France Antacids Market Size, Share, and COVID-19 Impact Analysis, By Type (Tablet and Liquid), By End Use (Hospital Pharmacy and Retail Pharmacy), and France Antacids Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Antacids Market Insights Forecasts To 2035

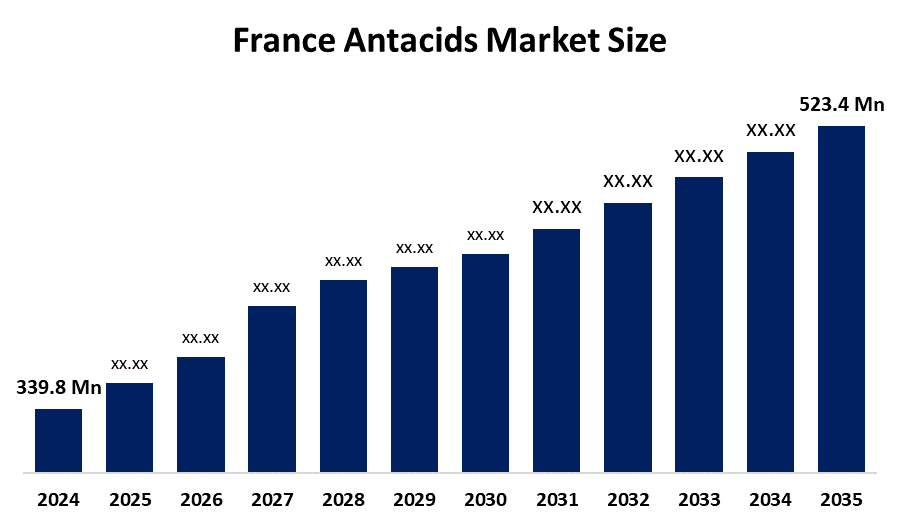

- The France Antacids Market Size Was Estimated At USD 339.8 Million In 2024

- The France Antacids Market Size Is Expected To Grow At A CAGR Of Around 4.01% From 2025 To 2035

- The France Antacids Market Size Is Expected To Reach USD 523.4 Million By 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The France Antacids Market Size Is Anticipated To Reach USD 523.4 Million By 2035, Growing At A CAGR Of 4.01% From 2025 To 2035. The France antacids market is driven by the high prevalence of gastrointestinal disorders, growing consumer awareness of digestive health, easy availability of over-the-counter antacid products, and an increase in lifestyle-related factors like unhealthy diets, stress, and alcohol consumption that trigger gastric acidity.

Market Overview

The France Antacids Market Size Refers To The Market For Stomach Acid-Neutralizing Medications That Relieve Symptoms Of Disorders Caused By Acidic Stomachs, Like Heartburn, Indigestion, Gastroesophageal Reflux, And Peptic Ulcers. The products span both over-the-counter and prescription-grade antacids available in different forms such as tablets, chewables, liquids, and suspensions, and are distributed through retail pharmacies, hospital pharmacies, and online channels. The market is mainly driven by consumer knowledge, lifestyle factors, and the incidence of gastrointestinal diseases in France.

About Half Of The French Population Suffers From Acid-Related Digestive Disorders, Including Gastroesophageal Reflux, Heartburn, And Gastritis. Studies, as cited in IRM (2017), suggest that 10-20% of adults report frequent reflux symptoms, while gastrointestinal diseases affect about 1 in 5 people, resulting in physician visits and hospitalizations on a regular basis. Among these populations, Helicobacter pylori infection, which is found in 15-30% of adults, contributes to ulcer formation and acid-related discomfort. These diseases lead to the widespread use of antacids, proton pump inhibitors, and other acid-reducing treatments, both through prescription and over-the-counter (OTC) drugs. Thus, continuous consumption is guaranteed in hospitals, clinics, and pharmacies.

The Demand For Digestive Medications Is Projected To Remain Stable In The Near Term. An increasing elderly population, exacerbated stress levels, and lifestyle factors such as nutritional habits and obesity are some of the reasons that will amplify the prevalence of related disorders. France's universal healthcare system and national clinical guidelines assure broad access to these drug therapies, and scientific investigations into gastroenterology and antimicrobial resistance offer fresh treatment alternatives. All these factors together sustain the pivotal position of the antacids market as a means of gastrointestinal health care and enhancement of the quality of life across the nation.

