas Cardif, Crédit Agricole Assurances, CNP Assurances, Société Générale Assurances, SCOR SE, Amundi, Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?