France Arrhythmia Monitoring Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (ECG, Implantable Cardiac Monitors, Holter Monitors, Mobile Cardiac Telemetry, and Others), By Application (Bradycardia, Tachycardia, Atrial Fibrillation, Ventricular Fibrillation, Premature Contraction, and Others), By End Use (Hospitals and Diagnostic Centers), and France Arrhythmia Monitoring Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Arrhythmia Monitoring Devices Market Insights Forecasts to 2035

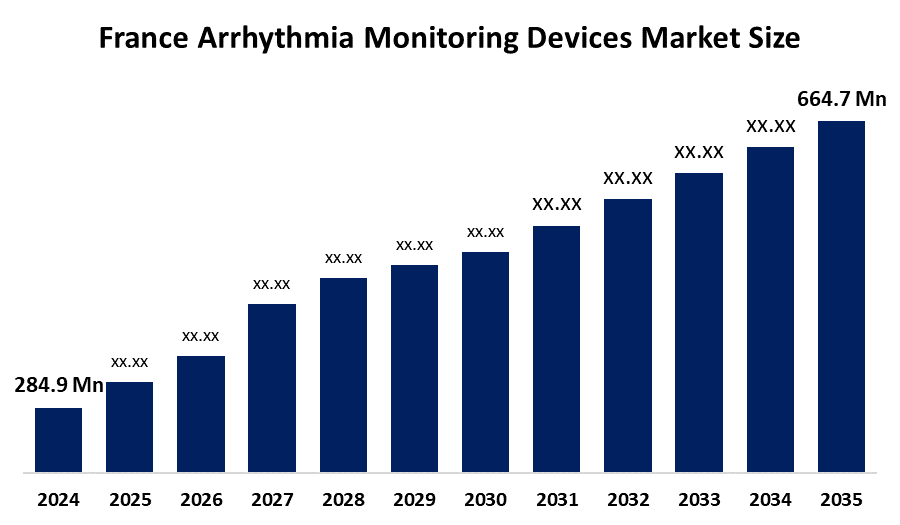

- The France Arrhythmia Monitoring Devices Market Size Was Estimated at USD 284.9 Million in 2024.

- The France Arrhythmia Monitoring Devices Market Size is Expected to Grow at a CAGR of Around 8.01% from 2025 to 2035.

- The France Arrhythmia Monitoring Devices Market Size is Expected to Reach USD 664.7 Million by 2035.

Get more details on this report -

According To a Research Report Published By Spherical Insights & Consulting, The France Arrhythmia Monitoring Devices Market Size Is Anticipated To Reach USD 664.7 Million by 2035, Growing At a CAGR of 8.01% From 2025 to 2035. The market is driven by the rising prevalence of cardiac arrhythmias, particularly among the aging population, along with increasing awareness of the importance of early diagnosis. Advancements in wearable and implantable monitoring technologies, the growing adoption of home-based cardiac care, and supportive healthcare infrastructure further contribute to market growth.

Market Overview

The France Arrhythmia Monitoring Devices Market Size is a segment of the medical devices industry in France that focuses on the development, production, and use of instruments designed to detect, monitor, and manage irregular heart rhythms. These instruments include wearable monitors, implantable loop recorders, Holter monitors, and remote cardiac monitoring systems, which are used in hospitals, outpatient clinics, and home care settings to track conditions such as atrial fibrillation, ventricular tachycardia, and other arrhythmias. The market emphasizes the use of these devices for early diagnosis, continuous monitoring, and effective management of cardiac rhythm disorders, leading to reduced complications and fewer hospitalizations.France is experiencing a significant and growing burden of cardiac arrhythmias, underscoring the need for advanced arrhythmia monitoring devices. In 2023, the number of people affected by major heart rhythm and conduction disorders in France was estimated at approximately 2.74 million.

Among them, more than 2 million individuals were reported to have atrial fibrillation or flutter, nearly 1 million had conduction disorders, and over 200,000 were affected by ventricular tachycardia or were survivors of cardiac arrest. Atrial fibrillation remains the most prevalent arrhythmia, affecting approximately 750,000 to 1 million people, predominantly adults aged over 65 years, with prevalence increasing significantly after the age of 75.The use of arrhythmia monitoring devices, including wearable ECGs, Holter monitors, and implantable loop recorders, enables early diagnosis, continuous monitoring, and effective treatment of arrhythmias. In the context of an aging population, rising arrhythmia incidence, and the growing shift toward remote and home-based cardiac care, these devices play a critical role in reducing complications such as stroke and heart failure, thereby improving patient outcomes across France.

Report Coverage

This Esearch Report Categorizes The France Arrhythmia Monitoring Devices Market Size based on various segments and regions, forecasting revenue growth and analyzing trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France arrhythmia monitoring devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France arrhythmia monitoring devices market.

