France Audiology Devices Market Size, Share, By Product (Hearing Aids, Cochlear Implants, BAHA/BAHS, Diagnostic Devices, Surgical Devices, and Others), By Technology (Digital and Analog), By Distribution Channel (Retail Sales, Government Purchases, E-commerce, and Others), and France Audiology Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Audiology Devices Market Insights Forecasts to 2035

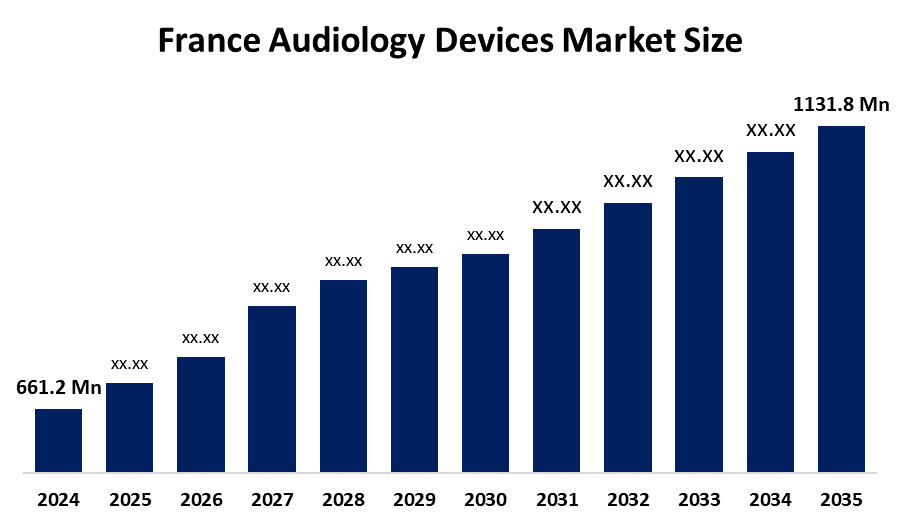

- France Audiology Devices Market Size 2024 USD 661.2 Mn

- France Audiology Devices Market Size 2035 USD 1131.8 Mn

- France Audiology Devices Market CAGR 2024 5.01%

- France Audiology Devices Market Segments Product, Technology, and Distribution Channel

Get more details on this report -

The France Audiology Devices Market Size is defined as the market for devices used to facilitate the identification, diagnosis, treatment, and management of individuals with hearing impairment/auditory disorders in the country of France. It includes the manufacturing of audiological devices, including cochlear implants, hearing aids, and bone-anchored hearing systems, and also covers the provision of diagnostic tools for audiologists through hospitals, ENT clinics, audiometry centers, and other types of hearing care resources available at retail. Audiology devices in France are influenced by factors such as an increase in the number of people over 65 years of age, the number of individuals living with hearing impairment, advancements in technology in the audiology field, and national policies on the reimbursement of healthcare related to audiological devices. The France audiology devices market will be a significant contributor to improving the quality of life and the hearing health of the population of France.

In France, more than 7 million people are affected by hearing loss, where about 25% of adults have a certain degree of hearing impairment; thus, it has become one of the major public health problems, particularly in the elderly population. The use of audiology devices receives a lot of support from the government through various initiatives like the 100% Sant reform that provides full reimbursement of hearing aids, in addition to the government-funded research programs led by Inserm, CNRS, and the French National Research Agency (ANR). Therefore, the combination of a high prevalence of diseases and active public support is a clear indication of the significance and expansion potential of the France audiology devices market.

France Audiology Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 661.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.01% |

| 2035 Value Projection: | USD 1131.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Technology, By Distribution Channel |

| Companies covered:: | Sonova Holding AG, Demant, GN Store Nord, Starkey Laboratories, Inc., Cochlear Limited, William Demant Holding, Widex, Med-El, Rion Co., Ltd., Audina Hearing Instruments, Inc., Sebotek Hearing Systems LLC, Eargo, Inc., Earlens Corporation, Inc., WS Audiology, Nurotron Biotechnology Co. Ltd., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the France Audiology Devices Market:

The France Audiology Devices Market Size is influenced by the increasing incidence of hearing loss, which is, in general, among the elderly population, of which several million are affected in the whole country. One of the main factors that is pushing the market forward is the presence of a supportive policy environment, along with reimbursement schemes like the 100% Sant program, which is greatly facilitating the use of hearing aids. Besides, the sound technological innovations in digitally enabled, rechargeable, and AI-based hearing instruments, as well as the awareness of hearing health and better diagnostic methods, are collectively raising the market to a higher level.