Report Coverage

This Research Report Categorizes The Market Size For The France Antacids Market Based On Various Segments And Regions, And Forecasts Revenue Growth And Analyses Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France antacids market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France antacids market.

France Antacids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 339.8 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 4.01% |

| 2023 Value Projection: | 523.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type By End Use |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France Antacids Market Size Is Driven By The Growing Prevalence Of Acid-Related Disorders, Helicobacter Pylori Infections, And Lifestyle Factors. The easy accessibility through retail pharmacies and increasing awareness of digestive health are the major factors that stimulate the use of antacid therapies across the country.

Restraining Factors

The France Antacids Market Size Is Restrained By Several Factors, Including Long-Term Or Excessive Use, Such As Kidney Or Electrolyte Issues. Competition from prescription acid-reducing drugs like proton pump inhibitors. Self-medication without proper diagnosis.

Market Segmentation

The France antacids market share is classified into type and end use.

- The tablet segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France Antacids Market Size Is Segmented By Type Into Tablet And Liquid. Among These, The Tablet Segment Accounted For The Largest Revenue Market Share In 2024 And Is Expected To Grow At A Significant CAGR During The Forecast Period. The tablet segment is growing because tablets are easy to use, portable, and have a longer shelf life compared with liquids, making them a convenient choice for consumers and healthcare providers in France for treating acid-related digestive disorders.

- The retail pharmacy segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The France Antacids Market Size Is Segmented By End Use Into Hospital Pharmacy And Retail Pharmacy. Among these, the retail pharmacy segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The retail pharmacy segment is growing because antacids are widely available over-the-counter, allowing consumers to easily purchase them for quick relief from heartburn and acid-related discomfort without needing a prescription, making retail pharmacies the primary channel for these products in France.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The France Antacids Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• Sanofi S.A.

• GSK plc

• Pfizer Inc.

• Takeda Pharmaceutical Company Limited

• AstraZeneca PLC

• Bayer AG

• Berlin-Chemie

• Abbott Laboratories

• Novartis AG

• Boehringer Ingelheim

• Merck & Co., Inc.

• Johnson & Johnson

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

• In December 2025, France added Gavinium antacid products, including sugar-free chewable tablets and sachet oral suspension, to the list of OTC medicines available at pharmacies, enhancing digestive relief options for consumers nationwide.

• In March 2023, updated clinical guidelines in Europe now recommend alginate-based antacid options alongside proton pump inhibitors for treating gastro-oesophageal reflux, highlighting broader use of alginate products like Gaviscon to manage acid reflux symptoms and improve symptom control.

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France antacids market based on the below-mentioned segments:

France Antacids Market, By Type

- Tablet

- Liquid

France Antacids Market, By End Use

- Hospital Pharmacy

- Retail Pharmacy

Frequently Asked Questions (FAQ)

-

What is the France antacids market size in 2024?The France antacids market size was estimated at USD 339.8 million in 2024.

-

What is the projected market size of the France antacids market by 2035?The France antacids market size is expected to reach USD 523.4 million by 2035.

-

What is the CAGR of the France antacids market?The France antacids market size is expected to grow at a CAGR of around 4.01% from 2024 to 2035.

-

What are the key growth drivers of the France antacids market?The France antacids market is driven by the high prevalence of gastrointestinal disorders, growing consumer awareness of digestive health, easy availability of over-the-counter antacid products, and an increase in lifestyle-related factors like unhealthy diets, stress, and alcohol consumption that trigger gastric acidity.

-

Which end-use segment dominated the market in 2024?The retail pharmacy segment dominated the market in 2024.

-

What segments are covered in the France antacids market report?The France antacids market is segmented on the basis of type and end use.

-

Who are the key players in the France antacids market?Key companies include Sanofi S.A., GSK plc, Pfizer Inc., Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Bayer AG, Berlin‑Chemie, Abbott Laboratories, Novartis AG, Boehringer Ingelheim, Merck & Co., Inc., Johnson & Johnson, and others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?