France Arrhythmia Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 664.7 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 8.01% |

| 2023 Value Projection: | USD 664.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | Medtronic plc, Abbott Laboratories, GE Healthcare, Philips Healthcare, iRhythm Technologies Inc., ACS Diagnostics (Applied Cardiac Systems), Biotronik SE & Co. KG, AliveCor, Inc., Spacelabs Healthcare, Medi-Lynx Cardiac Monitoring LLC, and Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Arrhythmia Monitoring Devices Market Size is primarily driven by the rising prevalence of cardiovascular diseases and the growing elderly population, both of which contribute to increased demand for continuous heart rhythm monitoring. Lifestyle-related risk factors, such as obesity, physical inactivity, and alcohol consumption, are further increasing the incidence of arrhythmias. Technological innovations, including wearable ECG devices, implantable monitors, and AI-enabled analytics, are improving diagnostic accuracy and patient comfort. Market growth is also supported by the expanding adoption of telemedicine and remote monitoring, favorable healthcare policies, preventive care initiatives, and strategic activities undertaken by key players in the market.

Restraining Factors

The Expansion Of The Arrhythmia Monitoring Devices Market Size in France is constrained by several factors. The high cost of devices particularly advanced wearable and implantable monitors—can limit accessibility for some patients. In addition, limited awareness or understanding of arrhythmia monitoring among certain patient groups and healthcare providers may reduce adoption. Furthermore, technological challenges such as device malfunctions, data privacy concerns, and the need for specialized expertise to accurately interpret monitoring data can hinder wider acceptance of these devices among the general population.

Market Segmentation

The France arrhythmia monitoring devices market share is categorized by product, application, and end use.

- The ECG segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Arrhythmia Monitoring Devices Market Size is segmented by product into ECG, implantable cardiac monitors, holter monitors, mobile cardiac telemetry, and others. Among these, the ECG segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The ECG segment's growth is due to its widespread clinical use, cost-effectiveness, and ability to provide real-time, accurate cardiac rhythm assessment. Increasing prevalence of cardiovascular diseases, growing adoption in hospitals and outpatient settings, and technological advancements in portable and digital ECG systems are further driving its strong market growth.

- The atrial fibrillation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The France Arrhythmia Monitoring Devices Market Size is segmented by application into bradycardia, tachycardia, atrial fibrillation, ventricular fibrillation, premature contraction, and others. Among these, the atrial fibrillation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The atrial fibrillation segmental growth is driven by the rising prevalence of atrial fibrillation in France, increasing awareness about early diagnosis and management, technological advancements in monitoring devices, the growing incidence of cardiovascular diseases, and the adoption of remote patient monitoring solutions. Additionally, favorable reimbursement policies supporting arrhythmia monitoring devices further boost the segment’s growth.

- The hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Arrhythmia Monitoring Devices Market Size is segmented by end use into hospitals and diagnostic centers. Among these, the hospitals segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hospitals segment's growth is due to the high patient inflow for cardiac care, the availability of advanced diagnostic and monitoring infrastructure, the presence of specialized cardiology departments, and the preference for continuous in-hospital arrhythmia monitoring. Additionally, hospitals often serve as referral centers for complex cardiac cases, which drives the demand for arrhythmia monitoring devices in clinical settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France arrhythmia monitoring devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic plc

- Abbott Laboratories

- GE Healthcare

- Philips Healthcare

- iRhythm Technologies Inc.

- ACS Diagnostics (Applied Cardiac Systems)

- Biotronik SE & Co. KG

- AliveCor, Inc.

- Spacelabs Healthcare

- Medi-Lynx Cardiac Monitoring LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

In January 2024, MicroPort CRM received the CE mark for its new ICD and CRT-D devices, TALENTIA and ENERGYA, which feature Bluetooth connectivity and enhanced remote monitoring capabilities. These devices are designed to improve arrhythmia therapy and facilitate better connectivity between patients and clinicians.

In September 2020, Cardiologs partnered with MicroPort CRM to exclusively distribute its AI-based cardiac diagnostics cloud solution for Holter ECG analysis in France. This partnership enhanced arrhythmia detection efficiency and supported the broader adoption of AI-driven rhythm monitoring solutions.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Arrhythmia Monitoring Devices Market based on the below-mentioned segments:

France Arrhythmia Monitoring Devices Market, By Product

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- Others

France Arrhythmia Monitoring Devices Market, By Application

- Bradycardia

- Tachycardia

- Atrial Fibrillation

- Ventricular Fibrillation

- Premature Contraction

- Others

France Arrhythmia Monitoring Devices Market, By End Use

- Hospitals

- Diagnostic Centers

Frequently Asked Questions (FAQ)

-

1. What is the France arrhythmia monitoring devices market size in 2024?The France arrhythmia monitoring devices market size was estimated at USD 284.9 million in 2024.

-

2. What is the projected market size of the France arrhythmia monitoring devices market by 2035?The France arrhythmia monitoring devices market size is expected to reach USD 664.7 million by 2035.

-

3. What is the CAGR of the France arrhythmia monitoring devices market?The France arrhythmia monitoring devices market size is expected to grow at a CAGR of around 8.01% from 2024 to 2035.

-

4. What are the key growth drivers of the France arrhythmia monitoring devices market?Rising prevalence of cardiac arrhythmias, particularly among the aging population, along with growing awareness of early diagnosis. Advances in wearable and implantable monitoring technologies.

-

5. Which application segment dominated the market in 2024?The atrial fibrillation segment dominated the market in 2024.

-

6. Which product segment accounted for the largest market share in 2024?The ECG segment accounted for the largest market share in 2024.

-

7. What segments are covered in the France arrhythmia monitoring devices market report?The France arrhythmia monitoring devices market is segmented on the basis of product, application, and end use.

Need help to buy this report?