TheFrance Audiology Devices Market Size faces restraining factors such as the high costs of premium and advanced hearing devices beyond the basic reimbursement coverage. These are some of the factors that have led to a slowdown in the France audiology devices market. The social stigma of hearing loss and a generally low level of awareness of the condition, especially in the younger and working-age populations, are causes of the decreased rate of early diagnosis, and consequently, few people use hearing devices.

The France market for audiology devices is an excellent prospect to develop in the coming years, with the main factors contributing to this advance being digitized and AI-enabled hearing technologies, among which are smart, rechargeable, and connected hearing aids. The teleaudiology and remote hearing care services are becoming more frequent, and together with other digital health initiatives, they are facilitating better access to health care in both urban and rural areas. Moreover, the increasing emphasis on early-stage screening, preventive hearing care, and research and innovation programs financed by the government will be there to constantly raise the market.

Market Segmentation

The France Audiology Devices Market share is classified into product, technology, and distribution channel.

By Product:

The France audiology devices market is divided by product into hearing aids, cochlear implants, BAHA/BAHS, diagnostic devices, surgical devices, and others. Among these, the hearing aids segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth of the hearing aids segment is due to the high prevalence of age-related hearing loss, increasing awareness of hearing health, technological advancements such as digital and rechargeable hearing aids, and favorable reimbursement policies that improve accessibility across France.

By Technology:

The France audiology devices market is divided by technology into digital and analog. Among these, the digital segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The digital segment dominates because of superior sound quality, advanced noise reduction and connectivity features, customization to individual hearing profiles, and growing consumer preference for smart and rechargeable hearing devices in France.

By Distribution Channel:

The France audiology devices market is divided by distribution channel into retail sales, government purchases, e-commerce, and others. Among these, the retail sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The retail sales segment dominance is due to the wide presence of audiology clinics and hearing aid centers, personalized fitting and after-sales services, strong consumer trust, and reimbursement support that encourages in-store consultations and purchases across France.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the France audiology devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in France Audiology Devices Market:

- Sonova Holding AG

- Demant

- GN Store Nord

- Starkey Laboratories, Inc.

- Cochlear Limited

- William Demant Holding

- Widex

- Med-El

- Rion Co., Ltd.

- Audina Hearing Instruments, Inc.

- Sebotek Hearing Systems LLC

- Eargo, Inc.

- Earlens Corporation, Inc.

- WS Audiology

- Nurotron Biotechnology Co. Ltd.

- Others

Recent Developments in France Audiology Devices Market:

- In February 2024, Starkey unveiled the world’s first fully custom rechargeable hearing aid as part of its Signature Series, combining discreet design with long battery life and advanced sound processing, marking a key innovation in audiology devices for markets including France.

- In March 2025, Cochlear launched the smart cochlear implant system, featuring advanced connectivity and AI-enhanced sound processing to improve hearing outcomes, representing a major innovation with strong relevance for the France audiology devices market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Audiology Devices market based on the below-mentioned segments:

France Audiology Devices Market, By Product

- Hearing Aids

- Cochlear Implants

- BAHA/BAHS

- Diagnostic Devices

- Surgical Devices

- Others

France Audiology Devices Market, By Technology

- Digital

- Analog

France Audiology Devices Market, By Distribution Channel

- Retail Sales

- Government Purchases

- E-commerce

- Others

Frequently Asked Questions (FAQ)

-

1. What is the France audiology devices market size in 2024?The France audiology devices market size was estimated at USD 661.2 million in 2024.

-

2. What is the projected market size of the France audiology devices market by 2035?The France audiology devices market size is expected to reach USD 1131.8 million by 2035.

-

3. What is the CAGR of the France audiology devices market?The France audiology devices market size is expected to grow at a CAGR of around 5.01% from 2024 to 2035.

-

4. What are the key growth drivers of the France audiology devices market?The increasing incidence of hearing loss, the presence of a supportive policy environment, along reimbursement schemes like the 100% Sant program. Besides, the sound technological innovations in digitally enabled, rechargeable, and AI-based hearing instruments

-

5. Which product segment dominated the market in 2024?The hearing aids segment dominated the market in 2024.

-

6. What segments are covered in the France audiology devices market report?The France audiology devices market is segmented on the basis of product, technology, and distribution channel.

Need help to buy this report?